Snow-Trade 2025 Review: Everything You Need to Know

Executive Summary

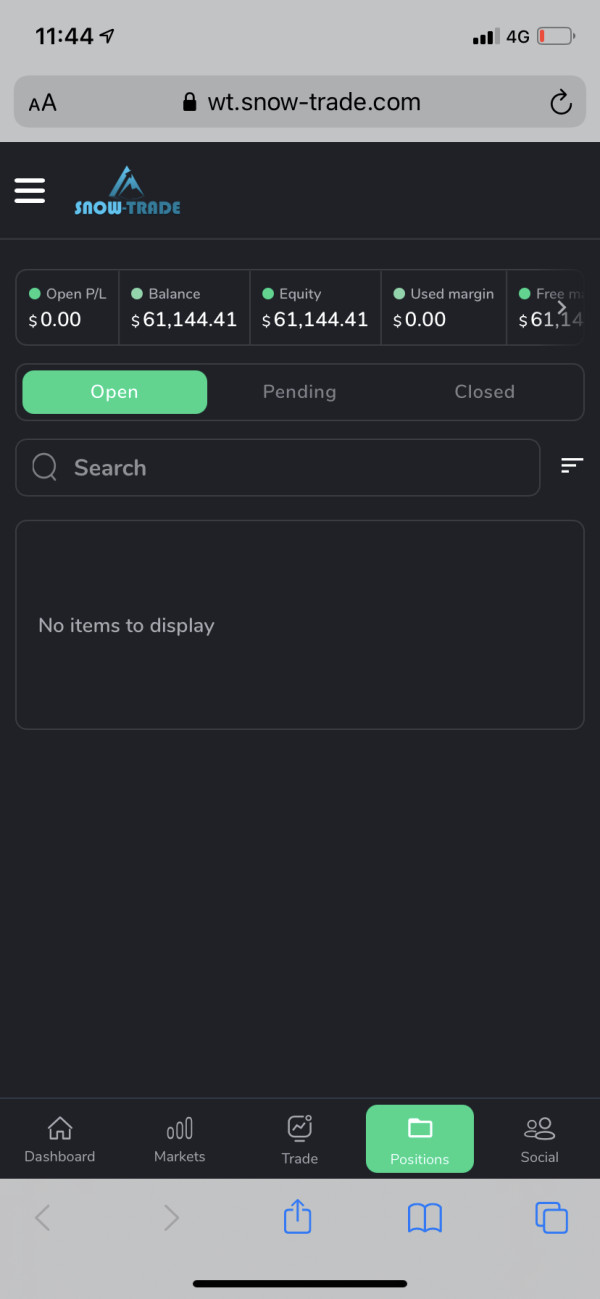

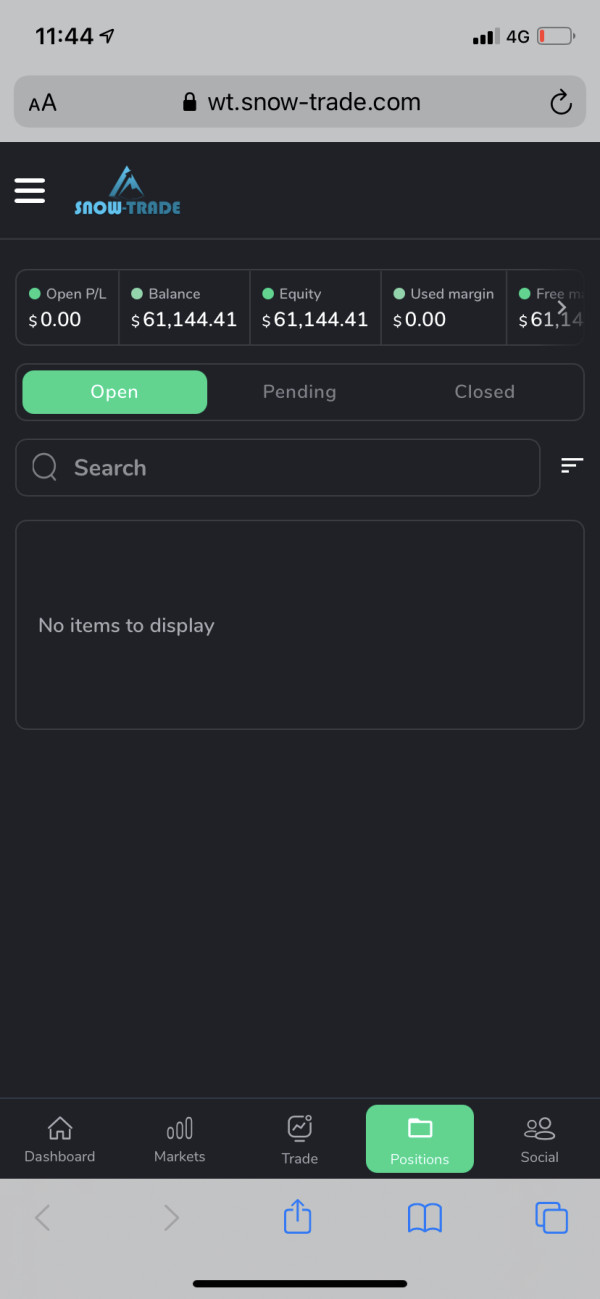

Our comprehensive snow-trade review shows major concerns about this forex broker's legitimacy and how it operates. We analyzed user feedback and market intelligence extensively to reach these conclusions. Snow-Trade presents itself as a high-end trading platform targeting wealthy investors, but multiple warning signs suggest potential issues with fund security and withdrawal processes.

The broker's account structure focuses only on high-net-worth individuals. Minimum deposit requirements start at €100,000 for Executive Accounts and go up to €250,000 for Presidential Accounts. This targeting of wealthy clients, combined with limited transparency about regulatory oversight and company operations, raises red flags about the platform's true intentions.

Multiple review platforms have flagged Snow-Trade as suspicious. Users report difficulties in fund withdrawal and concerns about the platform's legitimacy. The broker's trust score averages around 76%, which falls below industry standards for reputable forex brokers. Despite marketing itself to sophisticated investors, the lack of clear regulatory information and negative user experiences suggest potential investors should exercise extreme caution when considering this platform.

Important Notice

This review is based on publicly available information, user feedback, and analysis of Snow-Trade's online presence as of 2025. The forex trading landscape varies significantly across different jurisdictions, and regulatory requirements may differ based on your location. Our assessment methodology incorporates user testimonials, website analysis, and comparison with industry standards to provide a comprehensive evaluation of this broker's services and reliability.

Potential investors should always conduct their own due diligence and verify regulatory status before depositing funds with any forex broker. This is particularly important for brokers with limited transparency about their operational framework.

Rating Framework

Broker Overview

Snow-Trade positions itself as a premium forex trading platform designed specifically for high-net-worth individuals and institutional investors. The broker's marketing materials emphasize exclusivity and sophisticated trading opportunities, targeting clients with substantial capital reserves. However, detailed information about the company's founding date, corporate structure, and operational history remains notably absent from publicly available sources.

The platform's business model appears to focus on attracting large deposits through premium account offerings. The specific trading conditions, execution methods, and underlying technology infrastructure are not clearly disclosed. This lack of transparency regarding fundamental operational aspects raises immediate concerns about the broker's commitment to client education and informed decision-making.

From a regulatory perspective, snow-trade review analysis reveals significant gaps in available information about licensing, oversight, and compliance frameworks. The absence of clear regulatory disclosures, combined with the platform's focus on high-value accounts, creates a risk profile that potential investors should carefully evaluate before engaging with the broker's services.

Regulatory Status

Information about Snow-Trade's regulatory oversight and licensing remains unclear in available documentation. The lack of transparent regulatory disclosures represents a significant concern for potential investors seeking secure trading environments.

