Marcel Miller 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

Marcel Miller appears as a suspicious clone brokerage operating within the UK, presenting significant risks to potential traders. As an unregulated entity, it poses a high threat to investors' finances and overall investment strategy. The ideal customer segment is likely to comprise experienced traders who are drawn to high-risk trading opportunities. However, the precarious nature of trading with an unregulated broker necessitates caution; thus, novice traders and risk-averse individuals should steer clear of this platform. In the absence of regulatory oversight and clear operational frameworks, the potential for significant financial loss is severe. This comprehensive review aims to shed light on the key risks associated with Marcel Miller without losing sight of crucial verification steps to safeguard against potential scams.

⚠️ Important Risk Advisory & Verification Steps

Risk Statement: Marcel Miller operates as a financial brokerage that is not regulated by any credible authority, which significantly increases the risk of fraud and financial losses.

Potential Harms:

- Financial losses due to unregulated trading.

- Lack of recourse in case of scams or operational failures.

Self-Verification Guide:

- Check Regulatory Status: Visit the FCA's official website to confirm whether the broker is authorized.

- Scrutinize Company Details: Ensure to check the address and contact information against regulatory databases for legitimacy.

- Monitor Digital Channels: Inspect various communication channels for accessibility and reliability.

- Seek User Testimonials: Investigate online forums and review sites for feedback regarding their experiences with Marcel Miller.

Rating Framework

Broker Overview

Company Background and Positioning

Marcel Millers broker services come under scrutiny for their severe lack of regulatory structure. While the company claims to be based in the United Kingdom, it is identified as a clone of an FCA-authorized firm. This imitation potentially misleads traders about its legitimacy and fosters uncertainty regarding the safety of their investments. Registered in the United Kingdom, Marcel Miller has been operational for approximately 5-10 years but lacks a secure regulatory foundation, raising numerous red flags regarding its business practices.

Core Business Overview

The core operations of Marcel Miller include offering a variety of trading platforms and asset classes, yet its exact offerings remain vague due to a lack of accessible information. With claims of regulatory affiliation with the FCA, it is essential to highlight that they are operating under the guise of legitimacy, as evidenced by the FCA's warnings against them being a clone firm. This status not only jeopardizes the outlined financial services they propose but also amplifies the inherent risks associated with trading through such a broker.

Quick-Look Details Table

In-depth Analysis of Each Dimension

1. Trustworthiness Analysis

Teaching Users to Manage Uncertainty

The brokerage has been criticized heavily for its regulatory conflicts and clone status, generating questions about its legitimacy.

- Regulatory Information Conflicts:

- Marcel Miller is marked as an FCA clone, indicating a significant risk associated with trading or investing with them. The brokerage operates under a suspicious regulatory framework that has led to a 0.00 regulatory index according to various reviews and assessments.

- User Self-Verification Guide:

- To verify the legitimacy of Marcel Miller, users can take the following steps:

Use regulatory websites like the FCA's register to check for authorized firms and their details.

Collect any available documentation regarding the brokers operations and communication.

Review user experiences and complaints on trusted platforms.

Industry Reputation:

- Feedback regarding fund safety and overall trustworthiness is disheartening, as many users express concerns about potential scams. The following summarizes user sentiments:

"The lack of transparency and accessibility raises immense doubts about the safety of funds held under Marcel Miller."

2. Trading Costs Analysis

The Double-Edged Sword Effect

- Advantages in Commissions:

- Marcel Miller boasts a relatively low commission structure which may lure in traders. However, details about these benefits are shrouded in insufficient transparency.

