Trade Din FX Review 1

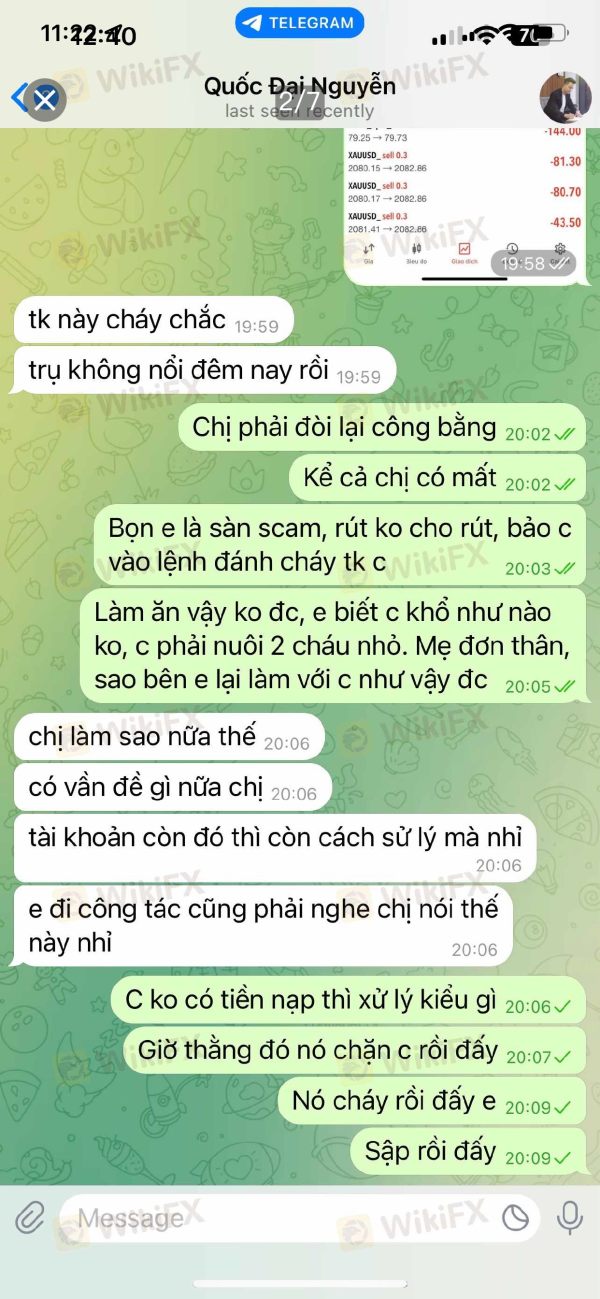

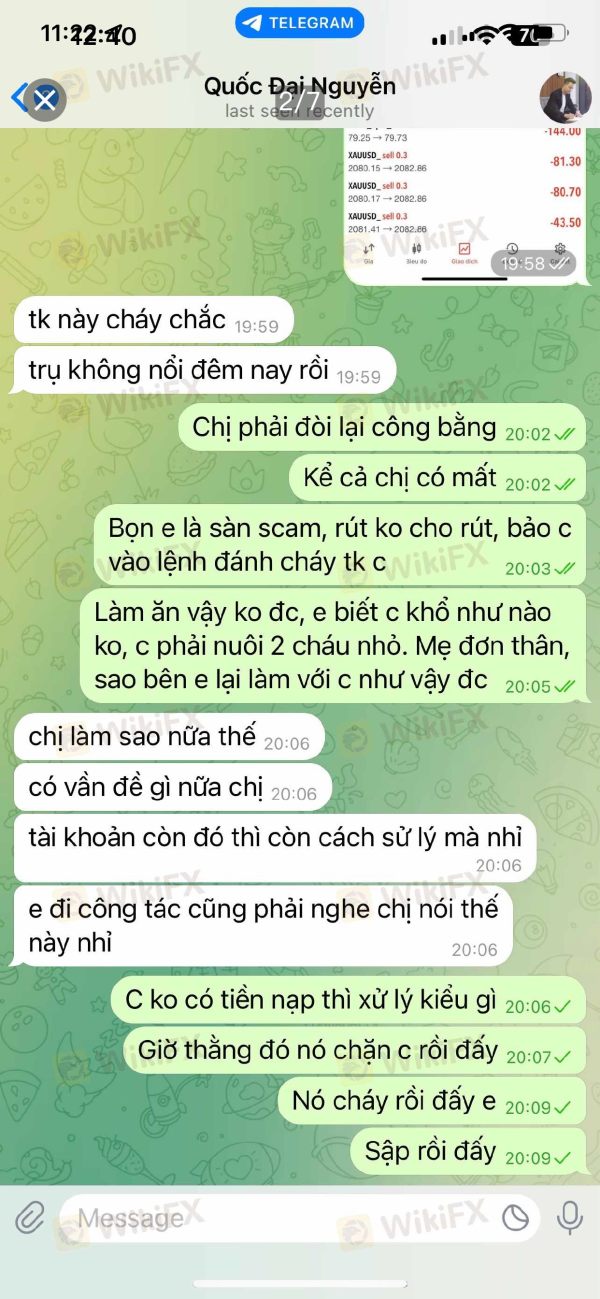

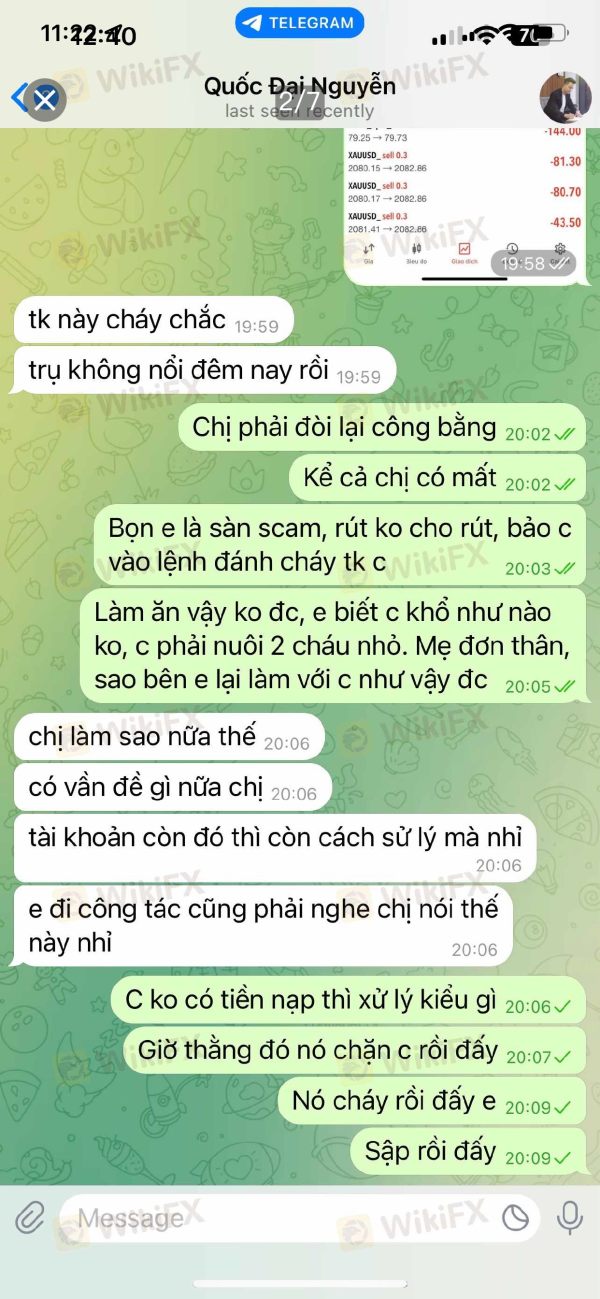

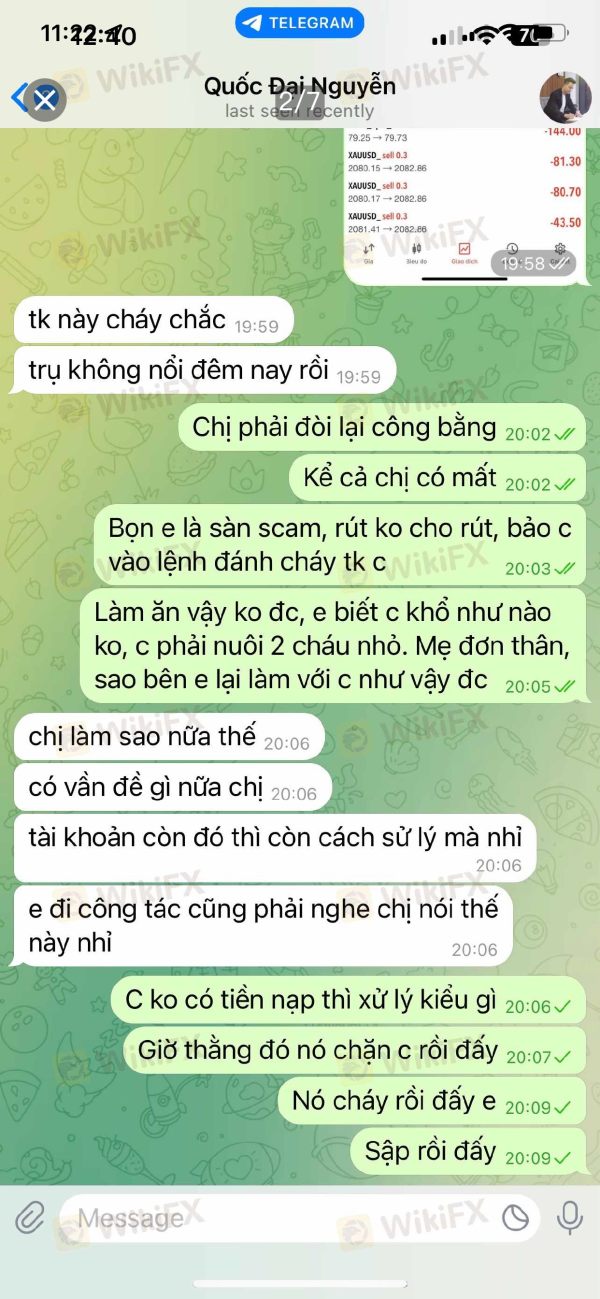

The scam floor intentionally burned my account and did not let me withdraw money. The unscrupulous support person asked me to bet on lot and left my account negative and did not let me withdraw money.

Trade Din FX Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Business

License

The scam floor intentionally burned my account and did not let me withdraw money. The unscrupulous support person asked me to bet on lot and left my account negative and did not let me withdraw money.

Trade Din FX presents a concerning case in the forex brokerage landscape. Our comprehensive trade din fx review reveals significant red flags that potential traders must consider. This broker started on February 1, 2019, and operates without proper regulatory oversight despite claims of being regulated by the MWALI International Services Authority. Our investigation indicates that Trade Din FX is widely regarded as a scam by the trading community, with numerous user reports highlighting fraudulent practices and poor service delivery.