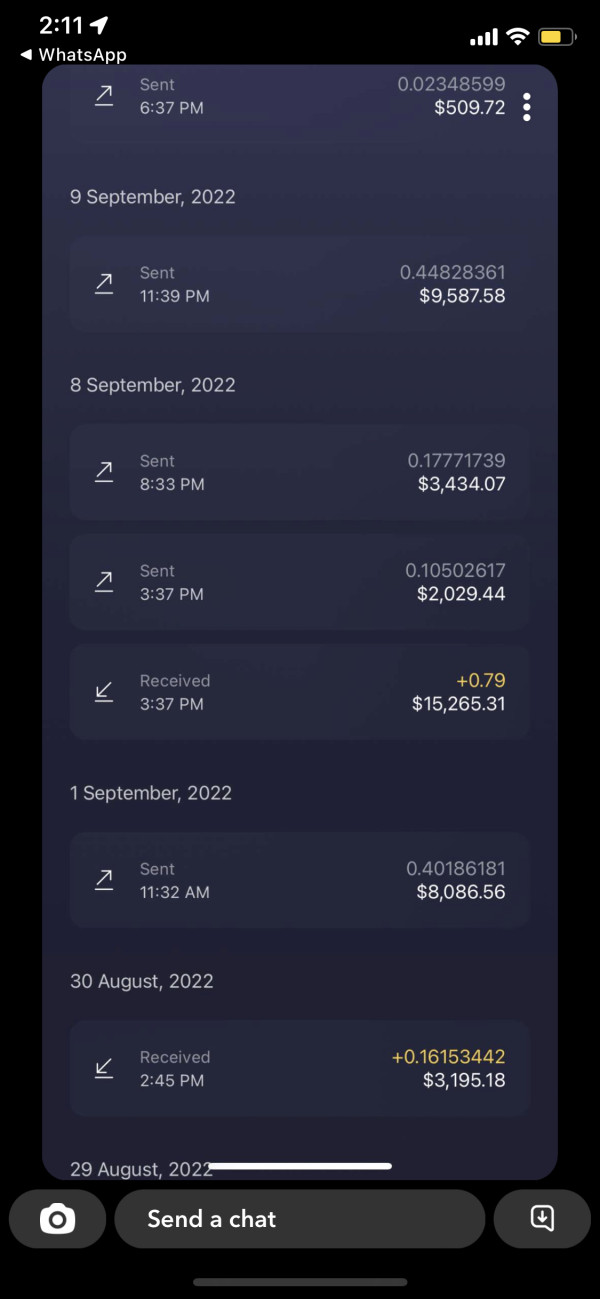

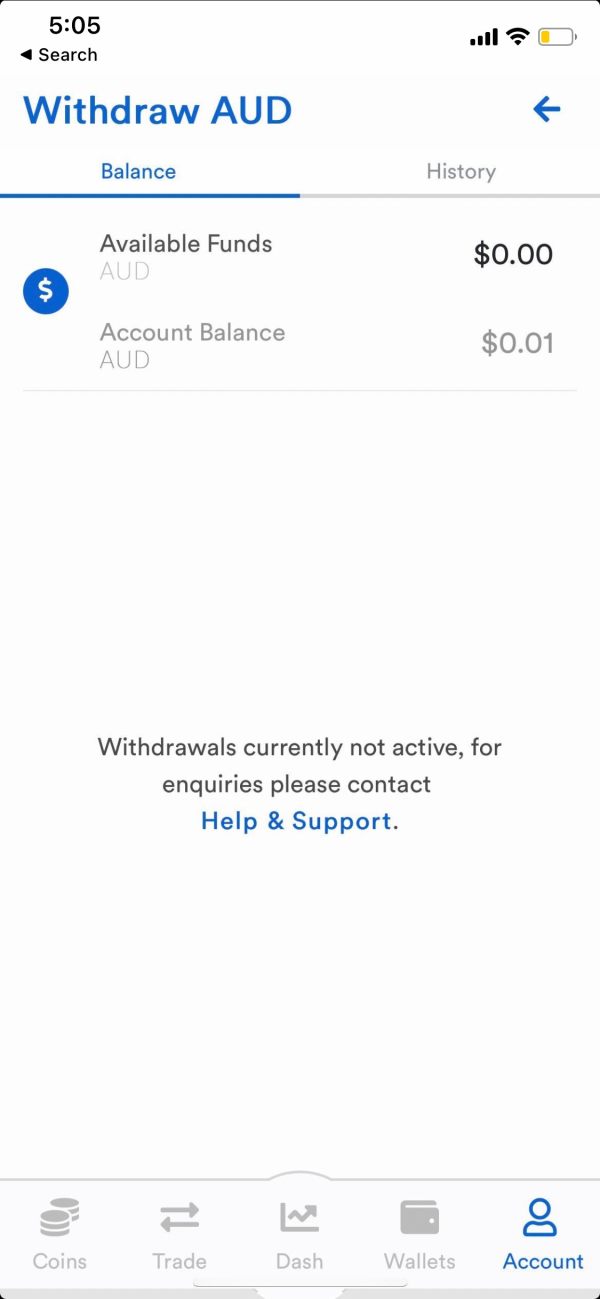

Deposit and Withdrawal Methods

Specific details about supported payment methods, processing times, and associated fees are not clearly outlined in accessible broker information. This contributes to overall transparency concerns.

