Is ECNMarkets safe?

Business

License

Is ECNMarkets Safe or Scam?

Introduction

ECNMarkets is a forex broker that positions itself as a provider of electronic communication network (ECN) trading services, allowing traders to access various financial markets. As the forex market is often fraught with risks, it is crucial for traders to carefully evaluate the reliability and legitimacy of brokers like ECNMarkets before committing their capital. This article aims to provide a comprehensive analysis of ECNMarkets by examining its regulatory status, company background, trading conditions, customer experience, and overall safety. The investigation draws from various online resources, user reviews, and regulatory databases to assess whether ECNMarkets is a safe trading option or a potential scam.

Regulatory and Legality

The regulatory status of a forex broker is one of the most critical factors influencing its credibility. A regulated broker is subject to oversight by financial authorities, which helps ensure compliance with industry standards and protects traders' interests. Unfortunately, ECNMarkets lacks regulation from any major financial authority, which raises significant concerns about its legitimacy and operational practices.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

The absence of regulatory oversight means that ECNMarkets does not adhere to the stringent requirements that regulated brokers must follow, such as maintaining segregated accounts for client funds and providing transparency in operations. Additionally, the Financial Conduct Authority (FCA) has issued warnings regarding ECNMarkets, indicating that it operates without proper authorization in jurisdictions like the UK. This lack of regulatory compliance is a significant red flag for potential clients considering whether is ECNMarkets safe for trading.

Company Background Investigation

Understanding a broker's history and ownership structure can provide valuable insights into its reliability. ECNMarkets claims to have been established to offer direct market access to traders; however, detailed information about its ownership and management team is scarce. This lack of transparency raises questions about the broker's accountability and operational integrity.

The absence of a clear corporate history and identifiable ownership structure is concerning. A reputable broker typically provides information about its founders, management team, and operational history to build trust with potential clients. Moreover, the lack of transparency in these areas often correlates with poor customer service and inadequate support for traders. Without a strong foundation in terms of management and corporate governance, it is challenging to ascertain whether is ECNMarkets safe for trading activities.

Trading Conditions Analysis

When evaluating a broker, it is essential to consider its trading conditions, including fees, spreads, and commission structures. ECNMarkets advertises competitive trading conditions, but the lack of transparency regarding its fee structure is concerning. Traders need to be aware of any hidden costs that could impact their profitability.

| Fee Type | ECNMarkets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | $3-$10 per lot |

| Overnight Interest Range | N/A | Varies |

The absence of specific information regarding spreads and commissions on the ECNMarkets website makes it difficult for traders to assess the true cost of trading. Moreover, the lack of clarity regarding overnight interest rates can lead to unexpected charges for traders holding positions overnight. This uncertainty raises further questions about whether is ECNMarkets safe for traders looking for a transparent and fair trading environment.

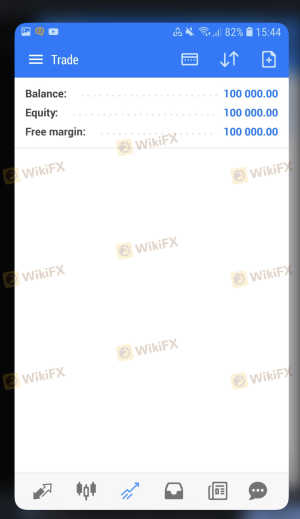

Client Fund Safety

The safety of client funds is paramount in the forex trading industry. Regulated brokers are required to implement measures such as segregating client funds from the company's operational funds and participating in investor protection schemes. However, ECNMarkets does not provide any information regarding these critical safety measures.

The absence of investor protection and fund segregation policies could expose traders to significant risks, especially in the event of the broker's insolvency. Additionally, there have been reports of withdrawal issues and complaints from users regarding difficulties in accessing their funds. Such incidents further highlight the potential risks associated with trading with ECNMarkets, leading to the question of whether is ECNMarkets safe for traders concerned about the security of their investments.

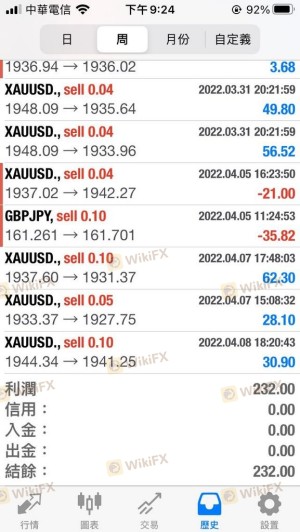

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating a broker's reliability. A review of user experiences with ECNMarkets reveals a concerning pattern of complaints regarding withdrawal issues and poor customer support. Many users have reported difficulties in accessing their funds, with some claiming that their accounts were restricted without clear explanations.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delays | Medium | Poor |

| Account Restrictions | High | Poor |

The consistent nature of these complaints raises significant concerns about the broker's operational practices and commitment to customer service. Traders should be cautious when considering ECNMarkets, as the negative experiences of others can provide valuable insights into the potential risks of trading with this broker. This leads to the critical question: is ECNMarkets safe for traders who prioritize reliable customer service and support.

Platform and Execution

The performance of a trading platform is crucial for a positive trading experience. Traders expect stability, fast execution, and minimal slippage when entering and exiting positions. While ECNMarkets claims to offer a robust trading platform, there is limited information available regarding its performance and reliability.

Concerns about order execution quality, including slippage and rejection rates, are common among users. If traders experience frequent execution issues, it could significantly impact their trading outcomes. Without concrete evidence of the platform's reliability, it is challenging to determine whether is ECNMarkets safe for those who rely on efficient trade execution.

Risk Assessment

Trading with any broker comes with inherent risks, and ECNMarkets is no exception. The lack of regulation, transparency, and customer support raises several risk factors for potential clients.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | No regulation, high risk of fraud |

| Fund Safety | High | No fund segregation or protection |

| Customer Support | Medium | Poor response to complaints |

| Trading Conditions | High | Unclear fees and potential hidden costs |

Given these risks, it is essential for traders to consider how they can mitigate potential issues. Researching alternative brokers with strong regulatory oversight and positive user feedback can help traders make informed decisions.

Conclusion and Recommendations

In conclusion, the investigation into ECNMarkets raises several red flags regarding its legitimacy and safety. The lack of regulatory oversight, transparency in operations, and numerous customer complaints suggest that potential traders should exercise extreme caution. The evidence gathered indicates that is ECNMarkets safe is a question that remains unanswered, with significant concerns outweighing any potential benefits.

For traders seeking reliable and secure options, it is advisable to consider alternative brokers that are well-regulated and have a proven track record of customer satisfaction. Brokers like Pepperstone and IC Markets offer robust trading conditions and regulatory compliance, making them safer choices for traders looking to navigate the forex market successfully. Always prioritize safety and transparency when choosing a broker to protect your investments.

Is ECNMarkets a scam, or is it legit?

The latest exposure and evaluation content of ECNMarkets brokers.

ECNMarkets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ECNMarkets latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.