Regarding the legitimacy of Chugin forex brokers, it provides FSA and WikiBit, .

Is Chugin safe?

Business

License

Is Chugin markets regulated?

The regulatory license is the strongest proof.

FSA Market Making License (MM)

Financial Services Agency

Financial Services Agency

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

中銀証券株式会社

Effective Date:

2007-09-30Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

岡山県岡山市北区本町2-5Phone Number of Licensed Institution:

0862353441Licensed Institution Certified Documents:

Is Chugin Safe or Scam?

Introduction

Chugin, formally known as Chugin Securities Co., Ltd., is a financial broker based in Okayama, Japan, that has been operational for approximately 15 to 20 years. It positions itself within the forex market, offering a range of financial services including forex trading, stock trading, and investment advisory. As the forex market is notoriously volatile and can be rife with unscrupulous entities, it is critical for traders to conduct thorough evaluations of brokers like Chugin before engaging with them. This article aims to provide a comprehensive assessment of Chugin's legitimacy, regulatory compliance, trading conditions, and overall safety for potential investors. Our investigation is based on a review of various sources, including regulatory records, customer feedback, and industry analyses.

Regulation and Legitimacy

The regulatory status of a broker is paramount in determining its safety and trustworthiness. Chugin is regulated by the Financial Services Agency (FSA) of Japan, a well-respected authority in the financial sector. The importance of regulation cannot be overstated, as it serves as a safeguard for investors, ensuring that brokers adhere to strict operational standards.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Services Agency (FSA) | Kinsho No. 6 | Japan | Verified |

The FSA imposes rigorous compliance requirements on financial entities, which include regular audits and adherence to ethical standards. However, while Chugin holds a valid license, there are concerns regarding its operational transparency and customer service responsiveness. Historical compliance records indicate that while the broker has maintained its regulatory status, there have been multiple complaints from users regarding withdrawal issues and customer support, raising questions about its operational integrity. Thus, while Chugin is regulated, potential clients should remain vigilant and consider these factors when assessing whether "Is Chugin safe?"

Company Background Investigation

Chugin Securities Co., Ltd. was established between 15 to 20 years ago and has since developed a reputation in the Japanese financial market. The company is headquartered in Okayama, Japan, and operates several offices across the country. Ownership details indicate that it is a privately held entity, which may limit the level of transparency typically associated with publicly traded companies.

The management team at Chugin comprises experienced professionals from the financial services industry, many of whom have held significant positions in other reputable financial institutions. This experience is crucial as it suggests that the management is likely equipped to navigate the complexities of the financial market. However, the company's transparency regarding its internal operations and decision-making processes appears limited, which could be a concern for potential investors. The lack of clear communication channels and an inactive primary website since February 2021 further complicates the evaluation of whether "Is Chugin safe?"

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions is essential. Chugin offers a range of trading accounts, including standard, premium, and VIP accounts, each with varying features and leverage options. However, the overall fee structure is not as transparent as one would hope, leading to potential confusion among traders.

| Fee Type | Chugin | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.1 pips | From 0.2 pips |

| Commission Model | None | Varies by broker |

| Overnight Interest Range | Not specified | Typically ranges from 0.5% to 2% |

Chugin's spreads are competitive, starting from as low as 0.1 pips for major currency pairs, which can be appealing to traders. However, the absence of clear information regarding commission structures and overnight interest rates may raise red flags. Traders should be cautious of any hidden fees that could impact their profitability. Therefore, while the trading conditions may seem attractive at first glance, a lack of transparency could indicate potential issues. This leads to the question of "Is Chugin safe?" for those looking to engage in forex trading.

Client Fund Security

The security of client funds is a critical aspect that potential investors must consider. Chugin claims to implement several measures to protect client funds, including segregating client accounts from the company's operational funds. This is a standard practice in the industry aimed at ensuring that client funds remain secure even in the event of a financial crisis.

Furthermore, the broker is expected to comply with investor protection regulations set forth by the FSA, which may include compensation schemes for clients in the event of insolvency. However, there have been reports of clients facing difficulties in withdrawing their funds, with numerous complaints highlighting issues such as blocked accounts and unresponsive customer service. This raises concerns about the actual effectiveness of Chugin's fund security measures. Thus, while the broker may claim to prioritize client fund security, the reported issues suggest that potential clients should approach with caution and thoroughly assess whether "Is Chugin safe?"