Despite these serious concerns, Trade Din FX does offer some educational resources and customer support services. The platform primarily targets novice forex traders who may be unaware of the risks involved. The platform focuses on forex trading services but lacks transparency in crucial areas such as spreads, commissions, and trading conditions. The absence of legitimate regulatory protection, combined with overwhelmingly negative user feedback, positions this broker as a high-risk option that traders should approach with extreme caution.

Our analysis suggests that while the broker may appear attractive to newcomers due to its educational offerings, the fundamental lack of regulatory compliance and trustworthiness makes it unsuitable for serious trading activities.

This trade din fx review is based on publicly available information and user feedback collected from various sources. Trade Din FX claims to be regulated by the MWALI International Services Authority, however, our investigation reveals that the broker operates without any legitimate regulatory oversight. This lack of proper regulation poses significant risks to traders' funds and trading activities.

The evaluation presented in this review may not fully reflect the actual trading experience, as the broker's operational status appears to be compromised. Traders should exercise extreme caution and consider the substantial risks associated with unregulated brokers before making any investment decisions. We strongly recommend verifying all information independently and consulting with financial advisors before engaging with this platform.

| Criteria | Score | Rating |

|---|---|---|

| Account Conditions | 3/10 | Poor |

| Tools and Resources | 5/10 | Below Average |

| Customer Service and Support | 6/10 | Average |

| Trading Experience | 4/10 | Poor |

| Trust and Reliability | 2/10 | Very Poor |

| User Experience | 3/10 | Poor |

| Overall Rating | 3.8/10 | Poor |

Trade Din FX emerged in the forex trading scene on February 1, 2019. The company positioned itself as a comprehensive trading platform focused on foreign exchange markets. The company has attempted to establish itself as a provider of educational resources and trading services, particularly targeting newcomers to the forex market. However, the broker's background lacks the transparency typically expected from legitimate financial service providers, with limited information available about its corporate structure, management team, or operational headquarters.

