Trade Option 2025 Review: Everything You Need to Know

Executive Summary

This Trade Option review shows major concerns about this broker's legitimacy and regulatory compliance. Trade Option is not considered a trustworthy broker due to its lack of proper regulatory oversight and potential fraudulent operations based on available information. The platform fails to provide transparent trading conditions, essential regulatory information, or clear operational details that legitimate brokers typically offer.

Key characteristics of Trade Option include a concerning absence of regulatory authorization from reputable financial authorities. The broker also has extremely limited user feedback, with only six reviews available across major review platforms. The broker appears to target forex traders seeking trading opportunities. However, potential clients should exercise extreme caution when considering this platform.

The lack of transparency regarding trading conditions, fee structures, and company background raises red flags. These warning signs are typically associated with unreliable or potentially fraudulent operations. Users seeking legitimate forex trading opportunities would be better served by choosing properly regulated brokers with established track records and transparent business practices.

Important Notice

Regional Entity Differences: Trade Option does not clearly specify its registration jurisdiction or operational regions. This creates uncertainty about which regulatory framework, if any, governs its operations. This lack of clarity regarding geographical presence and regulatory compliance is a significant concern for potential users.

Review Methodology: This evaluation is based on limited available information, including sparse user reviews and regulatory database searches. The assessment methodology is constrained by the broker's lack of transparency and minimal public information. This limitation itself serves as a critical evaluation factor.

Rating Framework

Broker Overview

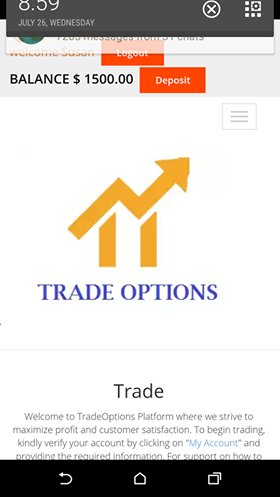

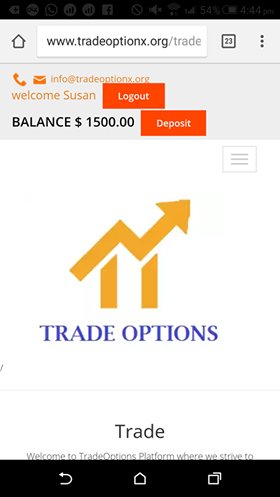

Trade Option operates in the forex trading space without clear establishment details or corporate background information. The broker's founding year, company history, and operational structure remain undisclosed in available documentation. This lack of fundamental business information is highly unusual for legitimate financial services providers. It raises immediate concerns about the platform's credibility and transparency.

The business model appears focused on forex trading services. However, specific details about trading mechanisms, execution methods, or operational procedures are not readily available. This absence of basic operational information makes it difficult for potential clients to understand how the platform functions. It also makes it unclear what services they would actually receive.

From a regulatory perspective, Trade Option lacks authorization from recognized financial regulatory bodies. This is a critical deficiency for any forex broker. Legitimate brokers typically maintain licenses from authorities such as the FCA, CySEC, ASIC, or other reputable regulators. The absence of such regulatory oversight eliminates crucial investor protections and dispute resolution mechanisms that are standard in the industry.

Regulatory Status: Available information indicates Trade Option operates without proper regulatory authorization from established financial authorities. This regulatory gap represents a significant risk factor for potential users. It eliminates standard investor protections and oversight mechanisms.

Deposit and Withdrawal Methods: Specific information about funding options, processing times, and associated fees is not available in current documentation. This makes it impossible to assess the broker's financial transaction capabilities.

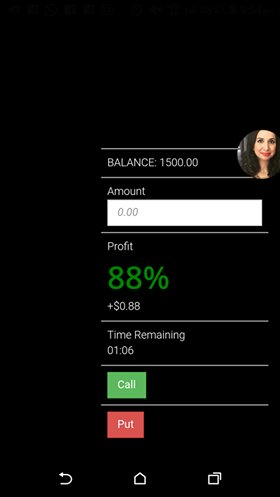

Minimum Deposit Requirements: No minimum deposit information is specified in available sources. This is unusual for legitimate trading platforms that typically clearly communicate their account funding requirements.

Promotional Offers: Details about bonuses, promotional campaigns, or special offers are not documented. However, this absence may be less concerning than other missing operational details.

