Regarding the legitimacy of CRESCOFX forex brokers, it provides FCA and WikiBit, (also has a graphic survey regarding security).

Is CRESCOFX safe?

Business

License

Is CRESCOFX markets regulated?

The regulatory license is the strongest proof.

FCA Forex Execution License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnsubscribedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Cresco Capital Markets (UK) Ltd

Effective Date:

2017-08-01Email Address of Licensed Institution:

compliance@crescofx.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

2022-12-09Address of Licensed Institution:

21 ArlinGTon STreeT London SW1A 1RN UNITED KINGDOM, 21 Arlington Street London SW1A 1RNPhone Number of Licensed Institution:

442079526822Licensed Institution Certified Documents:

Is CrescoFX A Scam?

Introduction

CrescoFX is a brokerage firm that has been operating in the forex market since 2011, positioning itself as a provider of forex and CFD trading services. As with any trading platform, potential investors must exercise caution and conduct thorough research before committing their funds. The forex market is notorious for its volatility and the presence of unregulated brokers, making it essential for traders to evaluate the legitimacy and reliability of their chosen brokers. This article aims to provide an objective analysis of CrescoFX, focusing on its regulatory status, company background, trading conditions, client funds safety, customer experiences, and overall risk assessment.

Regulation and Legitimacy

CrescoFX operates under the regulatory oversight of the Financial Conduct Authority (FCA) in the UK. Regulation by the FCA is considered a hallmark of legitimacy in the financial industry, as it imposes stringent requirements on brokers to ensure transparency and protect client funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 764353 | United Kingdom | Verified |

The FCA requires brokers to segregate client funds and adhere to strict financial standards. However, it is important to note that CrescoFX has faced scrutiny in the past, with reports indicating that its license was revoked due to various compliance issues. This history raises questions about the brokers reliability and adherence to regulatory standards. While the FCA's oversight is robust, the revocation of CrescoFX's license could suggest potential risks for traders.

Company Background Investigation

CrescoFX, officially registered as Cresco Capital Markets (UK) Ltd, has its headquarters in London. The company was founded in 2011 and aimed to cater to both retail and institutional traders. The ownership structure and management team significantly influence a broker's credibility. However, information regarding the specific individuals behind CrescoFX is limited, which may contribute to a lack of transparency.

The company's historical performance has also been mixed, with early reports indicating a positive reputation that has since deteriorated. As the market evolved, so did the complaints from clients regarding withdrawal issues and unresponsive customer support. Such issues can reflect poorly on the management's ability to maintain a trustworthy trading environment.

Trading Conditions Analysis

CrescoFX offers a range of trading conditions, but potential clients should be aware of the overall cost structure. The broker provides various account types, each with different minimum deposit requirements and fee structures.

| Fee Type | CrescoFX | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | 0.7 pips | 0.5 - 1.0 pips |

| Commission Structure | $6 per lot | $5 per lot |

| Overnight Interest Range | Variable | Variable |

CrescoFX's spreads are competitive for major currency pairs, but the commission structure is higher than some industry averages. Additionally, traders have reported unexpected fees and a lack of clarity regarding the overall cost of trading. This lack of transparency can be concerning, particularly for new traders who may not fully understand the financial implications of their trading activities.

Client Funds Safety

The safety of client funds is a critical consideration when evaluating any broker. CrescoFX claims to adhere to FCA regulations, which mandate that client funds be kept in segregated accounts at tier-1 banks. This practice is designed to protect clients in the event of the broker's insolvency.

However, there have been historical issues with fund withdrawals, with numerous complaints from clients who experienced difficulties in accessing their funds. This raises significant concerns about the actual implementation of these safety measures. Moreover, while the FCA provides a compensation scheme for clients, the effectiveness of this scheme in the event of insolvency is contingent on the broker's compliance with regulatory standards, which has been called into question in CrescoFX's case.

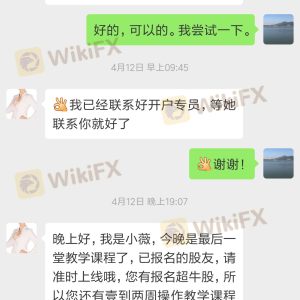

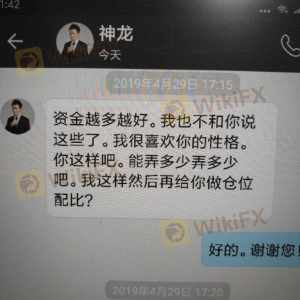

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing the reliability of a broker. Reports indicate a range of experiences with CrescoFX, from positive interactions to serious complaints regarding withdrawal issues and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Unresponsive |

| High Spreads | Medium | Addressed vaguely |

| Account Blocking | High | No clear resolution |

Common complaints include difficulty withdrawing funds, high spreads, and unresponsive customer service. In some cases, clients reported that their accounts were blocked without clear justification, leading to frustration and financial loss. These patterns of complaints suggest a troubling trend and indicate that potential clients should be cautious when considering CrescoFX.

Platform and Trade Execution

CrescoFX offers its clients access to the popular MetaTrader 4 platform alongside its proprietary trading platform, Cresco Trader. While MT4 is widely recognized for its robust features and user-friendly interface, the performance of Cresco Trader has not been as thoroughly reviewed.

Traders have reported mixed experiences regarding order execution quality, with some noting instances of slippage and rejected orders. Such issues can significantly impact trading performance, particularly in a fast-paced market like forex. The presence of slippage and execution problems raises concerns about the broker's operational integrity and whether traders can trust that their orders will be executed as intended.

Risk Assessment

Engaging with CrescoFX presents certain risks that potential traders should consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | History of license revocation |

| Fund Safety | Medium | Complaints about withdrawal issues |

| Customer Support | High | Unresponsive support reported |

The overall risk associated with trading through CrescoFX is elevated due to its regulatory history, client complaints, and concerns regarding fund safety. Traders should be vigilant and consider their risk tolerance before engaging with this broker.

Conclusion and Recommendations

In conclusion, while CrescoFX is regulated by the FCA, its historical compliance issues and the mixed feedback from clients raise significant concerns. The broker's past license revocation and ongoing complaints about fund withdrawals suggest that traders should exercise caution.

For traders seeking a reliable broker, it may be prudent to explore alternatives with a stronger track record and transparent operations. Recommended alternatives include brokers with robust regulatory oversight and positive customer feedback. Ultimately, traders should prioritize their safety and ensure they are comfortable with the risks associated with their chosen broker.

In summary, is CrescoFX safe? The evidence suggests potential risks, and traders are advised to conduct thorough research and consider alternative options before investing their funds.

Is CRESCOFX a scam, or is it legit?

The latest exposure and evaluation content of CRESCOFX brokers.

CRESCOFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CRESCOFX latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.