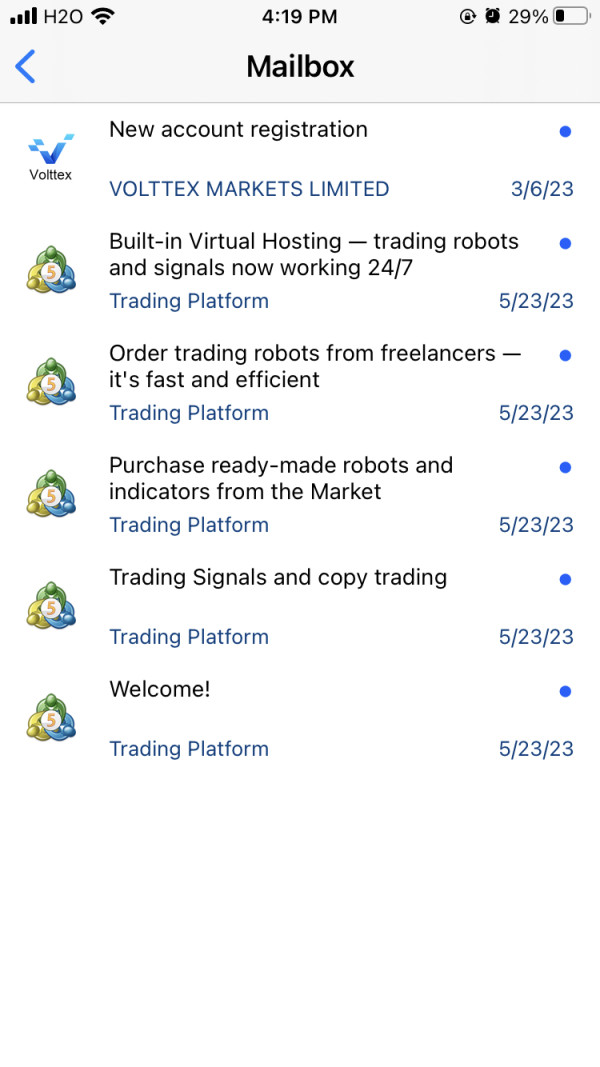

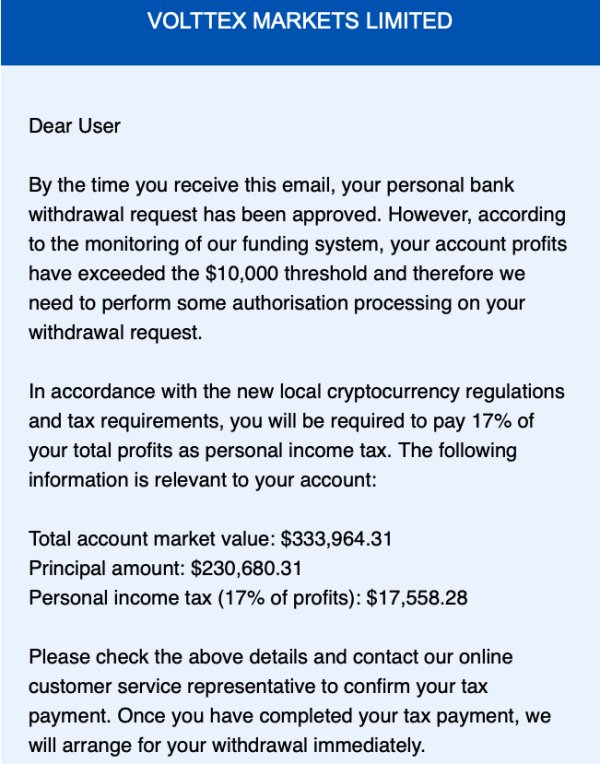

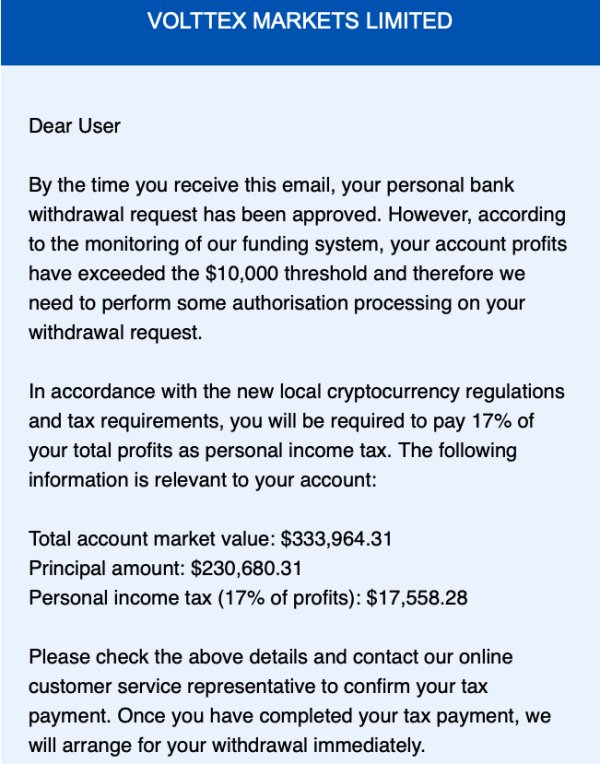

- The "Traps" of Non-Trading Fees:

