Is OGAM safe?

Business

License

Is Ogam Safe or a Scam?

Introduction

Ogam is a forex broker that has recently emerged in the trading landscape, positioning itself as a premier provider of forex and CFD trading services. It claims to offer a diverse range of trading instruments, including over 180 currency pairs and CFDs on commodities and indices. However, the influx of new brokers in the forex market necessitates a cautious approach from traders, as not all brokers operate with integrity or transparency. Evaluating a broker's credibility is essential to safeguard investments and ensure a positive trading experience. This article investigates Ogam's legitimacy by examining its regulatory status, company background, trading conditions, customer feedback, and overall risk profile.

Regulatory and Legitimacy

The regulatory framework within which a broker operates is critical for assessing its legitimacy. A regulated broker is typically subject to stringent oversight, which provides a layer of protection for traders. Unfortunately, Ogam appears to lack proper regulation.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

Ogam claims to have a license from the National Futures Association (NFA) in the United States; however, investigations reveal that no such license exists. Furthermore, their assertions of applying for licenses in Australia and Vanuatu are dubious, as there is no evidence supporting these claims. The absence of regulation raises significant concerns about the safety of funds and the broker's operational integrity. In the U.S., brokers must adhere to strict regulations, including maintaining a minimum operational capital and being members of the NFA. The lack of such compliance from Ogam suggests that it is operating outside the legal framework, which is a strong indicator that Ogam is not safe.

Company Background Investigation

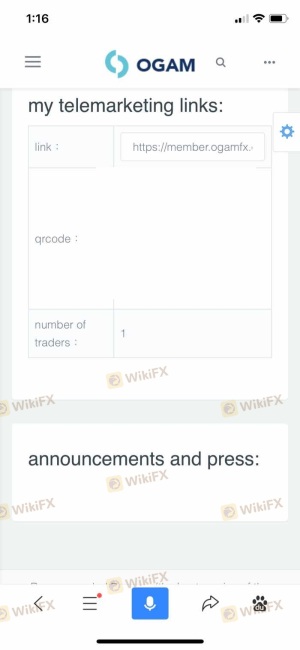

Ogam's company background is another area of concern. The broker claims to have been operational for over 20 years, yet there is little verifiable information regarding its establishment or ownership structure. The absence of a physical address, phone number, or credible company information is alarming. The only contact method is a generic Gmail address, which is not standard practice for legitimate financial institutions.

Moreover, the management team behind Ogam lacks transparency, with no public profiles or verifiable credentials available. This opacity raises questions about the broker's accountability and trustworthiness. A broker with a solid foundation should provide clear information about its history and management team, including their qualifications and experience in the financial sector. The lack of such information suggests that Ogam is not a safe broker, as it does not meet the transparency standards expected in the industry.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is vital. Ogam markets itself with attractive trading conditions, including claims of zero spreads and no handling fees. However, such offers often raise red flags, as they may be too good to be true.

| Fee Type | Ogam | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

Currently, Ogam does not provide clear information on its spreads, commissions, or overnight interest rates. The lack of a comprehensive fee structure is concerning, as traders should be fully informed about the costs associated with their trades. Additionally, the absence of a demo account prevents potential clients from testing the platform and its conditions before committing funds. This lack of transparency and accessibility further supports the notion that Ogam is not safe for traders.

Customer Funds Safety

The security of customer funds is paramount when selecting a broker. Regulated brokers are typically required to implement measures such as segregated accounts to protect client funds. However, Ogam does not provide any information regarding its fund safety measures.

Ogam's lack of regulatory oversight means that there are no guarantees for the safety of client funds. There is no indication that Ogam maintains segregated accounts or offers negative balance protection, which are standard practices among reputable brokers. The absence of these safety nets raises concerns about the broker's reliability and the potential risks involved in trading with them. Historical issues related to fund security or disputes are also absent from Ogams records, but this lack of information does not imply safety; rather, it highlights the need for caution. Therefore, it is evident that Ogam is not safe for traders looking to protect their investments.

Customer Experience and Complaints

Customer feedback is a critical component of assessing a broker's reliability. Reports suggest that Ogam has garnered a significant number of complaints, primarily concerning withdrawal issues and unresponsive customer service.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Support | Medium | Poor |

Common complaints include difficulties in processing withdrawals and a lack of responsiveness from customer support. Such issues can significantly impact the trading experience and erode trust in the broker. One notable case involved a trader who reported being unable to withdraw funds for several weeks, ultimately leading to frustration and distrust. The inability to address customer concerns promptly reflects poorly on Ogam and raises serious questions about its operational integrity. Thus, it is clear that Ogam is not a safe choice for traders seeking a reliable trading partner.

Platform and Trade Execution

The trading platform offered by a broker is crucial for executing trades efficiently. Ogam claims to utilize a web-based platform, but there is little information regarding its performance and reliability.

Issues regarding order execution quality, including slippage and order rejections, are common concerns among traders. If Ogam fails to provide a robust trading platform, it can hinder traders' ability to execute their strategies effectively. Furthermore, the absence of the widely recognized MetaTrader 4 (MT4) platform suggests that Ogam may not be equipped with the necessary tools for serious traders. This lack of industry-standard technology raises further doubts about the brokers credibility, indicating that Ogam is not safe for those looking for a reliable trading environment.

Risk Assessment

Engaging with an unregulated broker like Ogam poses various risks that traders must consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight, potential for fraud. |

| Fund Safety Risk | High | Lack of fund protection measures. |

| Customer Service Risk | Medium | Poor response to customer complaints. |

The combination of regulatory risks, fund safety concerns, and inadequate customer service creates a high-risk environment for traders. It is advisable for potential clients to seek alternative brokers that are well-regulated and have a proven track record of reliability. To mitigate risks, traders should prioritize brokers with strong regulatory oversight and transparent operations.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that Ogam is not safe for traders. The lack of regulation, transparency issues, unfavorable trading conditions, and negative customer feedback paint a concerning picture of this broker. Prospective clients are advised to exercise caution and consider alternative options that offer better security and reliability.

For traders seeking a safe trading environment, it is recommended to explore brokers regulated by reputable authorities such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC). These regulators enforce strict compliance measures, ensuring that traders' funds are protected and that brokers operate with integrity. Ultimately, it is essential to conduct thorough research before engaging with any forex broker, especially one like Ogam, which shows multiple signs of being potentially fraudulent.

Is OGAM a scam, or is it legit?

The latest exposure and evaluation content of OGAM brokers.

OGAM Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

OGAM latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.