Is Baosheng financial group safe?

Business

License

Is Baosheng Financial Group Safe or Scam?

Introduction

Baosheng Financial Group has emerged as a player in the forex market, offering trading services to a diverse clientele. However, the need for traders to exercise caution when evaluating forex brokers cannot be overstated. The forex market, while lucrative, is also fraught with risks, including potential scams perpetrated by unscrupulous brokers. Therefore, traders must conduct thorough due diligence before committing their funds. This article aims to assess whether Baosheng Financial Group is a safe trading option or a scam. Our investigation will utilize a comprehensive evaluation framework that includes regulatory compliance, company background, trading conditions, customer experiences, and risk assessments.

Regulation and Legitimacy

One of the foremost indicators of a broker's reliability is its regulatory standing. Baosheng Financial Group claims to operate under certain regulatory frameworks, but the specifics of its licenses and compliance history warrant scrutiny. Below is a summary of the core regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSPR | Not Available | New Zealand | Suspicious Clone |

While Baosheng Financial Group is registered in New Zealand, it has been flagged as a suspicious clone by the Financial Services Provider Register (FSPR). This raises significant concerns about its legitimacy and operational transparency. The absence of a robust regulatory framework is alarming, as it often correlates with higher risks for traders. A well-regulated broker typically adheres to stringent compliance standards, ensuring that client funds are protected. In contrast, Baosheng's questionable regulatory status may expose traders to potential fraud or mismanagement.

Company Background Investigation

Delving deeper into the history and ownership structure of Baosheng Financial Group reveals a lack of transparency. The company was established in recent years, and information regarding its founders and management team is sparse. This opacity can be a red flag for potential investors. A credible broker usually provides detailed information about its leadership, including their professional backgrounds and expertise in the financial sector.

Furthermore, the company's track record in terms of compliance and operational history is concerning. There have been multiple reports of clients facing difficulties in withdrawing funds, which often points to deeper issues within the company's operational framework. A transparent broker should have a clear history of compliance with regulatory requirements and an established reputation in the industry.

Trading Conditions Analysis

Understanding the trading conditions offered by Baosheng Financial Group is crucial for assessing its safety. The broker's fee structure and trading conditions can significantly impact a trader's profitability. Below is a comparison of the core trading costs:

| Fee Type | Baosheng Financial Group | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | Not Clear | $0 - $10 per lot |

| Overnight Interest Range | High | Low to Moderate |

The variability in spreads and the lack of clarity regarding commission models raise concerns about hidden fees. Traders have reported unexpected charges, which can erode profits and lead to frustration. A trustworthy broker typically offers a transparent fee structure, allowing traders to understand the costs associated with their trades clearly.

Client Fund Security

The security of client funds is a paramount concern when evaluating any forex broker. Baosheng Financial Group's measures for safeguarding client deposits are crucial to assess. Reports indicate that the broker does not employ effective fund segregation practices, which is a standard industry requirement. Furthermore, the absence of investor protection schemes raises alarms about the safety of client funds.

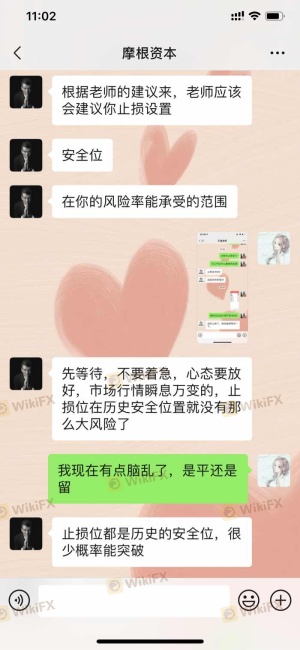

Historically, there have been allegations against Baosheng regarding difficulties in fund withdrawals, which further complicates the situation. Traders have voiced concerns about the broker's ability to facilitate timely withdrawals, leading to speculation about the security of their investments. A reliable broker should offer robust security measures, including fund segregation, negative balance protection, and transparent withdrawal processes.

Customer Experience and Complaints

Customer feedback provides valuable insights into a broker's reliability and service quality. Reviews of Baosheng Financial Group reveal a pattern of complaints related to withdrawal issues and poor customer support. Below is a summary of major complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Difficulties | High | Slow Response |

| Poor Customer Support | Medium | Inconsistent |

| Misleading Information | High | No Response |

The severity of complaints surrounding withdrawal difficulties and the company's slow response to customer inquiries are significant warning signs. A trustworthy broker should prioritize customer service and address complaints promptly. The lack of effective communication from Baosheng raises concerns about its commitment to client satisfaction and transparency.

Platform and Trade Execution

Evaluating the trading platform provided by Baosheng Financial Group is essential for understanding the overall trading experience. A reliable platform should offer stability, ease of use, and efficient trade execution. However, reports indicate that users have experienced issues with order execution quality, including slippage and rejections.

Traders have expressed concerns about the platform's stability, which can significantly impact trading outcomes. A broker that manipulates prices or executes trades in a way that disadvantages clients is a serious red flag. As such, it is vital to assess whether Baosheng Financial Group exhibits any signs of platform manipulation or poor execution practices.

Risk Assessment

Engaging with Baosheng Financial Group presents a multitude of risks that traders should consider. Below is a risk assessment summary:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Lack of robust regulatory oversight |

| Fund Security | High | Reports of withdrawal issues |

| Customer Support | Medium | Inconsistent response times |

| Trading Conditions | High | Unclear fee structures |

Given the high-risk levels associated with regulatory compliance and fund security, traders should proceed with caution. It is advisable to implement risk mitigation strategies, such as limiting initial deposits and actively monitoring account activity.

Conclusion and Recommendations

In conclusion, the evidence suggests that Baosheng Financial Group raises several red flags that warrant concern. The broker's questionable regulatory status, lack of transparency, and history of customer complaints indicate potential risks for traders. While not definitively a scam, the warning signs suggest that traders should exercise extreme caution when considering this broker.

For traders seeking a reliable forex trading experience, it is advisable to explore alternative options that offer robust regulatory oversight, transparent fee structures, and a proven track record of client satisfaction. Brokers regulated by top-tier authorities such as the FCA or ASIC generally provide a safer trading environment. Ultimately, the decision to engage with Baosheng Financial Group should be made with careful consideration of the associated risks.

Is Baosheng financial group a scam, or is it legit?

The latest exposure and evaluation content of Baosheng financial group brokers.

Baosheng financial group Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Baosheng financial group latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.