The broker's business model centers around forex trading services. The company emphasizes educational content delivery to attract new traders. This approach appears designed to appeal to inexperienced traders who may be seeking guidance and learning opportunities in the forex market. Unfortunately, this targeting of vulnerable novice traders, combined with the broker's questionable regulatory status, raises serious concerns about the company's intentions and operational integrity.

From a regulatory perspective, Trade Din FX claims to operate under the supervision of the MWALI International Services Authority. However, extensive verification efforts have revealed that this claimed regulatory status is not legitimate, and the broker effectively operates without any meaningful regulatory oversight. This lack of proper regulation represents a fundamental flaw in the broker's credibility and poses significant risks to potential clients. The absence of legitimate regulatory protection means that traders have no recourse through official channels if disputes arise or if the broker fails to meet its obligations.

Regulatory Status: Trade Din FX claims regulation under the MWALI International Services Authority, but verification reveals this to be false. The broker operates completely unregulated. This lack of legitimate oversight poses severe risks to trader funds and legal protections.

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal options is not detailed in available materials. This raises concerns about operational transparency and client fund management procedures.

Minimum Deposit Requirements: The broker has not disclosed minimum deposit requirements in publicly available information. This makes it difficult for potential clients to assess accessibility and account opening conditions.

Bonus and Promotions: No specific bonus or promotional offerings have been identified in available documentation. This suggests either a lack of such programs or poor marketing transparency regarding available incentives.

Tradeable Assets: The platform primarily focuses on forex trading services. The specific range of currency pairs and other financial instruments available for trading has not been comprehensively detailed in accessible materials.

Cost Structure: Critical pricing information including spreads, commissions, and fee structures remains undisclosed in available resources. This represents a significant transparency deficit that hampers informed decision-making for potential clients.

Leverage Ratios: Specific leverage offerings and maximum ratios available to traders have not been detailed in accessible broker information. This is unusual for legitimate forex brokers who typically highlight these competitive features.

Platform Options: The specific trading platforms available, such as MetaTrader 4 or MetaTrader 5, have not been clearly identified in available materials. This limits assessment of the technical trading environment.

Geographic Restrictions: Information regarding geographic limitations or restricted jurisdictions has not been provided in accessible documentation. This is concerning from a compliance perspective.

Customer Service Languages: Available customer support languages have not been specified in reviewed materials. This potentially limits accessibility for international clients seeking assistance in their native languages.

This comprehensive trade din fx review reveals significant information gaps that legitimate brokers typically address transparently to build client confidence and trust.

