ST5 2025 Review: Everything You Need to Know

Executive Summary

This st5 review shows major concerns about this platform that users must think about carefully. Based on available information and user feedback analysis, ST5 presents a complex picture with mixed signals that warrant serious attention. While some user ratings show 64% of reviewers giving 5-star ratings, and 63% indicating that sizing feels appropriate, these positive metrics are overshadowed by critical safety concerns identified in our investigation.

The platform targets users who want simple trading experiences. But multiple sources have flagged ST5 as a potentially fraudulent operation lacking transparency and professional standards. Industry watchdogs have specifically warned against downloading associated applications, citing fraud risks. This creates a stark contrast between user satisfaction metrics and professional security assessments.

Our analysis shows that some users report good experiences with basic functions. The underlying infrastructure and regulatory framework raise substantial red flags. The combination of positive user ratings alongside fraud warnings suggests either a sophisticated operation designed to initially satisfy users or a significant disconnect between user perception and actual platform security.

For traders considering ST5, the risk-reward calculation heavily favors extreme caution. This is true regardless of any appealing features or positive user testimonials that may initially seem encouraging.

Important Disclaimers

Regional Entity Differences: Available information does not specify detailed regulatory frameworks across different jurisdictions. Significant variations may exist between regional operations. Users should independently verify regulatory status in their specific location before considering any engagement with ST5.

Review Methodology: This evaluation is based on available user ratings, market feedback, and industry security assessments. Given the limited transparency of ST5's operations, some conclusions are drawn from pattern analysis and industry comparison rather than direct platform disclosure.

Rating Framework

Broker Overview

Company Background and Establishment

ST5's corporate background remains largely hidden. Source materials provide no clear information about establishment dates, founding team, or corporate structure. This lack of basic company information immediately raises transparency concerns that professional traders typically use as fundamental evaluation criteria. The absence of readily available corporate history contrasts sharply with legitimate brokers who prominently display their heritage, regulatory journey, and leadership team.

The business model employed by ST5 is not clearly defined in available documentation. This creates uncertainty about how the platform generates revenue, processes trades, or manages client relationships. This operational ambiguity extends to unclear descriptions of the platform's core services and target market positioning.

Platform and Asset Information

Available information does not specify the trading platform technology, supported asset classes, or technical infrastructure underlying ST5's operations. This st5 review finds that fundamental details about trading instruments, market access, and execution methodology are notably absent from accessible materials. The lack of clear asset class descriptions, platform specifications, or trading environment details makes it impossible to assess ST5's competitive positioning within the forex and trading industry.

Regulatory oversight information is similarly unavailable. There is no clear indication of which financial authorities, if any, provide supervision or consumer protection frameworks for ST5's operations.

Regulatory Framework: Source materials contain no specific information about regulatory jurisdictions, licensing authorities, or compliance frameworks governing ST5's operations.

