Regarding the legitimacy of Galaxy Group forex brokers, it provides HKGX and WikiBit, .

Is Galaxy Group safe?

Pros

Cons

Is Galaxy Group markets regulated?

The regulatory license is the strongest proof.

HKGX Precious Metals Trading (AGN)

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

UnverifiedLicense Type:

Precious Metals Trading (AGN)

Licensed Entity:

恒邦國際金業有限公司

Effective Date: Change Record

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

九龍長沙灣永明街3號泰昌工廠大廈9樓C室Phone Number of Licensed Institution:

63888285Licensed Institution Certified Documents:

Is Galaxy Group Safe or a Scam?

Introduction

Galaxy Group is a forex broker based in Hong Kong, offering trading services primarily in precious metals like gold and silver. Established for approximately 5 to 10 years, it positions itself as a legitimate player in the forex market. However, potential traders must exercise caution when selecting a broker, as the forex industry is rife with scams and unregulated entities. Given the financial risks involved, it is crucial for traders to thoroughly evaluate the broker's credibility, regulatory compliance, and overall reputation. This article employs a comprehensive investigative approach, utilizing various sources to assess Galaxy Group's safety and legitimacy, including regulatory status, company background, trading conditions, and customer feedback.

Regulation and Legitimacy

When evaluating the safety of any forex broker, regulatory oversight is a fundamental aspect. Galaxy Group claims to be regulated by the Chinese Gold & Silver Exchange Society, which operates under the jurisdiction of Hong Kong. However, the regulatory environment in Hong Kong is often criticized for its leniency compared to top-tier regulators. The following table summarizes key regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Chinese Gold & Silver Exchange Society | 203 | Hong Kong | Suspicious Clone |

While Galaxy Group holds a Type B license, the lack of stringent regulation raises concerns about the broker's operational integrity. Moreover, the absence of a transparent website further complicates matters, as potential clients cannot easily verify the broker's claims or access important information. The regulatory quality is essential, as brokers under strong regulatory bodies like the FCA or ASIC are more likely to adhere to strict compliance measures, ensuring better protection for clients. In contrast, Galaxy Group's regulatory status appears to be questionable, warranting further investigation into its historical compliance and operational practices.

Company Background Investigation

Galaxy Group's history and ownership structure play a crucial role in assessing its credibility. While the broker has been operational for 5 to 10 years, specific details about its founding, management team, and ownership are scarce. The lack of transparency regarding the company's leadership raises red flags about its operational practices. A credible broker typically discloses information about its management team, including their professional backgrounds and expertise in the financial markets.

Furthermore, the company's commitment to transparency is questionable, given the limited information available about its office locations, trading conditions, and customer service. Such opacity is often a hallmark of less reputable brokers that may engage in deceptive practices. Without a clear understanding of the company's structure and management, potential clients are left in the dark, increasing the risks associated with trading with Galaxy Group.

Trading Conditions Analysis

The trading conditions offered by Galaxy Group are another critical factor in determining its safety. The broker provides access to the MetaTrader 4 and 5 platforms, which are widely recognized in the industry for their reliability and user-friendly interfaces. However, the overall fee structure and potential hidden costs are areas of concern. The following table outlines the core trading costs associated with Galaxy Group:

| Fee Type | Galaxy Group | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of detailed information about spreads, commissions, and overnight interest rates complicates the evaluation of trading costs. Traders should be wary of brokers that do not provide transparent pricing, as this may indicate hidden fees that could significantly impact profitability. Moreover, the lack of clarity surrounding these costs raises questions about the broker's overall integrity and commitment to fair trading practices.

Client Fund Security

The safety of client funds is paramount in the forex trading landscape. Galaxy Group claims to implement various security measures to protect clients' investments. However, the specifics of these measures, such as fund segregation and negative balance protection, are not clearly articulated. A detailed analysis of Galaxy Group's fund security policies reveals the following concerns:

- Fund Segregation: It is unclear whether client funds are held in segregated accounts, which is a crucial practice to ensure that client funds are protected in the event of the broker's insolvency.

- Investor Protection: There is no indication of any investor compensation schemes that could protect clients in case of broker failure.

- Negative Balance Protection: The absence of a clear policy regarding negative balance protection raises concerns about the risks traders might face if market conditions turn unfavorable.

