Is Cmtradingfx safe?

Business

License

Is CMTradingFX A Scam?

Introduction

CMTradingFX is a forex broker that has positioned itself as a significant player in the online trading market since its inception in 2012. Based in South Africa, it offers a range of trading instruments including forex, commodities, and cryptocurrencies. For traders, the choice of a broker is crucial; the reliability and safety of their funds depend heavily on the broker's regulatory status and operational practices. As the forex market is rife with potential scams, it is essential for traders to conduct thorough due diligence before committing their capital. This article aims to investigate the legitimacy of CMTradingFX by examining its regulatory status, company background, trading conditions, customer experiences, and risk factors.

Regulation and Legitimacy

The regulatory framework within which a broker operates is a key indicator of its legitimacy. CMTradingFX claims to be regulated by the Financial Sector Conduct Authority (FSCA) in South Africa, which is known for its stringent regulatory standards. However, there are concerns regarding the legitimacy of this claim, as some sources suggest that the FSCA license number provided may correspond to a clone or unregulated entity.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSCA | 38782 | South Africa | Suspected Clone |

| FSA | SD 070 | Seychelles | Offshore Regulation |

The FSCA requires brokers to keep client funds in segregated accounts, which adds a layer of security for traders. However, the offshore regulation by the Seychelles Financial Services Authority (FSA) is often viewed with skepticism due to less stringent regulatory practices. Without robust oversight, traders may face increased risks, including potential loss of funds. Therefore, while CMTradingFX appears to have some regulatory backing, the quality and credibility of this regulation are questionable.

Company Background Investigation

CMTradingFX was founded in 2012 and is operated by Global Capital Markets Trading Ltd. The company has set its sights on becoming a leading broker in the African market, but its operational history raises some red flags. The management team consists of individuals with varying degrees of experience in finance and trading, yet the lack of transparency regarding their backgrounds can lead to doubts about the broker's governance.

The company's transparency is critical; however, there are mixed reviews regarding its information disclosure practices. While it provides basic information about its services, detailed insights into its financial health, ownership structure, and management team are lacking. This opacity can be a significant concern for potential investors, as it undermines trust and raises questions about the broker's accountability.

Trading Conditions Analysis

CMTradingFX offers a variety of trading conditions, including different account types and fee structures. The broker has a minimum deposit requirement of $250, which is relatively standard in the industry but may be a barrier for novice traders. The overall fee structure includes spreads and potential commissions, though the specifics can vary based on account type.

| Fee Type | CMTradingFX | Industry Average |

|---|---|---|

| Spread on Major Pairs | 1.2 - 1.9 pips | 1.0 - 1.5 pips |

| Commission Model | Spread Only | Varies |

| Overnight Interest Range | Varies | Varies |

Traders have reported that the spreads can be higher than average, particularly during volatile market conditions, which could significantly impact profitability. Furthermore, hidden fees related to deposits and withdrawals have been a common complaint among users. This lack of clarity in the fee structure can be concerning for traders looking for a straightforward trading experience.

Client Fund Security

The safety of client funds is paramount for any trading platform. CMTradingFX claims to implement several security measures, including segregated accounts for client funds and negative balance protection. The segregation of funds means that even in the event of bankruptcy, client funds remain protected. However, the effectiveness of these measures is contingent upon the broker's adherence to regulatory obligations.

Despite these claims, there have been instances in the past where traders expressed concerns about the withdrawal process and the potential for lost funds. While the broker states that withdrawal requests are generally processed within 24 hours, some users have reported delays and complications, raising questions about the broker's reliability in safeguarding client assets.

Customer Experience and Complaints

Analyzing customer feedback provides valuable insights into the broker's operational integrity. Reviews of CMTradingFX reveal a mixed bag of experiences. Some users report satisfactory trading conditions and responsive customer service, while others highlight significant issues, particularly concerning withdrawals and customer support responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Inconsistent |

| High Spreads | Medium | Addressed |

| Poor Customer Service | High | Mixed Responses |

Typical cases include complaints about difficulties in withdrawing funds, with some users claiming their requests were ignored or delayed. On the other hand, several clients have praised the broker for its educational resources and trading tools, suggesting that experiences can vary widely based on individual circumstances.

Platform and Trade Execution

The trading platforms offered by CMTradingFX include MetaTrader 4 and their proprietary web trader. While MT4 is widely respected for its robust features and reliability, some users have reported issues related to platform stability and execution speed. Concerns about slippage and order rejections have also been noted, which can adversely affect trading outcomes.

The broker's commitment to providing a seamless trading experience is evident, but the frequency of reported issues suggests that there may be room for improvement in platform performance and reliability.

Risk Assessment

Using CMTradingFX carries inherent risks, as with any trading platform. The lack of tier-1 regulation and the questionable status of its FSCA license raise red flags that traders should consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Potential clone regulation concerns |

| Operational Risk | Medium | Issues with withdrawals and support |

| Market Risk | High | High leverage can amplify losses |

To mitigate these risks, traders should approach their investments with caution, utilize risk management tools, and consider starting with a demo account to familiarize themselves with the platform before committing real funds.

Conclusion and Recommendations

In conclusion, while CMTradingFX presents itself as a legitimate broker with various trading opportunities, there are significant concerns regarding its regulatory status and customer experiences. The potential for scams, particularly in the context of unverified claims and withdrawal issues, necessitates a cautious approach.

For potential traders, it is advisable to conduct thorough research and consider alternative brokers with stronger regulatory oversight and better customer feedback. If you choose to engage with CMTradingFX, ensure that you are fully aware of the risks involved and consider starting with a smaller investment to gauge the broker's reliability.

In summary, the question "Is CMTradingFX safe?" remains complex, and while there are positive aspects to the broker, the potential risks and complaints warrant careful consideration before proceeding.

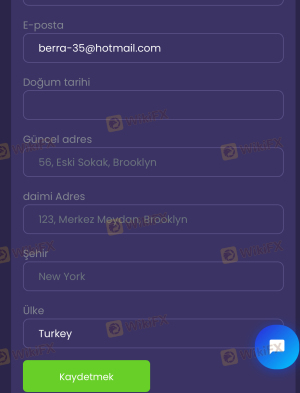

Is Cmtradingfx a scam, or is it legit?

The latest exposure and evaluation content of Cmtradingfx brokers.

Cmtradingfx Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Cmtradingfx latest industry rating score is 1.32, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.32 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.