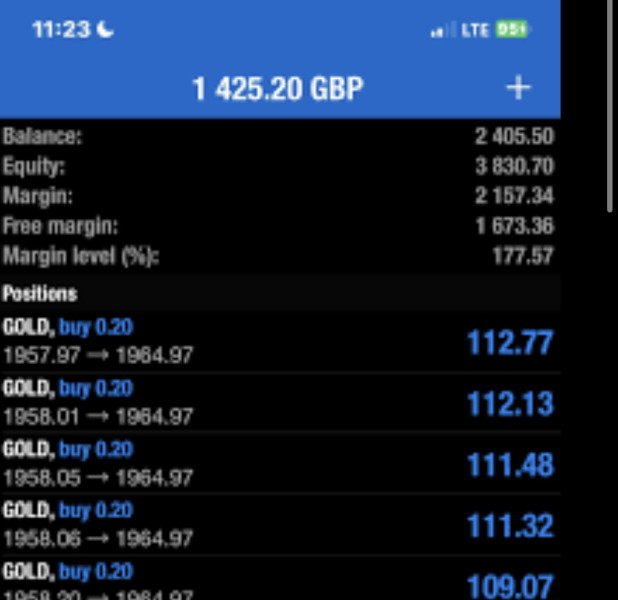

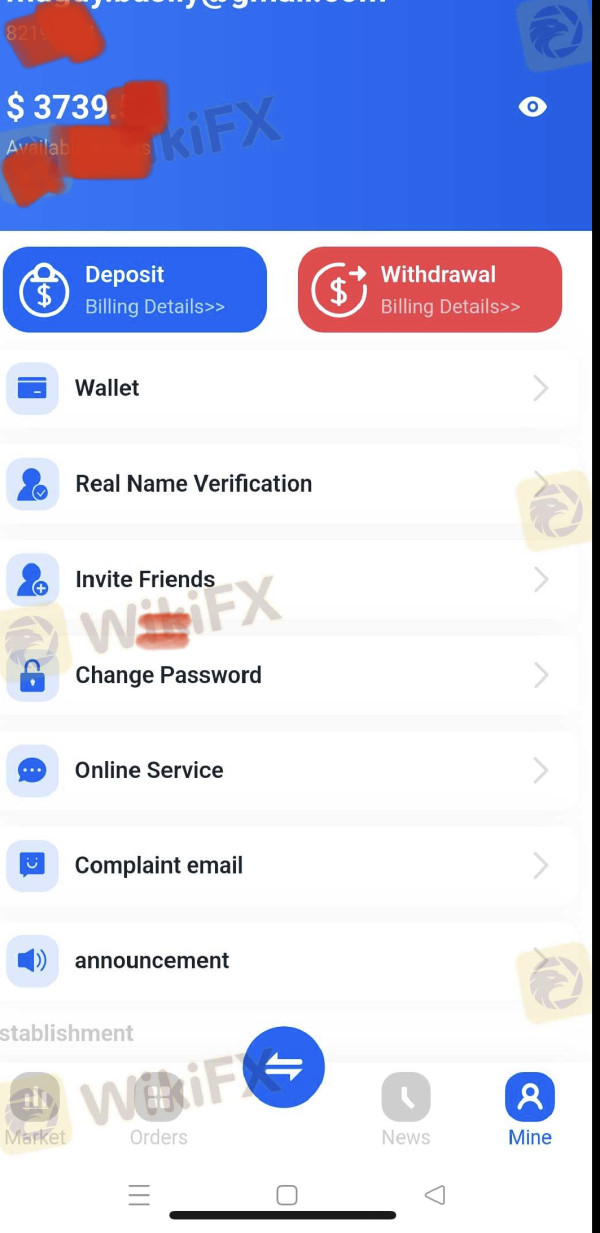

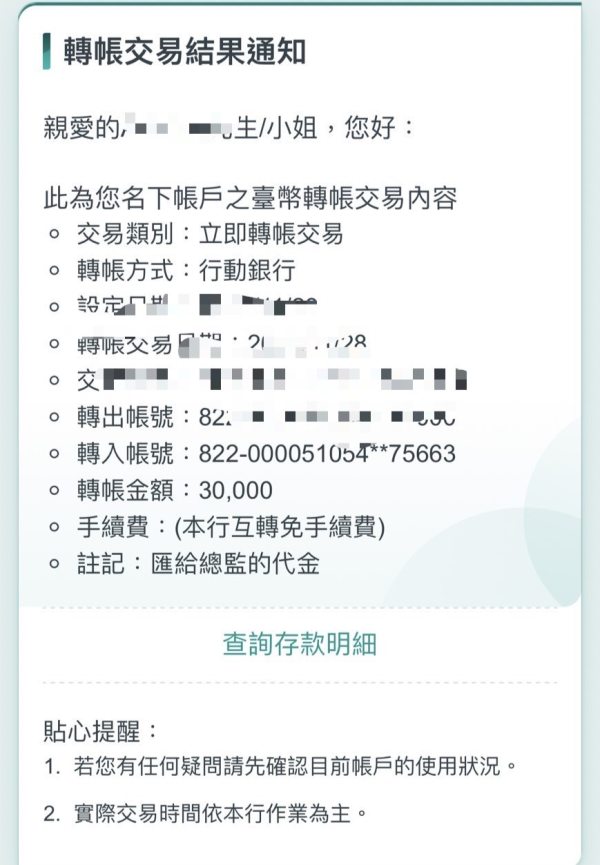

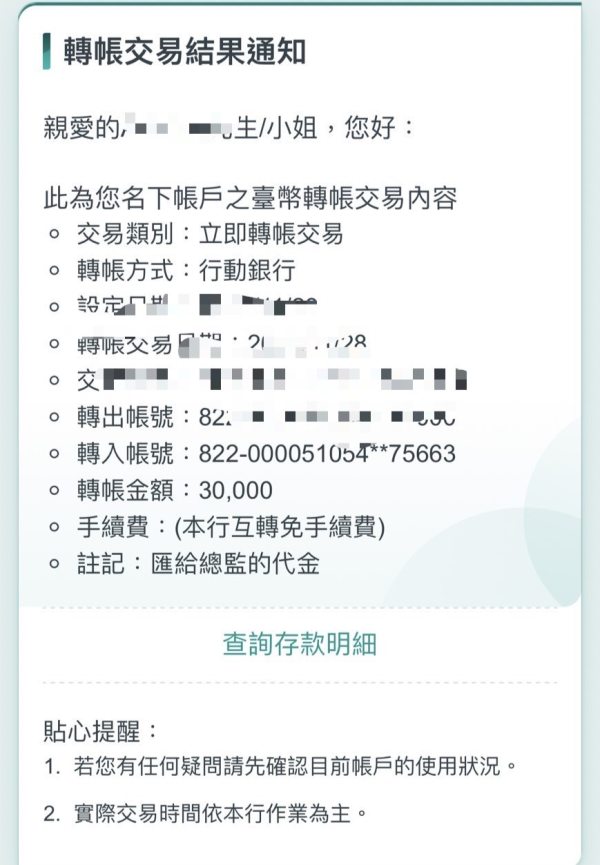

Deposit and Withdrawal Methods: Available documentation does not detail supported payment methods, processing times, or financial transaction procedures.

Minimum Deposit Requirements: Specific deposit thresholds and account funding requirements are not mentioned in accessible materials.

Promotional Offers: Information about bonuses, promotional campaigns, or incentive programs is not available in source documentation.

Tradeable Assets: The range of available trading instruments, market coverage, and asset categories remain unspecified in available materials.

Cost Structure: Details about spreads, commissions, fees, and other trading costs are not provided in accessible information. This st5 review cannot assess the platform's pricing competitiveness without transparent cost disclosure.

Leverage Ratios: Margin requirements and leverage options are not specified in available documentation.

Platform Options: Technical specifications about trading platforms, software options, or interface choices are not detailed in source materials.

Geographic Restrictions: Regional availability and access limitations are not clearly outlined in accessible information.

Customer Support Languages: Available customer service languages and communication options are not specified in source documentation.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of ST5's account conditions faces major limitations due to missing information in available source materials. Traditional account analysis typically examines account tier structures, minimum deposit requirements, special features, and account opening procedures, but ST5 provides insufficient transparency in these areas.

Without clear documentation of account types, this st5 review cannot assess whether ST5 offers different service levels for various trader segments. The absence of minimum deposit information makes it impossible to evaluate accessibility for different investor categories or compare ST5's entry requirements against industry standards.

Account opening procedures, verification requirements, and special account features such as Islamic accounts or professional trader classifications are not detailed in accessible materials. This lack of transparency extends to account management features, funding options, and any unique benefits that might differentiate ST5's offerings.

The absence of clear account condition information represents a major transparency problem that legitimate brokers typically address prominently in their marketing and regulatory disclosures.

Assessment of ST5's trading tools and educational resources is severely limited by the lack of detailed information in available source materials. Professional trading platforms typically provide comprehensive tool suites including technical analysis capabilities, research resources, economic calendars, and automated trading support, but ST5's offerings in these areas remain unspecified.

The absence of clear information about research and analysis resources makes it impossible to evaluate whether ST5 provides market insights, fundamental analysis, or technical research that traders rely on for informed decision-making. Educational resources, which legitimate brokers use to support trader development and regulatory compliance, are not detailed in accessible documentation.

Automated trading support, including expert advisor compatibility, algorithmic trading capabilities, or API access, is not mentioned in available materials. This gap is particularly significant given the importance of automated trading in modern forex markets.

Without transparent disclosure of available tools and resources, traders cannot assess whether ST5's platform meets their analytical and educational requirements or compare its offerings against industry alternatives.

Customer Service and Support Analysis

Evaluation of ST5's customer service capabilities is limited by the absence of specific information about support channels, availability, and service quality in accessible materials. Professional brokers typically provide detailed information about customer service hours, communication methods, response time commitments, and multilingual support capabilities.

The lack of clear information about customer service availability makes it impossible to assess whether ST5 provides adequate support for different time zones, trading sessions, or emergency situations that require immediate assistance. Response time commitments, which legitimate brokers often guarantee as part of their service standards, are not specified in available documentation.

Service quality indicators, including customer satisfaction metrics, problem resolution procedures, or escalation processes, are not detailed in accessible materials. Multilingual support capabilities and regional service variations are similarly unspecified.

Without transparent customer service information, traders cannot evaluate whether ST5's support infrastructure meets their requirements or provides adequate assistance for trading-related issues, account management, or technical problems.

