Is BitcoinTradeLine safe?

Business

License

Is Bitcoin Tradeline Safe or a Scam?

Introduction

Bitcoin Tradeline is an online forex broker that has recently gained attention in the trading community. Positioned as a platform for trading various assets, including cryptocurrencies, commodities, and forex, Bitcoin Tradeline claims to offer competitive trading conditions and a user-friendly interface. However, as with any online trading platform, it is crucial for traders to conduct thorough due diligence before committing their funds. The nature of the forex market, which is largely unregulated, makes it essential for traders to evaluate the legitimacy and reliability of brokers carefully. This article investigates Bitcoin Tradeline's credibility by examining its regulatory status, company background, trading conditions, customer safety, user experiences, and overall risk factors.

Regulation and Legitimacy

The regulatory status of a trading platform is one of the most critical factors in determining its safety. A broker operating under strict regulations is generally viewed as more trustworthy and secure. Unfortunately, Bitcoin Tradeline operates without any valid regulatory oversight. The absence of regulation is a significant red flag, as it raises concerns about the broker's compliance with industry standards and its accountability to traders.

| Regulatory Authority | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The lack of a regulatory body overseeing Bitcoin Tradeline means that there are no guarantees for traders regarding the safety of their funds or the fairness of trading practices. Moreover, the broker's parent company, Plus One Limited, has been flagged by various financial authorities, including warnings from the Italian regulator. This lack of oversight and the company's dubious background raise significant concerns about the legitimacy of Bitcoin Tradeline. Therefore, it is imperative to consider these factors when assessing whether Bitcoin Tradeline is safe for trading.

Company Background Investigation

Bitcoin Tradeline is registered in St. Vincent and the Grenadines, a jurisdiction known for its lenient regulatory environment. This aspect alone raises questions about the broker's transparency and accountability. The company's ownership structure is unclear, with limited information available about the individuals behind it. Such anonymity is concerning, as it makes it difficult for traders to ascertain who is managing their funds.

Furthermore, the management team's background lacks verifiable credentials or relevant experience in the financial services industry. The absence of information about the team signifies a lack of transparency, which is often associated with untrustworthy brokers. Without a clear understanding of the company's operations and leadership, traders are left vulnerable to potential scams or fraud.

Trading Conditions Analysis

When evaluating a forex broker, understanding its trading conditions is crucial. Bitcoin Tradeline advertises various trading accounts with purportedly attractive features, including high leverage and a wide range of trading instruments. However, the broker's fee structure raises some concerns.

| Fee Type | Bitcoin Tradeline | Industry Average |

|---|---|---|

| Spread on Major Pairs | High | Moderate |

| Commission Structure | Unknown | Varies |

| Overnight Interest Range | High | Low |

The spreads offered by Bitcoin Tradeline are notably higher than the industry average, which could significantly impact traders' profitability. Additionally, the commission structure is not clearly defined, leading to potential hidden fees. Such opacity in pricing is a common tactic employed by fraudulent brokers, making it essential for traders to approach Bitcoin Tradeline with caution.

Customer Funds Security

The security of customer funds is paramount when choosing a trading platform. Bitcoin Tradeline does not provide clear information regarding its fund protection measures. There is no evidence of segregated accounts, which are essential for ensuring that client funds are kept separate from the broker's operational funds. Moreover, the lack of investor protection schemes, such as those provided by regulated brokers, raises further concerns about the safety of traders' capital.

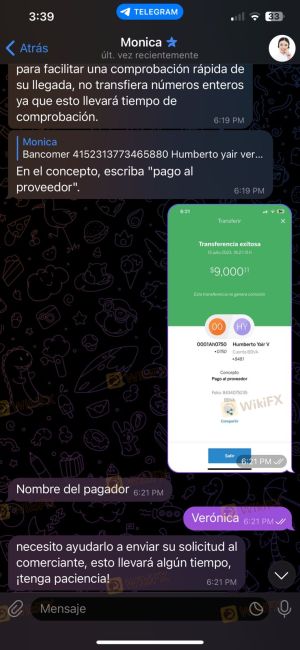

The absence of a clear withdrawal policy is another alarming aspect. Many users have reported difficulties in withdrawing their funds, often facing excessive fees or delays. This pattern of complaints aligns with typical behaviors exhibited by scam brokers, where withdrawal issues are common as a means to retain client funds.

Customer Experience and Complaints

User feedback is a valuable source of information when assessing a broker's reliability. Reviews of Bitcoin Tradeline reveal a concerning trend of negative experiences among traders. Common complaints include withdrawal difficulties, lack of customer support, and issues with account verification.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

| Account Verification | High | Poor |

Many users have reported that their withdrawal requests were either denied or met with unreasonable delays. Additionally, the quality of customer support has been criticized, with traders often left without timely assistance. These complaints indicate a pattern of neglect and unprofessionalism, further questioning whether Bitcoin Tradeline is safe for trading.

Platform and Execution

The performance of a trading platform is crucial for a seamless trading experience. Bitcoin Tradeline claims to offer a user-friendly interface; however, reports suggest that the platform suffers from frequent outages and slow execution speeds. Traders have noted instances of slippage and rejected orders, which can adversely affect trading outcomes.

Moreover, there are allegations of potential platform manipulation, where trades may not be executed at the intended prices. Such practices are indicative of a lack of integrity and transparency, which are essential for a trustworthy trading environment.

Risk Assessment

Engaging with a broker like Bitcoin Tradeline carries inherent risks that traders must consider. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Security Risk | High | Lack of fund protection |

| Withdrawal Risk | High | Difficulties in fund retrieval |

| Operational Risk | Medium | Platform performance issues |

Given these risks, it is crucial for traders to approach Bitcoin Tradeline with extreme caution. To mitigate these risks, potential users should consider using well-regulated brokers with transparent practices and established reputations.

Conclusion and Recommendations

In conclusion, the investigation into Bitcoin Tradeline raises significant concerns regarding its legitimacy and safety. The broker's lack of regulation, unclear company background, high trading costs, and numerous customer complaints suggest that it may not be a trustworthy platform. Therefore, it is prudent for traders to exercise caution and consider alternative options.

For those seeking reliable trading platforms, it is advisable to explore brokers that are regulated by reputable authorities, offer transparent trading conditions, and have a proven track record of positive customer experiences. Overall, the evidence points to the conclusion that Bitcoin Tradeline is not safe for trading, and traders should be wary of engaging with this broker.

Is BitcoinTradeLine a scam, or is it legit?

The latest exposure and evaluation content of BitcoinTradeLine brokers.

BitcoinTradeLine Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BitcoinTradeLine latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.