Is Bloom Forex safe?

Business

License

Is Bloom Forex Safe or a Scam?

Introduction

Bloom Forex has emerged as a notable player in the forex trading market, offering a range of services aimed at both novice and experienced traders. As the trading landscape becomes increasingly crowded, it is crucial for traders to thoroughly evaluate the legitimacy and safety of their chosen brokers. This article aims to assess whether Bloom Forex is a safe platform for trading or if it exhibits characteristics typical of a scam.

To achieve this objective, we utilized a comprehensive investigative approach, analyzing various sources, including user reviews, regulatory information, and financial reports. Our evaluation framework focuses on several critical aspects, such as regulatory compliance, company background, trading conditions, client fund security, customer experiences, platform performance, and overall risk assessment.

Regulation and Legitimacy

The regulatory status of a forex broker is paramount in determining its safety and legitimacy. A regulated broker is subject to strict oversight, ensuring that it adheres to necessary financial standards and provides a level of protection to its clients. In the case of Bloom Forex, we found that it operates without any valid regulatory oversight, which raises significant concerns.

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of regulation means that Bloom Forex is not held accountable by any financial authority, which can expose traders to higher risks of fraud and malpractice. Regulatory bodies are essential in maintaining market integrity and protecting investors, and working with an unregulated broker like Bloom Forex can lead to potential financial loss without any recourse.

Company Background Investigation

Bloom Forex's history and ownership structure are vital components in assessing its reliability. Founded in Australia, the company claims to have been in operation for several years. However, detailed information about its management team and ownership remains scarce, leading to questions about transparency.

The lack of disclosure regarding the company's leadership and operational history can be a red flag. A trustworthy broker typically provides clear information about its management team, including their qualifications and experience in the financial industry. In the case of Bloom Forex, the opacity surrounding its corporate structure may suggest a lack of accountability, further complicating its credibility.

Trading Conditions Analysis

Understanding a broker's trading conditions is essential for evaluating its overall value proposition. Bloom Forex offers a range of trading services, but the specifics of its fee structure and trading conditions warrant scrutiny.

| Fee Type | Bloom Forex | Industry Average |

|---|---|---|

| Spread on Major Pairs | N/A | 1.0 - 3.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 2.0% |

While the exact figures for Bloom Forexs trading fees are not clearly stated, the lack of transparency regarding costs can be concerning. Traders should be wary of hidden charges or unusual fee policies that may erode their profits. A competitive fee structure is essential for maintaining a fair trading environment, and without clear information, potential clients may find themselves at a disadvantage.

Client Fund Security

The security of client funds is a critical concern when choosing a forex broker. Bloom Forex's approach to fund security is unclear, as it does not provide substantial information regarding its measures for protecting client deposits.

Key aspects to consider include fund segregation, investor protection schemes, and negative balance protection policies. A reputable broker typically segregates client funds from its operational funds, ensuring that traders' money is safe even in the event of the broker's insolvency. Unfortunately, Bloom Forex does not appear to have such safeguards in place, which raises alarms about the safety of client investments.

Customer Experience and Complaints

Customer feedback offers valuable insights into a broker's reliability and service quality. In the case of Bloom Forex, user reviews reveal a mixed bag of experiences, with some clients expressing satisfaction while others raise serious concerns.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

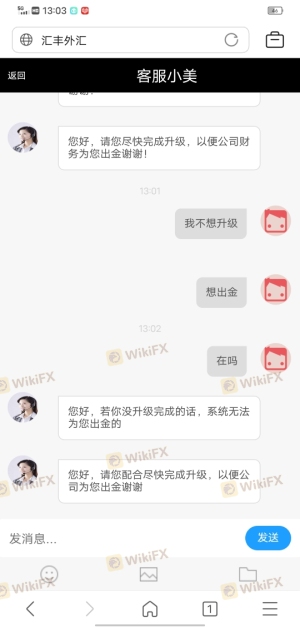

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | Medium | Inconsistent |

| Transparency Concerns | High | Unresponsive |

Common complaints include difficulty in withdrawing funds, inadequate customer support, and a general lack of transparency. These issues are significant red flags that potential clients should consider when evaluating whether Bloom Forex is safe.

Platform and Trade Execution

The performance and reliability of a trading platform are crucial for ensuring a seamless trading experience. Bloom Forex's trading platform has been reported to have performance issues, including slow execution times and occasional outages.

Moreover, the quality of order execution is vital in forex trading, as delays or slippage can significantly impact trading outcomes. Users have reported instances of slippage and order rejections, raising concerns about the platform's reliability and efficiency. Such issues can lead to frustration and financial loss, further questioning the safety of trading with Bloom Forex.

Risk Assessment

Engaging with any forex broker comes with inherent risks, and evaluating these risks is essential for informed decision-making.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Financial Risk | High | Lack of transparency in fees and conditions |

| Operational Risk | Medium | Platform performance issues |

The absence of regulation and the unclear nature of trading conditions significantly elevate the risk level associated with Bloom Forex. Traders should exercise extreme caution and consider alternative options that offer better security and transparency.

Conclusion and Recommendations

In conclusion, the investigation into Bloom Forex raises numerous concerns regarding its safety and legitimacy. The absence of regulatory oversight, coupled with a lack of transparency and significant customer complaints, suggests that potential traders should approach this broker with caution.

For those seeking a reliable trading environment, it is advisable to consider regulated brokers with a proven track record of compliance and customer satisfaction. Some reputable alternatives include brokers regulated by authorities such as the FCA, ASIC, or CySEC, which offer better protection for client funds and more transparent trading conditions.

Ultimately, while Bloom Forex may present itself as a viable trading option, the potential risks and red flags indicate that it may not be a safe choice for traders. Always prioritize due diligence and choose brokers that prioritize client security and regulatory compliance.

Is Bloom Forex a scam, or is it legit?

The latest exposure and evaluation content of Bloom Forex brokers.

Bloom Forex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Bloom Forex latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.