Weike 2025 Review: Everything You Need to Know

Summary

This comprehensive Weike review examines a forex broker with limited publicly available information. Based on our analysis of accessible data, Weike appears to be a company headquartered in Foshan, China, with some presence on professional networking platforms like LinkedIn. However, the lack of detailed regulatory information, trading conditions, and user feedback makes it challenging to provide a definitive assessment of this broker's services.

The available information suggests that Weike operates in the financial services sector. Specific details about their forex trading offerings, platform capabilities, and regulatory compliance remain unclear. For potential traders considering this broker, the absence of transparent information about licensing, trading conditions, and user experiences raises important questions. These questions require careful consideration before opening an account.

Our neutral stance in this Weike review reflects the limited data available for comprehensive evaluation. Traders seeking reliable forex services should prioritize brokers with clear regulatory oversight, transparent trading conditions, and established market presence.

Important Notice

Due to the limited regulatory information available about Weike, potential users should exercise considerable caution when considering this broker. The absence of clear licensing details and regulatory oversight information means traders cannot easily verify the safety and legitimacy of their operations across different jurisdictions.

This review is based on publicly available information and market analysis. Given the scarcity of detailed operational data, users are strongly advised to conduct additional due diligence and seek brokers with more transparent regulatory standing and comprehensive service documentation.

Rating Framework

Broker Overview

Weike operates as a financial services company with its headquarters located in Foshan, China. The company is specifically located in the Lishui area of Nanhai District in Guangdong Province. The company maintains some level of professional presence, as evidenced by its LinkedIn profile. Detailed information about its founding date, employee count, and specific business specializations remains unavailable in public records.

The broker's business model and primary service offerings are not clearly documented in available sources. This makes it difficult to assess their position within the competitive forex trading landscape. Without clear information about their regulatory status, trading platforms, or target market segments, potential clients face significant uncertainty about the nature and scope of services provided.

The lack of comprehensive public information about Weike's trading infrastructure, asset offerings, and regulatory compliance creates challenges for traders seeking reliable forex services. This Weike review emphasizes the importance of transparency in broker selection, particularly given the competitive nature of the forex industry. Established brokers typically provide detailed information about their services, regulatory status, and trading conditions.

Regulatory Status: Available information does not specify any regulatory oversight or licensing from recognized financial authorities. This represents a significant concern for potential traders seeking regulated forex services.

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and associated fees for deposits and withdrawals is not available in accessible sources.

Minimum Deposit Requirements: The minimum account funding requirements and any tier-based account structures are not detailed in available documentation.

Bonuses and Promotions: No information is available regarding welcome bonuses, trading incentives, or promotional offers. These might be available to new or existing clients.

Tradeable Assets: The range of available trading instruments, including currency pairs, commodities, indices, or other financial products, is not specified in accessible information.

Cost Structure: Details about spreads, commissions, overnight fees, and other trading costs are not provided in available sources. This makes it impossible to assess the competitiveness of their pricing.

Leverage Options: Information about maximum leverage ratios and margin requirements for different account types and trading instruments is not available.

Platform Options: Specific trading platforms offered, whether proprietary or third-party solutions like MetaTrader, are not detailed in accessible documentation.

Geographic Restrictions: Countries or regions where services are restricted or unavailable are not specified in available information.

Customer Support Languages: The languages supported by customer service teams are not mentioned in accessible sources.

This comprehensive Weike review highlights the significant information gaps that potential clients must consider when evaluating this broker option.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Weike's account conditions faces substantial limitations due to the absence of detailed information about their account offerings. Without access to specific data about account types, minimum deposit requirements, or special features, it becomes impossible to assess the competitiveness and suitability of their account structures for different trader segments.

Traditional forex brokers typically offer multiple account tiers designed to accommodate various trading styles and capital levels. These range from beginner-friendly micro accounts to professional-grade institutional accounts. The lack of such information for Weike represents a significant transparency gap that potential clients must consider.

Account opening procedures, verification requirements, and any special account features such as Islamic accounts for Sharia-compliant trading are not documented in available sources. This absence of fundamental account information contributes to the moderate rating assigned to this category.