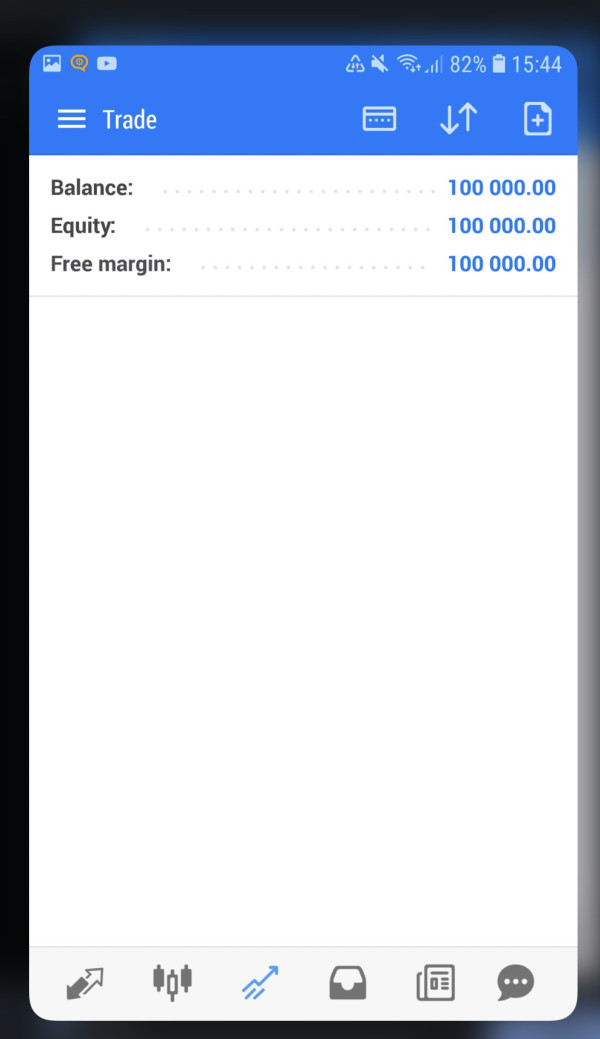

Minimum Deposit Requirements

Snow-Trade operates with exceptionally high minimum deposit thresholds, requiring €100,000 for Executive Accounts and €250,000 for Presidential Accounts. This effectively limits access to only the wealthiest potential clients.

