Is 178yr safe?

Business

License

Is 178yr Safe or Scam?

Introduction

178yr is a forex brokerage firm that has recently attracted attention in the trading community. Positioned as an accessible platform for retail traders, it promises a range of trading options across various currency pairs. However, the forex market is notorious for its lack of regulation, and traders must exercise caution when selecting a broker. This article aims to provide a comprehensive evaluation of 178yr, exploring its regulatory status, company background, trading conditions, customer experience, and overall safety. Our investigation relies on a thorough analysis of online reviews, regulatory databases, and direct information from the brokerage itself.

Regulation and Legitimacy

The regulatory framework surrounding forex trading is crucial for ensuring the safety and security of traders' funds. A reputable broker should be licensed by recognized financial authorities, which provide oversight and protection for clients. Unfortunately, 178yr operates without any valid regulatory licenses, raising significant concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation means that 178yr is not subject to the stringent compliance requirements that protect investors from fraud and malpractice. This lack of oversight is a red flag for potential traders, as it indicates that the broker may engage in practices that are not in the best interest of its clients. Moreover, the broker's operations appear to be based in China, a jurisdiction known for its lax regulatory environment regarding forex trading. Consequently, the lack of regulatory oversight and the dubious verification status of 178yr suggest that traders should be cautious and consider alternative options.

Company Background Investigation

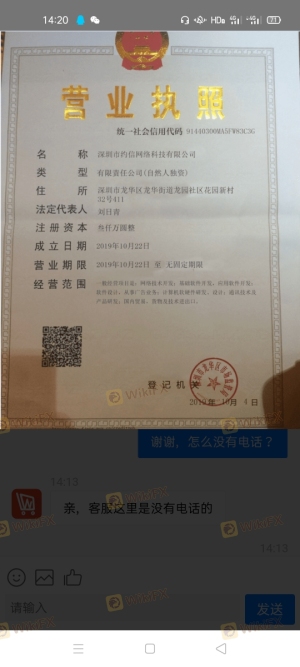

178yr is owned by Changsha Xingtan Network Information Technology Co., Ltd., a company that lacks a significant presence in the financial services industry. The firm has been operational for a relatively short period, which raises questions about its stability and reliability. Furthermore, there is limited information available regarding the management team behind 178yr, making it difficult to assess their qualifications and experience in the forex market.

The company's transparency is also questionable, as potential clients cannot easily find comprehensive information about its operations, financial health, or corporate governance. This lack of transparency further compounds the concerns surrounding the legitimacy of 178yr. Without a solid foundation of trustworthiness, it is challenging for traders to feel secure in their dealings with the broker.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall reliability. 178yr claims to provide competitive spreads and various account types, but the absence of transparent information regarding its fee structure raises concerns.

| Fee Type | 178yr | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Unspecified | 1-2 pips |

| Commission Model | N/A | Varies by broker |

| Overnight Interest Range | Unspecified | Varies by broker |

The lack of clarity regarding spreads and commissions is a significant drawback for 178yr. Traders should be wary of hidden fees that could erode their profits. Additionally, the absence of a well-defined commission structure further complicates the evaluation of trading costs. Without competitive and transparent trading conditions, traders may find themselves at a disadvantage, making 178yr a less attractive option.

Client Fund Security

The safety of client funds is paramount in the forex trading industry. A trustworthy broker should implement robust security measures to safeguard traders' investments. Unfortunately, 178yr's lack of regulation raises concerns about its ability to protect client funds adequately.

While specific details about fund security measures are not readily available, the absence of regulatory oversight suggests that 178yr may not adhere to best practices in fund management. This includes the segregation of client funds from the broker's operational capital, which is essential for ensuring that traders' investments are protected in the event of financial difficulties faced by the brokerage.

Furthermore, there have been no reports of negative balance protection or investor compensation schemes associated with 178yr, which are common features among reputable brokers. The lack of these safeguards indicates that traders could face significant risks when using this platform, making it imperative for potential clients to reconsider their options carefully.

Customer Experience and Complaints

Evaluating customer feedback is crucial in assessing the reliability of a broker. Unfortunately, reviews for 178yr are mixed, with numerous complaints regarding withdrawal issues and poor customer service.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Unresponsive |

| Poor Customer Support | Medium | Slow Response |

Common complaints include difficulties in withdrawing funds, which is often a major red flag for traders. The inability to access one's own money is a significant concern and can indicate potential fraudulent practices. Moreover, the lack of timely responses from the company's support team further exacerbates the problems faced by clients.

In light of these complaints, potential traders should be cautious when considering 178yr as their forex broker. The negative experiences reported by other users may serve as a warning about the broker's reliability and commitment to customer service.

Platform and Trade Execution

The trading platform's performance and reliability are critical factors for traders. A smooth and efficient trading experience is essential for executing trades effectively. However, there is limited information available regarding the trading platform used by 178yr, making it difficult to assess its performance.

Traders have reported issues with order execution quality, including slippage and order rejections. These problems can significantly impact a trader's ability to capitalize on market movements and may suggest potential manipulation by the broker. Without a transparent and trustworthy trading environment, traders may find themselves at a disadvantage, further raising concerns about the safety and reliability of 178yr.

Risk Assessment

Using 178yr as a forex broker carries inherent risks due to its lack of regulation, transparency, and customer complaints.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Fund Security Risk | High | Lack of protections for client funds |

| Customer Service Risk | Medium | Poor responsiveness to complaints |

Given these risks, potential traders should exercise caution when considering 178yr. It is advisable to conduct thorough research and consider alternative brokers with better regulatory standing and customer feedback.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that 178yr poses significant risks for potential traders. The lack of regulatory oversight, questionable fund security measures, and negative customer feedback indicate that this broker may not be a safe choice for forex trading. Therefore, traders should be wary of engaging with 178yr.

For those seeking a reliable trading experience, it is advisable to consider alternative brokers that are well-regulated and have a positive reputation in the trading community. Brokers with strong regulatory frameworks, transparent fee structures, and positive customer experiences should be prioritized to ensure a safer trading environment.

Is 178yr a scam, or is it legit?

The latest exposure and evaluation content of 178yr brokers.

178yr Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

178yr latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.