The inability to compare Weike's account conditions with industry standards due to information limitations suggests that potential traders should seek more transparent alternatives. This Weike review emphasizes that account condition transparency is crucial for informed decision-making in forex broker selection.

Assessment of Weike's trading tools and resources proves challenging given the complete absence of information about their platform capabilities, analytical tools, and educational offerings. Modern forex traders typically expect access to comprehensive charting packages, technical indicators, economic calendars, and market analysis resources.

Research and analysis capabilities, which are essential for informed trading decisions, are not detailed in any accessible documentation. Professional traders often require advanced analytical tools, real-time market data, and expert commentary to support their trading strategies.

Educational resources, including webinars, tutorials, trading guides, and market insights, play a crucial role in trader development and retention. The absence of information about such offerings makes it impossible to evaluate Weike's commitment to client education and support.

Automated trading support, including Expert Advisor compatibility and algorithmic trading capabilities, represents another area where information is completely lacking. This gap significantly impacts the ability to assess the broker's suitability for advanced trading strategies.

Customer Service and Support Analysis

The evaluation of Weike's customer service capabilities is severely hampered by the complete absence of information regarding support channels, availability, and service quality standards. Effective customer support typically includes multiple contact methods such as live chat, email, phone support, and potentially social media channels.

Response times and service quality metrics, which are crucial indicators of customer support effectiveness, are not documented in any available sources. Professional forex brokers usually provide specific commitments regarding response times and service level agreements.

Multilingual support capabilities, particularly important for international brokers, remain unspecified. Given Weike's Chinese headquarters, questions about English-language support and other international languages cannot be answered based on available information.

Customer service hours and availability across different time zones represent another critical gap in available information. Forex markets operate 24/5, making round-the-clock support availability an important consideration for active traders.

Trading Experience Analysis

Analyzing Weike's trading experience requires information about platform stability, execution quality, and overall trading environment. None of this information is available in accessible sources. Platform reliability and order execution speed are fundamental factors that directly impact trading success and user satisfaction.

Order execution quality, including slippage rates, requote frequency, and execution speed metrics, cannot be evaluated due to the absence of performance data or user feedback. These factors are crucial for traders, particularly those employing scalping or high-frequency trading strategies.

Platform functionality and user interface design represent important aspects of trading experience that remain unknown. Modern traders expect intuitive interfaces, comprehensive charting capabilities, and seamless order management systems.

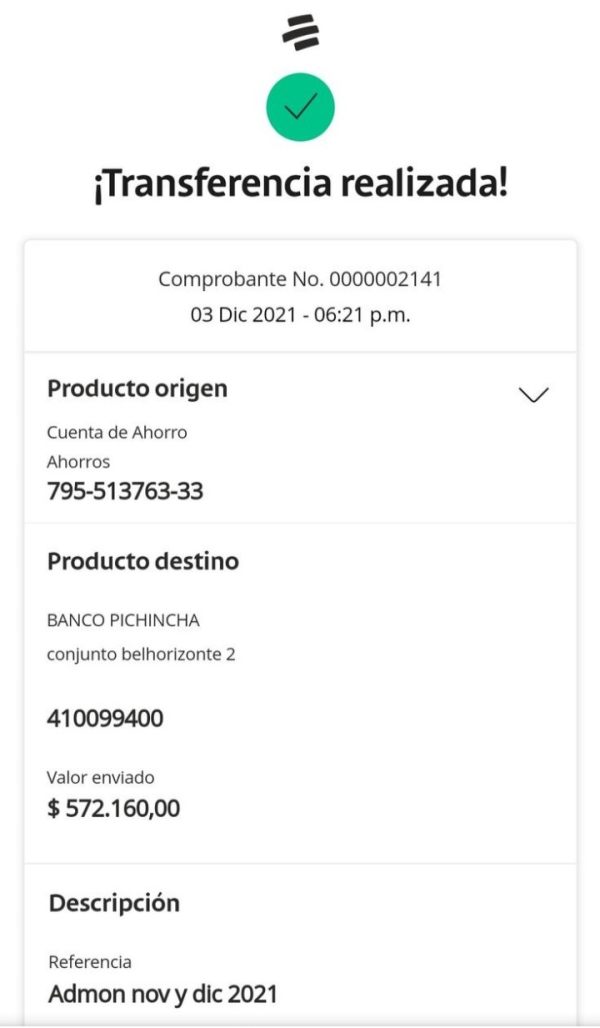

Mobile trading capabilities, which have become essential in today's trading environment, are not documented. The ability to monitor positions, execute trades, and access account information from mobile devices is considered standard among reputable forex brokers.

