Is AFT FX safe?

Business

License

Is AFT FX A Scam?

Introduction

AFT FX is a forex broker that has emerged in the competitive landscape of online trading since its establishment in 2017. Operating primarily in Japan, it claims to offer a range of trading services, including forex and CFDs, via the widely-used MetaTrader 4 platform. However, as the forex market continues to attract both seasoned and novice traders, it is crucial for individuals to conduct thorough evaluations of brokers to ensure their safety and reliability. The potential for fraud and mismanagement in the forex industry necessitates careful scrutiny of a broker's regulatory status, operational history, and customer feedback. This article aims to provide an objective assessment of AFT FX, utilizing information from various sources and reviews to determine whether AFT FX is safe or potentially a scam.

Regulation and Legitimacy

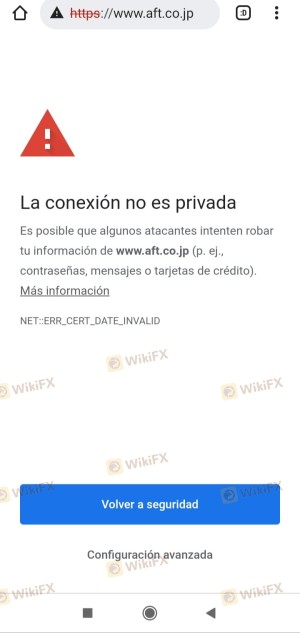

The regulatory status of AFT FX is a significant factor in determining its credibility. A broker's regulation can provide traders with a level of assurance regarding the safety of their funds and the integrity of the trading environment. In the case of AFT FX, the information regarding its regulatory status is concerning. According to various sources, AFT FX does not hold valid licenses from recognized financial regulatory authorities, which raises red flags about its operations.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulation is a critical issue, as it means that AFT FX is not subject to oversight by any authoritative body that enforces compliance with industry standards. This lack of oversight can lead to a higher risk of fraudulent activities and untrustworthy practices. Additionally, reports indicate that AFT FX has previously been identified as a suspicious clone of other regulated entities, further complicating its legitimacy. The quality of regulation is paramount; brokers regulated by top-tier authorities, such as the FCA or ASIC, are generally deemed safer due to stringent compliance requirements. In contrast, AFT FX's lack of regulation suggests that traders should exercise extreme caution when considering this broker.

Company Background Investigation

AFT FX, officially known as AFT Co., Ltd., was founded in 2017. However, the companys operational history and ownership structure remain opaque, which is often a cause for concern among potential clients. AFT FX claims to provide various trading services, but the absence of detailed information about its management team and corporate governance raises questions about its transparency.

The management team's background is a vital aspect of a broker's reliability. A well-experienced team with a solid track record in finance and trading can enhance a broker's credibility. Unfortunately, AFT FX has not provided sufficient information regarding its leadership or their professional qualifications. This lack of transparency can lead to skepticism among traders, as it is essential to know who is managing their investments.

Moreover, the company's information disclosure levels are inadequate. A reputable broker typically offers comprehensive details about its operations, including financial reports, regulatory compliance, and customer service practices. In contrast, AFT FX appears to lack this level of transparency, which is alarming for potential investors. Without a clear understanding of the company's background, traders are left in the dark about the trustworthiness and operational integrity of AFT FX.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions and fee structures is vital. AFT FX presents itself as a competitive broker, but the specifics of its trading costs need careful examination. Reports indicate that AFT FX offers trading on the MetaTrader 4 platform, which is known for its user-friendly interface and robust features. However, the overall cost structure and any unusual fees associated with trading on this platform warrant scrutiny.

| Fee Type | AFT FX | Industry Average |

|---|---|---|

| Major Currency Pairs Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies by broker |

| Overnight Interest Range | N/A | Varies by broker |

The lack of specific information regarding spreads and commissions on AFT FX's website raises concerns. Typically, reliable brokers provide clear details about their fee structures, including spreads for various currency pairs and any commissions applicable to trades. The absence of this information could indicate hidden fees or unfavorable trading conditions that may not be immediately apparent to traders. Furthermore, the potential for high overnight interest fees could significantly impact trading profitability, particularly for those engaging in long-term positions.

