Is Advantage Equity safe?

Pros

Cons

Is Advantage Equity Safe or Scam?

Introduction

Advantage Equity is a forex broker that primarily targets the Chinese market, offering various trading instruments, including forex, CFDs, and commodities. As the forex market continues to grow, traders are increasingly attracted to the potential for high returns. However, this allure also brings risks, as not all brokers operate ethically or transparently. Therefore, it is crucial for traders to conduct thorough evaluations of forex brokers before committing their funds. This article investigates whether Advantage Equity is a safe trading platform or a potential scam, employing a comprehensive assessment framework that includes regulatory status, company background, trading conditions, and user experiences.

Regulation and Legitimacy

Regulation is a cornerstone of a broker's legitimacy and operational integrity. Advantage Equity operates without significant regulatory oversight, which raises concerns for potential investors. A lack of regulation can often indicate a higher risk of fraud or unethical practices, as these brokers are not held accountable by authoritative bodies. Below is a summary of the regulatory information pertinent to Advantage Equity:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | China | Not Verified |

The absence of regulation means that Advantage Equity does not adhere to the stringent standards imposed by reputable regulatory authorities like the FCA or ASIC. This lack of oversight can lead to various issues, including the potential for fund mismanagement and insufficient investor protection. Traders should be particularly cautious when dealing with brokers that operate in regions with lax regulatory frameworks.

Company Background Investigation

Advantage Equity was established to cater specifically to the Chinese market, but information regarding its history and ownership structure is limited. The company's website does not provide comprehensive details about its management team or their professional backgrounds, which is a red flag for transparency. A reputable broker typically discloses information about its founders and key executives, showcasing their qualifications and experience in the financial industry.

Moreover, the company's transparency regarding its operational practices and financial disclosures is minimal. This lack of information can hinder traders' ability to make informed decisions about the safety and reliability of their investments. Transparency is crucial in building trust, and the absence of clear information about Advantage Equity's operations raises questions about its commitment to ethical practices.

Trading Conditions Analysis

When evaluating whether Advantage Equity is safe, it is essential to analyze its trading conditions, including fees and commissions. The broker offers a variety of trading instruments, but the cost structure is not clearly defined, leading to potential confusion for traders. Below is a comparison of core trading costs associated with Advantage Equity:

| Fee Type | Advantage Equity | Industry Average |

|---|---|---|

| Spread on Major Pairs | 2.0 pips | 1.0-1.5 pips |

| Commission Model | None | $5 per lot |

| Overnight Interest Range | High | Moderate |

The spreads offered by Advantage Equity are significantly higher than the industry average, which can eat into traders' profits. Additionally, the lack of a transparent commission structure raises concerns about hidden fees that could further impact trading costs. Traders should be aware of these potential expenses when considering whether to engage with this broker.

Client Funds Security

The safety of client funds is paramount when assessing whether Advantage Equity is a safe broker. Unfortunately, the broker does not provide clear information on its fund security measures, such as segregation of client funds or negative balance protection policies. The absence of these safeguards can expose traders to significant risks, especially in volatile market conditions.

Furthermore, there have been no reports of Advantage Equity implementing investor protection measures, which is a common practice among regulated brokers. This lack of security protocols raises concerns about the potential for fund misappropriation or loss in the event of the broker's financial instability. Traders should prioritize brokers that offer robust fund security measures to mitigate risks associated with their investments.

Customer Experience and Complaints

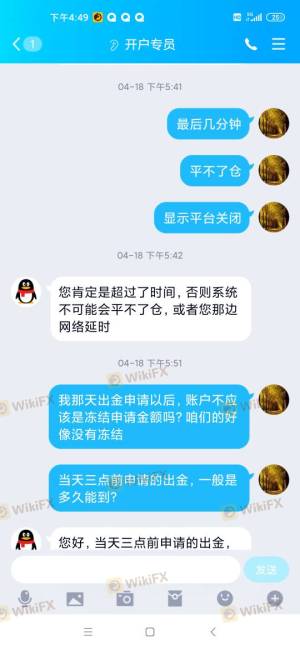

Analyzing customer feedback is a vital component in determining whether Advantage Equity is safe. Many reviews highlight issues related to withdrawal difficulties and unresponsive customer service. Common complaint patterns include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Lack of Support | Medium | Unresolved |

| Misleading Information | High | No Acknowledgment |

One notable case involves a trader who reported being unable to withdraw funds after making profits. This situation is alarming and reflects a pattern of complaints regarding the company's responsiveness and operational integrity. Such experiences can indicate deeper issues within the broker's operational framework, leading to skepticism about its legitimacy.

Platform and Execution

The trading platform offered by Advantage Equity is another critical factor in assessing its safety. While the platform may provide essential trading functionalities, user experiences suggest that execution quality is inconsistent. Traders have reported instances of slippage and delayed order executions, which can significantly impact trading outcomes.

Moreover, there are concerns about potential platform manipulation, particularly in a broker with no regulatory oversight. A reliable broker should ensure that its trading platform operates fairly and transparently, without any undue influence on market prices or execution speeds. Traders should be cautious when using platforms that lack clear operational guidelines and oversight.

Risk Assessment

When evaluating the overall risk associated with using Advantage Equity, several factors need to be considered. Below is a risk scorecard summarizing the key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No significant regulatory oversight |

| Fund Safety Risk | High | Lack of fund protection measures |

| Customer Service Risk | Medium | Reports of poor response and support |

| Trading Execution Risk | High | Inconsistent order execution and slippage |

To mitigate these risks, traders should consider diversifying their investments and not committing large sums of money to a broker with such a questionable reputation. Engaging with regulated brokers and utilizing demo accounts before trading with real funds can also help minimize potential losses.

Conclusion and Recommendations

In conclusion, the evidence suggests that Advantage Equity raises several red flags that may indicate it is not a safe broker. The lack of regulatory oversight, transparency issues, high trading costs, and poor customer feedback contribute to a concerning picture. Traders should exercise caution when considering this broker and be aware of the potential risks involved.

For those seeking safer alternatives, it is advisable to explore brokers that are regulated by reputable authorities, offer transparent fee structures, and maintain high standards of customer service. Overall, while Advantage Equity may present some opportunities, the associated risks warrant careful consideration and skepticism.

Is Advantage Equity a scam, or is it legit?

The latest exposure and evaluation content of Advantage Equity brokers.

Advantage Equity Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Advantage Equity latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.