Trading Experience Analysis

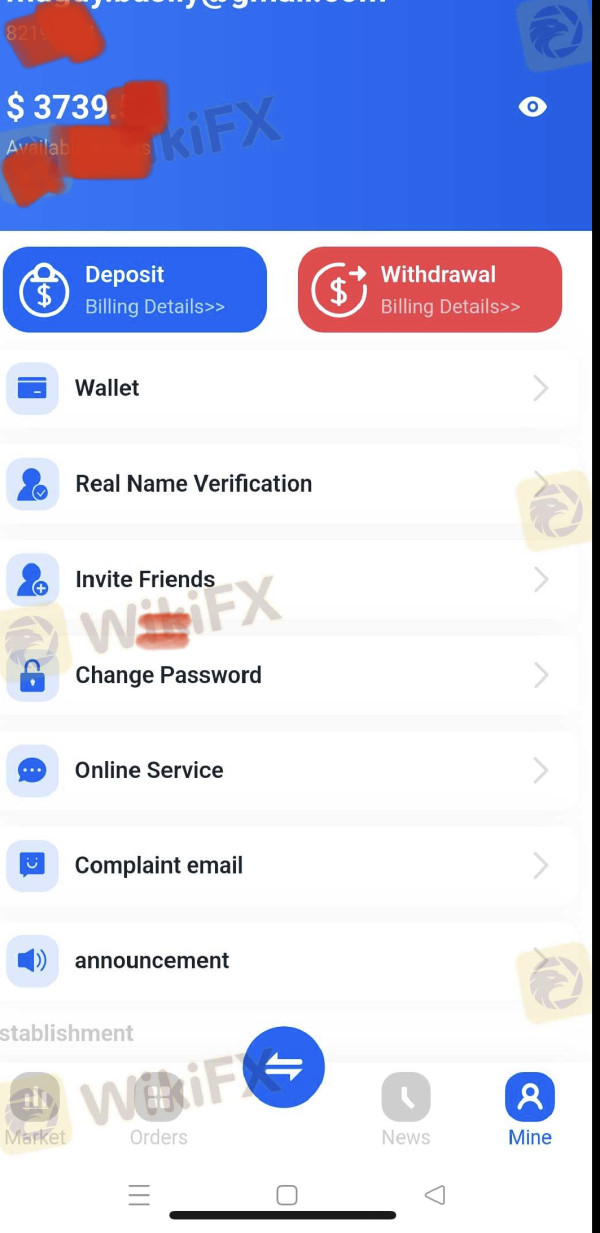

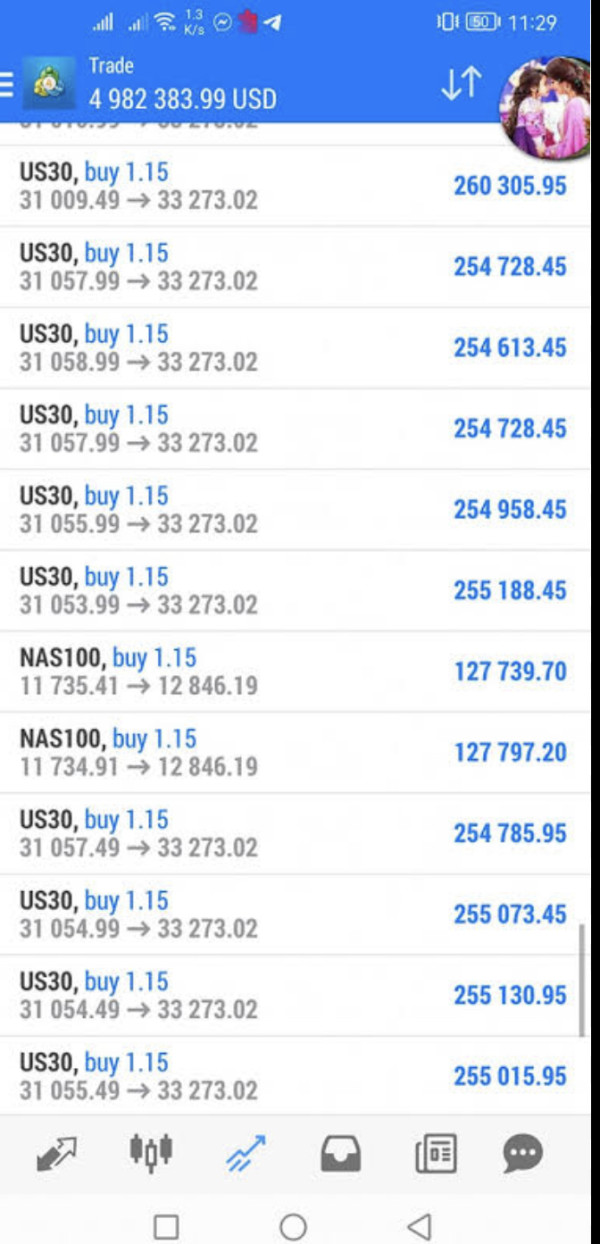

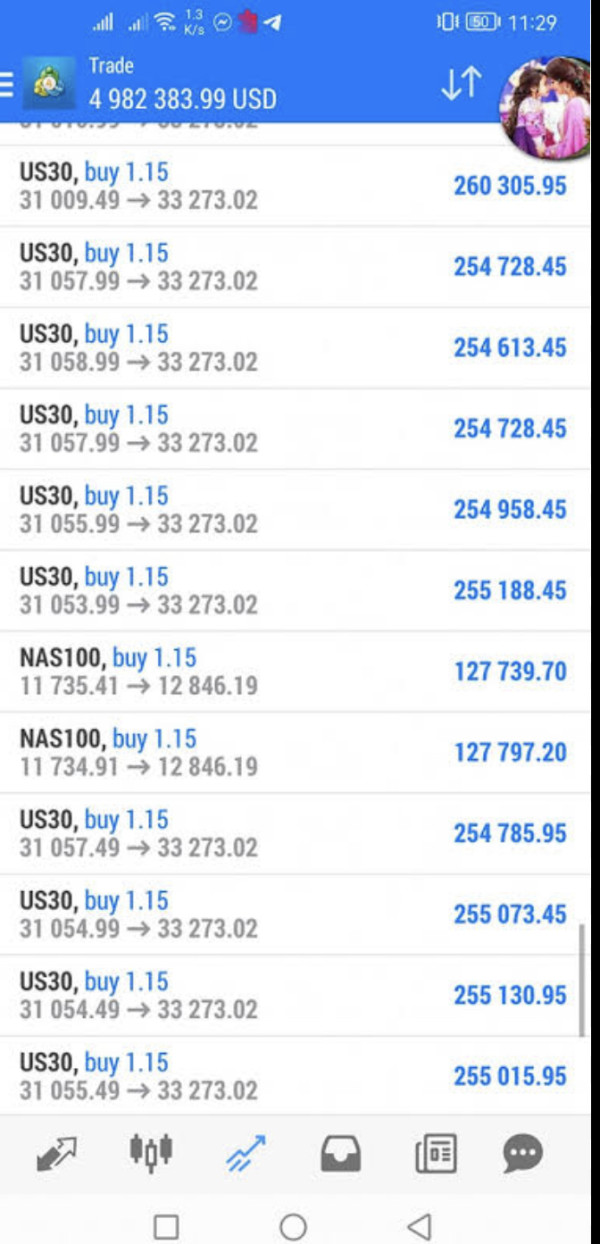

Assessment of ST5's trading experience requires evaluation of platform stability, execution quality, feature completeness, and mobile accessibility. Available source materials provide insufficient detail in these critical areas. This st5 review finds that fundamental aspects of the trading environment remain unclear.

Platform stability and execution speed, which directly impact trading outcomes and user satisfaction, are not documented in accessible materials. Order execution quality, including slippage rates, rejection frequencies, and fill accuracy, cannot be assessed without transparent performance data.

Platform functionality, including charting capabilities, order types, risk management tools, and market access features, is not detailed in available information. Mobile trading experience, increasingly important for active traders, is not described in accessible documentation.

The trading environment's competitive positioning, including unique features, technological advantages, or user interface innovations, cannot be evaluated without comprehensive platform disclosure that ST5 has not provided in accessible materials.