Available information does not detail any specific promotional offerings or bonus structures. This may be intentional given the broker's focus on high-net-worth clientele.

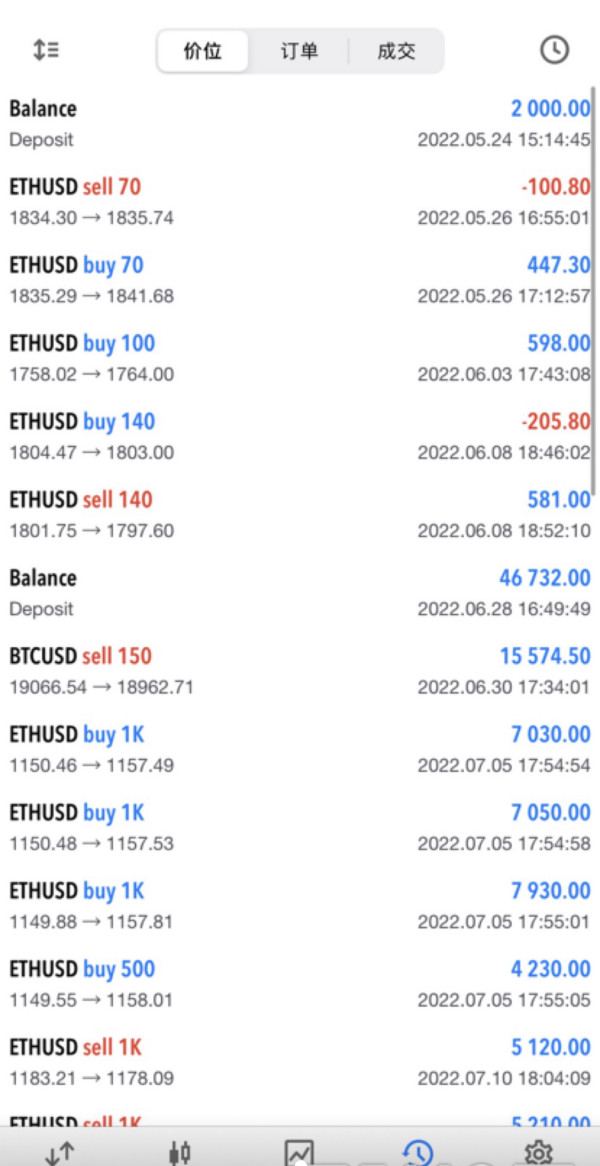

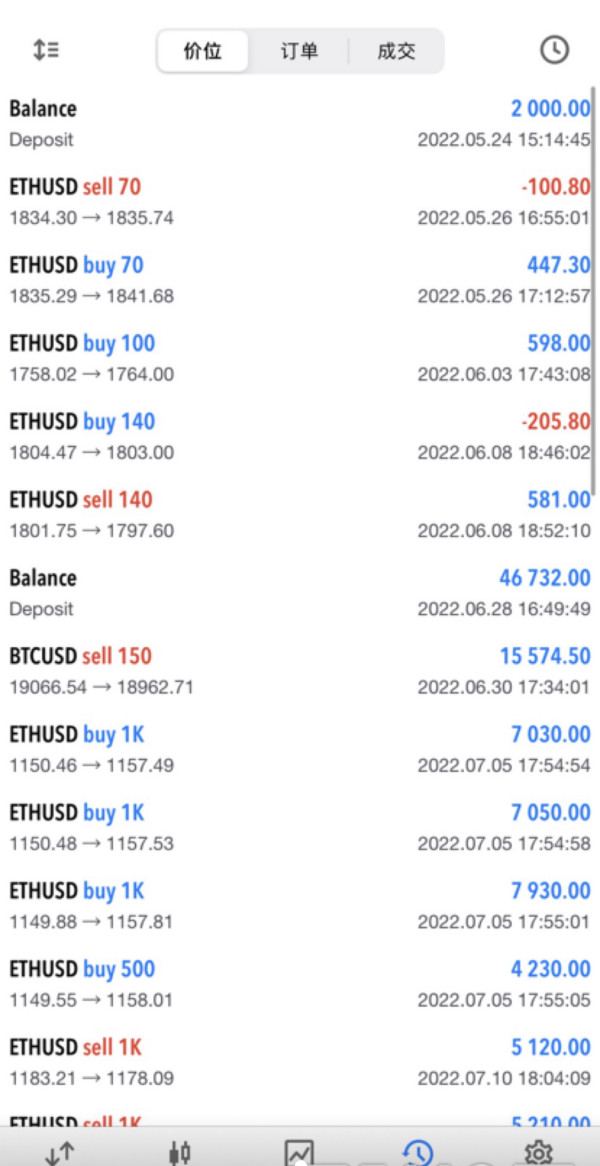

Tradeable Assets

The range of available trading instruments, including forex pairs, commodities, indices, and other financial products, is not comprehensively detailed in accessible broker materials.

Cost Structure

Commission rates, spread structures, overnight financing costs, and other trading-related fees are not transparently disclosed. This makes it difficult for potential clients to assess total trading costs.

Leverage Ratios

Maximum leverage offerings and margin requirements across different account types and asset classes are not clearly specified in available documentation.

Details about trading platform technology, mobile applications, and third-party platform integrations are not adequately disclosed in this snow-trade review analysis.

Geographic Restrictions

Information about jurisdictional limitations and restricted territories is not clearly outlined in accessible broker documentation.

Customer Support Languages

Available customer service languages and regional support capabilities are not detailed in current broker information.

Detailed Rating Analysis

Account Conditions Analysis

Snow-Trade's account structure reveals a concerning focus on extremely high minimum deposits that effectively exclude the vast majority of retail traders from accessing their services. The Executive Account requires a minimum deposit of €100,000, while the Presidential Account demands €250,000, positioning these thresholds far above industry norms and raising questions about the broker's true target market and business intentions.

User feedback consistently highlights the prohibitive nature of these deposit requirements. Many potential clients express frustration about the lack of accessible entry-level options. The absence of standard retail accounts, demo offerings, or educational account types suggests a business model that prioritizes large capital acquisition over client development and trading education.

The account opening process lacks transparency, with limited information available about verification requirements, documentation needs, or approval timelines. This opacity, combined with the substantial financial commitments required, creates an environment where potential clients cannot adequately assess the platform's suitability before making significant financial commitments.

