SBI Holdings Review 2

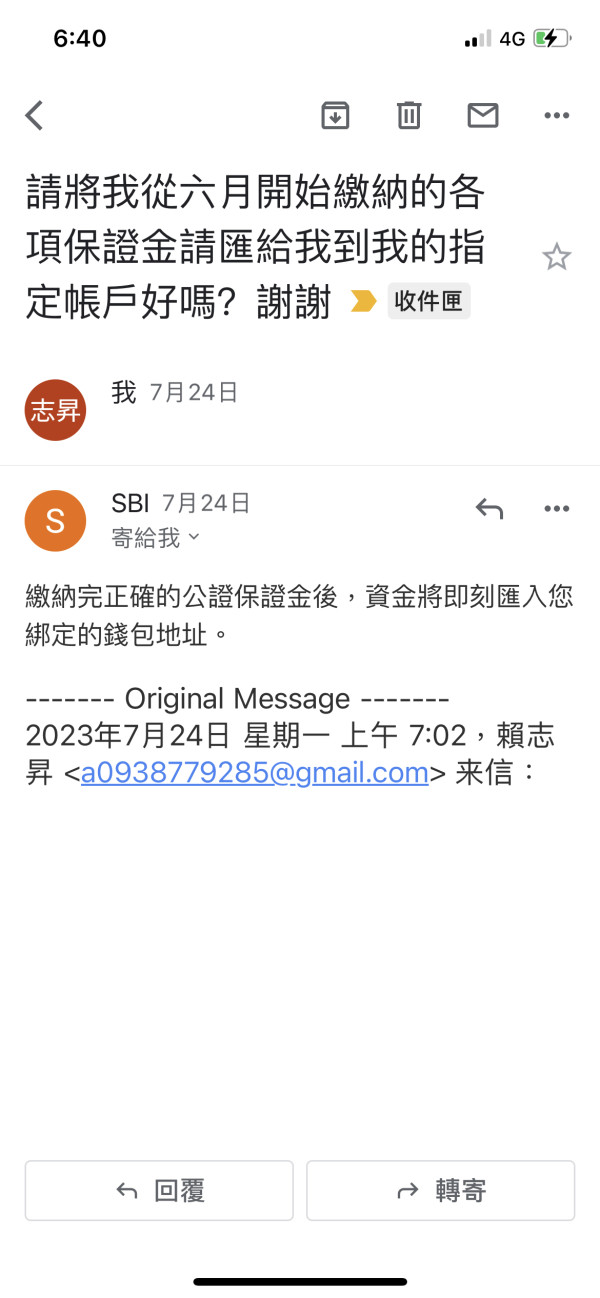

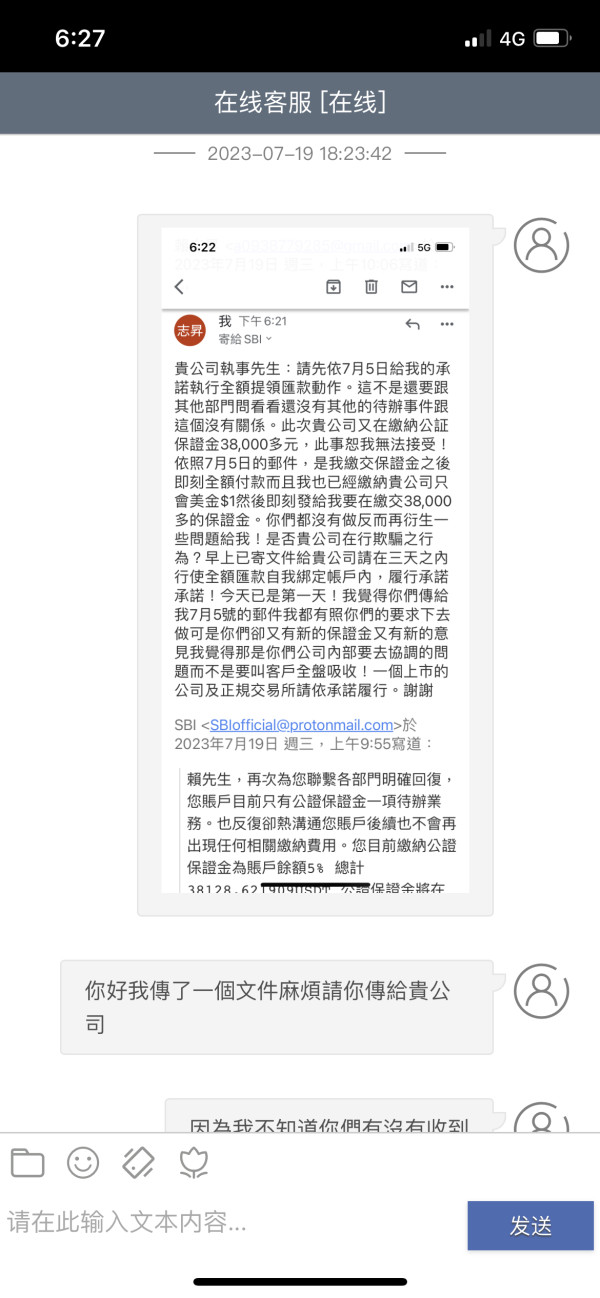

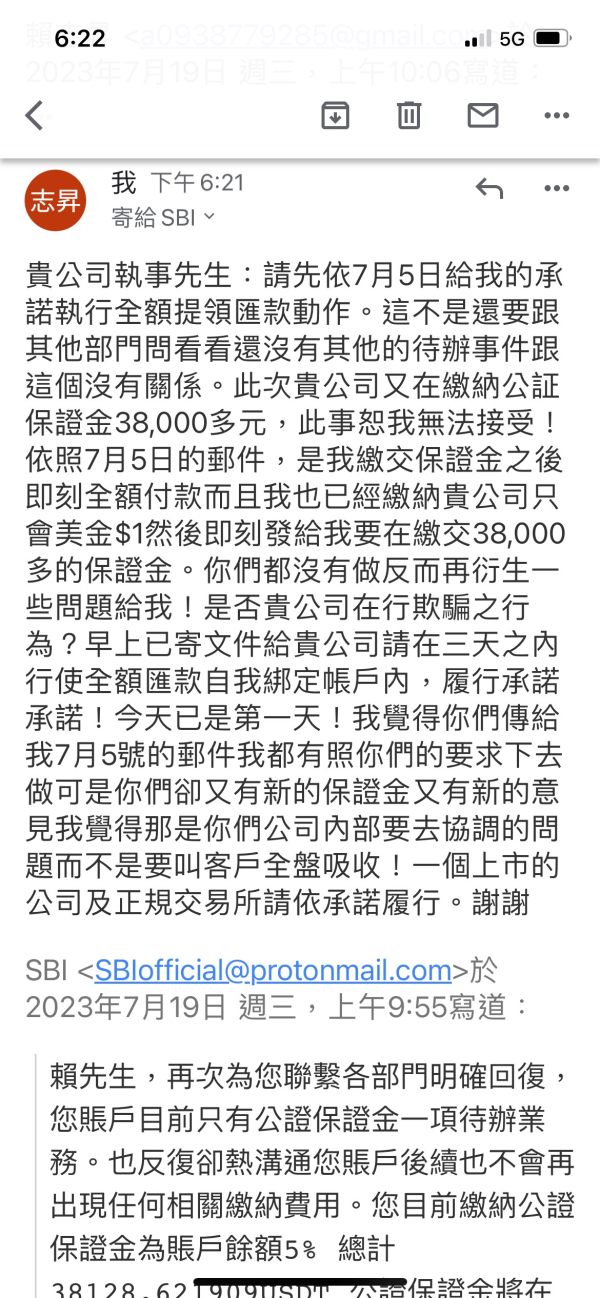

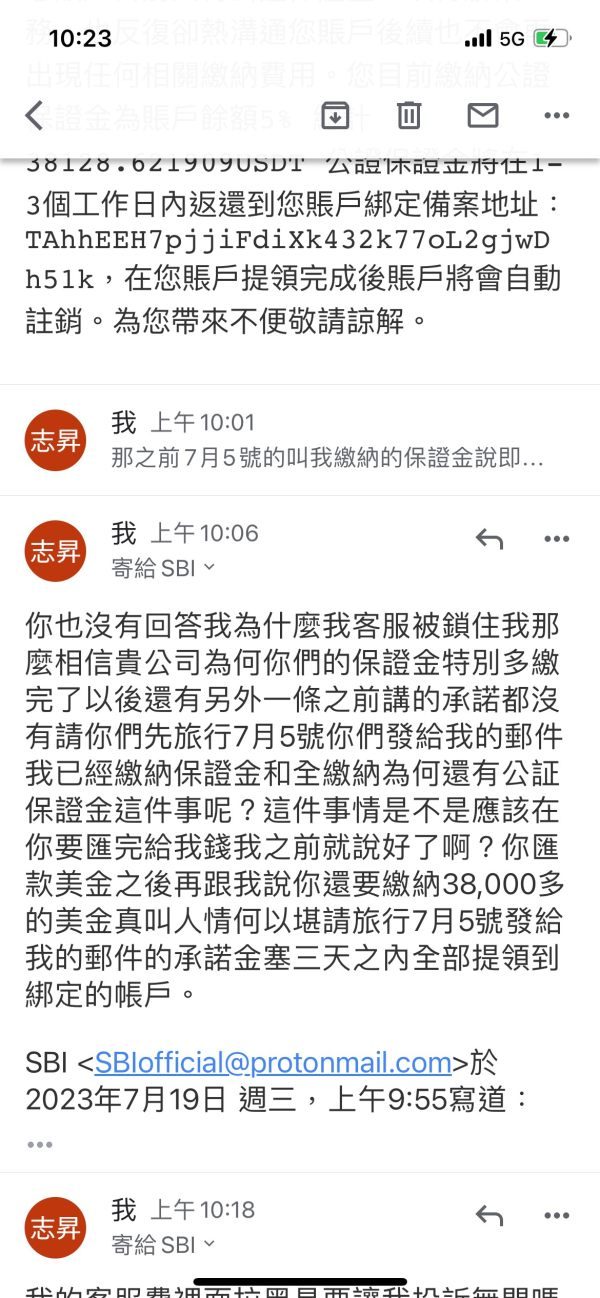

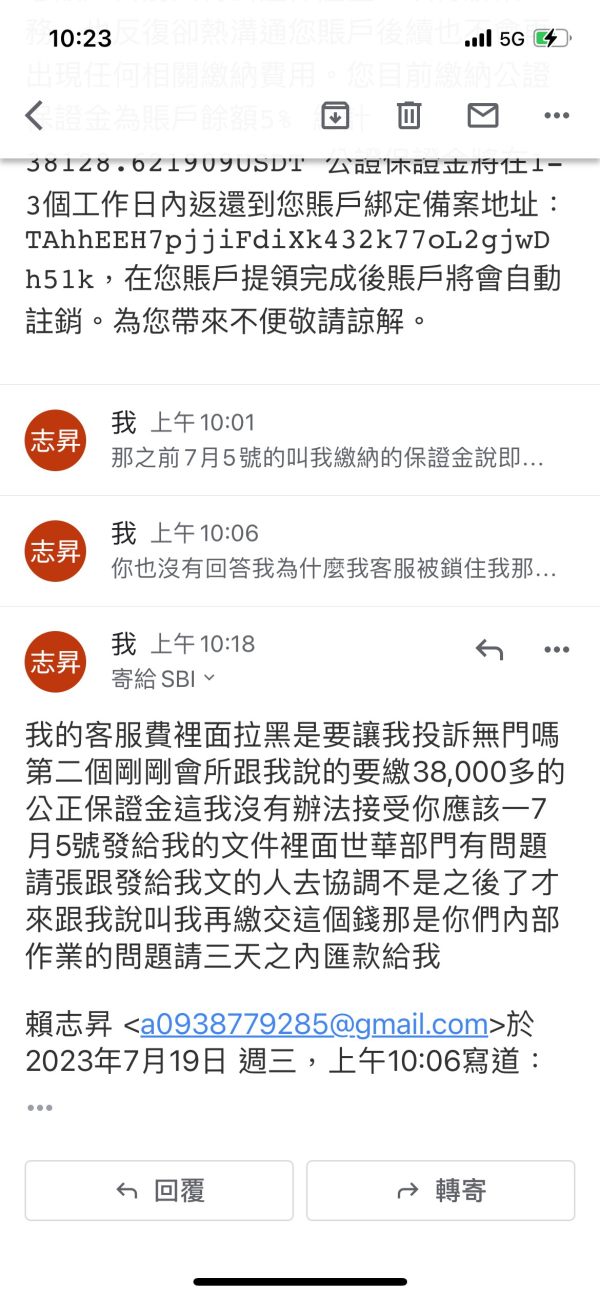

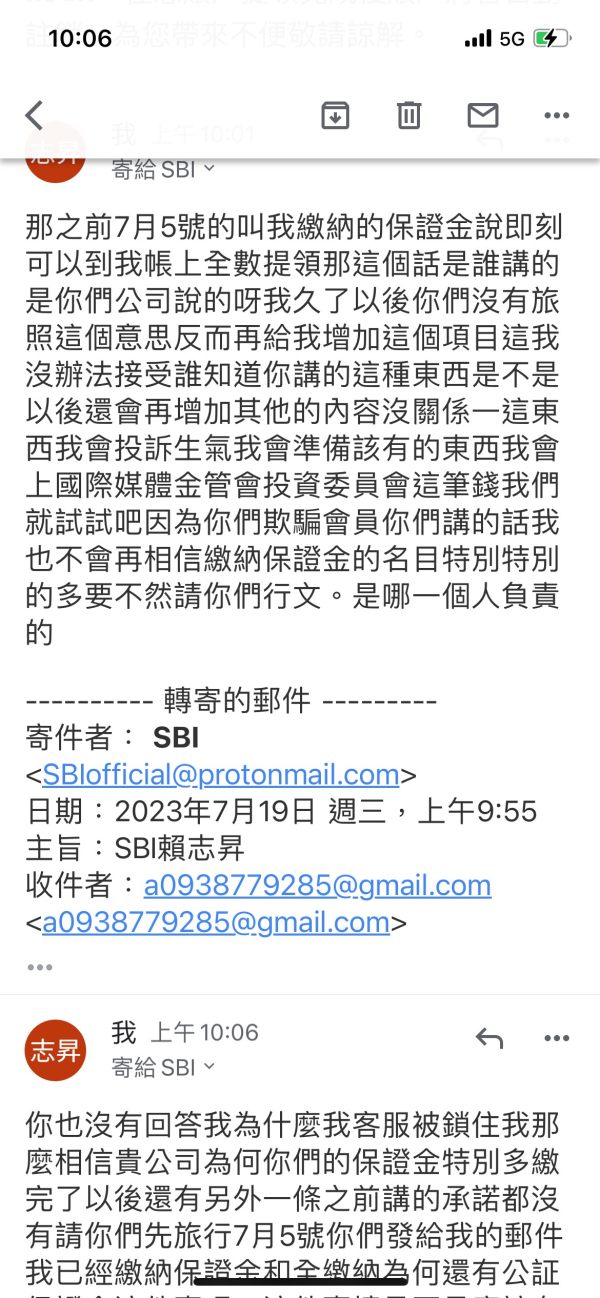

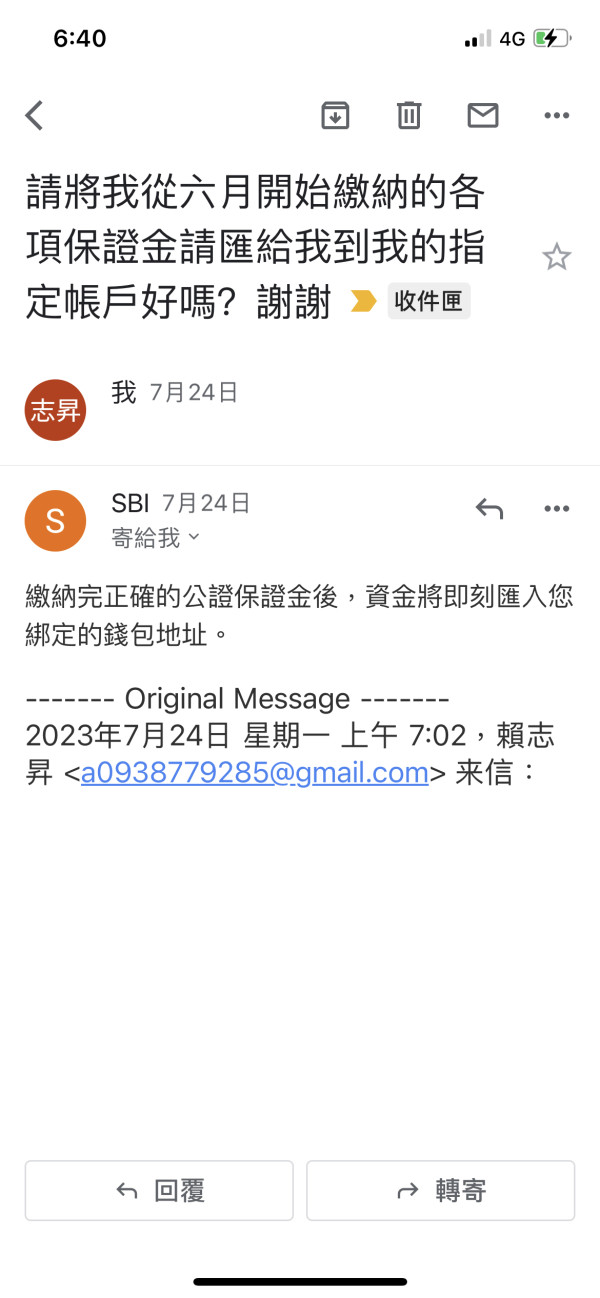

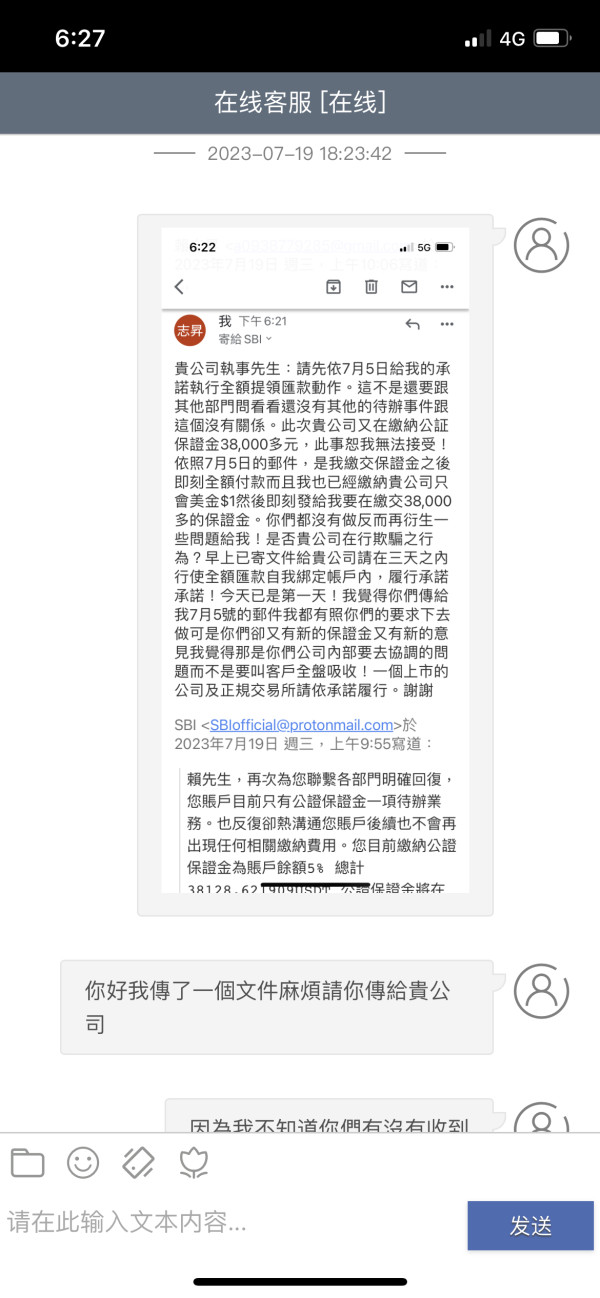

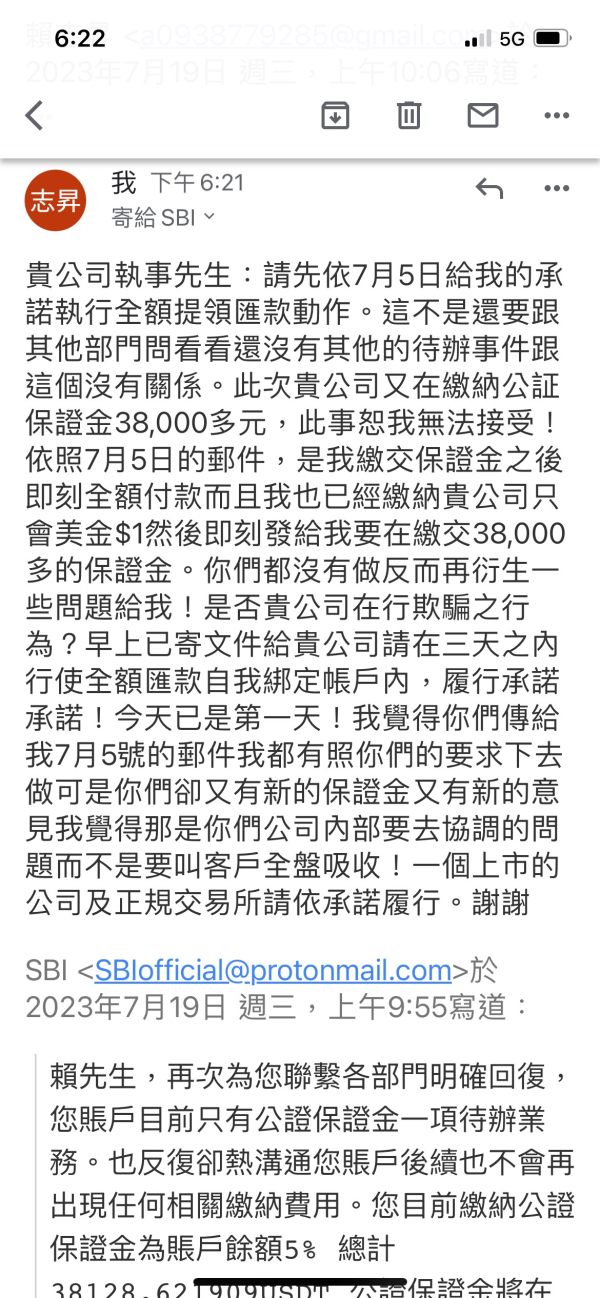

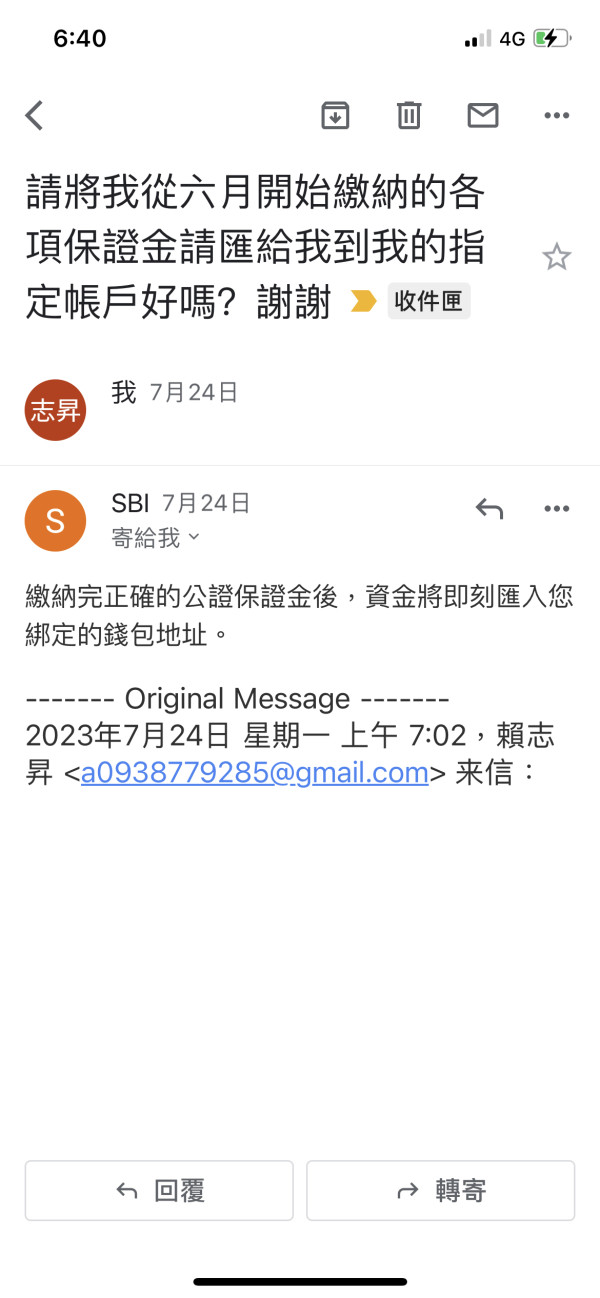

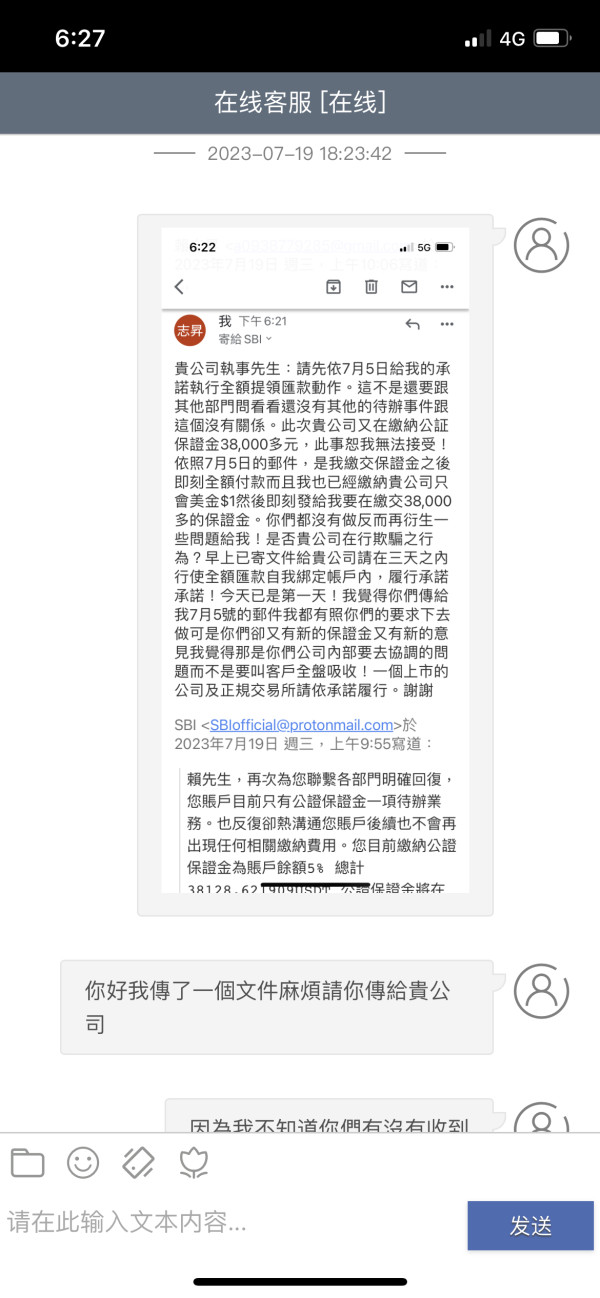

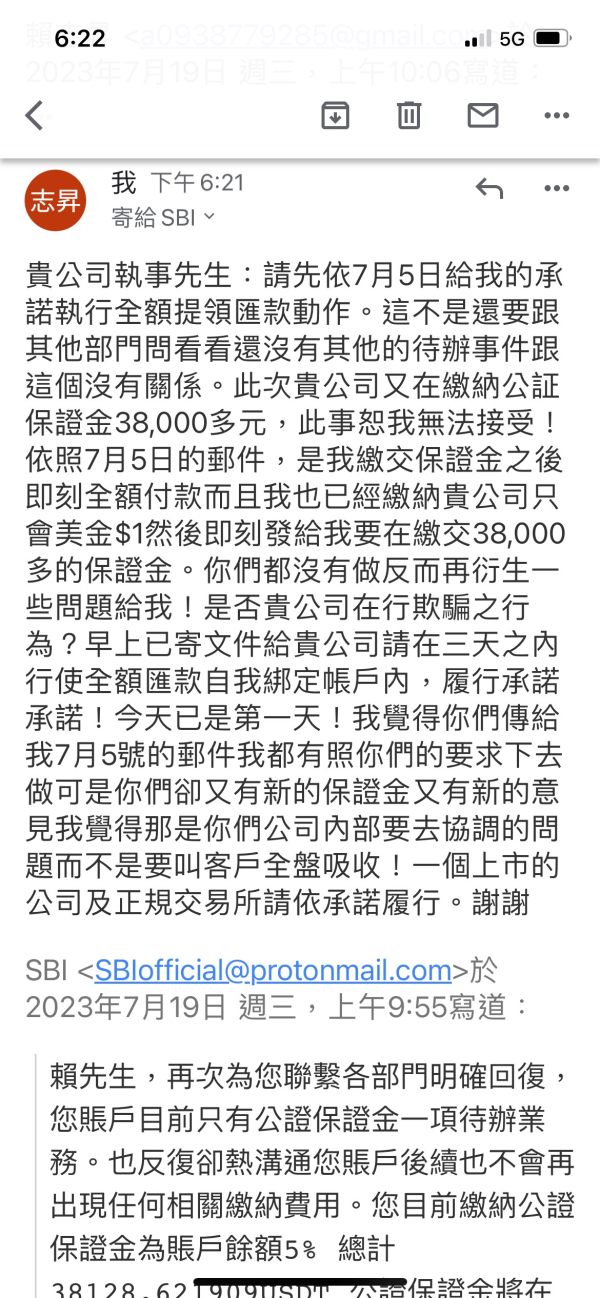

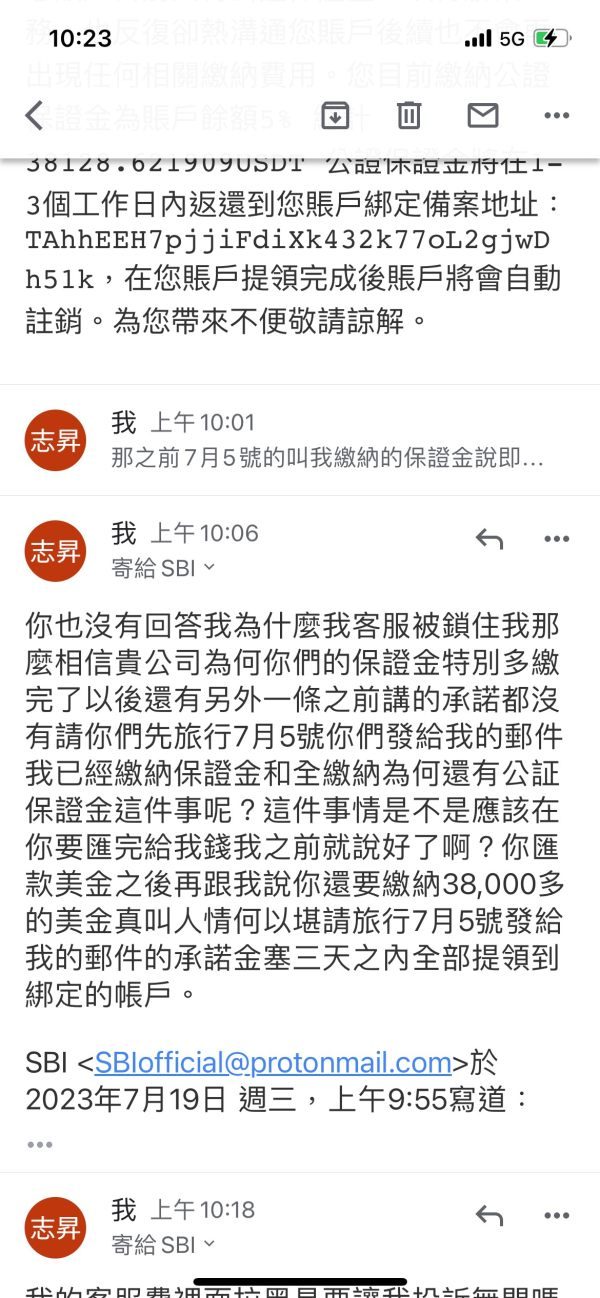

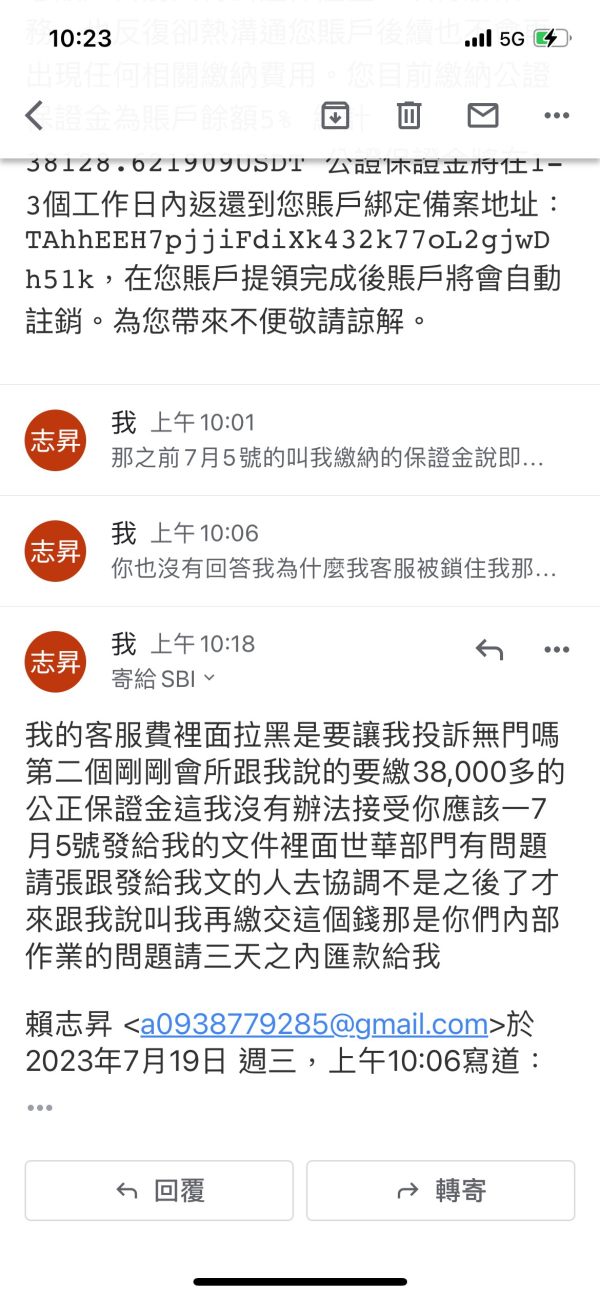

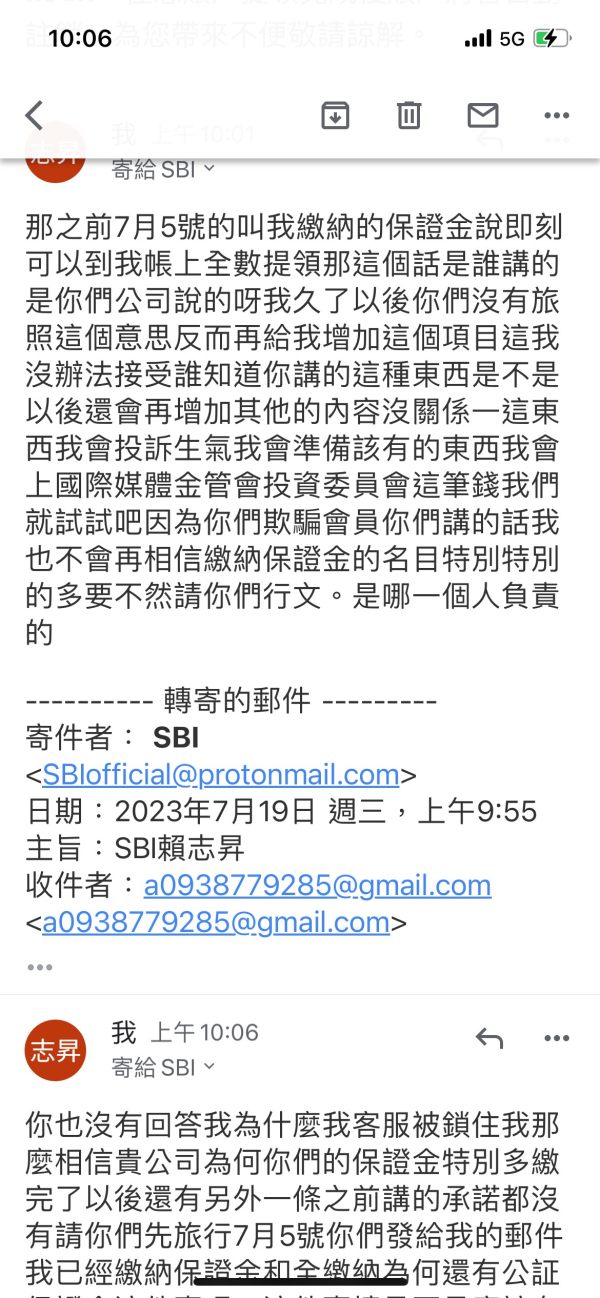

