SST 2025 Review: Everything You Need to Know

Executive Summary

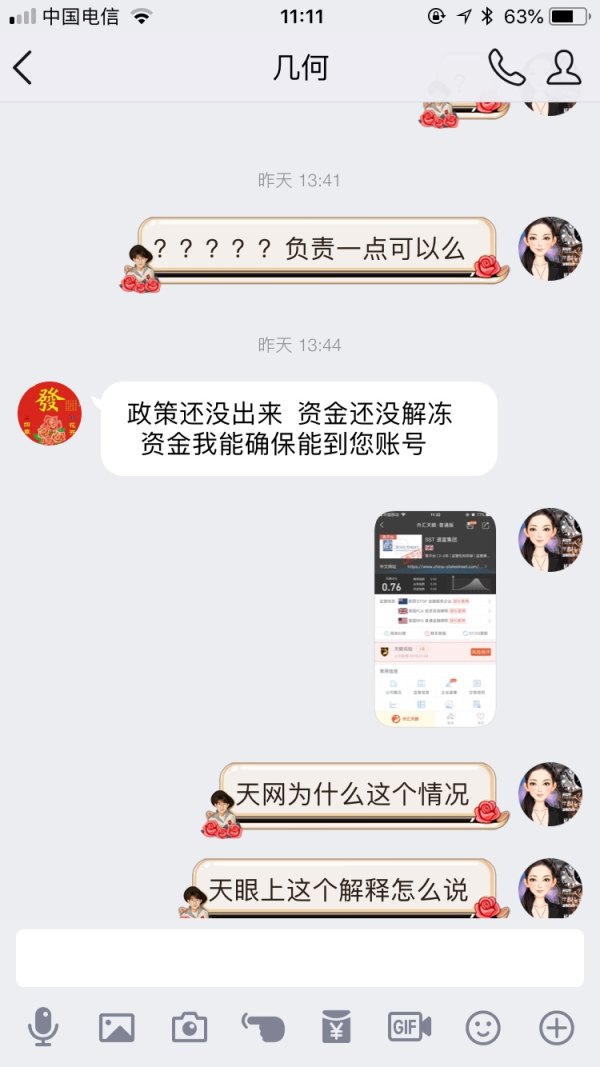

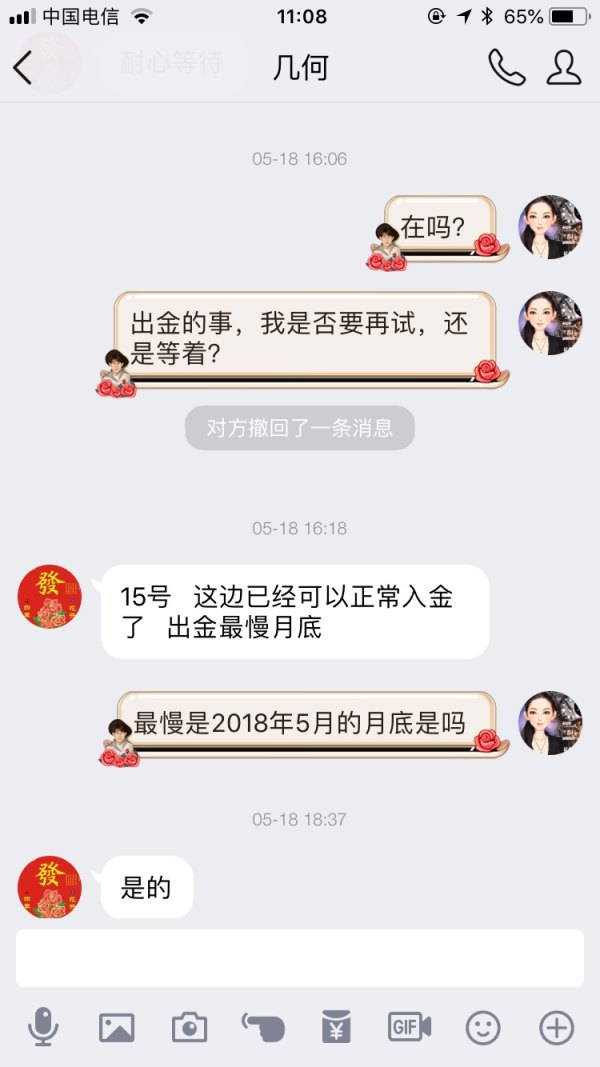

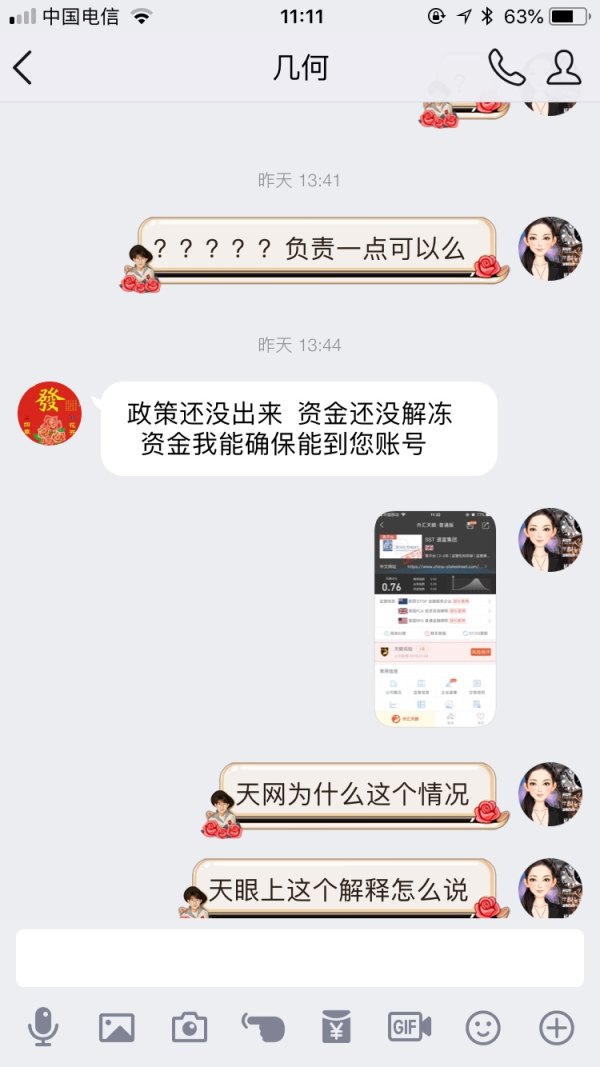

This sst review shows a complete analysis of SST Broker. It reveals major concerns that potential traders must consider before using this platform. Based on available information and user feedback, SST has been classified as a suspicious and potentially fraudulent broker, raising serious red flags about its legitimacy and safety. The company claims to be headquartered in the United Kingdom and offers online trading services. However, the lack of transparent regulatory information and negative user assessments paint a troubling picture.

Our investigation reveals that SST Broker targets forex market participants. Traders should exercise extreme caution when considering this platform. The absence of specific details regarding trading conditions, regulatory oversight, and customer protection measures suggests that this broker may not meet the standards expected from legitimate financial service providers. The overall assessment indicates that SST Broker poses substantial risks to potential clients. This makes it unsuitable for serious forex trading activities.

Important Notice

Traders should be aware that SST's regulatory information lacks specific details. The company may operate under different legal frameworks across various jurisdictions. This regulatory ambiguity creates potential complications for traders seeking legal recourse or protection of their funds. The broker has not disclosed specific regulatory agencies or license numbers. This is a significant concern for anyone considering opening an account.

This evaluation is based on publicly available information and user feedback collected from various sources. Given the limited transparency provided by SST Broker, traders are strongly advised to conduct additional due diligence before making any financial commitments.

Overall Rating Framework

Broker Overview

SST operates as State Street Trustees Limited. It presents itself as a UK-based global company providing online trading services. However, the company's background information remains notably sparse, with no clear establishment date provided in available materials. The broker claims to focus on financial services distribution, particularly targeting the forex trading market. The lack of detailed company history and operational transparency raises immediate concerns about its legitimacy.

The business model appears to center around online trading services. Specific details about the company's operational structure, management team, and business strategy remain undisclosed. This opacity is particularly concerning in an industry where transparency and regulatory compliance are paramount for trader protection and confidence.

According to available information, SST's trading platform types and supported asset classes are not clearly specified. This represents a significant gap in essential information that potential clients would expect from a legitimate broker. Similarly, the company has failed to provide clear information about its regulatory status, oversight agencies, or compliance measures, all of which are standard disclosures for reputable financial service providers. This sst review emphasizes the critical importance of regulatory transparency in broker selection.