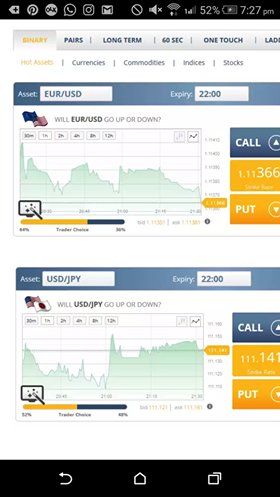

Trading Assets: While the platform appears to focus on forex trading, specific currency pairs, asset categories, or trading instruments are not clearly outlined in available information.

Cost Structure: Commission rates, spread information, overnight fees, and other trading costs remain undisclosed. This makes it impossible for potential users to assess the platform's competitiveness or total trading expenses.

Leverage Options: Maximum leverage ratios and margin requirements are not specified in available documentation.

Platform Technology: Specific trading platform details, including software type, features, and technical capabilities, are not provided in current sources.

Geographic Restrictions: Regional availability and service limitations are not clearly communicated.

Customer Support Languages: Available support languages and communication options are not specified.

This comprehensive Trade Option review highlights the concerning lack of basic operational information. Legitimate brokers typically provide this information transparently.

Detailed Rating Analysis

Account Conditions Analysis (Score: 3/10)

Trade Option's account offerings remain largely undefined in available documentation. This significantly impacts the evaluation of their account conditions. Legitimate forex brokers typically provide detailed information about different account types, each designed for specific trader segments such as beginners, experienced traders, or high-volume clients. The absence of such information makes it impossible to assess whether Trade Option offers suitable options for different trading needs.

Minimum deposit requirements, which are fundamental to account accessibility, are not specified in available sources. This lack of clarity prevents potential users from understanding the financial commitment required to begin trading. It also makes it difficult to compare the broker's accessibility with industry standards.

The account opening process, including required documentation, verification procedures, and approval timeframes, is not detailed in current information sources. Legitimate brokers typically provide clear guidance on these procedures to ensure regulatory compliance and user understanding.

Special account features such as Islamic accounts for Muslim traders, demo accounts for practice trading, or premium accounts with enhanced features are not mentioned in available documentation. This Trade Option review cannot verify whether such options exist or what their terms might be.

The trading tools and educational resources offered by Trade Option are not documented in available information sources. This is a significant concern for potential users seeking comprehensive trading support. Professional forex brokers typically provide extensive analytical tools, including technical indicators, charting software, and market analysis features that are essential for informed trading decisions.

Research and market analysis resources, such as daily market commentary, economic calendars, or expert analysis reports, are not mentioned in current documentation. These resources are standard offerings from reputable brokers. They are crucial for traders seeking to stay informed about market developments and trading opportunities.

Educational materials, including trading guides, webinars, video tutorials, or market education programs, appear to be absent from Trade Option's documented offerings. Such educational support is particularly important for novice traders. It is typically provided by legitimate brokers as part of their client service commitment.

Automated trading support, including Expert Advisor compatibility, algorithmic trading options, or copy trading features, is not addressed in available information. This limits assessment of the platform's advanced trading capabilities.

Customer Service and Support Analysis (Score: 3/10)

Trade Option's customer service infrastructure and support capabilities are not adequately documented in available sources. This makes it difficult to assess the quality and accessibility of client assistance. Professional forex brokers typically maintain multiple communication channels, including phone support, email assistance, and live chat options to ensure clients can receive help when needed.

Response time commitments and service level agreements are not specified in current documentation. This leaves potential users without clear expectations about support availability. Legitimate brokers often provide specific timeframes for responding to different types of inquiries. They maintain service standards to ensure client satisfaction.

The quality of customer service, including staff expertise, problem-solving capabilities, and overall client satisfaction levels, cannot be evaluated based on available information. User feedback specifically addressing customer service experiences is not documented in current sources.

Multilingual support capabilities and the availability of customer service in different languages are not specified. This may impact accessibility for international users seeking assistance in their preferred language.

Trading Experience Analysis (Score: 4/10)

The trading experience offered by Trade Option cannot be thoroughly evaluated due to insufficient information about platform performance, execution quality, and overall trading environment. Platform stability and execution speed are critical factors for successful forex trading. However, specific performance metrics or user experiences are not documented in available sources.