Furthermore, the lack of detailed information about account features, trading conditions, and specific benefits associated with each account tier makes it impossible for investors to make informed comparisons with other market offerings. This snow-trade review identifies these account conditions as a significant weakness in the broker's overall service proposition.

The availability of trading tools, analytical resources, and educational materials represents one of Snow-Trade's most significant deficiencies. Despite targeting sophisticated investors who typically require advanced analytical capabilities and comprehensive market research, the broker provides minimal information about available trading tools or analytical resources.

Professional traders and institutional clients typically expect access to advanced charting packages, technical analysis tools, economic calendars, market research reports, and automated trading capabilities. However, Snow-Trade's public materials fail to detail any of these essential trading resources, creating concerns about the platform's ability to meet the needs of its stated target market.

Educational resources, which are crucial for ongoing trader development and platform familiarity, appear to be entirely absent from the broker's offerings. This lack of educational support is particularly concerning given the substantial financial commitments required for account opening, as clients investing significant capital typically expect comprehensive support and resources to maximize their trading potential.

The absence of detailed information about research capabilities, market analysis, or third-party tool integrations suggests that Snow-Trade may lack the infrastructure necessary to support serious trading activities. This is concerning despite its premium positioning and high deposit requirements.

Customer Service and Support Analysis

Customer service quality represents a critical concern based on available user feedback and the broker's limited transparency about support capabilities. While specific details about customer service channels, response times, and support quality are not comprehensively documented, user reports suggest significant issues with communication and problem resolution.

