Is ILLUZION safe?

Pros

Cons

Is Illuzion Safe or Scam?

Introduction

Illuzion is a relatively new player in the forex market, positioning itself as a broker that offers a range of trading services, including forex, commodities, and CFDs. As the forex trading landscape becomes increasingly crowded, traders need to exercise caution when selecting brokers. This is essential not only for protecting their investments but also for ensuring compliance with regulatory standards. In this article, we will explore whether Illuzion is safe or a scam by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. Our investigation is based on a thorough review of multiple online sources, including user reviews, regulatory databases, and expert analyses.

Regulation and Legitimacy

One of the most critical factors in determining if a forex broker is safe is its regulatory status. Illuzion's regulatory framework has raised some concerns among industry experts. The broker operates without a robust regulatory license, which is a significant red flag for potential traders. Below is a summary of the available regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

The absence of a regulatory authority overseeing Illuzion raises questions about the broker's legitimacy. Regulatory bodies, such as the FCA in the UK or ASIC in Australia, are crucial for ensuring that brokers adhere to strict operational standards. Illuzion's lack of regulation means that traders may have limited recourse in case of disputes or issues with fund withdrawals. Furthermore, the broker has been flagged for suspicious activities, including complaints regarding its operational practices. Thus, the question of is Illuzion safe is complicated by its lack of oversight.

Company Background Investigation

Illuzion is relatively new in the forex trading scene, having been established in the last few years. However, details regarding its ownership structure and management team are scarce. The broker's website provides limited information about its founders or the experience of its management team. This lack of transparency is concerning, as a well-established broker typically offers detailed biographies of its leadership, showcasing their expertise and industry experience.

Moreover, the company appears to utilize a privacy service to hide its ownership details, which is often a tactic employed by less reputable brokers. This practice can make it difficult for traders to ascertain the legitimacy of the broker. In terms of information disclosure, Illuzion's website lacks comprehensive details about its operations, fees, and risk warnings, which are essential for informed trading decisions. Overall, these factors contribute to a perception that Illuzion may not be safe, as transparency is a key indicator of a broker's reliability.

Trading Conditions Analysis

When evaluating a broker's safety, it's essential to consider its trading conditions, including fees and spreads. Illuzion offers a variety of trading instruments, but its fee structure is not clearly outlined on its website. This lack of clarity can lead to unexpected costs for traders, which raises concerns about the broker's integrity. Below is a comparison of Illuzion's key trading costs against industry averages:

| Fee Type | Illuzion | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 2.0% |

The absence of specific figures for spreads and commissions makes it challenging for traders to assess the overall cost of trading with Illuzion. High or hidden fees can erode profitability and may indicate that the broker is not operating in the best interests of its clients. Additionally, without a clear understanding of overnight interest rates, traders may face unexpected charges that could affect their trading strategies. Therefore, the question of is Illuzion safe is further complicated by the opacity of its trading conditions.

Customer Funds Security

The safety of customer funds is paramount when evaluating any forex broker. Illuzion has not provided clear information regarding its fund security measures. In reputable brokers, funds are typically held in segregated accounts to protect clients in the event of insolvency. However, Illuzion's lack of transparency on this front raises concerns.

Key aspects to consider include:

- Segregation of Funds: Does Illuzion segregate client funds from its operational funds?

- Investor Protection: Is there any insurance or compensation scheme in place for clients?

- Negative Balance Protection: Does Illuzion offer negative balance protection to prevent traders from losing more than their deposits?

Without clear answers to these questions, traders may be at risk of losing their investments. Historical complaints regarding fund withdrawals further exacerbate concerns about the broker's reliability. Thus, the overall safety of customer funds with Illuzion remains questionable, leading to the conclusion that Illuzion may not be safe for traders.

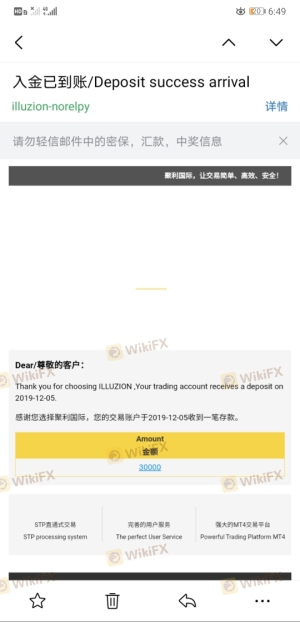

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability. Reviews of Illuzion reveal a mixed bag of experiences, with several users reporting issues related to fund withdrawals and customer service. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Slow |

| Transparency | High | Lacking |

One notable case involved a trader who faced significant delays in withdrawing funds, leading to frustration and concern over the broker's legitimacy. Another user reported inadequate customer support when attempting to resolve issues. These complaints suggest that Illuzion may not prioritize customer satisfaction, raising further doubts about its safety.

Platform and Trade Execution

The trading platform is another critical aspect of a broker's reliability. Illuzion claims to offer a robust trading platform, but user reviews indicate mixed experiences regarding its performance and stability. Issues such as slippage and order rejections have been reported, which can significantly impact trading outcomes.

Additionally, there are concerns about potential platform manipulation, as some users have alleged that the broker's trading conditions change unexpectedly, leading to unfavorable trading results. This raises alarms about the integrity of Illuzion's trading environment, further complicating the question of is Illuzion safe for traders.

Risk Assessment

In light of the findings, it is essential to evaluate the overall risk of trading with Illuzion. Below is a risk scorecard summarizing key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Transparency Risk | High | Lack of information available |

| Customer Service Risk | Medium | Poor response to complaints |

| Fund Security Risk | High | Unclear fund protection measures |

Given these risks, potential traders should exercise extreme caution when considering Illuzion as a trading partner. Recommendations for mitigating risks include conducting thorough due diligence, starting with a small investment, and being prepared to withdraw funds if issues arise.

Conclusion and Recommendations

In conclusion, the evidence suggests that Illuzion may not be a safe broker for forex trading. The lack of regulatory oversight, transparency issues, and negative customer experiences raise significant red flags. Traders should approach this broker with caution and consider alternative options that offer better security and reliability.

For those seeking trustworthy brokers, we recommend considering firms that are regulated by top-tier authorities, have transparent fee structures, and provide robust customer support. Some reputable alternatives include brokers like OANDA, IG, and Forex.com, which have established track records and prioritize client safety. Ultimately, thorough research and careful consideration are crucial in navigating the forex trading landscape.

Is ILLUZION a scam, or is it legit?

The latest exposure and evaluation content of ILLUZION brokers.

ILLUZION Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ILLUZION latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.