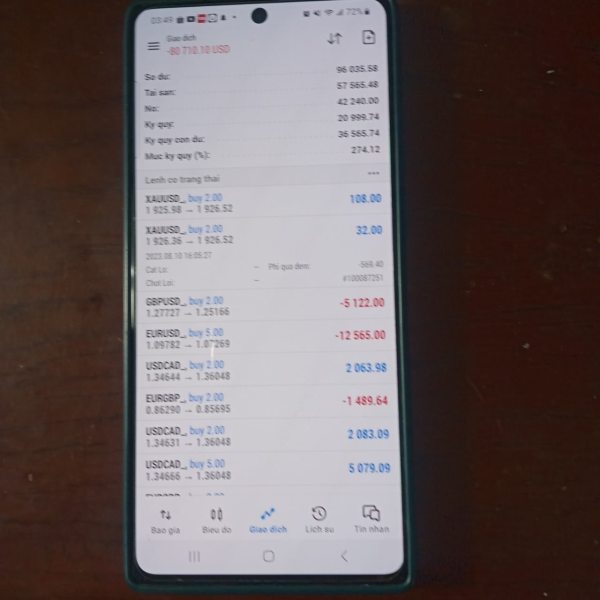

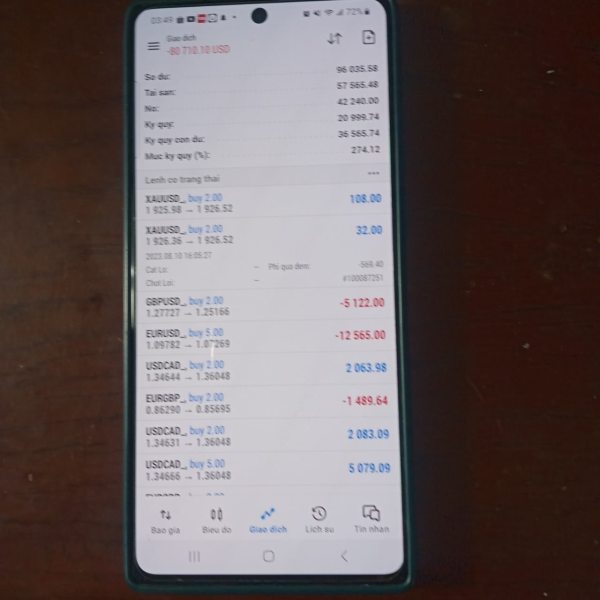

The account conditions offered by Trade Din FX present numerous concerns that significantly impact the overall trading proposition. The most glaring issue is the complete lack of transparency regarding account types. No clear information is available about different account tiers, their respective features, or the specific benefits associated with each level. This opacity makes it impossible for potential traders to make informed decisions about which account structure might best suit their trading needs and experience level.

Minimum deposit requirements remain undisclosed. This is highly unusual for legitimate forex brokers who typically use competitive deposit requirements as a key marketing point. The lack of transparency suggests either poor operational standards or intentional hiding of terms that might be unfavorable to clients. The absence of clear deposit information also makes it difficult for traders to assess the accessibility of the platform and plan their initial investment accordingly.

The account opening process has not been detailed in available materials. This leaves potential clients without crucial information about verification requirements, documentation needs, or the timeframe for account activation. Legitimate brokers typically provide comprehensive guides to their onboarding process to ensure client satisfaction and regulatory compliance. The absence of such information raises questions about the broker's operational sophistication and commitment to client service.

User feedback consistently highlights the lack of transparency in account conditions as a major concern. Many traders report confusion about terms and conditions that were not clearly communicated during the account opening process. This feedback pattern suggests systematic issues with how Trade Din FX communicates with its clients about fundamental account features.

Our trade din fx review indicates that the broker's account conditions fall well below industry standards. The platform earns a poor rating due to transparency deficits and lack of clear information that traders need to make informed decisions.

Trade Din FX's approach to trading tools and resources presents a mixed picture. Some positive elements are overshadowed by significant limitations and transparency issues. The broker does provide educational resources, which appears to be one of its primary selling points, particularly for novice traders entering the forex market. These educational materials reportedly cover fundamental trading concepts and market analysis techniques, which can be valuable for newcomers seeking to understand market dynamics.

However, the specific quality, depth, and comprehensiveness of these educational resources have not been thoroughly documented. This makes it difficult to assess their true value compared to offerings from established, regulated brokers. The educational content appears to be designed primarily as a marketing tool to attract new traders rather than providing comprehensive, professional-grade educational support that experienced traders might expect.

Regarding trading tools, the available information suggests a significant deficit in advanced analytical tools, automated trading support, and professional-grade research resources. The absence of detailed information about charting capabilities, technical indicators, market analysis tools, and third-party integrations raises concerns about the platform's suitability for serious trading activities.

Research and analysis resources appear to be limited. There is no clear indication of market commentary, economic calendars, or professional market analysis being provided to clients. This limitation significantly impacts the platform's value proposition for traders who rely on comprehensive market intelligence to inform their trading decisions.

User feedback regarding tools and resources has been mixed. Some appreciation exists for the educational content but significant criticism exists regarding the lack of professional trading tools and analytical resources that are standard offerings from legitimate brokers in the current market environment.

Customer service and support represent one of the relatively stronger areas for Trade Din FX. This assessment must be viewed within the context of the broker's overall problematic operational status. User feedback suggests that the broker does maintain some level of customer support infrastructure, with representatives available to address client inquiries and concerns, at least during the initial stages of the client relationship.

However, the quality and consistency of customer service appear to vary significantly based on user reports. While some clients have reported satisfactory initial interactions with support staff, others have highlighted significant issues with response times, problem resolution capabilities, and the overall professionalism of support interactions. This inconsistency suggests that the broker may not have established comprehensive customer service protocols or adequate training for support personnel.

