Is BIGBEN PRO safe?

Business

License

Is BigBen Pro Safe or Scam?

Introduction

BigBen Pro is a forex broker that positions itself as a global financial derivatives trading service provider. It claims to offer trading in various asset classes, including forex currency pairs, stocks, indices, and commodities. However, the world of forex trading is fraught with risks, and traders must exercise caution when evaluating brokers. The importance of due diligence cannot be overstated, as choosing an unregulated or dubious broker can lead to significant financial losses. This article aims to assess the safety and legitimacy of BigBen Pro by examining its regulatory status, company background, trading conditions, customer feedback, and other critical factors. Our investigation is based on a comprehensive review of available online resources and user experiences.

Regulation and Legitimacy

The regulatory status of a broker is a crucial factor in determining its safety. A well-regulated broker is more likely to adhere to industry standards and provide a secure trading environment. Unfortunately, BigBen Pro operates without any regulatory oversight, which raises significant concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of a regulatory authority means that BigBen Pro is not subject to the stringent rules and oversight that protect traders. This lack of regulation poses a considerable risk, as unregulated brokers can engage in questionable practices without fear of repercussions. Additionally, the offshore nature of BigBen Pro's operations further complicates matters, as these brokers often lack transparency and accountability. Historical compliance issues and the potential for bankruptcy without warning are significant red flags for potential traders.

Company Background Investigation

BigBen Pro is owned by Big Ben Pro Ltd., a company registered in the Marshall Islands. The company claims to have its headquarters in London, UK, but its lack of transparency regarding its ownership structure raises concerns. There is little publicly available information about the management team or their professional backgrounds, which is a significant drawback for potential investors. A reputable broker should provide clear information about its leadership, including the CEO and key personnel, enabling traders to assess their qualifications and experience.

The overall transparency of BigBen Pro is inadequate, as it does not disclose essential information such as its financial status or operational history. This lack of clarity can be alarming for traders, as it makes it difficult to ascertain the broker's reliability and trustworthiness.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for evaluating its overall value. BigBen Pro presents itself as a competitive option, but its fee structure and trading conditions require careful scrutiny.

| Fee Type | BigBen Pro | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | Variable | Varies |

While the minimum deposit is set at $100, which is relatively low, the lack of clarity surrounding spreads and commissions is concerning. Traders must be wary of hidden fees that could erode their profits. Additionally, the variable spreads may lead to higher trading costs, especially during volatile market conditions. The absence of a defined commission structure can also create uncertainty, as traders may not know the true cost of their trades until they execute them.

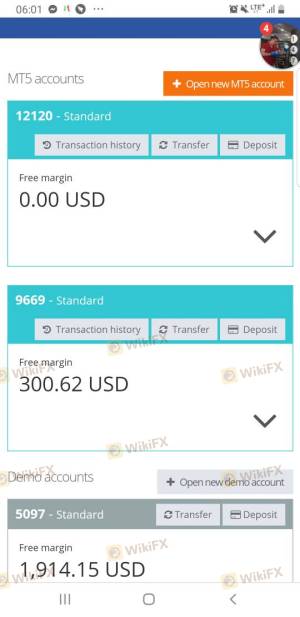

Client Fund Security

The security of client funds is paramount when evaluating a broker's safety. BigBen Pro's lack of regulation raises questions about its fund protection measures. Regulated brokers typically offer segregated accounts to ensure that client funds are kept separate from the broker's operational funds. However, without regulatory oversight, there is no guarantee that BigBen Pro follows such practices.

Moreover, the absence of investor protection schemes means that traders are at risk of losing their funds without recourse. Historical issues related to fund withdrawals and client complaints about being unable to access their money further highlight the risks associated with BigBen Pro.

Customer Experience and Complaints

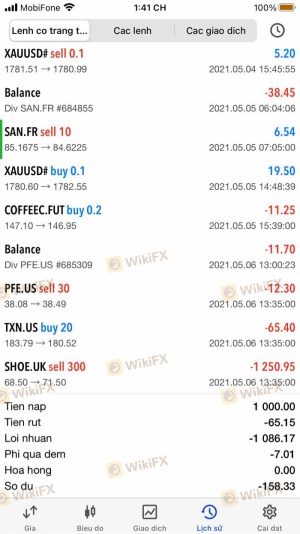

Customer feedback is a critical component of assessing a broker's reliability. Reviews and experiences shared by users of BigBen Pro reveal a concerning trend of complaints, particularly related to fund withdrawals and customer service.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | High | Poor |

Many users have reported difficulties in withdrawing their funds, with some claiming that their accounts were frozen without explanation. The company's response to these complaints has been largely inadequate, with many users stating that they received little to no support when seeking assistance. This pattern of complaints raises serious concerns about the overall customer experience and the broker's commitment to addressing client issues.

Platform and Trade Execution

The trading platform is another critical factor in determining a broker's reliability. BigBen Pro offers the MetaTrader 4 (MT4) platform, which is widely recognized for its user-friendly interface and robust features. However, user experiences indicate that the platform may suffer from performance issues, including slippage and order rejections.

Traders have reported instances of delayed order execution, which can lead to missed opportunities and increased trading costs. Additionally, any signs of platform manipulation or unfair trading practices can significantly undermine trust in the broker.

Risk Assessment

Using BigBen Pro carries inherent risks due to its unregulated status and customer feedback.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Potential for fund loss |

| Operational Risk | Medium | Platform performance issues |

To mitigate these risks, traders should consider using smaller amounts for initial trades, diversifying their investment across multiple brokers, and conducting thorough research before committing to any trading activities with BigBen Pro.

Conclusion and Recommendations

In conclusion, the evidence suggests that BigBen Pro raises significant concerns regarding its safety and legitimacy. The lack of regulation, transparency issues, and negative customer feedback indicate that this broker may not be a safe choice for traders. While some traders may be tempted by the low minimum deposit and the promise of competitive trading conditions, the potential risks far outweigh the benefits.

For those considering forex trading, it is advisable to seek out regulated and reputable brokers with a proven track record of reliability and customer satisfaction. Alternatives to BigBen Pro may include brokers regulated by top-tier authorities, which provide better protection for client funds and a more transparent trading environment. Always prioritize safety and due diligence when selecting a forex broker to ensure a secure trading experience.

Is BIGBEN PRO a scam, or is it legit?

The latest exposure and evaluation content of BIGBEN PRO brokers.

BIGBEN PRO Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BIGBEN PRO latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.