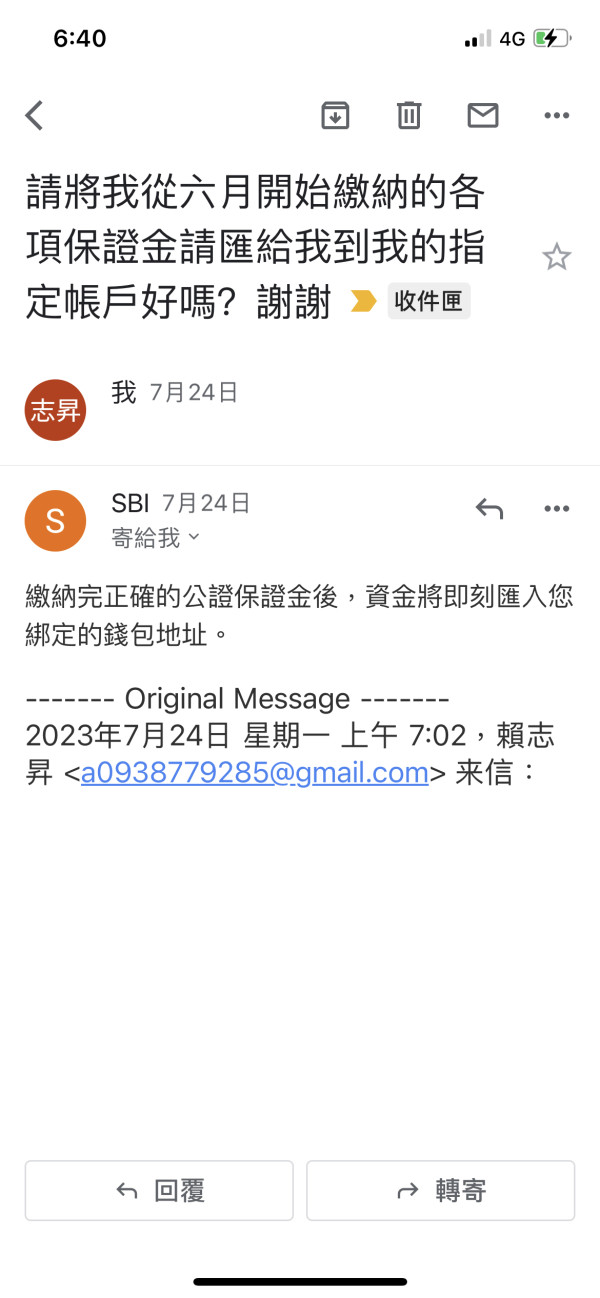

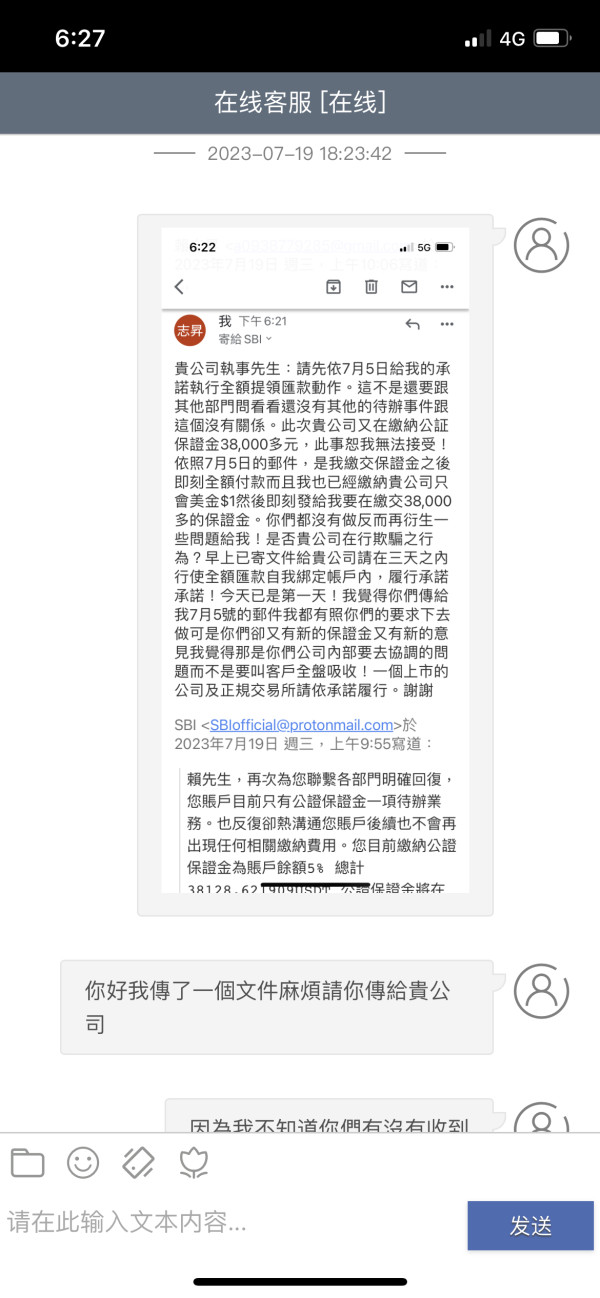

Once the margin is paid, there is a new margin needs to pay. Unable to fulfill the withdrawal and remittance commitments. Scam

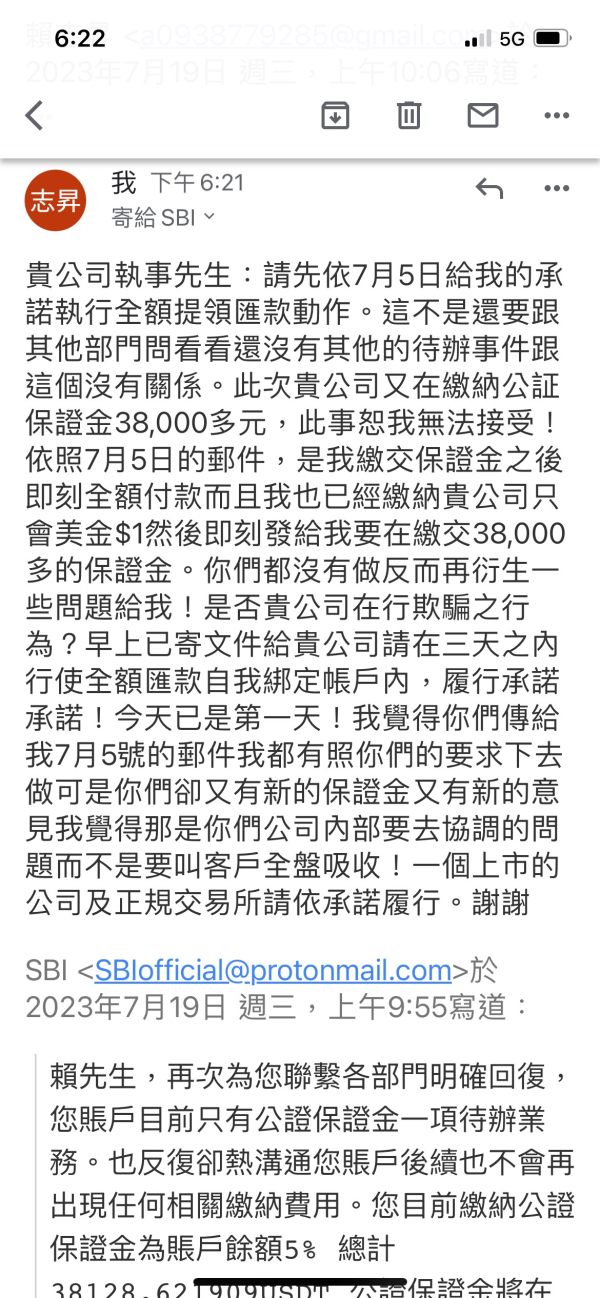

I deposited 100,000 and found it cheated me because my withdrawal was rejected.

SBI Holdings Forex Broker provides real users with * positive reviews, * neutral reviews and 2 exposure review!

Once the margin is paid, there is a new margin needs to pay. Unable to fulfill the withdrawal and remittance commitments. Scam

I deposited 100,000 and found it cheated me because my withdrawal was rejected.

