Is Cang safe?

Business

License

Is Cang Limited A Scam?

Introduction

Cang Limited, often referred to as Cang FX, positions itself as an online trading platform within the forex market. However, the lack of regulatory oversight and numerous negative reviews have raised significant concerns among potential investors. In the volatile world of forex trading, it is crucial for traders to thoroughly evaluate brokers before committing their funds. This article aims to provide a comprehensive assessment of Cang Limited, focusing on its regulatory status, company background, trading conditions, and customer experiences. The analysis is based on a review of multiple sources, including user feedback, regulatory warnings, and expert evaluations.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its legitimacy and safety. Cang Limited claims to operate under various licenses; however, independent investigations reveal a troubling lack of valid regulatory oversight.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Regulated |

Cang Limited does not hold any legitimate licenses from recognized financial authorities such as the Financial Conduct Authority (FCA) in the UK or the Securities and Futures Commission (SFC) in Hong Kong. This absence of regulatory oversight is a significant red flag, as it indicates that traders' funds may not be protected. The lack of regulation also means that there are no guarantees for investor compensation in the event of the broker's insolvency. Furthermore, Cang Limited has been flagged by multiple regulatory bodies, including the Cyprus Securities and Exchange Commission (CySEC), which has issued warnings about its operations. Such warnings suggest that Cang Limited is operating in a high-risk environment, making it imperative for traders to exercise caution.

Company Background Investigation

Cang Limited's history and ownership structure are also critical in assessing its reliability. The company claims to have been operating for several years; however, investigations reveal that its domain was registered only recently, casting doubts on its purported history. The lack of transparency regarding its ownership and management team further complicates matters.

The company's website offers minimal information about its founders or key personnel, which is unusual for a legitimate broker. Typically, reputable brokers provide detailed profiles of their management teams, highlighting their experience and qualifications. In contrast, Cang Limited's opacity raises concerns about its operational integrity. Additionally, the company's claims of awards and accolades appear dubious, as they cannot be substantiated with credible evidence. This lack of transparency is a significant concern for potential investors, as it suggests that Cang Limited may not be forthcoming about its operations and intentions.

Trading Conditions Analysis

Cang Limited's trading conditions also warrant scrutiny. The broker advertises competitive spreads and leverage, but the specifics remain vague.

| Fee Type | Cang Limited | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 pips | 1.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

While Cang Limited claims to offer spreads as low as 0.0 pips, the lack of transparency regarding commission structures raises concerns. Many brokers typically disclose their commission models to provide clarity for traders, but Cang Limited's ambiguity may indicate hidden fees that could impact profitability. Furthermore, the broker's high leverage ratios, which can reach up to 1:500, pose additional risks, particularly for inexperienced traders. High leverage can lead to significant losses if not managed properly, making it essential for traders to understand the potential implications of using such a broker.

Customer Funds Safety

The safety of customer funds is a paramount concern for any trader. Cang Limited does not provide sufficient information regarding its fund security measures. There are no indications that client funds are held in segregated accounts, which are crucial for ensuring that traders' money is protected in the event of the broker's insolvency.

Moreover, there is no mention of investor protection schemes, such as those offered by regulated brokers, which can provide compensation in case of financial disputes. The absence of these safety measures is alarming and raises questions about the broker's commitment to safeguarding client assets. Historical complaints from users about difficulties in withdrawing funds further exacerbate these concerns, suggesting that Cang Limited may not prioritize the security of its clients' investments.

Customer Experience and Complaints

Analyzing customer feedback is vital in assessing the overall reputation of Cang Limited. Numerous reports indicate that clients have faced significant challenges when attempting to withdraw their funds.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Transparency | Medium | Poor |

| Customer Support | High | Poor |

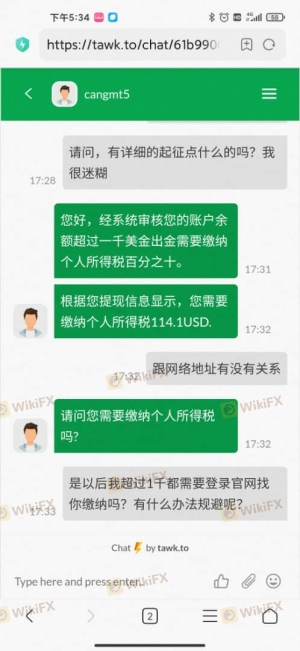

Common complaints revolve around withdrawal delays, with many users reporting that their requests are either ignored or met with unreasonable demands for additional fees or taxes. This pattern of behavior is often indicative of a scam operation, where brokers create obstacles to prevent clients from accessing their funds. Additionally, the quality of customer support has been criticized, with many users highlighting slow response times and unhelpful interactions.

For instance, one user recounted their experience of being unable to withdraw funds after being prompted to pay a "tax" on their earnings, a tactic commonly employed by fraudulent brokers. Such experiences underscore the importance of exercising caution when dealing with Cang Limited, as they suggest a lack of accountability and transparency.

Platform and Trade Execution

The trading platform offered by Cang Limited is another critical aspect to consider. The broker claims to provide access to the popular MetaTrader 5 (MT5) platform, which is known for its advanced trading features. However, the quality of execution and overall user experience remains questionable.

Issues such as slippage and order rejections have been reported by users, which can significantly impact trading outcomes. Moreover, there are concerns about potential platform manipulation, where brokers may artificially influence prices to benefit their own interests. Such practices are often associated with unregulated brokers, making it essential for traders to remain vigilant.

Risk Assessment

Engaging with Cang Limited involves several inherent risks, primarily due to its unregulated status and the numerous complaints from users.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Withdrawal Risk | High | Numerous complaints about withdrawal issues |

| Transparency Risk | High | Lack of information about management and operations |

To mitigate these risks, traders are advised to conduct thorough research and consider alternative, regulated brokers. Utilizing demo accounts to test trading conditions before committing real funds can also be a prudent strategy.

Conclusion and Recommendations

In conclusion, Cang Limited exhibits several characteristics commonly associated with scam brokers. The absence of regulatory oversight, coupled with a lack of transparency and numerous customer complaints, raises significant concerns about its legitimacy.

Traders should exercise extreme caution when considering this broker, as there are ample indications that it may not be a safe option for trading. For those looking to engage in forex trading, it is advisable to seek out regulated brokers with a proven track record of reliability and customer satisfaction. Alternatives such as Hantec Markets or Forex Club, which are well-established and regulated, may offer a more secure trading environment. Ultimately, the question of "Is Cang Safe?" can be answered with a resounding "no," and potential investors should prioritize their financial security by avoiding this broker.

Is Cang a scam, or is it legit?

The latest exposure and evaluation content of Cang brokers.

Cang Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Cang latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.