Is CryptoMatex safe?

Business

License

Is CryptoMatex A Scam?

Introduction

CryptoMatex is a brokerage firm that positions itself in the forex and cryptocurrency markets, claiming to offer a wide array of trading options for both novice and experienced traders. In an era where online trading has gained immense popularity, it is crucial for traders to carefully evaluate the legitimacy and reliability of brokerages before committing their funds. With numerous reports of scams and fraudulent activities in the trading sector, conducting thorough due diligence is essential. This article aims to investigate the safety and reliability of CryptoMatex by analyzing its regulatory status, company background, trading conditions, customer feedback, and overall risk profile.

Regulation and Legitimacy

When assessing the safety of a brokerage, regulation is one of the most significant factors to consider. A well-regulated broker is subject to strict oversight, which can provide traders with an added layer of security. Unfortunately, CryptoMatex is not regulated by any top-tier financial authority, which raises red flags regarding its legitimacy. Below is a summary of the regulatory information regarding CryptoMatex:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulation means that CryptoMatex does not adhere to the stringent standards imposed by reputable financial authorities. This lack of oversight could potentially expose traders to risks such as unfair trading practices, lack of transparency, and difficulty in fund recovery in case of disputes. Furthermore, warnings from financial regulators like the Swiss Financial Market Supervisory Authority (FINMA) and the Belgian Financial Services and Markets Authority (FSMA) have flagged CryptoMatex for operating without authorization. These warnings highlight the importance of exercising caution when considering this broker.

Company Background Investigation

Understanding the history and ownership structure of a brokerage can provide insights into its reliability. CryptoMatex claims to operate from Switzerland; however, there is no verifiable information confirming its registration in that country. The lack of transparency regarding its ownership and operational history raises concerns about its credibility. Additionally, the management team behind CryptoMatex appears to lack publicly available information, which is crucial for assessing their expertise and commitment to ethical trading practices.

The companys transparency level is notably low, with limited information provided on its website regarding its operational procedures, financial backing, or corporate governance. This opacity can be detrimental to traders seeking to understand the entity they are engaging with. In the absence of a clear company background, traders may find themselves in a vulnerable position, making it challenging to trust the broker with their investments.

Trading Conditions Analysis

Trading conditions are a critical aspect that can significantly influence a trader's experience and profitability. CryptoMatex offers a variety of account types, each with different minimum deposit requirements and leverage options. However, the overall fee structure and trading costs are not clearly outlined, which can lead to unexpected expenses for traders.

| Fee Type | CryptoMatex | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | N/A | Varies |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of detailed information about trading fees raises concerns about potential hidden charges that may not be disclosed upfront. Traders should be wary of any broker that does not provide clear and transparent information regarding its fee structures, as this can lead to financial losses and frustration.

Customer Funds Security

The safety of customer funds is paramount when evaluating a brokerage. CryptoMatex claims to implement various security measures, including segregated accounts for client funds and adherence to Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. However, the effectiveness of these measures is questionable given the broker's unregulated status.

A lack of investor protection mechanisms or compensation schemes further exacerbates the risk for traders. In the event of financial disputes or broker insolvency, clients may have limited recourse to recover their funds. Historical issues related to fund security and transparency have been reported, casting doubt on the safety of trading with CryptoMatex.

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability. A review of user experiences with CryptoMatex reveals a mix of positive and negative sentiments. Common complaints include difficulties in fund withdrawals, unresponsive customer service, and issues with trade execution.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Average |

| Trade Execution | High | Poor |

Notably, many users have reported challenges in withdrawing their funds, which is a significant red flag. A broker's ability to facilitate smooth and timely withdrawals is crucial for maintaining trust with its clients. Additionally, the quality of customer support has been criticized, with many users expressing frustration over slow response times and inadequate assistance.

Platform and Trade Execution

The trading platform provided by CryptoMatex is another critical factor to consider. A thorough evaluation of the platform's performance, stability, and user experience is essential for traders. Reports indicate that the platform may suffer from issues such as slippage and order rejections, which can adversely affect trading outcomes.

While specific details about the platform's execution quality are sparse, the potential for manipulation or technical glitches raises concerns. Traders should be cautious when using platforms that lack transparency regarding their execution practices.

Risk Assessment

The overall risk associated with trading through CryptoMatex is significant, particularly due to its unregulated status and lack of transparency. Below is a summary of key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulation; warnings from authorities. |

| Fund Security Risk | High | Lack of investor protection and transparency. |

| Customer Service Risk | Medium | Reports of poor support and unresolved complaints. |

| Trading Execution Risk | High | Issues with slippage and order rejections. |

Traders should consider these risks seriously and implement measures to mitigate them, such as limiting their initial investment and using risk management strategies.

Conclusion and Recommendations

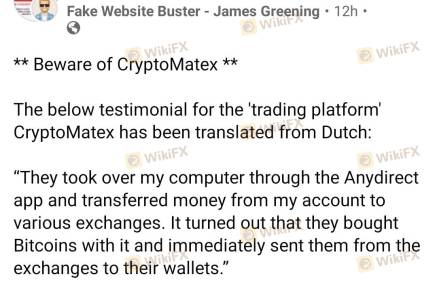

In conclusion, the evidence suggests that CryptoMatex raises several red flags regarding its legitimacy and safety. The absence of regulation, coupled with multiple complaints about customer service and fund withdrawals, indicates that traders should exercise extreme caution when considering this broker. There are significant concerns about the potential for fraud and the lack of adequate protections for investors.

For traders looking for a reliable and secure trading environment, it is advisable to explore alternatives that are regulated by reputable authorities. Brokers such as Interactive Brokers, OANDA, and Forex.com are examples of trusted options that provide robust regulatory oversight and a transparent trading experience. Ultimately, ensuring the safety of your investments should be the top priority when selecting a trading platform.

Is CryptoMatex a scam, or is it legit?

The latest exposure and evaluation content of CryptoMatex brokers.

CryptoMatex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CryptoMatex latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.