SBI Holdings is a major online securities brokerage company. It has quickly become an important player in the Japanese securities market, showing impressive growth in a short time. This SBI Holdings review shows a company with strong financial performance and notable increases in year-end dividends that reflect solid business operations. However, the company faces challenges in employee satisfaction metrics. Only 39% of employees recommend the company as a workplace, which raises some concerns about internal culture. The financial strength shows through consistent dividend growth and solid market positioning. Yet workplace culture concerns need attention from management. SBI Holdings mainly serves investors who want exposure to Japanese securities markets through complete online brokerage services. While the company does well in financial performance and market presence, potential clients should think about the mixed employee feedback when looking at overall service quality and organizational stability.

This evaluation focuses on SBI Holdings as a financial services company. Investors should know that regulatory frameworks may vary across different areas where the company operates, creating different compliance requirements. Specific regulatory information was not detailed in available sources. This makes it essential for potential clients to verify compliance requirements in their own regions before proceeding. This assessment comes from publicly available information and user feedback. It may not fully reflect every individual user's experience with the company. Market conditions and company policies can change over time. Readers should seek current information directly from official sources before making investment decisions.

| Dimension | Score | Rating Basis |

|---|---|---|

| Account Conditions | N/A/10 | Specific account terms not detailed in available information |

| Tools and Resources | N/A/10 | Trading tools and educational resources not specified |

| Customer Service and Support | N/A/10 | Customer service metrics not provided in source materials |

| Trading Experience | N/A/10 | Platform performance data not available |

| Trustworthiness | N/A/10 | Detailed regulatory information not specified |

| User Experience | 4/10 | Based on 39% employee recommendation rate indicating mixed satisfaction |

SBI Holdings is also known as Strategic Business Innovator Group. It has built itself as a strong presence in Japan's financial services sector through strategic growth and market expansion. The company operates as an online securities brokerage. It provides complete investment services to clients seeking exposure to Japanese markets with a focus on accessibility and innovation. While the exact founding year is not specified in available sources, SBI Holdings has shown consistent growth and market expansion over time. It has positioned itself as a key player in the competitive Japanese brokerage landscape through strategic planning and execution. The company's business model centers on delivering accessible online securities trading services. It caters to both individual and institutional investors with different needs and investment goals.