Trust and Security Analysis

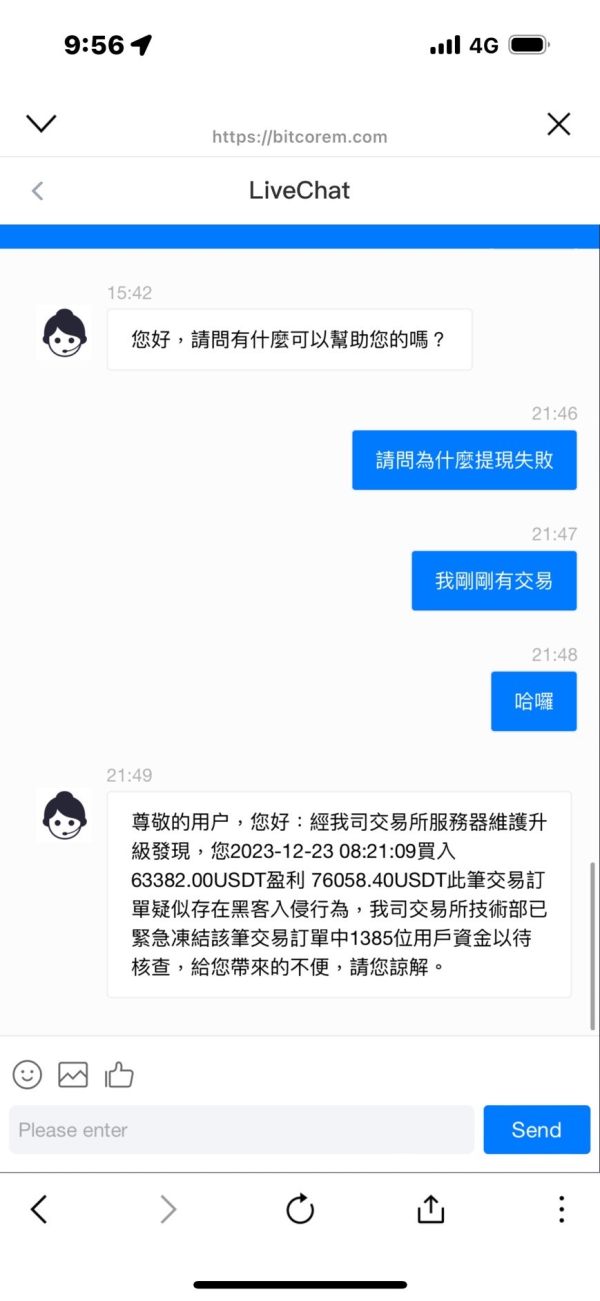

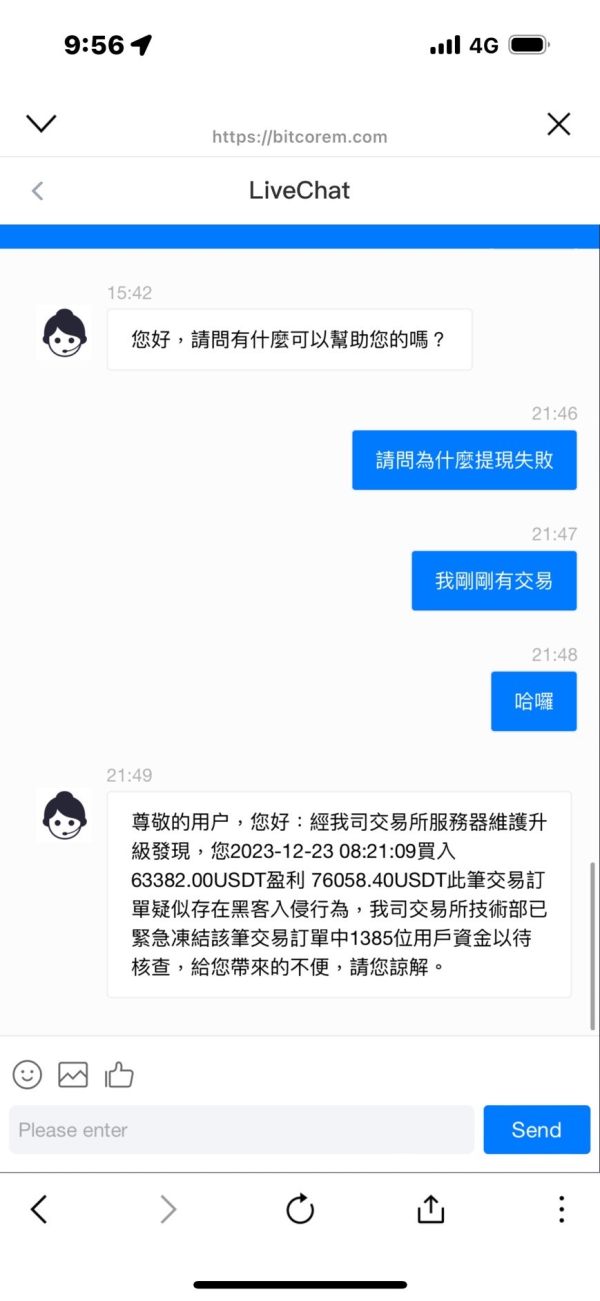

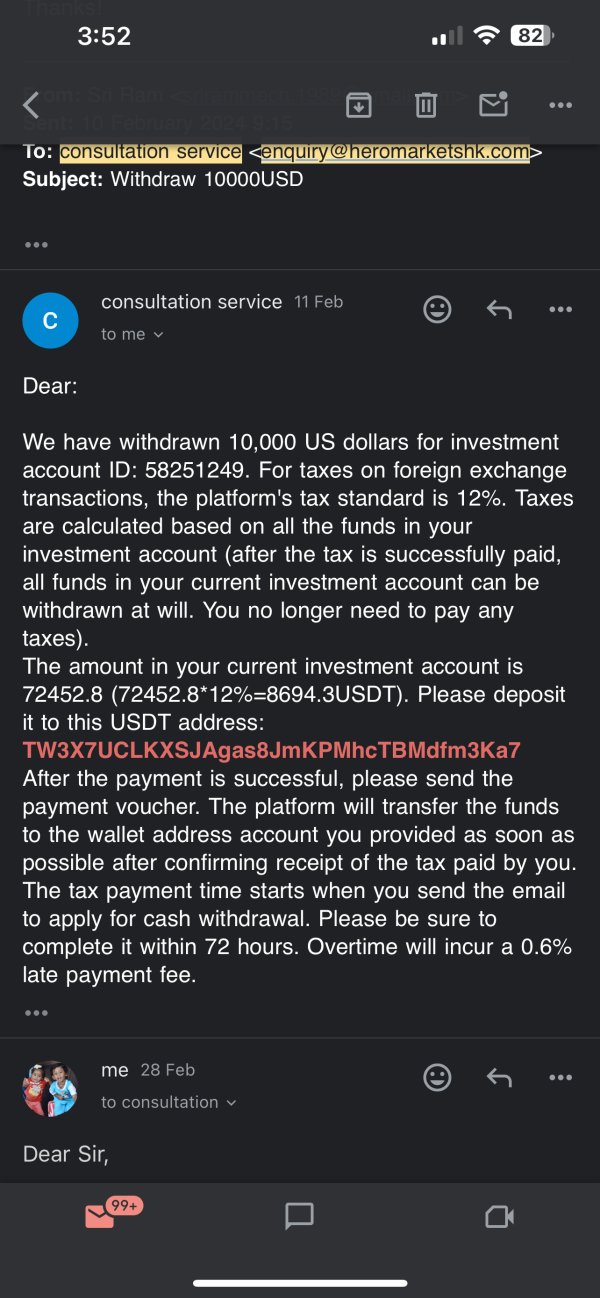

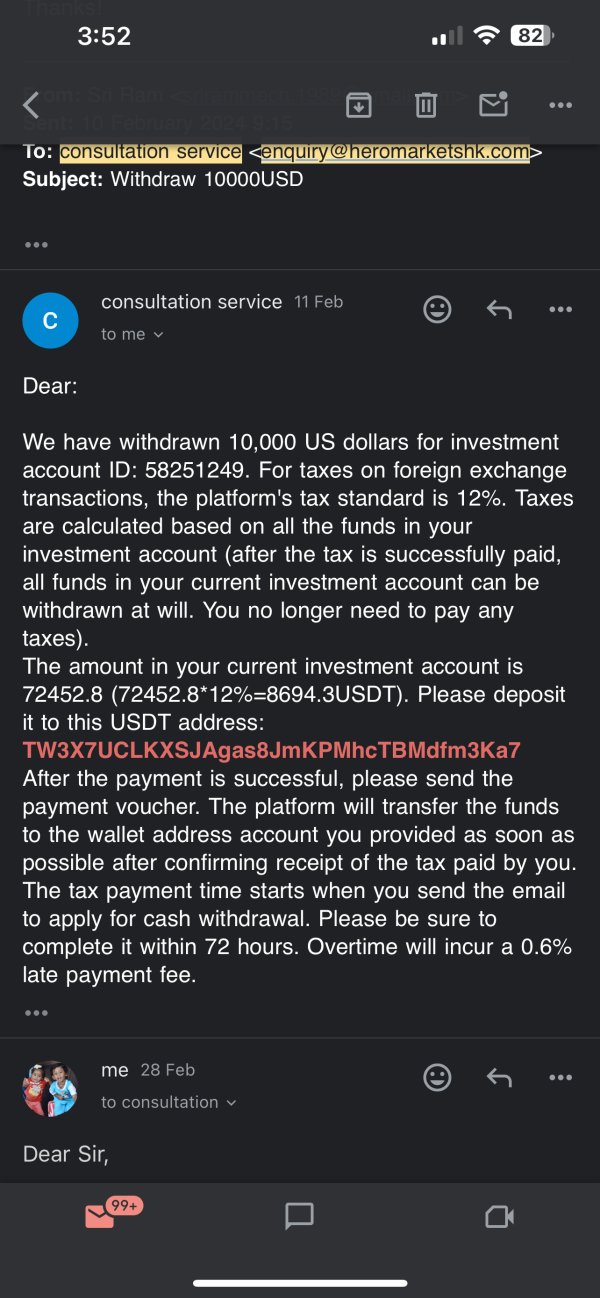

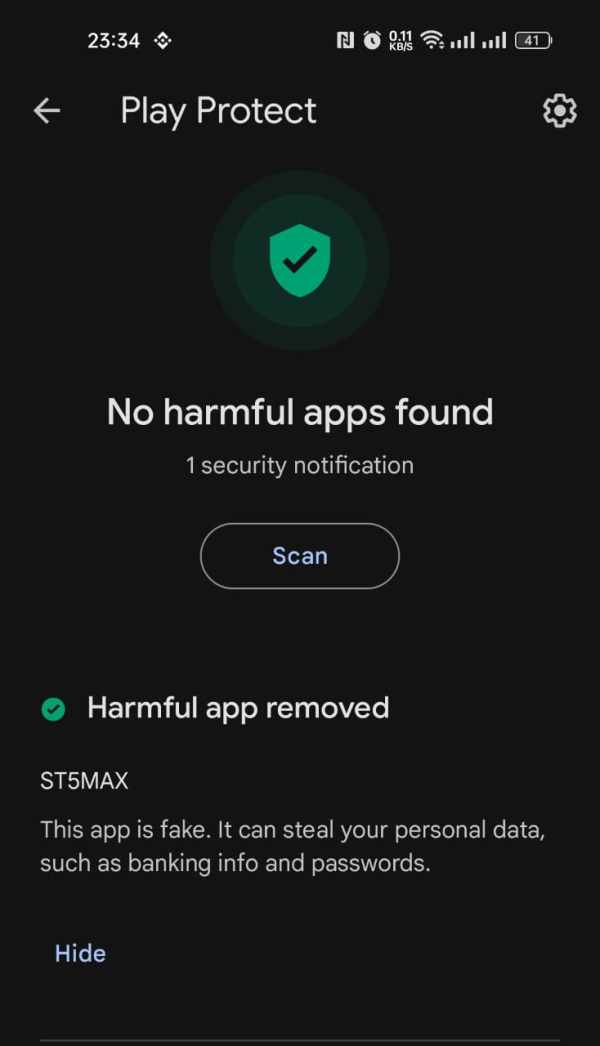

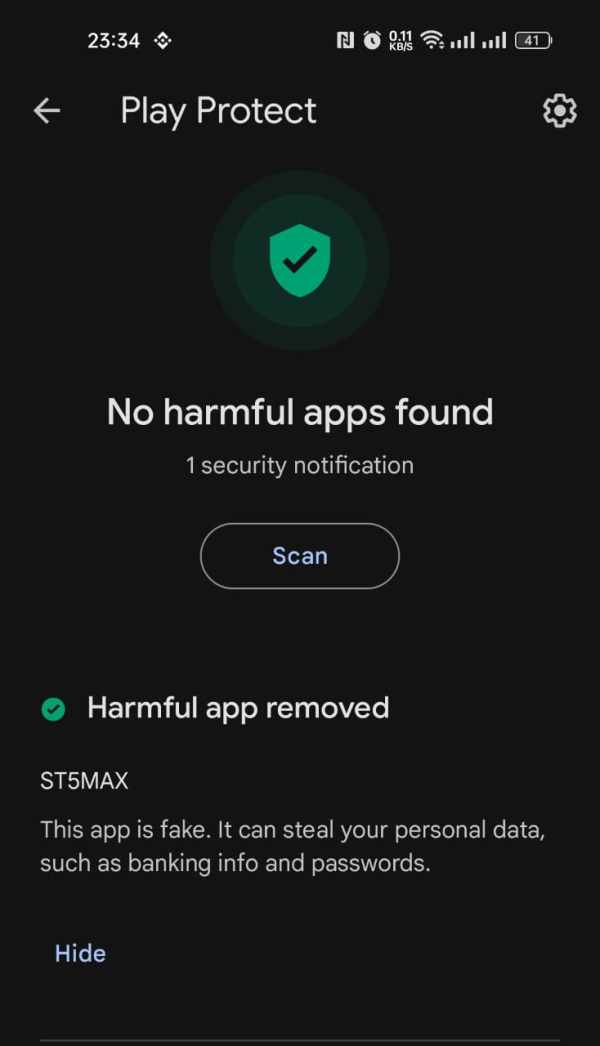

Trust and security evaluation reveals the most concerning aspects of ST5's operations. Multiple sources identify the platform as a fraudulent operation lacking fundamental transparency and professional standards. Industry watchdogs have specifically warned potential users against downloading ST5-associated applications, citing significant fraud risks.

The absence of clear regulatory oversight represents a fundamental security concern. Legitimate brokers typically operate under strict financial authority supervision that provides consumer protection frameworks. ST5's lack of transparent regulatory disclosure suggests potential operation outside established financial oversight systems.

Company transparency, including corporate structure disclosure, leadership team information, and operational procedures, is notably absent from accessible materials. This opacity contrasts sharply with legitimate brokers who provide comprehensive corporate information to build user trust and meet regulatory requirements.

The combination of fraud warnings from industry sources and fundamental transparency deficits creates a trust profile that strongly suggests users should avoid engagement with ST5. This is true regardless of any appealing features or positive user testimonials.