The most concerning aspect of customer service feedback relates to withdrawal processing and fund access difficulties. Multiple user reports indicate challenges in contacting support representatives when attempting to withdraw funds, suggesting potential issues with the broker's commitment to client service and fund security.

Language support capabilities, regional service availability, and operating hours are not clearly outlined in available broker documentation. This makes it difficult for potential international clients to assess whether adequate support will be available in their time zones and preferred languages.

The lack of transparent communication channels, published response time commitments, or detailed support policies creates an environment where clients cannot reasonably expect consistent or reliable customer service experiences. This is particularly concerning given the substantial deposits required for account access.

Trading Experience Analysis

The trading experience evaluation for Snow-Trade is significantly hampered by the lack of available information about platform technology, execution quality, and trading conditions. Despite targeting sophisticated investors who typically require advanced trading capabilities and institutional-quality execution, the broker provides minimal details about its trading infrastructure.

Platform stability, execution speeds, order types, and trading tools are not adequately documented in accessible materials. This makes it impossible for potential clients to assess whether the trading environment meets professional standards. This lack of transparency is particularly concerning for a broker targeting high-net-worth individuals who typically require detailed technical specifications before committing substantial capital.

User feedback regarding actual trading experiences is limited, though available reports suggest concerns about platform reliability and execution quality. The absence of detailed performance metrics, execution statistics, or third-party platform evaluations makes it difficult to verify the broker's claims about trading quality and technology capabilities.

Mobile trading capabilities, platform customization options, and integration with third-party tools are not clearly outlined. This suggests that Snow-Trade may lack the comprehensive trading ecosystem that sophisticated investors typically require for effective portfolio management and trading execution. This snow-trade review identifies the limited trading experience information as a significant barrier to informed decision-making for potential clients.

Trust and Reliability Analysis

Trust and reliability represent Snow-Trade's most significant weaknesses, with multiple indicators suggesting serious concerns about the broker's legitimacy and operational integrity. The absence of clear regulatory oversight, combined with negative user feedback and third-party warnings, creates a risk profile that is unsuitable for most investors.

Multiple review platforms and scam-detection websites have flagged Snow-Trade as suspicious or potentially fraudulent. Warning scores indicate high risk for potential investors. These third-party assessments, combined with user reports of withdrawal difficulties, suggest fundamental issues with the broker's business practices and client treatment.

The broker's trust score of 76% falls significantly below industry standards for reputable forex brokers. This indicates that a substantial portion of user interactions have resulted in negative experiences or concerns about platform reliability. This score, while not the lowest possible, represents a clear warning signal for potential investors.

Regulatory transparency, which forms the foundation of broker trustworthiness, is notably absent from Snow-Trade's public disclosures. The lack of clear licensing information, regulatory oversight details, or compliance frameworks makes it impossible for potential clients to verify the broker's legal status or operational legitimacy.

Fund security measures, segregation policies, and investor protection schemes are not clearly outlined. This creates additional concerns about client capital safety and the broker's commitment to industry best practices.

User Experience Analysis

Overall user experience with Snow-Trade appears to be predominantly negative, with consistent reports of frustration, withdrawal difficulties, and concerns about platform legitimacy. The user base, while limited due to high deposit requirements, has provided feedback that raises serious questions about the broker's service quality and operational practices.

