Regarding the legitimacy of EASY SECURITIES forex brokers, it provides SFC and WikiBit, (also has a graphic survey regarding security).

Is EASY SECURITIES safe?

Business

License

Is EASY SECURITIES markets regulated?

The regulatory license is the strongest proof.

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

BERKSHIRE CAPITALS LIMITED

Effective Date:

2011-01-05Email Address of Licensed Institution:

cs@ruisensec.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Unit 1706-7, China Hong Kong City Tower 1,, 33 Canton Road,, Tsim sha tsui,, Hong KongPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Easy Securities Safe or a Scam?

Introduction

Easy Securities is a broker that has emerged in the foreign exchange market, aiming to cater to both novice and experienced traders. With the increasing popularity of online trading, it is crucial for traders to carefully evaluate brokers before committing their funds. An in-depth assessment of a broker's credibility, regulatory compliance, and overall trading conditions can help traders make informed decisions. This article investigates whether Easy Securities is a reliable trading platform or if it raises red flags that would classify it as a scam. The evaluation methodology includes a thorough examination of regulatory status, company background, trading conditions, customer safety measures, user experiences, and potential risks.

Regulation and Legitimacy

The regulatory framework surrounding a broker is a vital aspect of its legitimacy. Easy Securities claims to operate under the supervision of regulatory authorities; however, the specifics of its licensing remain ambiguous. The following table summarizes the core regulatory details:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SFC | N/A | Hong Kong | Suspicious Clone |

The lack of a clear licensing number and the designation as a “suspicious clone” raises concerns about the broker's legitimacy. Regulatory bodies like the SFC are responsible for ensuring that brokers adhere to strict operational standards, protecting traders from potential fraud. The absence of robust regulatory oversight can expose traders to significant risks, including the possibility of losing their investment without recourse. Furthermore, the history of compliance or violations is crucial in assessing the broker's reliability. Easy Securities has not provided sufficient transparency regarding its regulatory status, which is a significant red flag for potential traders.

Company Background Investigation

Understanding the history and ownership structure of Easy Securities is essential in determining its credibility. The company operates primarily in Hong Kong and has positioned itself as a player in the forex market. However, detailed information regarding its founding, evolution, and ownership is sparse. The management team's background and professional experience are also critical in evaluating the broker's reliability. A strong, experienced leadership team can indicate a broker's commitment to ethical practices and customer service.

Transparency is another crucial factor; a broker should openly disclose its ownership structure, financial health, and operational history. Unfortunately, Easy Securities lacks sufficient information in these areas, which may lead to concerns about its integrity and operational practices. The absence of clear communication about the companys background and the individuals behind it can deter potential clients from trusting their funds with the broker.

Trading Conditions Analysis

Examining the trading conditions offered by Easy Securities is vital for assessing its overall value proposition. The broker's fee structure, including spreads, commissions, and other costs, can significantly impact a trader's profitability. Easy Securities has advertised competitive trading conditions, but the specifics remain unclear. The following table outlines the core trading costs:

| Fee Type | Easy Securities | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5 - 1.0% |

The lack of transparency regarding spreads and commissions raises questions about the broker's overall trading costs. Traders should be wary of hidden fees or unusual cost structures that could erode their profits. Additionally, the absence of clear information regarding overnight interest rates can lead to unexpected charges for traders holding positions overnight. This ambiguity is concerning, especially when compared to industry standards, which typically provide clear guidelines on these costs.

Customer Funds Security

The security of customer funds is paramount when evaluating a broker's trustworthiness. Easy Securities claims to implement various safety measures to protect client assets. However, the specifics of these measures remain unclear. It is essential to assess whether the broker segregates client funds, offers investor protection, and has policies for negative balance protection.

A detailed analysis of Easy Securities' fund safety measures reveals potential gaps. The lack of clear information about fund segregation raises concerns about the security of client deposits. Additionally, without robust investor protection policies, traders may find themselves at risk of losing their investments in the event of a broker failure. Historical issues regarding fund safety or disputes with clients can further exacerbate these concerns. Traders should prioritize brokers that provide clear information about their safety protocols and have a proven track record of safeguarding client funds.

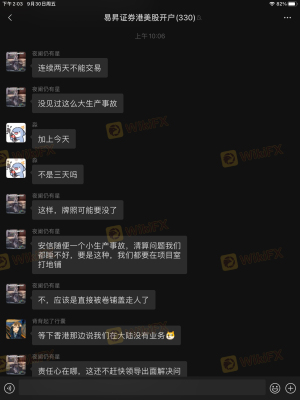

Customer Experience and Complaints

User feedback and real customer experiences are critical in assessing a broker's reliability. Reviews of Easy Securities indicate a mixed bag of experiences, with some users reporting positive interactions while others express dissatisfaction. Common complaints revolve around withdrawal issues, lack of responsive customer service, and unclear trading conditions.

The following table summarizes the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow Response |

| Customer Service Issues | Medium | Average Response |

| Unclear Trading Conditions | High | No Response |

Case studies from users highlight significant concerns, particularly regarding withdrawal processing times and the quality of customer support. One user reported a delay in withdrawing funds for several weeks, leading to frustration and distrust in the brokers operations. Another user noted that the customer service team was unresponsive to inquiries regarding account issues. These patterns suggest a need for improvement in customer service and overall responsiveness.

Platform and Execution

The performance and reliability of the trading platform are essential for a positive trading experience. Easy Securities offers a proprietary platform, but reviews suggest that its performance may not meet industry standards. Issues related to order execution quality, slippage, and order rejections have been reported by users.

A thorough evaluation of the platform reveals significant concerns regarding its stability and user experience. Traders have reported instances of technical glitches and slow execution speeds, which can adversely affect trading outcomes. Additionally, any signs of platform manipulation or unfair practices should be taken seriously, as they can indicate deeper operational issues within the brokerage.

Risk Assessment

Using Easy Securities comes with inherent risks that potential traders should consider. The lack of regulatory oversight, unclear trading conditions, and mixed user experiences contribute to an overall risk profile that may not be suitable for all traders.

The following risk assessment summary highlights key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of clear regulation |

| Financial Risk | Medium | Ambiguous trading costs |

| Operational Risk | High | Platform stability issues |

To mitigate these risks, traders should conduct thorough research and consider alternative brokers with more robust regulatory frameworks and clearer trading conditions. It is advisable to start with smaller investments and utilize demo accounts to gauge the broker's performance before committing significant funds.

Conclusion and Recommendations

In conclusion, the investigation into Easy Securities raises several concerns about its legitimacy and overall reliability. The lack of clear regulatory oversight, ambiguous trading conditions, and mixed user experiences suggest that traders should exercise caution when considering this broker. While Easy Securities may offer some attractive features, the potential risks associated with its operations cannot be overlooked.

For traders seeking a safer investment environment, it is advisable to consider alternative brokers with established regulatory frameworks and proven track records of customer satisfaction. Brokers such as Charles Schwab, Fidelity, or Interactive Brokers may offer more reliable trading experiences and better customer protection. Ultimately, thorough research and careful consideration of all factors are essential for making informed trading decisions.

Is EASY SECURITIES a scam, or is it legit?

The latest exposure and evaluation content of EASY SECURITIES brokers.

EASY SECURITIES Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

EASY SECURITIES latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.