Is Carnival Forex safe?

Business

License

Is Carnival Forex Safe or Scam?

Introduction

Carnival Forex, established in 2021, positions itself as an online trading broker offering a range of forex and CFD trading products. In a market where numerous brokers promise high returns, it is crucial for traders to exercise caution and thoroughly assess the credibility of their chosen trading platform. Evaluating a broker's legitimacy involves examining regulatory compliance, company background, trading conditions, and customer feedback. This article aims to provide a comprehensive analysis of Carnival Forex, focusing on its safety and potential risks for traders.

Regulation and Legitimacy

The regulatory environment is vital for any financial broker, as it ensures that the broker adheres to specific standards of operation and client protection. In the case of Carnival Forex, the broker operates without any valid regulatory licenses, which raises significant concerns regarding its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

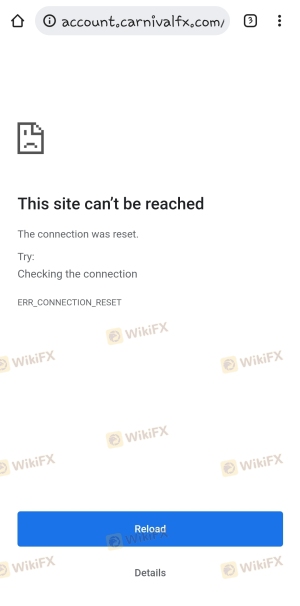

The absence of regulation means that Carnival Forex is not subject to oversight by any financial authority, which is alarming for potential investors. A lack of regulatory compliance often correlates with higher risks of fraud and malpractice, making it essential for traders to be wary. Moreover, the broker's website has been reported as inaccessible at times, further complicating any attempts to verify its claims or obtain essential information about its services. The overall regulatory quality is low, and without any history of compliance, traders should be cautious when considering this broker.

Company Background Investigation

Carnival Forex Limited, the entity behind Carnival Forex, has a limited history since its inception in 2021. The company claims to be based in China, but the lack of transparency regarding its ownership structure and management team raises red flags.

The management teams qualifications and experience are critical to establishing trust. Unfortunately, there is little publicly available information about the individuals running Carnival Forex, which makes it difficult for potential clients to assess their qualifications and reliability. Transparency is a significant factor in determining a broker's trustworthiness; thus, the lack of clear information about Carnival Forex's management contributes to its questionable reputation.

In summary, Carnival Forex's limited background and opaque ownership structure do not inspire confidence. The absence of detailed company information and the inability to verify its claims further exacerbate concerns about its legitimacy and safety.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is essential for assessing its overall reliability. Carnival Forex claims to offer competitive trading conditions, but the lack of regulatory oversight raises questions about the actual trading environment.

| Cost Type | Carnival Forex | Industry Average |

|---|---|---|

| Spread on Major Pairs | 2 pips | 1-1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The spread on major currency pairs offered by Carnival Forex is relatively high at 2 pips, compared to the industry average of 1-1.5 pips. This indicates that traders may be paying more to execute trades, which can eat into profits over time. Furthermore, the absence of clear information regarding commission structures and overnight interest rates makes it challenging for traders to understand the total cost of trading with this broker.

High trading costs can be indicative of a broker that is not operating in the best interests of its clients. Given the lack of transparency regarding fees and the absence of a regulated environment, traders should be cautious when considering Carnival Forex as their trading platform.

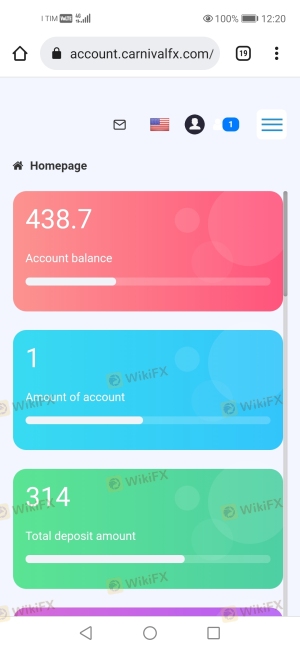

Client Fund Security

The safety of client funds is paramount when choosing a broker. Carnival Forex lacks essential safety measures that protect investor capital. There are no indications that the broker utilizes segregated accounts, which is a standard practice among regulated brokers to keep client funds separate from the company's operating capital.

