Is Brisk Liquidity safe?

Business

License

Is Brisk Liquidity A Scam?

Introduction

Brisk Liquidity is a forex broker that has recently gained attention in the trading community, primarily due to its claims of offering competitive trading conditions and a user-friendly platform. As with any financial service provider, it is crucial for traders to conduct thorough due diligence before committing their funds. The forex market is rife with both reputable and dubious brokers, making it essential to assess the legitimacy and safety of any trading partner carefully. This article aims to evaluate whether Brisk Liquidity is safe or a scam by analyzing its regulatory status, company background, trading conditions, customer feedback, and overall risk profile.

To conduct this assessment, we utilized various online resources, including broker reviews, regulatory databases, and customer feedback platforms. Our evaluation framework focuses on several critical aspects: regulatory compliance, company history, trading conditions, customer fund safety, user experiences, platform performance, and risk assessment. By synthesizing this information, we aim to provide a clear and comprehensive view of Brisk Liquidity's operations and reliability.

Regulatory and Legality

One of the most significant factors determining a broker's credibility is its regulatory status. Brisk Liquidity operates under Brisk Liquidity Limited, a company registered in New Zealand. However, it is important to note that this broker is not regulated by any major financial authority, which raises concerns regarding its legitimacy and the safety of client funds.

Core Regulatory Information

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | New Zealand | Unregulated |

The absence of regulation is a red flag for many traders. Regulatory bodies like the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC) enforce strict guidelines to protect investors. These regulations often include requirements for segregated accounts, regular audits, and investor compensation schemes. Brisk Liquidity's claim of being regulated in Australia was found to be unsubstantiated, as no records were available on the ASIC website. This lack of oversight can lead to potential risks, including the misuse of client funds and a lack of accountability in trading practices.

Company Background Investigation

Brisk Liquidity Limited has a relatively obscure background, with limited information available about its history and ownership structure. The company presents itself as part of a larger "Brisk Group," but details regarding this parent company are also vague.

The management team behind Brisk Liquidity has not been prominently featured in public disclosures, making it difficult to assess their qualifications and experience in the financial sector. Transparency in a broker's management is essential, as experienced leaders often contribute to the broker's reliability and ethical standards. The lack of clear information about the team raises questions about the company's commitment to transparency and accountability.

Furthermore, the level of information disclosure on Brisk Liquiditys website is not comprehensive. This lack of transparency can be concerning for potential clients, as it may indicate a reluctance to fully disclose operational practices or potential risks associated with trading through their platform.

Trading Conditions Analysis

When evaluating whether Brisk Liquidity is safe, it is also essential to consider its trading conditions, including fees, spreads, and execution policies. The broker offers two primary account types: a standard account and an active trader account, each with different fee structures.

Core Trading Costs Comparison

| Fee Type | Brisk Liquidity | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.3 pips | 1.0 - 1.5 pips |

| Commission Model | Varies | Varies |

| Overnight Interest Range | Not disclosed | Varies |

While Brisk Liquidity advertises attractive spreads, particularly on its demo accounts, there are concerns about the sustainability of these rates in live trading conditions. Many reviews suggest that the spreads on demo accounts do not accurately reflect the conditions traders will face in practice, which could mislead potential clients. Additionally, the lack of transparency regarding commissions and overnight interest rates can further complicate the cost structure for traders.

Customer Fund Safety

The safety of customer funds is paramount when determining if Brisk Liquidity is safe. The broker does not appear to offer any investor protection schemes or segregated accounts for client funds. Without these safeguards, traders may face significant risks if the broker encounters financial difficulties or engages in unethical practices.

In terms of negative balance protection, there is no clear information available on Brisk Liquidity's policies. Negative balance protection is a critical feature that prevents traders from losing more than their initial investment, which is particularly important in the highly volatile forex market.

Historically, unregulated brokers have faced numerous complaints regarding fund mismanagement and withdrawal issues, further emphasizing the need for potential clients to be cautious.

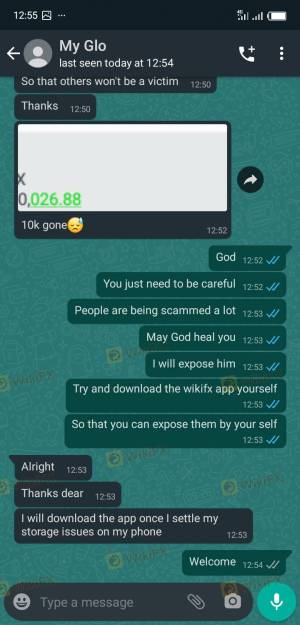

Customer Experience and Complaints

Customer feedback can provide valuable insights into a broker's reliability and service quality. Reviews of Brisk Liquidity reveal a mixed bag of experiences, with some users praising the platform's ease of use and others raising serious concerns about withdrawal issues and customer support.

Major Complaint Types

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Account Bans | Medium | Average |

| Poor Customer Support | High | Poor |

Several users reported difficulties in withdrawing funds, with delays stretching into weeks. Such issues are particularly alarming, as they can indicate deeper problems within the broker's operations. Additionally, complaints regarding poor customer service suggest a lack of responsiveness, which can further frustrate traders seeking assistance.

Platform and Execution

Brisk Liquidity utilizes the widely-known MetaTrader 4 platform, which is favored by many traders for its robust features and user-friendly interface. However, the quality of order execution is also a critical factor in assessing whether Brisk Liquidity is safe.

Concerns have been raised about potential slippage and order rejections, which can significantly impact trading performance. Users have reported instances where orders were not executed at the desired price, leading to unexpected losses. Such execution issues can be indicative of a broker's operational integrity and their commitment to fair trading practices.

Risk Assessment

Using Brisk Liquidity carries several risks that traders should consider before opening an account.

Risk Scorecard

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Safety Risk | High | No investor protection |

| Execution Risk | Medium | Reports of slippage and rejections |

| Customer Service Risk | High | Frequent complaints about support |

Given these risks, potential traders should approach Brisk Liquidity with caution. It is advisable to seek brokers with robust regulatory backing and proven track records in customer service and fund safety.

Conclusion and Recommendations

In conclusion, the evidence suggests that Brisk Liquidity may not be a safe option for forex trading. The lack of regulation, coupled with concerning customer feedback and transparency issues, raises significant red flags. While the broker offers attractive trading conditions, these may not be sustainable or reflective of actual trading experiences.

For traders seeking reliable alternatives, it is recommended to consider well-regulated brokers with strong reputations, such as Plus500, XM, or eToro. These options provide a safer trading environment with necessary protections for client funds and more transparent trading conditions.

Before deciding to trade with Brisk Liquidity, potential clients should carefully weigh the risks involved and consider whether the potential rewards justify the inherent uncertainties associated with this broker.

Is Brisk Liquidity a scam, or is it legit?

The latest exposure and evaluation content of Brisk Liquidity brokers.

Brisk Liquidity Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Brisk Liquidity latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.