Given the competitive nature of the forex market, traders should be wary of brokers that do not clearly disclose their trading costs. The ambiguity surrounding AFT FX's fee structure could lead to unexpected expenses, making it essential for traders to seek clarity before committing their funds.

Client Funds Safety

The safety of client funds is paramount when choosing a forex broker. AFT FX's approach to fund safety measures is critical to evaluate. A reputable broker typically implements strict protocols for fund segregation, investor protection, and negative balance protection. However, the information available regarding AFT FX's safety measures is limited and raises concerns.

Traders should look for brokers that maintain client funds in segregated accounts, ensuring that these funds are kept separate from the broker's operational funds. This practice is essential for protecting clients in the event of the broker's insolvency. Additionally, the presence of an investor compensation scheme can provide further assurance, offering protection up to a certain amount if the broker fails.

Unfortunately, AFT FX lacks clear information regarding its fund safety measures, which is a significant red flag. The absence of any historical issues related to fund safety is not enough to alleviate concerns, especially given the broker's unregulated status. Traders should be cautious, as the lack of transparency regarding fund security can lead to potential risks regarding the safety of their investments.

Customer Experience and Complaints

Customer feedback plays a vital role in assessing a broker's reliability and service quality. AFT FX has garnered mixed reviews from users, with several complaints highlighting issues related to customer service and withdrawal processes. Common complaints include difficulties in withdrawing funds, poor customer support responses, and a lack of transparency regarding trading conditions.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Support Availability | Medium | Fair |

| Transparency of Fees | High | Poor |

One notable case involved a trader who reported significant delays in withdrawing their funds, which ultimately led to frustration and a loss of trust in the broker. Such experiences reflect a concerning pattern where clients struggle to access their money, a common warning sign of potential fraud. Furthermore, the quality of customer support has been criticized, with users reporting long wait times and inadequate responses to their inquiries.

The overall sentiment among clients suggests a need for AFT FX to improve its customer service and address common complaints. Traders should approach this broker with caution, as unresolved issues can indicate deeper operational problems that may jeopardize the safety of their investments.

Platform and Trade Execution

AFT FX utilizes the MetaTrader 4 platform for trading, which is widely regarded for its reliability and advanced features. However, the performance of the platform, including execution quality, slippage, and rejection rates, is crucial for traders. Reports indicate that while the platform is generally stable, users have experienced occasional slippage and order rejections, which can significantly impact trading outcomes.

The quality of trade execution is a critical factor for traders, as delays or inconsistencies can lead to missed opportunities and financial losses. AFT FX's performance in this area requires careful consideration, especially for those who rely on precise execution for their trading strategies.

Risk Assessment

Using AFT FX presents several risks that traders should be aware of. Given its unregulated status, the potential for fraud and mismanagement is high. Additionally, the lack of transparency regarding fees and fund safety measures adds to the overall risk profile of this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulation |

| Fund Safety Risk | High | Lack of transparency on fund safety |

| Customer Service Risk | Medium | Poor response times and support |

To mitigate these risks, traders should thoroughly research and consider alternative brokers with established regulatory oversight and positive customer feedback. Opting for well-regulated brokers can significantly enhance the safety of investments in the forex market.

Conclusion and Recommendations

In conclusion, the evidence suggests that AFT FX raises several red flags regarding its legitimacy and safety. The lack of regulation, transparency issues, and a concerning pattern of customer complaints indicate that traders should approach this broker with caution. While some may find the trading platform appealing, the risks associated with AFT FX may outweigh the potential benefits.

For traders seeking a reliable and secure trading experience, it is advisable to consider alternative brokers that are well-regulated and have a proven track record of positive customer experiences. Brokers regulated by top-tier authorities, such as the FCA or ASIC, provide a safer environment for trading and greater peace of mind regarding fund safety. Ultimately, the decision to trade with AFT FX should be made with careful consideration of the associated risks and the broker's overall reliability.

Is AFT FX a scam, or is it legit?

The latest exposure and evaluation content of AFT FX brokers.

AFT FX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AFT FX latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.