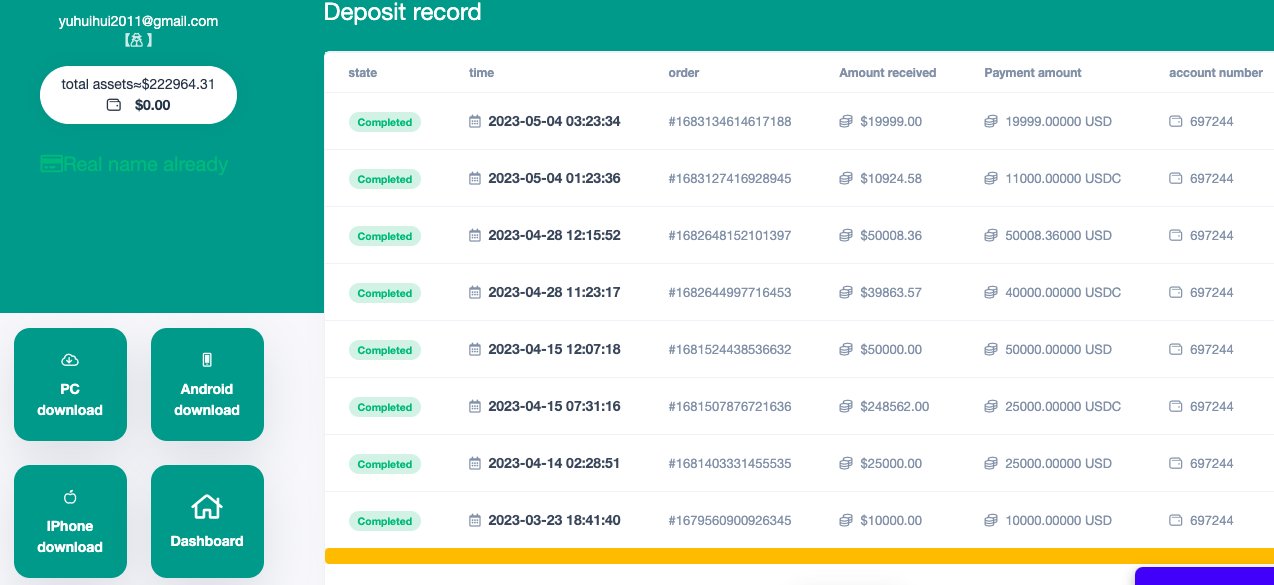

- Users have reported hidden fees, particularly during the withdrawal process. One example includes claims of having to pay up to $30 for withdrawals, which significantly eats into profits:

"They kept delaying my withdrawal requests and finally charged me a hefty fee for cashing out."

- Cost Structure Summary:

- The trading cost structure may appeal to some traders, but the prevalence of hidden fees starkly contrasts any purported benefits.

Professional Depth vs. Beginner-Friendliness

- Platform Diversity:

- The broker offers limited platform options, which calls into question their adaptability to cater to both experienced and beginner traders. Currently, the platforms lack mainstream accessibility.

- Quality of Tools and Resources:

- An analysis reveals a significant deficiency in trading tools (like charting software) and educational materials.

- Platform Experience Summary:

- Feedback from users indicates a poor navigational experience. Many have highlighted:

"The platform crashes frequently, making it frustrating to trade."

4. User Experience Analysis

The User Experience

- Navigation and Design:

- Many users report a frustrating and unreliable interface. The appearance of frequent outages only aggravates these experiences.

5. Customer Support Analysis

The Need for Reliable Support

- Accessibility and Responsiveness:

- Users report long wait times and unresponsive channels when attempting to reach customer support, which is critical for timely assistance in trading.

6. Account Conditions Analysis

Clarity of Terms

- Confusing Terms and Conditions:

- Many account requirements and conditions are not clearly outlined. This lack of transparency can lead to misunderstandings and potential disputes.

Quality Control

In reviewing Marcel Miller, it remains paramount to emphasize the importance of verifying any financial firm before engaging. Regulatory oversight is essential, and due diligence is the best course of action to mitigate risks. For those assessing potential financial partners, opting for firms with recognized regulatory certifications and transparent operational frameworks is highly advisable.

In conclusion, while Marcel Miller may appear enticing with attractive commissions and promised services, the reality is a grave risk due to its dubious operational status. Financial investments require careful consideration, and this review underscores the necessity to perform thorough background checks before engaging with any financial broker.