Additionally, there is no mention of investor protection schemes or negative balance protection policies, which further heightens the risk for traders. In the event of insolvency or operational issues, clients may find themselves without recourse for recovering their funds. The absence of documented safety measures raises serious concerns about the broker's commitment to safeguarding investor capital.

Historically, unregulated brokers have faced numerous allegations of mismanaging client funds, leading to significant losses for investors. Without a robust framework for protecting client funds, Carnival Forex presents a high-risk environment for traders.

Customer Experience and Complaints

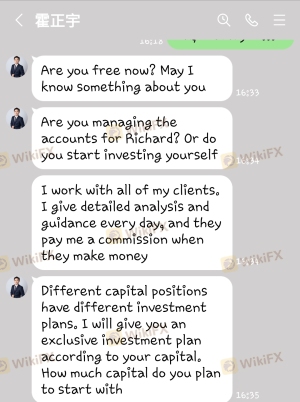

Customer feedback provides valuable insights into a broker's reliability and operational practices. Reviews and complaints about Carnival Forex indicate a troubling pattern of negative experiences. Many users have reported difficulties in reaching customer support, delayed withdrawals, and issues with account management.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Access | Medium | Inadequate |

| Misleading Information | High | Unresponsive |

Common complaints include withdrawal issues, where clients have reported being unable to access their funds after requesting withdrawals. This is a significant red flag, as the ability to withdraw funds is a fundamental aspect of any trading platform's reliability. Additionally, the company's response to complaints has been deemed inadequate, with many users expressing frustration over the lack of timely support.

Two notable cases highlight these concerns: one trader reported investing a substantial amount only to find their withdrawal requests ignored, while another experienced constant delays in accessing their funds. These patterns suggest that Carnival Forex may not prioritize client satisfaction or operational transparency.

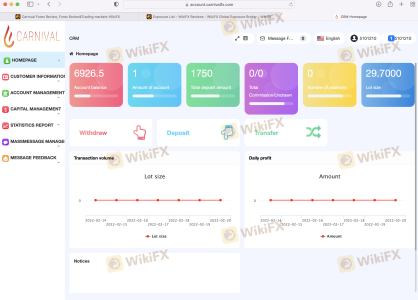

Platform and Trade Execution

The performance of a trading platform is crucial for a trader's success. Carnival Forex claims to utilize the industry-standard MetaTrader 5 platform; however, users have reported significant issues with platform stability and execution quality.

The quality of order execution, including slippage and rejection rates, is a critical factor for traders. Reports indicate that users have experienced frequent slippage and delays in order execution, which can adversely affect trading outcomes. Furthermore, any signs of platform manipulation or discrepancies in trade execution can severely undermine trust.

Given these concerns, traders should approach Carnival Forex with caution, as poor platform performance can lead to substantial financial losses.

Risk Assessment

Using Carnival Forex presents several inherent risks that potential traders should consider:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight, increasing fraud risk. |

| Fund Security Risk | High | Lack of segregation and investor protection. |

| Operational Risk | Medium | Issues with platform stability and customer service. |

The overall risk associated with trading through Carnival Forex is significant. The absence of regulatory oversight and the company's lack of transparency contribute to a precarious trading environment. Traders should be aware of these risks and consider alternative brokers that offer greater security and reliability.

Risk Mitigation Suggestions

- Conduct Thorough Research: Always investigate a broker's regulatory status and user reviews before committing funds.

- Start Small: If you decide to engage with Carnival Forex, consider starting with a minimal investment to gauge the platform's reliability.

- Seek Regulated Alternatives: Look for brokers that are regulated by reputable authorities to ensure a safer trading experience.

Conclusion and Recommendations

Based on the comprehensive analysis presented, it is evident that Carnival Forex raises several red flags regarding its safety and legitimacy. The absence of regulatory oversight, coupled with poor customer feedback and questionable trading conditions, strongly suggests that this broker may not be a trustworthy option for traders.

In summary, is Carnival Forex safe? The evidence points to a high level of risk associated with this broker, and potential clients should exercise extreme caution. For traders seeking reliable platforms, it is advisable to consider well-regulated alternatives that prioritize client protection and transparency.

If you are looking for trustworthy brokers, consider options that are regulated by top-tier authorities, such as FCA, ASIC, or CySEC, which offer better security for your investments.

Is Carnival Forex a scam, or is it legit?

The latest exposure and evaluation content of Carnival Forex brokers.

Carnival Forex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Carnival Forex latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.