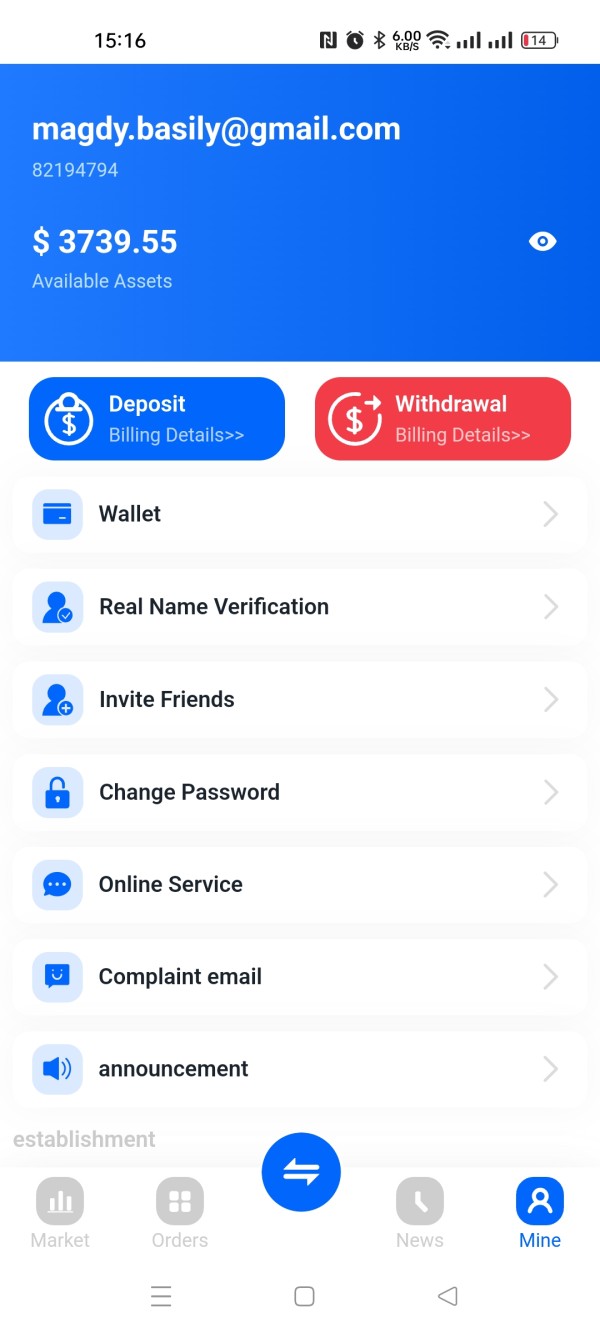

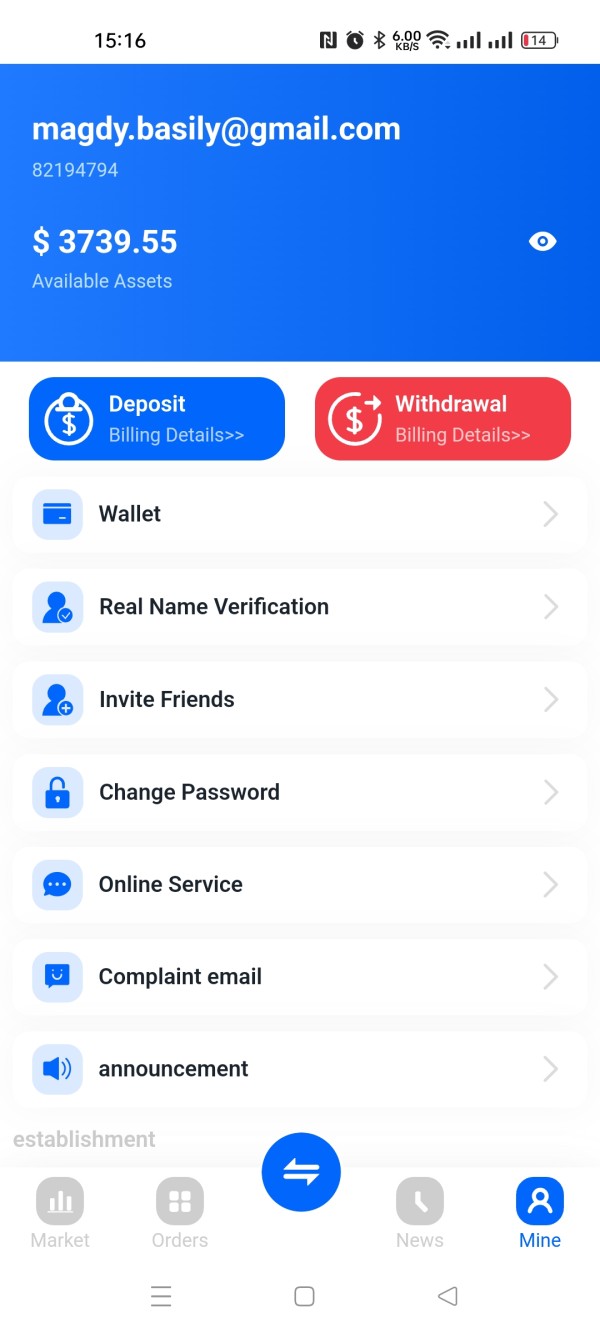

User Experience Analysis

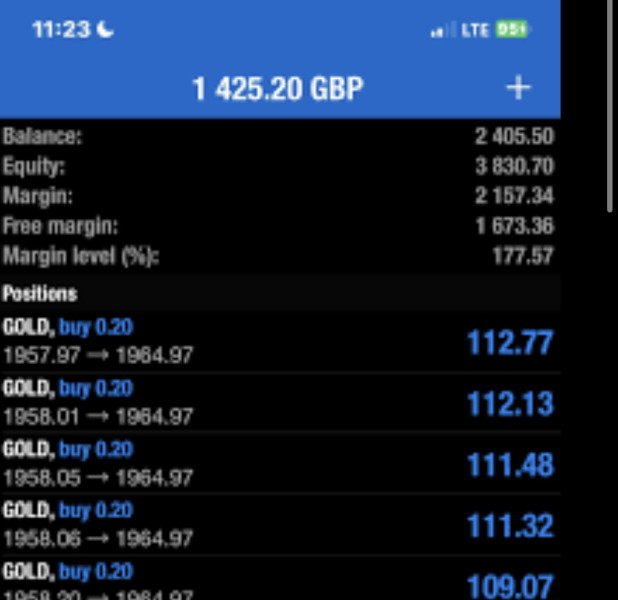

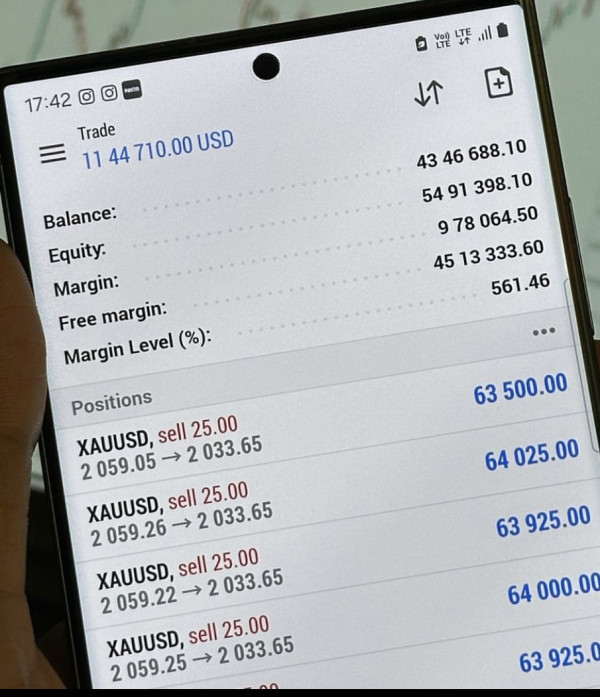

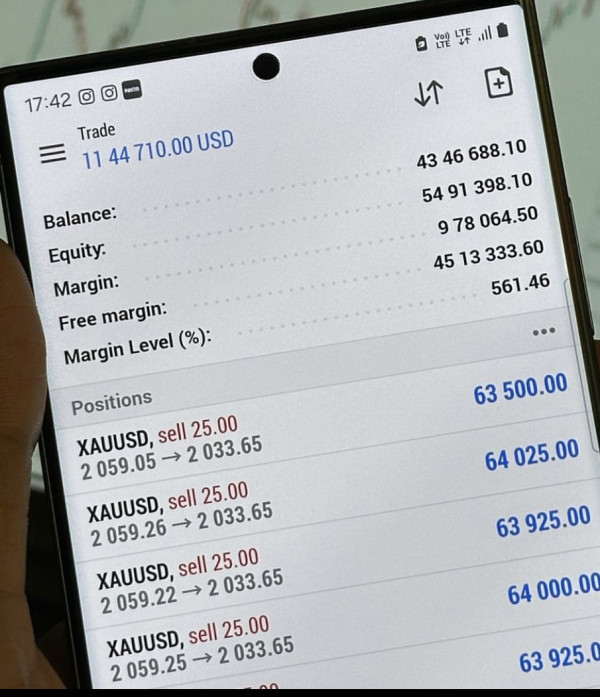

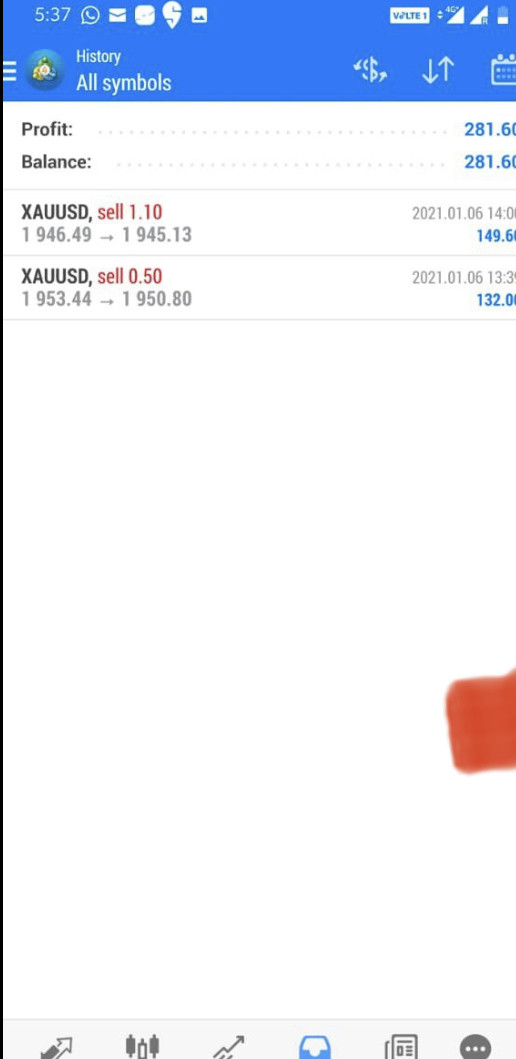

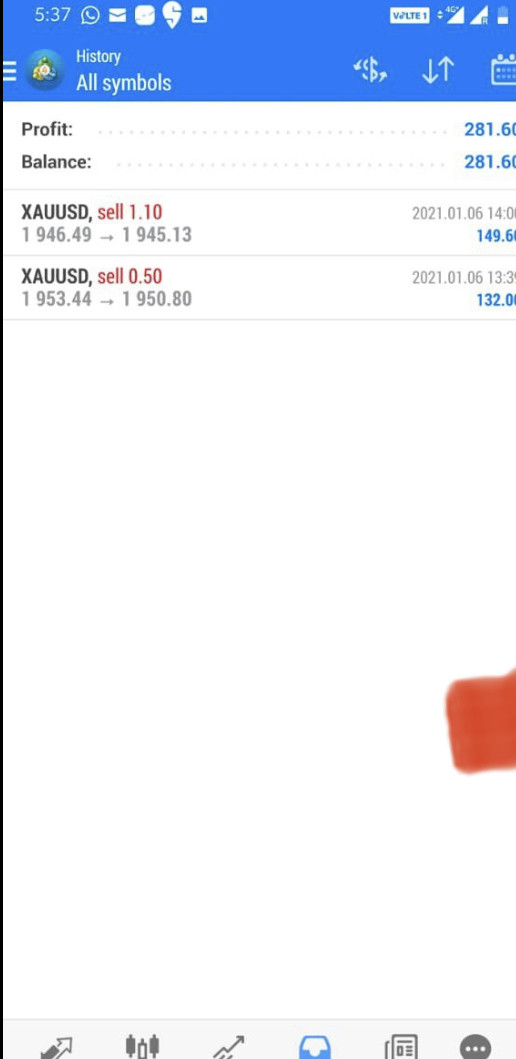

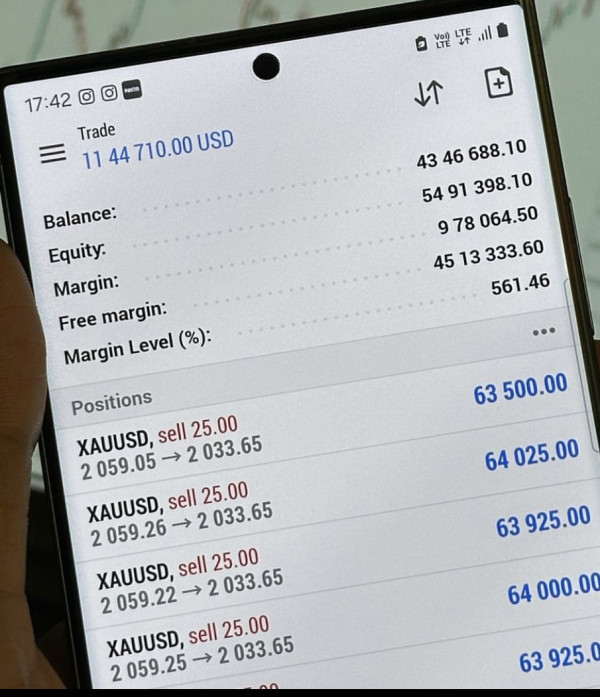

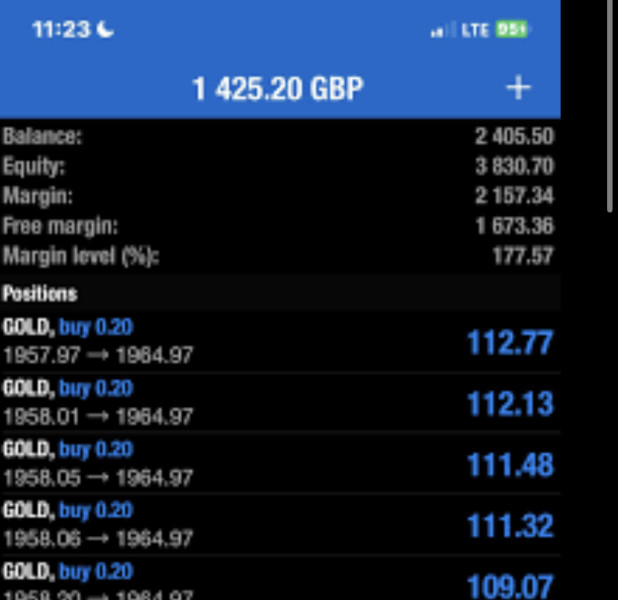

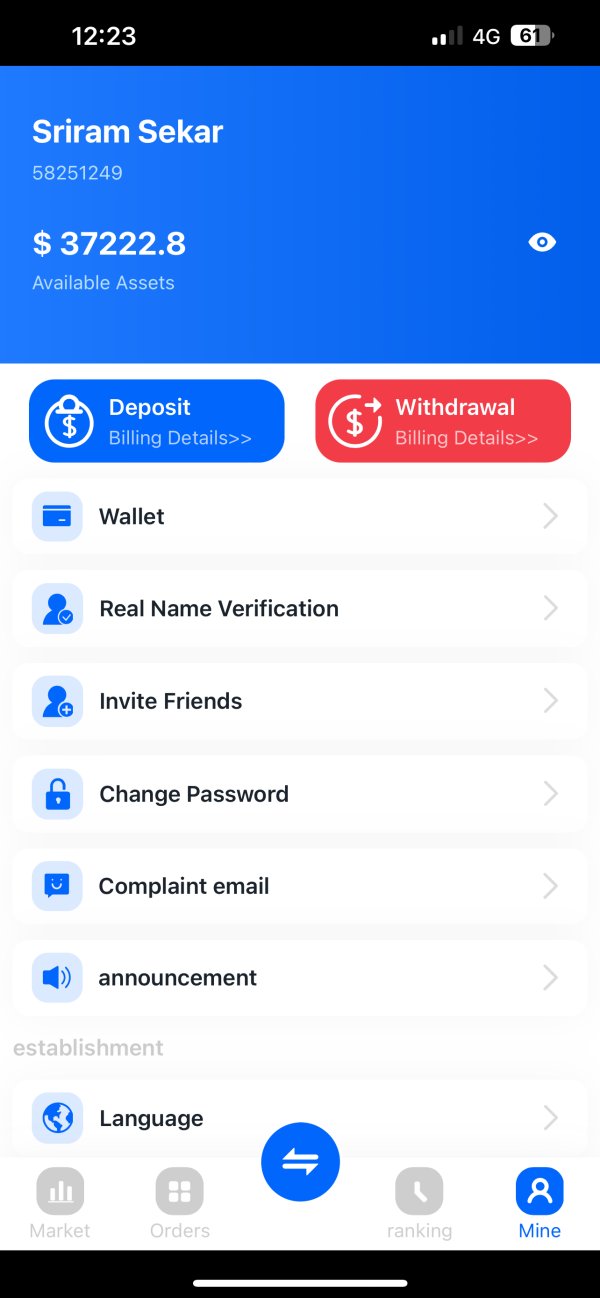

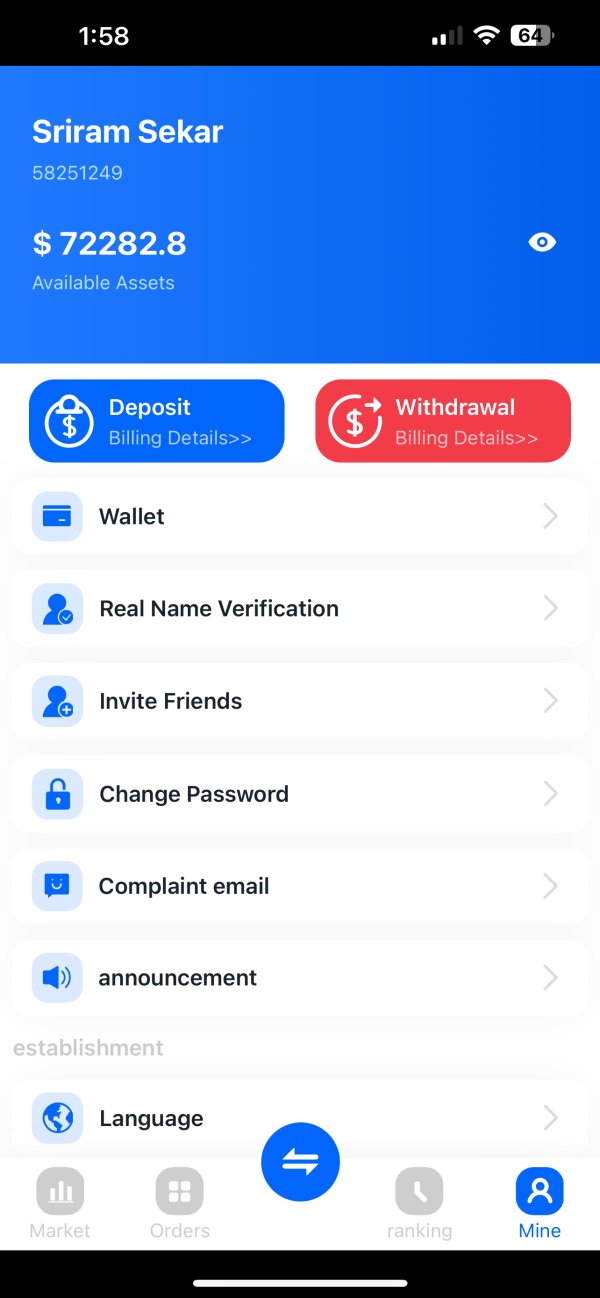

User experience analysis presents a complex picture with conflicting signals between user satisfaction metrics and professional security assessments. Available data shows 64% of users providing five-star ratings, with 63% indicating appropriate sizing and 85% reporting suitable width parameters, suggesting some level of user satisfaction with basic functionality.

