Is Aurea Capital Markets safe?

Business

License

Is Aurea Capital Markets Safe or Scam?

Introduction

Aurea Capital Markets is a forex and CFD broker that has emerged in the competitive landscape of online trading. Positioned as a platform catering primarily to Spanish-speaking clients, it claims to offer a range of trading instruments, including forex, cryptocurrencies, and commodities. However, the rise of online trading has also seen a surge in fraudulent activities, making it essential for traders to carefully assess the credibility and safety of their chosen brokers. This article aims to provide a comprehensive evaluation of Aurea Capital Markets, focusing on its regulatory status, company background, trading conditions, and overall trustworthiness. The analysis is based on extensive research from various reputable sources, including user reviews, regulatory announcements, and financial expert evaluations.

Regulation and Legitimacy

One of the primary factors that determine the safety of a trading platform is its regulatory status. Aurea Capital Markets operates without any recognized regulatory oversight, which raises significant concerns. The broker is registered in Saint Vincent and the Grenadines, a jurisdiction notorious for its lack of stringent financial regulations. This absence of regulation means that clients are not afforded the protections typically associated with regulated brokers, such as segregated accounts and investor compensation schemes.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Saint Vincent and the Grenadines | Unregulated |

The lack of regulatory oversight is compounded by reports from the CNMV (Spanish Securities Market Commission) that have flagged Aurea Capital Markets for fraudulent activities. This history of non-compliance and the absence of a governing body to oversee operations are critical red flags for potential investors. In summary, is Aurea Capital Markets safe? The evidence suggests a resounding "no," as the broker operates in a high-risk environment without the necessary safeguards to protect client funds.

Company Background Investigation

Aurea Capital Markets LLC, the entity behind the broker, has a relatively obscure history. The company is based in Saint Vincent and the Grenadines and claims to have been established to provide trading services to clients in Latin America. However, detailed information about its ownership structure and management team is scant. This lack of transparency raises concerns about the broker's accountability and operational integrity.

The management team, while not extensively documented, reportedly includes individuals with backgrounds in finance and trading. However, without verifiable credentials or a solid track record in the industry, it is challenging to assess their competence. Moreover, the absence of a physical office or contact number further diminishes the broker's credibility. Clients seeking to engage with Aurea Capital Markets may find themselves at a disadvantage due to the broker's opaque operational practices.

Trading Conditions Analysis

Aurea Capital Markets offers a variety of trading accounts, including zero spread, standard, and pro accounts, with minimum deposits starting at $200. While the broker advertises competitive spreads and high leverage options (up to 1:400), the overall cost structure remains a concern due to the lack of transparency regarding fees.

| Fee Type | Aurea Capital Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.5 pips (standard) | 1.0 - 1.5 pips |

| Commission Model | $5 per side (zero spread) | Varies widely |

| Overnight Interest Range | Not disclosed | Typically available |

The spread on major currency pairs is notably higher than the industry average, which may erode potential profits for traders. Additionally, the commission structure, particularly for the zero spread account, could lead to unexpected costs for traders who are not fully aware of the terms. This lack of clarity in the fee structure raises questions about the broker's commitment to fair trading practices, further compounding concerns about whether Aurea Capital Markets is safe for clients.

Client Fund Security

The safety of client funds is paramount in the trading industry, and Aurea Capital Markets falls short in this regard. The broker does not provide information about fund segregation or any investor protection schemes, leaving clients vulnerable to potential losses. Without regulatory oversight, there are no guarantees that client funds will be protected in the event of insolvency or fraud.

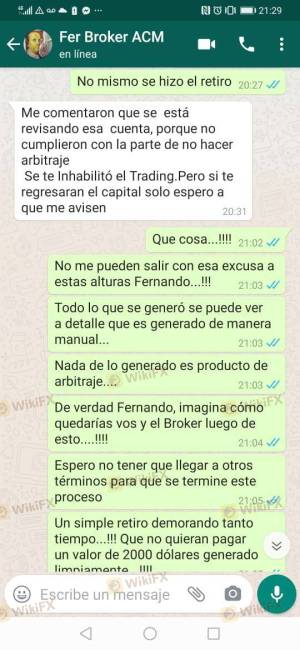

Historically, unregulated brokers have faced numerous allegations regarding fund mismanagement and withdrawal issues. There are reports from users claiming difficulties in withdrawing their funds, indicating a pattern of behavior that is often associated with scam operations. The absence of robust security measures raises significant concerns about whether Aurea Capital Markets is safe for traders looking to invest their hard-earned money.

Customer Experience and Complaints

User feedback is a valuable indicator of a broker's reliability and service quality. In the case of Aurea Capital Markets, customer reviews are overwhelmingly negative. Many users have reported issues with account management, withdrawal delays, and unresponsive customer support. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow or unresponsive |

| Account Management | Medium | Inconsistent |

| Customer Support | High | Poor communication |

One notable case involved a user who claimed to have difficulty withdrawing funds after a profitable trading session, only to find their account suspended without explanation. Such experiences contribute to the growing sentiment that Aurea Capital Markets may not be safe for potential investors.

Platform and Trade Execution

Aurea Capital Markets utilizes the MetaTrader 5 platform, which is widely regarded for its user-friendly interface and robust trading tools. However, the platform's performance in terms of execution quality and reliability remains questionable. Users have reported instances of slippage and order rejections, which can significantly impact trading outcomes.

Moreover, the lack of transparency regarding the broker's execution model raises concerns about potential manipulative practices. Traders must be cautious of platforms that exhibit signs of market manipulation, as this can lead to substantial financial losses. Therefore, in assessing whether Aurea Capital Markets is safe, the evidence suggests a need for caution due to reported execution issues.

Risk Assessment

Engaging with Aurea Capital Markets presents several risks that potential clients should be aware of. The absence of regulation, combined with negative customer feedback and a lack of transparency, creates a high-risk environment for traders.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Potential for fund mismanagement |

| Operational Risk | Medium | Issues with platform execution |

To mitigate these risks, traders are advised to conduct thorough due diligence, consider alternative brokers with robust regulatory frameworks, and maintain a cautious approach to investing with unregulated entities.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that Aurea Capital Markets is not safe for traders. The lack of regulatory oversight, coupled with negative user experiences and transparency issues, paints a concerning picture of the broker's operations. Potential investors should exercise extreme caution and consider alternative options that offer greater security and regulatory protection.

For traders looking for safer alternatives, it is recommended to explore brokers that are regulated by reputable authorities, such as those in the EU, UK, or Australia. These brokers typically provide better client protections, more transparent fee structures, and a more reliable trading environment. Always prioritize safety and due diligence when choosing a trading partner in the forex market.

Is Aurea Capital Markets a scam, or is it legit?

The latest exposure and evaluation content of Aurea Capital Markets brokers.

Aurea Capital Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Aurea Capital Markets latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.