Is Bull Fx Options safe?

Business

License

Is Bull FX Options Safe or Scam?

Introduction

Bull FX Options is an online forex broker that has emerged in the highly competitive landscape of foreign exchange trading. Positioned as a platform that offers various trading instruments, including forex, commodities, and cryptocurrencies, it claims to provide exceptional trading opportunities for both novice and experienced traders. However, with the proliferation of online trading platforms, it has become increasingly essential for traders to exercise caution and thoroughly evaluate the legitimacy and safety of any broker before committing their funds. This article aims to investigate whether Bull FX Options is a safe trading platform or a potential scam. Our analysis is based on a comprehensive review of available resources, including regulatory information, company background, trading conditions, customer feedback, and security measures.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical aspect that can significantly influence a trader's decision. A regulated broker is typically subject to strict oversight by financial authorities, which helps ensure fair trading practices and the safety of client funds. Unfortunately, Bull FX Options is not regulated by any major financial authority, which raises significant red flags about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of regulatory oversight means that traders using Bull FX Options may not have access to the same level of protection as they would with a regulated broker. For instance, regulated brokers are often required to maintain segregated accounts for client funds, ensuring that these funds are protected in the event of insolvency. Moreover, the lack of a regulatory framework can lead to potential issues regarding unfair practices, withdrawal difficulties, and lack of recourse in case of disputes. Given these concerns, it is prudent for traders to be wary of engaging with Bull FX Options.

Company Background Investigation

A thorough examination of Bull FX Options reveals limited information regarding its history, ownership structure, and management team. The company claims to operate from an address in the United States, but there is little transparency about its founders or the team behind it. This lack of clarity can be concerning, as reputable brokers typically provide detailed information about their management and operational history. Moreover, Bull FX Options does not disclose any verifiable information regarding its ownership, which further complicates the assessment of its credibility.

The absence of a clear corporate structure and the use of a generic email address for customer support raises questions about the company's transparency and commitment to ethical practices. Traders often feel more secure when they can identify the individuals behind a broker and understand their qualifications and experience in the financial industry. Unfortunately, Bull FX Options falls short in this regard, making it difficult for potential clients to trust the platform.

Trading Conditions Analysis

When evaluating whether Bull FX Options is safe, it is essential to consider its trading conditions, including fees, spreads, and commissions. A brokers fee structure can significantly impact a trader's profitability, and any hidden fees can lead to unexpected losses.

The following table summarizes the core trading costs associated with Bull FX Options compared to industry averages:

| Fee Type | Bull FX Options | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | High | Low to Medium |

While Bull FX Options may offer competitive spreads, reports indicate that traders might encounter unusually high overnight interest rates, which could erode profits significantly over time. Additionally, the lack of a clear commission structure raises concerns about potential hidden fees that could be detrimental to traders, especially those who engage in frequent trading. Given these factors, it is crucial for traders to carefully assess whether the trading conditions offered by Bull FX Options align with their trading strategies and risk tolerance.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. A reputable broker should have robust measures in place to protect client deposits and ensure secure transactions. Unfortunately, Bull FX Options does not provide sufficient information regarding its fund safety protocols.

The absence of details about fund segregation, investor protection schemes, and negative balance protection suggests a lack of commitment to safeguarding client assets. Traders should be aware that in the event of the broker's insolvency, they may not have any recourse to recover their funds. Historical complaints and reports indicate that clients have faced challenges when attempting to withdraw funds from Bull FX Options, further highlighting potential risks associated with this broker.

Customer Experience and Complaints

Customer feedback is a vital component of assessing the reliability of any trading platform. Reviews and testimonials regarding Bull FX Options indicate a mixed to negative sentiment among users. Many traders have reported issues related to withdrawal delays, lack of responsive customer support, and difficulties in accessing their accounts.

The following table outlines the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Account Access Issues | Medium | Moderate |

| Customer Support Response | High | Poor |

Typical cases include traders experiencing significant delays in processing withdrawal requests, leading to frustration and financial strain. Furthermore, the lack of timely and effective responses from the customer support team has exacerbated these issues, leaving clients feeling abandoned and unsupported. Such patterns of complaints raise serious questions about the overall customer experience and whether Bull FX Options is a broker worth trusting.

Platform and Execution

The trading platform's performance is another critical aspect to consider when evaluating whether Bull FX Options is safe. A reliable trading platform should offer stability, ease of use, and efficient order execution. However, reports from users indicate that the platform provided by Bull FX Options suffers from frequent outages and slow execution speeds, which can be detrimental in the fast-paced forex market.

Additionally, traders have reported instances of slippage and rejected orders, which can significantly impact trading outcomes. Such issues may suggest potential manipulation or inefficiencies within the trading system, raising further concerns about the broker's integrity.

Risk Assessment

Using Bull FX Options carries a variety of risks that traders should be aware of. The lack of regulation, combined with the numerous complaints regarding fund safety and customer support, indicates a high-risk trading environment.

The following risk assessment table summarizes the key risk areas associated with Bull FX Options:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status poses significant risks. |

| Fund Safety Risk | High | Lack of transparency regarding fund protection. |

| Customer Service Risk | Medium | Poor response to complaints and issues. |

To mitigate these risks, traders are advised to conduct thorough research, consider using regulated brokers, and only invest what they can afford to lose.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that Bull FX Options raises several red flags regarding its safety and legitimacy. The lack of regulation, combined with numerous complaints about withdrawal issues and inadequate customer support, points to a potentially risky trading environment. Traders should exercise extreme caution and consider alternative, more reputable brokers that offer regulatory oversight and a proven track record of customer satisfaction. For those seeking safer options, brokers regulated by top-tier authorities such as the FCA or ASIC are recommended, as they typically provide better protection for client funds and adhere to strict operational standards.

Ultimately, while Bull FX Options may present itself as an attractive trading platform, the potential risks and concerns highlighted in this analysis warrant serious consideration before engaging with this broker.

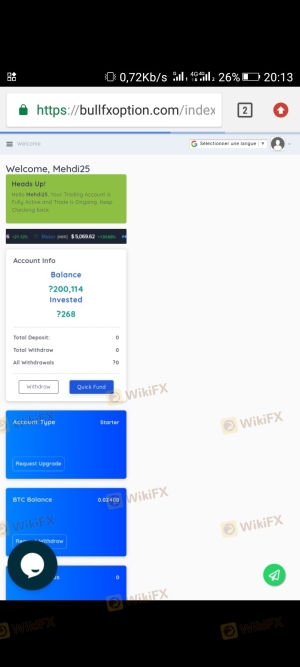

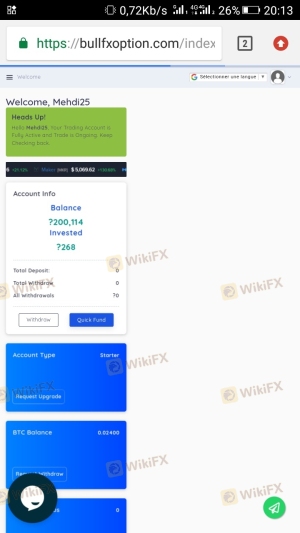

Is Bull Fx Options a scam, or is it legit?

The latest exposure and evaluation content of Bull Fx Options brokers.

Bull Fx Options Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Bull Fx Options latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.