Regulatory Status

The regulatory information for SST Broker remains conspicuously absent from available materials. No specific regulatory agencies, license numbers, or compliance certifications have been disclosed, which is highly unusual for legitimate forex brokers operating in regulated markets.

Deposit and Withdrawal Methods

Specific information regarding deposit and withdrawal methods has not been provided by SST Broker. This leaves potential clients without crucial details about fund management procedures and processing times.

Minimum Deposit Requirements

The minimum deposit requirements for opening accounts with SST Broker are not specified in available documentation. This makes it impossible for traders to assess the financial commitment required.

Details about bonus promotions, welcome offers, or trading incentives are not mentioned in the available information about SST Broker's services.

Tradeable Assets

The range of tradeable assets has not been clearly specified by SST Broker. This includes currency pairs, commodities, indices, or other financial instruments.

Cost Structure

Critical information about spreads, commissions, overnight fees, and other trading costs remains undisclosed. This prevents potential clients from evaluating the true cost of trading with this broker.

Leverage Ratios

Maximum leverage ratios and margin requirements are not specified in available materials. These are essential factors for risk assessment in forex trading.

Specific trading platform options have not been clearly identified in this sst review. This includes whether they offer proprietary or third-party solutions like MetaTrader.

Regional Restrictions

Information about geographical restrictions or country-specific limitations is not available in current documentation.

Customer Support Languages

The languages supported by customer service representatives have not been specified in available materials.

Detailed Scoring Analysis

Account Conditions Analysis (Score: 2/10)

The account conditions offered by SST Broker receive an extremely low rating. This is due to the complete absence of transparent information about account types, features, and requirements. Legitimate forex brokers typically provide detailed specifications about their account offerings, including standard, premium, and professional account tiers, each with clearly defined features and benefits. However, SST Broker has failed to disclose even basic information about account structures.

The lack of information regarding minimum deposit requirements is particularly concerning. This prevents potential traders from understanding the financial commitment required to begin trading. Reputable brokers clearly communicate their account opening requirements, including initial deposit amounts, verification procedures, and account activation timelines. The absence of such fundamental information suggests either poor business practices or intentional obfuscation.

Account opening procedures and verification processes remain undefined. This raises questions about the broker's compliance with know-your-customer and anti-money laundering regulations. Additionally, there is no mention of special account features such as Islamic accounts for Muslim traders, demo accounts for practice trading, or managed account options for less experienced traders.

This sst review emphasizes that the lack of transparent account condition information represents a significant red flag. Potential traders should not ignore this when evaluating broker options.

The tools and resources category receives the lowest possible rating. This is due to the complete absence of information about trading tools, analytical resources, and educational materials. Professional forex brokers typically provide comprehensive suites of trading tools, including advanced charting packages, technical analysis indicators, economic calendars, and market research reports. SST Broker has not disclosed any information about such essential trading resources.

Research and analytical resources are fundamental components of professional forex trading platforms. Yet no information is available about market analysis, daily reports, expert commentary, or trading signals that might be provided by SST Broker. This absence of analytical support severely limits the potential value proposition for serious traders who rely on comprehensive market information to make informed trading decisions.

Educational resources appear to be entirely absent from SST's service portfolio. These are standard offerings from reputable brokers. Professional brokers typically provide webinars, trading tutorials, market education materials, and ongoing training programs to support trader development. The lack of such resources suggests that SST may not be committed to supporting trader success and education.

Automated trading support has not been mentioned in available materials. This includes expert advisor compatibility and algorithmic trading tools, further limiting the platform's appeal to sophisticated traders who rely on automated strategies.

Customer Service and Support Analysis (Score: 2/10)

Customer service and support capabilities receive a poor rating. This is due to the lack of specific information about support channels, availability, and service quality. Professional forex brokers typically provide multiple customer support channels, including live chat, telephone support, email assistance, and comprehensive FAQ sections. However, SST Broker has not clearly outlined its customer support infrastructure.

Response time commitments have not been specified. These are crucial for traders who may need urgent assistance during volatile market conditions. Reputable brokers typically guarantee response times for different support channels and provide emergency contact procedures for critical issues. The absence of such commitments raises concerns about the broker's ability to provide timely assistance when needed.