Order execution quality, including fill rates, slippage statistics, and execution speed benchmarks, is not addressed in current information. These factors are crucial for traders seeking reliable and efficient trade execution. This is particularly important in fast-moving market conditions.

Platform functionality, including charting capabilities, order management features, and trading tools integration, remains undocumented. Modern trading platforms typically offer sophisticated features that enhance the trading experience. However, Trade Option's platform capabilities cannot be assessed based on available information.

Mobile trading experience, including app availability, mobile platform features, and cross-device synchronization, is not mentioned in current sources. Given the importance of mobile trading in today's market, this information gap represents a significant evaluation limitation for this Trade Option review.

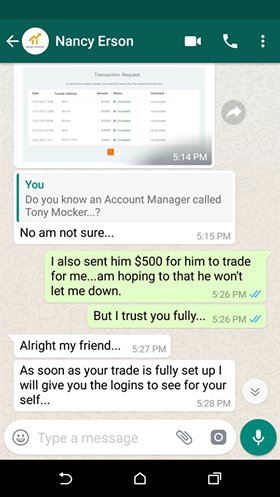

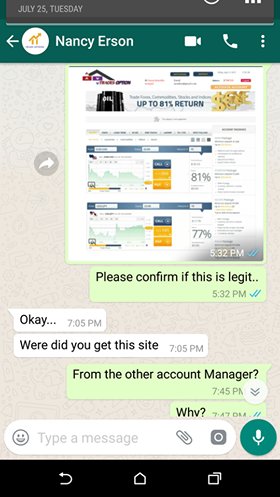

Trust and Reliability Analysis (Score: 2/10)

Trust and reliability represent the most concerning aspects of Trade Option's operations. Significant red flags have been identified in available information. The broker's lack of proper regulatory authorization from established financial authorities eliminates crucial investor protections and oversight mechanisms that are standard in legitimate forex operations.

Fund security measures, including client money segregation, deposit insurance, and financial safeguards, are not documented in available sources. Legitimate brokers typically maintain strict protocols for protecting client funds. They clearly communicate these protections to build user confidence.

Company transparency regarding ownership, operational history, and business practices is notably absent from available information. Reputable brokers typically provide comprehensive background information, including company registration details, management team information, and operational transparency. This allows clients to verify their legitimacy.

The potential for fraudulent operations, as suggested in available information sources, represents the most serious concern regarding Trade Option's trustworthiness. Such warnings should be taken seriously by potential users considering this platform for their trading activities.

User Experience Analysis (Score: 3/10)

User experience assessment for Trade Option is severely limited by the minimal feedback available from actual platform users. With only six user reviews documented across major review platforms, there is insufficient data to establish clear patterns of user satisfaction. There is also insufficient data to identify common experience themes.

Interface design and platform usability cannot be evaluated based on available information. Specific details about the user interface, navigation structure, and overall design quality are not documented. Modern trading platforms typically prioritize user-friendly design to enhance the trading experience.

Registration and account verification processes are not detailed in current sources. This makes it impossible to assess the efficiency and user-friendliness of the onboarding experience. Streamlined registration processes are important for user satisfaction and platform accessibility.

Fund management experience, including deposit and withdrawal processes, transaction efficiency, and related user experiences, cannot be evaluated due to lack of specific information about these crucial operational aspects.

The limited user feedback available does not provide sufficient insight into common user concerns, satisfaction levels, or areas where the platform might excel or require improvement. This limits the comprehensiveness of this Trade Option review.

Conclusion

This comprehensive evaluation reveals that Trade Option presents significant risks and concerns. These make it unsuitable for traders seeking a reliable and trustworthy forex trading environment. The broker's lack of proper regulatory oversight, absence of transparent operational information, and potential fraud warnings create an unacceptable risk profile for serious traders.

Trade Option is not recommended for any category of forex traders, whether beginners seeking their first trading platform or experienced traders looking for additional trading opportunities. The platform's deficiencies in transparency, regulation, and documented user support make it inappropriate for safe trading activities.

The primary disadvantages include complete lack of regulatory authorization, absence of transparent trading conditions, minimal user feedback, and potential fraud concerns. These factors collectively create a risk profile that far exceeds any potential benefits the platform might offer to prospective users.