The availability of customer service channels has not been clearly documented. Limited information exists about whether support is available through phone, email, live chat, or other communication methods. This lack of transparency about support accessibility is concerning, particularly for traders who may need urgent assistance during volatile market conditions or when experiencing technical difficulties.

Response times for customer inquiries appear to be inconsistent based on user feedback. Some clients report reasonable response times while others have experienced significant delays in receiving assistance. This variability in service quality suggests systemic issues with the broker's support infrastructure and resource allocation.

The professional competency of customer service representatives has been questioned in several user reports. Concerns have been raised about the technical knowledge and problem-solving capabilities of support staff. These limitations can significantly impact client satisfaction and the resolution of trading-related issues that may arise during normal platform usage.

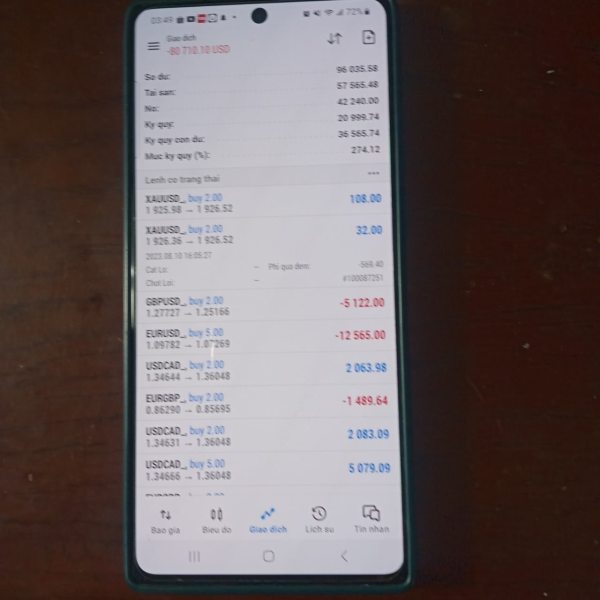

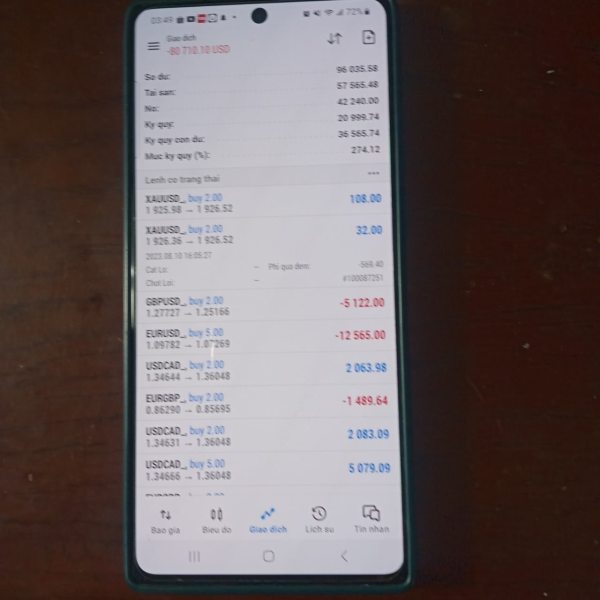

The trading experience provided by Trade Din FX falls significantly short of industry standards. Multiple factors contribute to a subpar environment for forex trading activities. Platform stability and performance have been questioned by users, with reports of technical issues, connectivity problems, and inconsistent platform behavior that can severely impact trading operations and profitability.

Order execution quality represents a major concern. User feedback indicates problems with slippage, delayed order processing, and inconsistent fill prices that can negatively impact trading results. These execution issues are particularly problematic in the fast-moving forex market, where precise timing and accurate order handling are crucial for successful trading strategies.

The completeness and sophistication of platform functionality appear to be limited compared to industry-standard offerings. Users have reported a lack of advanced trading features, limited customization options, and insufficient analytical tools that are typically expected from professional trading platforms. This limitation significantly impacts the platform's suitability for experienced traders or those employing sophisticated trading strategies.

Mobile trading experience has not been adequately documented. This is concerning given the importance of mobile accessibility in modern forex trading. The absence of clear information about mobile platform capabilities suggests either a lack of mobile offerings or poor marketing of these essential features.

