Is APFX safe?

Business

License

Is APFX Safe or Scam?

Introduction

APFX, a broker in the foreign exchange market, has garnered attention since its establishment in 2017. Operating primarily from the United States, it offers a range of trading solutions and services to its clients. As the forex market is rife with opportunities, it also attracts a multitude of scams and unregulated entities, making it crucial for traders to conduct thorough due diligence before engaging with any broker. This article aims to objectively analyze whether APFX is a safe trading option or a potential scam. The evaluation will be based on various factors, including regulatory compliance, company background, trading conditions, customer feedback, and risk assessments.

Regulatory and Legitimacy

The regulatory status of a broker is a pivotal element in assessing its legitimacy. A regulated broker is generally considered safer, as it must adhere to specific standards and practices designed to protect investors. Unfortunately, APFX's regulatory situation is somewhat ambiguous. The information gathered indicates that it claims to be regulated by reputable authorities; however, there are numerous complaints regarding its operations which raise concerns.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 344139 | Australia | Suspicious Clone |

| FCA | 407382 | United Kingdom | Suspicious Clone |

The above table summarizes APFX's claimed regulatory affiliations. The Australian Securities and Investments Commission (ASIC) and the Financial Conduct Authority (FCA) are both respected regulators; however, reports suggest that APFX may be operating as a clone firm under these licenses. This is a significant red flag, as clone firms often misrepresent their regulatory status to lure unsuspecting traders. Therefore, the question "Is APFX safe?" becomes more pressing, as potential clients must consider the risks associated with trading with a broker that may not be legitimately regulated.

Company Background Investigation

APFX was founded in 2017 and has positioned itself as a provider of foreign exchange solutions and trading services. The company's history, however, is marred by numerous complaints and a lack of transparency regarding its ownership and management structure.

The absence of detailed information about the management team raises concerns about the broker's accountability. A professional management team with a strong background in finance and trading is essential for the successful operation of a brokerage. Unfortunately, APFX has not provided sufficient information to instill confidence in its leadership.

Moreover, the company's transparency appears to be lacking, with many users reporting difficulties in accessing reliable information about its services and operations. This lack of clarity further compounds the question: Is APFX safe? Traders are advised to be cautious, as a broker that does not openly share information about its management and operations may not have the best interests of its clients at heart.

Trading Conditions Analysis

The trading conditions offered by APFX are critical in evaluating its overall value proposition. The broker claims to provide competitive spreads and a variety of trading instruments; however, the actual trading costs and fee structures require careful examination.

| Fee Type | APFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.0 pips | 1.5 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | 0.5% | 0.3% |

The table above highlights some key trading costs associated with APFX. While the spreads may seem competitive at first glance, they are notably higher than the industry average, which raises questions about the broker's pricing strategy. Additionally, the commission model is variable, adding another layer of uncertainty for traders. This variability can lead to unexpected costs, making it difficult for traders to accurately calculate their potential profits or losses.

Understanding these trading conditions is essential for traders who are asking, "Is APFX safe?" The high spreads and unclear commission structure could indicate a lack of transparency and fairness, leading to potentially unfavorable trading experiences.

Customer Funds Safety

The safety of customer funds is a paramount concern for any trader. APFX claims to implement various measures to protect client funds, including segregation of accounts and investor protection policies. However, the effectiveness of these measures remains in question.

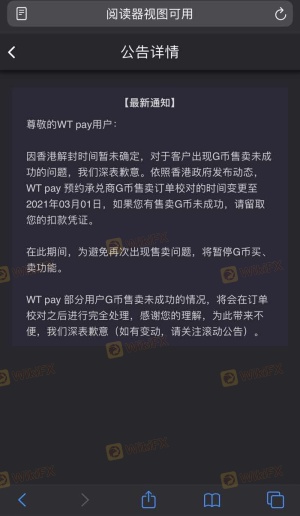

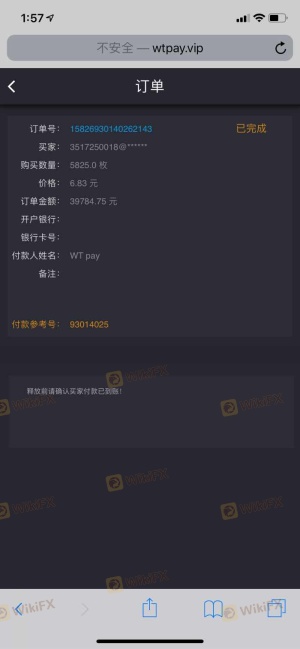

Reports indicate that clients have faced significant difficulties when attempting to withdraw their funds. Many users have complained about delays and outright refusals to process withdrawals, raising alarms about the broker's financial practices.

The lack of a clear and reliable policy on fund protection is another red flag. Without robust measures in place, clients may find themselves at risk of losing their investments. Therefore, the question "Is APFX safe?" is particularly relevant when considering the broker's history of fund access issues.

Customer Experience and Complaints

Customer feedback is a crucial indicator of a broker's reliability. Unfortunately, APFX has received numerous complaints from its users, which paint a troubling picture of the broker's operations.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Support Issues | Medium | Poor |

| Misleading Information | High | Non-responsive |

The table above summarizes the primary complaints associated with APFX. Many clients have reported severe delays in withdrawing their funds, with some waiting for months without resolution. Additionally, users have expressed frustration with the broker's customer support, often describing it as unresponsive or ineffective.

One typical case involved a trader who attempted to withdraw funds for over six months, only to receive vague responses from customer support. Such experiences highlight the risks of engaging with APFX and raise further questions regarding its legitimacy.

Platform and Execution

The trading platform used by APFX is another critical factor in assessing its reliability. A reliable platform should be stable, user-friendly, and capable of executing trades efficiently.

However, numerous users have reported issues with the platform's performance, including frequent outages and slow execution speeds. These problems can significantly impact trading outcomes, leading to missed opportunities and increased frustration for traders.

Moreover, there have been allegations regarding order manipulation and slippage, which could indicate a lack of integrity in the trading environment. This further complicates the question of whether "Is APFX safe?" as traders must be wary of platforms that do not provide a fair trading experience.

Risk Assessment

In light of the various concerns surrounding APFX, it is essential to conduct a comprehensive risk assessment.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Possible clone operations |

| Financial Risk | High | Withdrawal issues reported |

| Operational Risk | Medium | Platform performance concerns |

The table above summarizes the key risk areas associated with trading with APFX. The high regulatory risk, coupled with significant financial and operational risks, paints a concerning picture for potential clients.

To mitigate these risks, traders are advised to conduct thorough research, consider using demo accounts, and only invest funds they can afford to lose.

Conclusion and Recommendations

In conclusion, the evidence suggests that APFX may not be a safe trading option for potential clients. The numerous complaints regarding withdrawal issues, lack of transparency, and questionable regulatory status raise significant concerns about the broker's legitimacy.

For traders seeking reliable alternatives, it is advisable to consider brokers that are well-regulated by top-tier authorities, have positive customer feedback, and offer transparent trading conditions.

In summary, if you are wondering, "Is APFX safe?" the answer leans towards caution. It is essential for traders to prioritize their safety and consider other reputable brokers in the market.

Is APFX a scam, or is it legit?

The latest exposure and evaluation content of APFX brokers.

APFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

APFX latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.