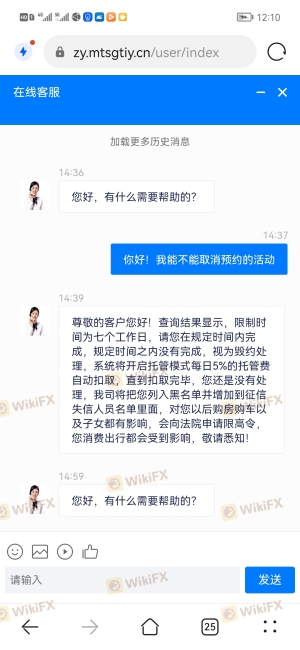

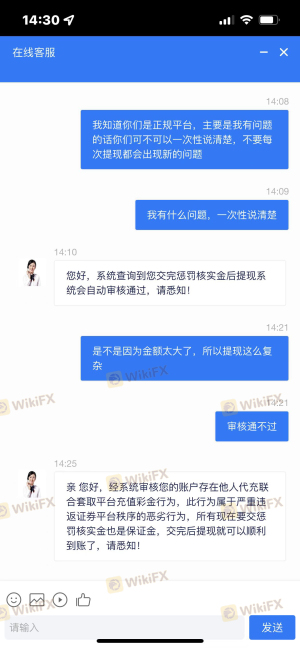

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. In the case of Chugin, reviews from clients have been mixed, with a significant number of complaints focusing on withdrawal difficulties and poor customer support. Users have reported instances where their withdrawal requests were denied or delayed, with some claiming they were unable to access their funds altogether.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Customer Service Quality | Medium | Slow Response |

| Transparency of Fees | Low | Inconsistent |

Typical complaints include clients being asked to deposit additional funds before they could withdraw their existing balances, which raises red flags about the broker's practices. While some clients have reported satisfactory trading conditions, the overwhelming number of complaints regarding withdrawals cannot be overlooked. This leads to a strong recommendation for potential clients to thoroughly investigate and consider whether "Is Chugin safe?" before committing their funds.

Platform and Trade Execution

Evaluating the trading platform's performance is essential for assessing a broker's reliability. Chugin primarily utilizes the MetaTrader 4 (MT4) platform, which is well-regarded in the industry for its user-friendly interface and extensive features. However, the platform's performance has been scrutinized, with reports of occasional slippage and execution delays.

Issues with order execution quality can significantly impact a trader's profitability, especially in the fast-paced forex market. Furthermore, there are concerns about the potential for platform manipulation, particularly given the broker's mixed reputation. Traders should be aware of these risks and evaluate whether "Is Chugin safe?" based on their trading preferences and experiences.

Risk Assessment

Using Chugin as a trading platform presents various risks that potential clients should consider. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | Regulated by FSA but with numerous complaints |

| Withdrawal Difficulties | High | Frequent reports of blocked withdrawals |

| Customer Support | High | Slow and unresponsive support reported |

| Trading Conditions | Medium | Competitive spreads but lack of transparency |

To mitigate these risks, potential clients should conduct thorough due diligence, consider starting with a smaller investment, and ensure they have a clear understanding of the broker's terms and conditions. This will help them make an informed decision about whether "Is Chugin safe?" for their trading needs.

Conclusion and Recommendations

In conclusion, while Chugin Securities Co., Ltd. is a regulated broker in Japan, numerous complaints regarding withdrawal issues and customer service raise significant concerns about its overall safety and reliability. Despite offering competitive trading conditions, the lack of transparency and the reported difficulties faced by clients indicate that potential investors should exercise caution.

For traders looking for a reliable forex broker, it may be wise to explore alternatives with stronger reputations and better customer feedback. Brokers regulated by top-tier authorities and known for their transparency and customer service may provide a safer trading environment. Ultimately, the question "Is Chugin safe?" remains open, and potential clients should weigh the risks and benefits carefully before proceeding.

Is Chugin a scam, or is it legit?

The latest exposure and evaluation content of Chugin brokers.

Chugin Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Chugin latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.