Recent reports show that SBI Holdings review data indicates the company has maintained strong financial performance. This is particularly clear in its decision to increase year-end dividends, showing confidence in future growth. This financial strength suggests stable operations and effective management strategies that create value for shareholders. The company trades on the Tokyo Stock Exchange under the symbol 8473. This provides transparency and regulatory oversight typical of publicly listed financial institutions in Japan. SBI Holdings' strategic focus on innovation and digital transformation has enabled it to adapt to changing market demands. It maintains its competitive position in Japan's dynamic financial services sector through continuous improvement and strategic planning.

Regulatory Jurisdiction: Specific regulatory details were not provided in available information sources. The company operates under Japanese financial regulations as a Tokyo Stock Exchange-listed entity, which provides some oversight.

Deposit and Withdrawal Methods: Available information does not specify the payment methods and processing procedures offered by SBI Holdings for client transactions.

Minimum Deposit Requirements: Minimum deposit amounts and account opening requirements are not detailed in the source materials reviewed.

Bonuses and Promotions: Current promotional offerings and bonus structures are not specified in available documentation.

Tradeable Assets: The company is confirmed as an online securities brokerage. Specific asset classes and instrument availability require further verification from official sources for complete accuracy.

Cost Structure: Detailed fee schedules, commission rates, and cost breakdowns are not provided in the available information for this SBI Holdings review.

Leverage Ratios: Leverage options and margin requirements are not specified in source materials.

Platform Options: Specific trading platform features and technology specifications are not detailed in available sources.

Regional Restrictions: Geographic limitations and availability restrictions are not clearly outlined.

Customer Service Languages: Language support options are not specified in reviewed materials.

The account conditions offered by SBI Holdings need further investigation. Specific details about account types, minimum deposit requirements, and opening procedures are not fully covered in available sources, making evaluation difficult. As a publicly traded securities brokerage operating in Japan, the company likely offers standard brokerage account options typical of the Japanese market. However, without detailed information, it's hard to assess how competitive their account terms are compared to other brokers. The lack of specific information about account features suggests potential clients should directly contact the company for complete account details. Special features like Islamic accounts for religious compliance or specialized trading accounts for different investor types are not mentioned in available sources. This SBI Holdings review cannot provide a clear assessment of account conditions without more detailed information about minimum balances, account fees, and special features. The company's strong financial performance suggests they have the resources to offer competitive account terms. Verification from official sources is necessary for accurate assessment.

The trading tools and educational resources provided by SBI Holdings are not specifically detailed in available information sources. As an established online securities brokerage, the company likely offers standard trading platforms and analytical tools expected in the Japanese market for competitive positioning. However, without specific details, it's challenging to evaluate the quality and scope of their offerings compared to industry standards. Research capabilities, market analysis tools, and educational content availability require direct verification from the company for accurate assessment. The absence of detailed information about automated trading support, charting capabilities, and research resources limits comprehensive evaluation. Given the company's market position and financial strength, investors might expect professional-grade tools that meet industry standards. However, specific features and capabilities need confirmation from official sources for proper evaluation. The lack of detailed tool specifications in this review reflects the limited information available. It does not indicate the absence of such resources at the company.

Customer service quality and support infrastructure details are not specifically outlined in the available information for SBI Holdings. Standard expectations for a major Japanese brokerage would include multiple contact channels, reasonable response times, and professional service quality for customer satisfaction. However, specific metrics are not provided in available sources for evaluation. The 39% employee recommendation rate might indirectly suggest internal operational challenges. These could potentially impact customer service quality, though this connection requires careful consideration and further investigation. Multi-language support capabilities, service hours, and response time commitments are not detailed in source materials reviewed. Without specific customer feedback about service experiences, support quality assessment remains incomplete and requires additional research. The company's established market presence suggests some level of service infrastructure exists. However, detailed evaluation requires additional information about support channels, availability, and service quality metrics from official sources or verified customer testimonials.

The trading experience offered by SBI Holdings cannot be fully evaluated due to limited platform-specific information in available sources. Platform stability, execution speed, and order processing quality are crucial factors for any brokerage assessment that affects user satisfaction. However, these technical specifications are not detailed in the reviewed materials for proper evaluation. Mobile trading capabilities, platform functionality, and user interface quality require verification from official sources or user testimonials for accurate assessment. The company's position as an established player in the Japanese market suggests adequate trading infrastructure exists. However, specific performance metrics are not available for this SBI Holdings review to provide detailed analysis. Without detailed information about platform features, execution quality, or trading environment characteristics, potential clients should seek demonstrations or trial access. This would allow them to evaluate the trading experience firsthand before making decisions. The absence of specific technical performance data limits the ability to provide comparative analysis with other brokerages in the market.

SBI Holdings' trustworthiness assessment benefits from its status as a publicly traded company on the Tokyo Stock Exchange. This provides regulatory oversight and transparency requirements typical of listed financial institutions in Japan, which adds credibility. The company's strong financial performance and dividend increases suggest operational stability and sound management practices that build investor confidence. However, specific regulatory licenses, compliance certifications, and safety measures for client funds are not detailed in available sources for complete evaluation. The company's established market presence and public trading status provide some assurance of regulatory compliance with Japanese standards. However, detailed verification of specific licenses and safety protocols requires additional research from authoritative sources. Industry reputation and third-party evaluations are not fully covered in available materials for comprehensive assessment. While the financial strength indicators are positive and suggest stability, a complete trustworthiness assessment requires more detailed information. This includes regulatory compliance, client fund protection measures, and industry standing from authoritative sources for proper evaluation.

User experience evaluation for SBI Holdings reveals mixed indicators based on available information from various sources. The 39% employee recommendation rate suggests internal challenges that could potentially impact overall service quality and organizational effectiveness in various areas. While this metric reflects employee satisfaction rather than direct customer experience, it may indicate broader operational or cultural issues within the company structure. Specific information about user interface design, registration processes, and account management experiences are not detailed in available sources for evaluation. The company's financial performance suggests adequate resources for maintaining user-friendly systems that meet customer needs. However, without specific user feedback or interface evaluations, comprehensive assessment remains limited and requires additional research. Common user complaints or satisfaction metrics are not provided in source materials for detailed analysis. The relatively low employee recommendation rate warrants consideration when evaluating overall organizational effectiveness and potential service quality impacts on customers. Direct customer satisfaction data would provide more relevant insights for proper assessment.

This SBI Holdings review reveals a company with strong financial fundamentals but mixed organizational indicators that potential clients should consider. The brokerage shows solid financial performance through dividend increases and market presence, making it potentially suitable for investors seeking exposure to Japanese securities markets. However, the 39% employee recommendation rate raises questions about internal operations. These concerns may impact service quality and should be considered when making investment decisions. SBI Holdings appears most appropriate for investors specifically interested in Japanese market access through an established local brokerage with proven financial stability. The main advantages include financial stability and strong market presence in the Japanese securities sector. The primary concern centers on organizational satisfaction metrics that could influence service delivery and overall customer experience. Potential clients should conduct additional research regarding specific services, fees, and platform capabilities before making final investment decisions.

FX Broker Capital Trading Markets Review