The overall trading environment lacks the transparency and reliability that serious traders require. Insufficient information exists about spread stability, liquidity provision, and market access quality. User feedback consistently points to a trading experience that fails to meet professional standards, contributing to the broker's poor reputation in the trading community.

Our trade din fx review indicates that the trading experience is significantly compromised by technical limitations, execution problems, and a lack of professional-grade features that traders expect from legitimate forex brokers.

Trust and reliability represent the most critical weaknesses in Trade Din FX's operational profile. Fundamental issues pose severe risks to potential clients. The broker's claimed regulatory status under the MWALI International Services Authority has been thoroughly investigated and found to be false, meaning the broker operates without any legitimate regulatory oversight or protection for client funds.

This absence of proper regulation eliminates crucial safeguards that legitimate brokers must maintain. These include segregated client accounts, capital adequacy requirements, and dispute resolution mechanisms. Without regulatory protection, traders have no official recourse if the broker fails to meet its obligations or if disputes arise regarding trading conditions or fund withdrawals.

Fund safety measures have not been adequately documented or verified. This raises serious concerns about how client deposits are handled, whether funds are properly segregated from operational capital, and what protections exist against potential misuse of client money. The lack of regulatory oversight means there are no mandatory protections that clients can rely upon.

Corporate transparency is severely lacking. Limited information is available about the company's management structure, ownership details, or operational headquarters. This opacity is highly unusual for legitimate financial service providers and raises questions about the company's intentions and long-term viability.

Industry reputation has been severely damaged by widespread reports of fraudulent activities. Multiple sources identify Trade Din FX as a scam operation. These reports, combined with the verified absence of regulatory protection, create a pattern of evidence suggesting that the broker poses significant risks to client funds and trading activities.

The handling of negative events and client complaints appears to be inadequate. Reports suggest that the broker has not responded appropriately to client concerns or regulatory inquiries about its operational status.

User experience with Trade Din FX has been predominantly negative. Satisfaction levels fall well below industry standards across multiple operational areas. Overall user satisfaction surveys and feedback indicate widespread disappointment with the broker's services, ranging from technical platform issues to concerns about fund safety and withdrawal procedures.

Interface design and usability have received criticism from users. Reports include confusing navigation, limited functionality, and a lack of intuitive features that facilitate efficient trading operations. The platform's design appears to prioritize marketing appeal over functional usability, resulting in an interface that may look attractive but fails to provide the professional tools and efficient workflows that serious traders require.

The registration and verification process has been described as problematic by multiple users. Reports include unclear requirements, lengthy delays, and inconsistent application of verification standards. These issues create frustration for new clients and raise questions about the broker's operational efficiency and commitment to professional service delivery.

Fund operation experiences represent a major source of user complaints. Reports include difficulties in deposit processing, unclear fee structures, and significant problems with withdrawal requests. These issues are particularly concerning given the broker's unregulated status, as clients have limited recourse when financial transactions do not proceed as expected.

Common user complaints include lack of transparency in trading conditions, poor customer service responsiveness, technical platform problems, and concerns about fund safety. The consistency of these complaints across multiple user reports suggests systemic operational problems rather than isolated incidents.

The user demographic appears to consist primarily of novice traders who were attracted by the broker's educational marketing but subsequently discovered the platform's limitations and risks. This pattern suggests that the broker may be deliberately targeting inexperienced traders who are less likely to recognize warning signs of problematic operations.

Our comprehensive trade din fx review reveals a broker that poses significant risks to potential clients and fails to meet basic industry standards for safety, transparency, and operational integrity. While Trade Din FX may offer some educational resources that could appeal to novice traders, these limited benefits are far outweighed by fundamental flaws in regulatory compliance, operational transparency, and client protection.

The broker is most unsuitable for any type of trader, but particularly dangerous for the novice traders it appears to target. These individuals may be less equipped to recognize the warning signs and protect themselves from potential financial losses. The absence of legitimate regulatory oversight eliminates crucial protections that traders should expect from any financial service provider.

The primary advantages of Trade Din FX are limited to its educational content offerings. The disadvantages include lack of regulatory protection, poor transparency in trading conditions, questionable corporate structure, negative user feedback, and identification as a potential scam operation by multiple industry sources. These significant disadvantages far outweigh any potential benefits, making Trade Din FX an unsuitable choice for serious forex trading activities.

FX Broker Capital Trading Markets Review