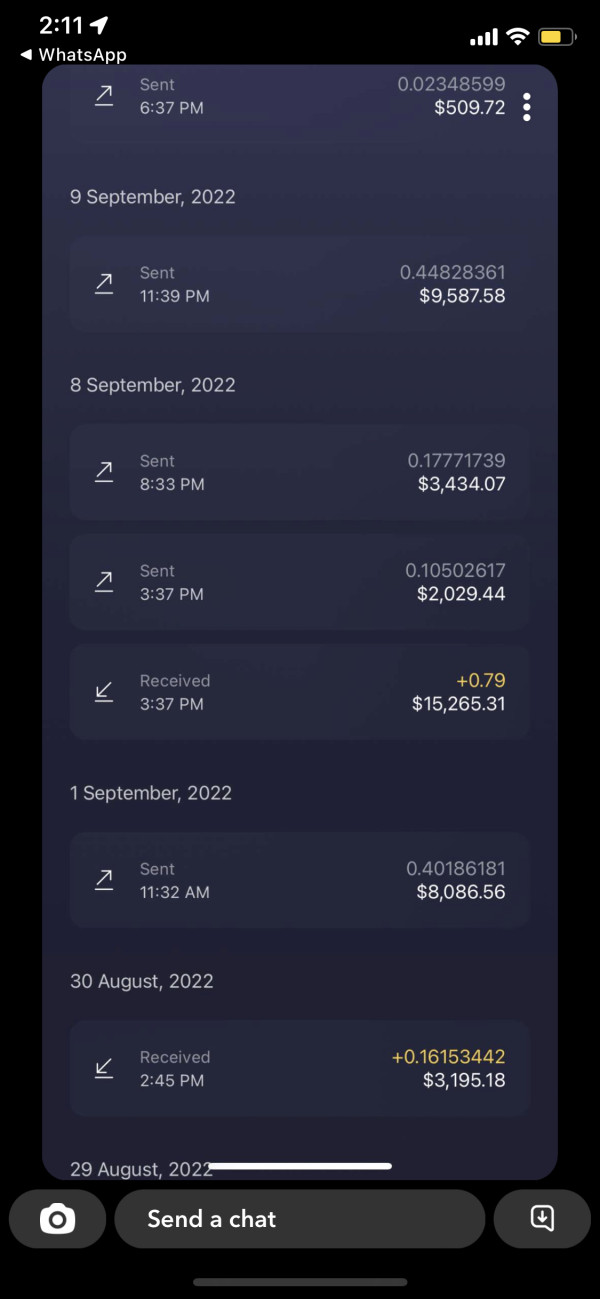

The most significant user experience issue relates to fund withdrawal processes, with multiple reports indicating difficulties in accessing deposited capital. This fundamental concern about fund accessibility represents a critical failure in basic broker services and suggests potential issues with the platform's business model and operational integrity.

Interface design and platform usability information is limited, though user feedback suggests that the trading environment may not meet the sophisticated requirements typically expected by high-net-worth investors. The lack of detailed user interface descriptions or platform demonstrations makes it difficult for potential clients to assess whether the trading environment will meet their needs.

Registration and verification processes are not clearly documented, creating uncertainty about account opening requirements and approval timelines. This lack of transparency extends to ongoing account management, with limited information about account maintenance, reporting capabilities, or client communication protocols.

The predominance of negative user feedback, combined with withdrawal difficulties and trust concerns, creates an overall user experience that falls well below industry standards. This suggests that potential investors should seek alternative brokers with stronger track records and regulatory oversight.

Conclusion

This comprehensive snow-trade review reveals a forex broker with significant operational and trustworthiness concerns that make it unsuitable for most investors. While Snow-Trade positions itself as a premium trading platform for high-net-worth individuals, the combination of withdrawal difficulties, regulatory opacity, and negative user feedback suggests serious issues with the broker's business practices and client treatment.

The broker's focus on extremely high minimum deposits, combined with limited transparency about trading conditions and regulatory oversight, creates a risk profile that even sophisticated investors should approach with extreme caution. The absence of clear regulatory licensing and the presence of multiple third-party warnings indicate fundamental concerns about platform legitimacy and operational integrity.

For investors seeking reliable forex trading services, Snow-Trade's current operational framework and user feedback patterns suggest that alternative brokers with stronger regulatory oversight, transparent operational practices, and positive user experiences would represent significantly safer choices for capital deployment and trading activities.