Is AXFXPV safe?

Business

License

Is AXFXPV Safe or Scam?

Introduction

AXFXPV is a forex brokerage that has carved a niche in the competitive landscape of online trading. Established with the intent to provide a diverse range of trading instruments, AXFXPV offers services across various asset classes, including forex, commodities, and indices. However, as the forex market is rife with both legitimate and fraudulent brokers, it is imperative for traders to conduct thorough evaluations before engaging with any broker. This article aims to assess whether AXFXPV is a safe trading option or if it raises red flags that warrant caution.

To arrive at a fair assessment, we utilized multiple sources, including regulatory databases, user reviews, and expert analyses. Our evaluation framework encompasses the broker's regulatory standing, company background, trading conditions, client fund security, user experiences, platform performance, and an overall risk assessment.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy. AXFXPV claims to be regulated, but the reality is more complex. According to various sources, AXFXPV's regulatory license appears to be revoked, raising significant concerns about its operational legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 001287576 | Australia | Revoked |

ASIC (Australian Securities and Investments Commission) is known for its stringent regulatory framework and oversight. However, the revocation of AXFXPV's license indicates a lack of compliance with regulatory standards, which is a major red flag for potential traders. Without valid regulation, traders may find it challenging to seek recourse in case of disputes or issues with fund withdrawals. This situation necessitates a cautious approach to determining whether AXFXPV is safe for trading.

Company Background Investigation

AXFXPV was founded in 2017 and is purportedly based in Australia. However, the lack of transparent information about its ownership structure and management team raises questions about its credibility. A thorough investigation reveals minimal details regarding the individuals behind the brokerage, which is concerning for potential clients. Transparency in ownership and management is crucial for establishing trust, and AXFXPV seems to fall short in this regard.

Moreover, the broker's historical compliance record appears to be questionable. The absence of a solid track record, coupled with the revocation of its regulatory license, suggests that AXFXPV may not have adhered to the necessary legal and ethical standards expected of a reputable brokerage. This lack of transparency and accountability further complicates the assessment of whether AXFXPV is safe.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is essential. AXFXPV offers various account types with differing minimum deposit requirements and leverage options. However, the fee structure is somewhat opaque, and potential clients may find themselves facing unexpected costs.

| Fee Type | AXFXPV | Industry Average |

|---|---|---|

| Spread for Major Pairs | 1.8 pips | 1.0 - 1.5 pips |

| Commission Model | Not disclosed | 0 - 10 USD per lot |

| Overnight Interest Range | Not specified | Varies widely |

The spreads offered by AXFXPV are on the higher side compared to industry averages, which could eat into traders' profits. Furthermore, the lack of clarity regarding commission structures and overnight interest rates is concerning. Traders should be wary of hidden costs that could impact their trading experience, raising questions about whether AXFXPV is truly safe for trading.

Client Fund Security

The safety of client funds is paramount in the forex industry. AXFXPV claims to implement various security measures, but the lack of a clear outline of these measures raises concerns. It is essential for brokers to segregate client funds from their operational funds to ensure that traders' money is protected in the event of financial difficulties.

Additionally, the absence of information regarding investor protection schemes, such as negative balance protection, further complicates the safety assessment. Traders should be cautious, as any historical issues related to fund security could indicate potential risks associated with trading with AXFXPV. This lack of clarity leads to questions about whether AXFXPV is safe when it comes to protecting client investments.

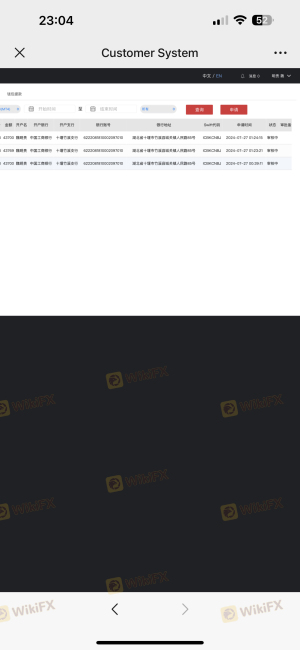

Customer Experience and Complaints

Customer feedback serves as a vital indicator of a broker's reliability and service quality. Unfortunately, numerous reviews regarding AXFXPV indicate a pattern of dissatisfaction among clients. Many users report difficulties in withdrawing funds, delayed responses from customer support, and overall negative trading experiences.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Poor Customer Support | Medium | Inconsistent |

| Lack of Transparency | High | No clear answers |

Two notable cases highlight these concerns. In one instance, a trader reported being unable to withdraw their funds for several months, leading to frustration and distrust. Another user noted that customer support often provided vague responses, failing to address specific issues effectively. These complaints underscore the potential risks of trading with AXFXPV and raise questions about whether AXFXPV is safe for traders.

Platform and Trade Execution

The trading platform is a crucial element for any forex broker. AXFXPV utilizes the popular MetaTrader 4 (MT4) platform, which is known for its user-friendly interface and robust features. However, user feedback suggests that while the platform is functional, there are concerns regarding execution quality. Reports of slippage and order rejections have surfaced, which could severely impact trading outcomes.

Traders have expressed frustration over experiencing significant delays in order execution, particularly during volatile market conditions. Such issues may indicate potential manipulation or inefficiencies within the trading environment, further complicating the assessment of whether AXFXPV is truly safe for trading.

Risk Assessment

Engaging with AXFXPV involves several risks that traders must consider. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Revoked ASIC license raises concerns. |

| Financial Risk | Medium | Lack of transparency in fees and conditions. |

| Customer Service Risk | High | Numerous complaints about withdrawal issues. |

| Platform Risk | Medium | Reports of slippage and execution delays. |

To mitigate these risks, traders should exercise caution when considering AXFXPV as their brokerage. Conducting thorough research, reading user reviews, and considering alternative brokers with better regulatory standing and customer feedback can help safeguard investments.

Conclusion and Recommendations

In conclusion, the evidence suggests that AXFXPV raises several red flags that warrant caution. The revocation of its regulatory license, coupled with a lack of transparency regarding its operations and management, poses significant risks for potential traders. Additionally, the numerous complaints regarding customer service and fund withdrawals further complicate the assessment of whether AXFXPV is safe.

For traders seeking a reliable and secure trading environment, it may be prudent to explore alternative options. Brokers with solid regulatory standing, transparent fee structures, and positive user feedback should be prioritized. Ultimately, the decision to engage with AXFXPV should be made with careful consideration of the associated risks.

Is AXFXPV a scam, or is it legit?

The latest exposure and evaluation content of AXFXPV brokers.

AXFXPV Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AXFXPV latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.