Service quality metrics and customer satisfaction data are not available. This makes it impossible to assess the effectiveness of SST's customer support operations. Professional brokers often publish customer satisfaction scores and service level achievements to demonstrate their commitment to client service excellence.

Multi-language support capabilities and customer service hours have not been disclosed. This may indicate limited international service capabilities or restricted support availability. This lack of transparency about fundamental support services represents a significant concern for potential clients who value reliable customer assistance.

Trading Experience Analysis (Score: 2/10)

The trading experience evaluation reveals significant deficiencies. This is due to the absence of information about platform performance, execution quality, and user interface design. Professional forex trading requires stable, fast, and reliable platform performance, yet SST Broker has not provided any technical specifications or performance metrics for their trading systems.

Order execution quality remains completely undisclosed. This includes execution speeds, slippage rates, and fill rates. These factors are crucial for successful forex trading, particularly for scalping strategies and high-frequency trading approaches. The lack of execution quality data prevents traders from assessing whether the platform can meet their performance requirements.

Platform functionality and feature completeness cannot be evaluated. This is due to the absence of detailed platform descriptions or user interface demonstrations. Modern forex traders expect comprehensive charting tools, one-click trading capabilities, multiple order types, and advanced risk management features, none of which have been clearly documented for SST's platform.

Mobile trading capabilities have not been specified. These are essential for contemporary forex trading. Professional traders require seamless mobile access to their accounts, real-time market data, and full trading functionality across multiple devices. This sst review notes that the absence of mobile platform information represents a significant limitation in today's trading environment.

Trust and Reliability Analysis (Score: 1/10)

Trust and reliability receive the lowest possible rating. This is due to SST Broker's classification as suspicious and potentially fraudulent. The absence of regulatory credentials represents the most serious concern, as legitimate forex brokers operate under strict regulatory oversight from recognized financial authorities such as the FCA, CySEC, or ASIC.

Fund safety measures have not been disclosed. This includes segregated client accounts, deposit insurance, and investor compensation schemes. These protections are standard requirements for regulated brokers and are essential for client fund security. The lack of such safeguards suggests that client funds may be at risk.

Company transparency is severely lacking. Minimal information is available about the company's ownership structure, management team, financial standing, or operational history. Legitimate brokers typically provide comprehensive company information, including executive biographies, financial statements, and corporate governance details.

The classification of SST as a potentially fraudulent broker represents the most serious red flag possible in forex broker evaluation. This assessment suggests that the broker may engage in deceptive practices, fail to honor withdrawal requests, or misappropriate client funds. Such concerns make SST unsuitable for any serious trading activities.

User Experience Analysis (Score: 1/10)

User experience receives the lowest rating. This is due to the overall negative assessment and lack of positive user feedback. The classification of SST as suspicious indicates that user experiences have been problematic, though specific user testimonials and detailed feedback are not available in current materials.

Interface design and usability cannot be properly evaluated. This is due to the absence of platform demonstrations or user interface documentation. Modern forex traders expect intuitive, customizable, and efficient trading interfaces that support their specific trading styles and preferences.

Registration and verification processes remain undefined. This creates uncertainty about account opening procedures and timeline expectations. Professional brokers typically provide clear guidance about account opening requirements, verification procedures, and activation timelines.

Fund management experiences are not documented. This includes deposit and withdrawal procedures, processing times, and fee structures. These operational aspects are crucial for user satisfaction and platform usability, yet SST has not provided transparency about these fundamental processes.

The designation of SST as a potentially fraudulent broker suggests that users may experience significant problems. These include fund withdrawals, account access, or trading operations, making the overall user experience highly problematic and potentially financially damaging.

Conclusion

This comprehensive sst review concludes that SST Broker presents substantial risks and should be avoided by forex traders. The broker's classification as suspicious and potentially fraudulent, combined with the complete lack of regulatory transparency and essential trading information, makes it unsuitable for any legitimate trading activities. The absence of basic information about trading conditions, platform features, and customer protections represents multiple red flags that serious traders should not ignore.

While the broker may target forex market participants, the overwhelming evidence suggests that SST does not meet the standards expected from professional financial service providers. The lack of regulatory oversight, transparent business practices, and verifiable operational information creates an environment where trader funds and interests are at significant risk. Potential traders are strongly advised to seek alternative brokers with established regulatory credentials and transparent business practices.