The historical context of any past security issues or disputes involving Galaxy Group is also crucial. While there are no widely reported incidents, the lack of transparency regarding fund security measures is a significant red flag for potential clients.

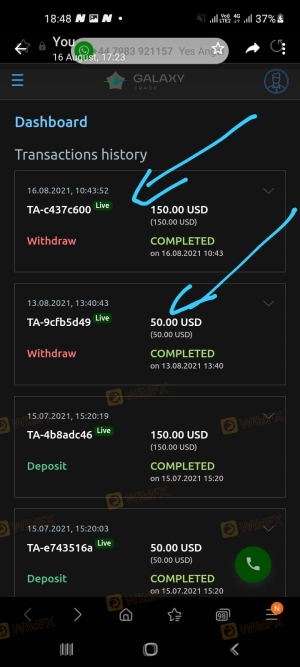

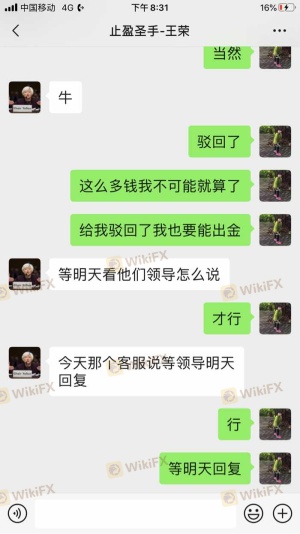

Client Experience and Complaints

Customer feedback is an essential component of assessing a broker's reliability. Reviews and testimonials about Galaxy Group indicate a mix of positive and negative experiences. Some clients report satisfactory trading experiences, while others express concerns about withdrawal difficulties and customer support responsiveness. The following table summarizes the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Difficulties | High | Poor |

| Platform Malfunctions | Medium | Average |

| Customer Service Issues | High | Poor |

Two typical cases highlight the concerns surrounding Galaxy Group. One user reported significant delays in processing withdrawal requests, while another faced unexpected position closures without prior notice. These issues raise questions about the broker's operational practices and commitment to customer satisfaction. The overall sentiment from customer feedback suggests that while some traders may find success, the risks and complaints associated with Galaxy Group may outweigh the potential benefits.

Platform and Trade Execution

The performance and reliability of the trading platform are crucial for traders. Galaxy Group utilizes the MetaTrader 4 and 5 platforms, which are known for their stability and extensive features. However, the execution quality, including slippage and rejection rates, is vital for assessing the overall trading experience. Reports of platform malfunctions and execution issues have surfaced, leading to concerns about the broker's operational integrity.

Traders should be vigilant for any signs of platform manipulation, as this can significantly impact trading outcomes. A broker that fails to provide a reliable trading environment may not be acting in the best interests of its clients, further emphasizing the need for caution when considering Galaxy Group as a trading partner.

Risk Assessment

Engaging with Galaxy Group entails various risks that traders should be aware of. The following risk assessment summarizes key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Limited regulatory oversight |

| Financial Risk | Medium | Lack of transparency in fees |

| Operational Risk | High | Reports of platform issues |

| Customer Service Risk | High | Negative feedback on support |

To mitigate these risks, traders are advised to conduct thorough research, utilize demo accounts for testing, and consider starting with minimal capital. Additionally, seeking alternative brokers with stronger regulatory frameworks may provide a safer trading environment.

Conclusion and Recommendations

In conclusion, the evidence suggests that Galaxy Group presents several concerning factors that potential traders should consider. While it is regulated by the Chinese Gold & Silver Exchange Society, the quality of this regulation is questionable, and the lack of transparency raises red flags. Moreover, customer feedback indicates significant issues with withdrawal processes and platform reliability, which could suggest that Galaxy Group may not be entirely safe for trading.

For those considering engaging with Galaxy Group, it is essential to weigh the risks carefully and consider alternative brokers known for their robust regulatory frameworks and positive customer feedback. Some recommended alternatives include brokers regulated by top-tier authorities such as the FCA or ASIC, which offer a more secure trading environment. In summary, while Galaxy Group may provide certain trading opportunities, the potential risks and concerns surrounding its operations warrant a cautious approach.

Is Galaxy Group a scam, or is it legit?

The latest exposure and evaluation content of Galaxy Group brokers.

Galaxy Group Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Galaxy Group latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.