Is CRYPTO1CAPITAL safe?

Business

License

Is Crypto1Capital Safe or a Scam?

Introduction

Crypto1Capital is an online brokerage that has emerged in the foreign exchange (forex) market, primarily positioning itself as a platform for trading cryptocurrencies, stocks, commodities, and various other financial instruments. As the trading landscape becomes increasingly crowded, it is vital for traders to conduct thorough evaluations of brokerage firms to ensure their safety and legitimacy. A broker's regulatory status, customer feedback, and overall transparency are critical factors that can influence a trader's decision to invest their funds. This article employs a comprehensive investigative approach, utilizing various sources to assess the credibility of Crypto1Capital, focusing on its regulatory status, company background, trading conditions, customer experiences, and risk factors.

Regulation and Legitimacy

The regulatory framework surrounding a brokerage is paramount in determining its safety and reliability. A well-regulated broker is typically subject to stringent oversight and compliance requirements, which can offer investors a layer of protection. In the case of Crypto1Capital, the broker has faced scrutiny regarding its regulatory status.

Regulatory Information Table

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | N/A | UK | Not Authorized |

| FINMA | N/A | Switzerland | Not Registered |

| FSMA | N/A | Belgium | Not Authorized |

The Financial Conduct Authority (FCA) in the UK has explicitly warned that Crypto1Capital is not authorized to provide financial services. Similarly, the Swiss Financial Market Supervisory Authority (FINMA) and the Belgian Financial Services and Markets Authority (FSMA) have issued warnings regarding the broker's lack of regulatory oversight. The absence of a legitimate regulatory framework raises significant concerns about the safety of funds deposited with Crypto1Capital. Traders should be particularly cautious, as unregulated brokers often operate without the necessary safeguards to protect investors.

Company Background Investigation

Crypto1Capital was established relatively recently, with claims of providing a reliable platform for various trading activities. However, the lack of transparency regarding its ownership structure and operational history raises red flags. The company appears to be registered in multiple jurisdictions, including the UK and offshore locations, which is a common tactic used by fraudulent brokers to evade regulatory scrutiny.

The management team‘s qualifications and experience are also critical in assessing the broker's credibility. Unfortunately, detailed information about the team behind Crypto1Capital is scarce, which limits the ability to evaluate their expertise and commitment to ethical trading practices. Transparency in a brokerage's operations is essential for building trust, and the lack of readily available information about Crypto1Capital’s management further complicates the assessment of whether Crypto1Capital is safe.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is crucial. This includes analyzing the fee structure, spreads, and overall trading environment. Crypto1Capital presents itself as a competitive broker, but several aspects of its trading conditions warrant closer scrutiny.

Fees Comparison Table

| Fee Type | Crypto1Capital | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.7 pips | 1.0-1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | High | Moderate |

Crypto1Capital's spreads, particularly for major currency pairs, are higher than the industry average, which could significantly impact trading profitability. Additionally, the broker's commission structure is not clearly defined, leaving potential clients in the dark about the total cost of trading. Such ambiguity can lead to unexpected charges and diminish the overall trading experience. Traders should thoroughly assess whether the costs associated with trading on Crypto1Capital align with their investment strategies and risk tolerance.

Customer Fund Safety

The safety of customer funds is a primary concern for any trader. A reputable broker should implement robust measures to safeguard client deposits, including segregated accounts, investor protection schemes, and negative balance protection policies.

Crypto1Capital has not provided clear information regarding its fund security measures. The absence of segregated accounts raises concerns about the safety of client funds, as it implies that customer deposits may be co-mingled with the broker's operating funds. Furthermore, without investor protection schemes in place, traders could face substantial risks if the broker encounters financial difficulties or engages in unethical practices. Historical disputes or security breaches related to fund safety can further erode confidence in a broker's reliability. Given these factors, it is crucial to question whether Crypto1Capital is safe for trading.

Customer Experience and Complaints

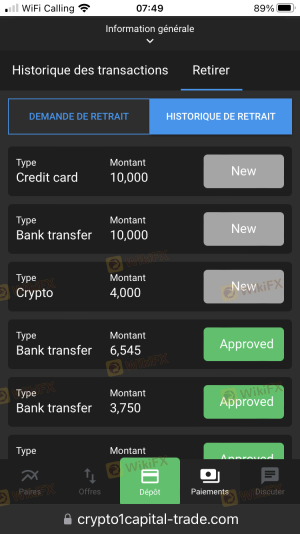

Analyzing customer feedback and real user experiences can provide valuable insights into a broker's reliability. In the case of Crypto1Capital, numerous reviews indicate a pattern of dissatisfaction among users, with complaints often focusing on withdrawal difficulties and unresponsive customer service.

Complaints Overview Table

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Lack of Transparency | Medium | Minimal Communication |

| Poor Customer Support | High | Inconsistent |

For instance, some users have reported that their withdrawal requests were delayed or denied without clear explanations, leading to frustration and distrust. The company's response to these complaints has been criticized for lacking transparency and efficiency. Such patterns of negative feedback raise significant concerns about whether Crypto1Capital is safe for traders seeking a reliable and trustworthy platform.

Platform and Execution

A broker's trading platform is a critical component of the trading experience, influencing order execution quality, stability, and user experience. Crypto1Capital offers a proprietary trading platform, but user reviews highlight several issues regarding its performance.

The platform has been criticized for experiencing frequent outages and slow execution times, which can adversely affect trading outcomes. Additionally, instances of slippage and rejected orders have been reported, further complicating the trading experience. These concerns point to potential manipulation or inefficiencies within the trading environment, leading to questions about the broker's integrity. Traders must consider whether they are willing to risk their investments on a platform with such issues, raising doubts about whether Crypto1Capital is safe.

Risk Assessment

Engaging with any trading platform involves inherent risks, and assessing these risks is crucial for informed decision-making. For Crypto1Capital, several risk factors emerge from the analysis.

Risk Assessment Summary Table

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status |

| Fund Safety Risk | High | Lack of segregation and protection |

| Execution Risk | Medium | Performance issues |

Given the high regulatory risk and concerns regarding fund safety, potential traders should approach Crypto1Capital with caution. Risk mitigation strategies, such as limiting the amount invested and conducting thorough research, are advisable for those considering engagement with this broker.

Conclusion and Recommendations

In conclusion, the investigation into Crypto1Capital reveals several concerning factors that suggest the broker may not be a safe choice for traders. The lack of regulatory oversight, ambiguous trading conditions, and negative customer experiences raise significant red flags. While some may find certain aspects of the platform appealing, the overall assessment indicates that potential investors should exercise extreme caution.

For traders seeking reliable alternatives, it is recommended to consider brokers that are well-regulated by reputable authorities, offer transparent trading conditions, and maintain a strong track record of positive customer experiences. Always ensure that any broker you choose has appropriate safeguards in place to protect your funds and interests. Ultimately, the question remains: Is Crypto1Capital safe? The evidence suggests that it is prudent to seek other options.

Is CRYPTO1CAPITAL a scam, or is it legit?

The latest exposure and evaluation content of CRYPTO1CAPITAL brokers.

CRYPTO1CAPITAL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CRYPTO1CAPITAL latest industry rating score is 1.44, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.44 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.