However, these positive user metrics must be evaluated against the backdrop of fraud warnings and transparency concerns identified by industry watchdogs. The disconnect between user ratings and professional security assessments suggests either sophisticated initial user satisfaction strategies or significant user awareness gaps regarding underlying platform risks.

Interface design and usability information is not detailed in accessible materials. This makes it impossible to assess whether positive user ratings reflect genuine platform quality or other factors. Registration and verification procedures, which impact initial user experience, are not described in available documentation.

The contrast between positive user feedback and serious security concerns creates a user experience profile that requires extreme caution. Initial satisfaction may not reflect long-term platform reliability or user fund security.

Conclusion

This st5 review concludes with strong recommendations for caution regarding ST5's operations. While some user metrics suggest satisfaction with basic functionality, the platform's identification as a fraudulent operation by industry watchdogs creates overwhelming security concerns that outweigh any potential benefits.

ST5 is not recommended for any users seeking secure, transparent, and professionally regulated trading environments. The combination of fraud warnings, transparency deficits, and regulatory ambiguity creates a risk profile unsuitable for serious traders regardless of experience level.

The primary advantages identified include some positive user ratings. These are significantly overshadowed by fundamental trustworthiness concerns, lack of regulatory transparency, and explicit fraud warnings from industry security sources. Potential users should seek alternative platforms with clear regulatory oversight and transparent operational frameworks.