This Weike review cannot provide meaningful insights into trading experience quality due to the comprehensive lack of relevant information. The neutral rating reflects uncertainty rather than confirmed mediocrity.

Trust and Safety Analysis

Trust and safety evaluation reveals the most concerning aspect of this Weike review. The complete absence of regulatory information and safety measures documentation raises significant concerns. Regulatory oversight from recognized authorities such as the FCA, ASIC, CySEC, or other established financial regulators provides essential investor protection.

Fund safety measures, including segregated client accounts, deposit insurance, and negative balance protection, are not detailed in any available sources. These protections are considered fundamental requirements for reputable forex brokers and their absence raises significant red flags.

Company transparency, including detailed company information, management team disclosure, and financial reporting, appears limited based on available public information. Established brokers typically provide comprehensive corporate information to build trust with potential clients.

Industry reputation and third-party recognition through awards, certifications, or professional associations are not evident in accessible sources. The absence of such credentials makes it difficult to verify the broker's standing within the financial services industry.

User Experience Analysis

User experience evaluation faces substantial challenges due to the complete absence of user feedback, testimonials, or experience reports in accessible sources. Real user experiences provide valuable insights into platform usability, customer service quality, and overall satisfaction levels.

Interface design and platform usability cannot be assessed without access to the trading platform or user interface screenshots. Modern traders expect intuitive, responsive, and feature-rich platforms that facilitate efficient trading operations.

Registration and account verification processes, which significantly impact initial user experience, are not documented in available sources. Streamlined onboarding procedures while maintaining proper KYC compliance represent important user experience factors.

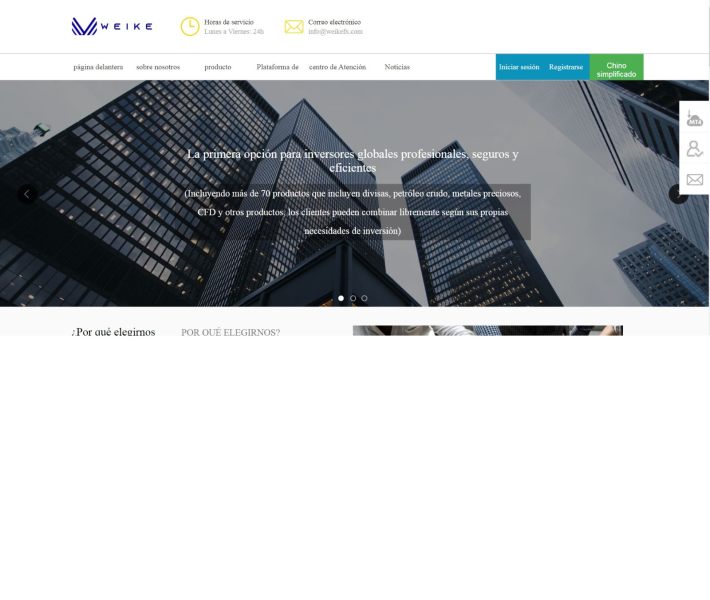

Funding and withdrawal experiences, including processing times, fees, and procedural complexity, remain unknown. These operational aspects significantly impact user satisfaction and overall broker evaluation.

Conclusion

This comprehensive Weike review reveals significant information limitations that make it impossible to provide a definitive recommendation. The absence of regulatory information, trading conditions, user feedback, and operational details creates substantial uncertainty for potential clients. While the company appears to have a physical presence in China, the lack of transparent information about their forex services raises important questions about their suitability for serious traders.

Potential users should exercise extreme caution and consider well-established, regulated alternatives that provide comprehensive information about their services, regulatory status, and trading conditions. The forex industry offers numerous transparent, regulated options that better serve trader needs and provide appropriate investor protections.