PROFIT TRADE Review 1

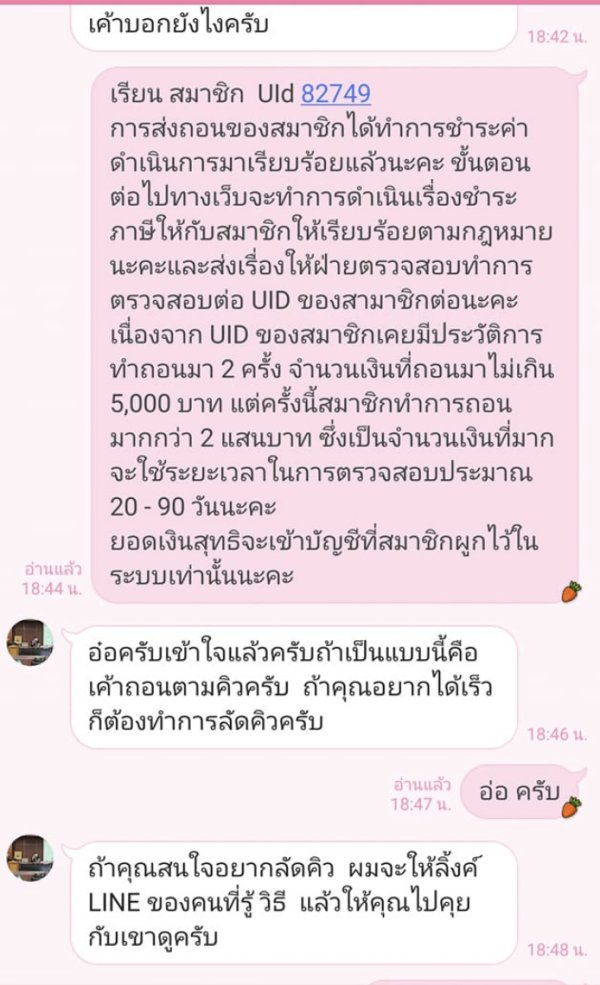

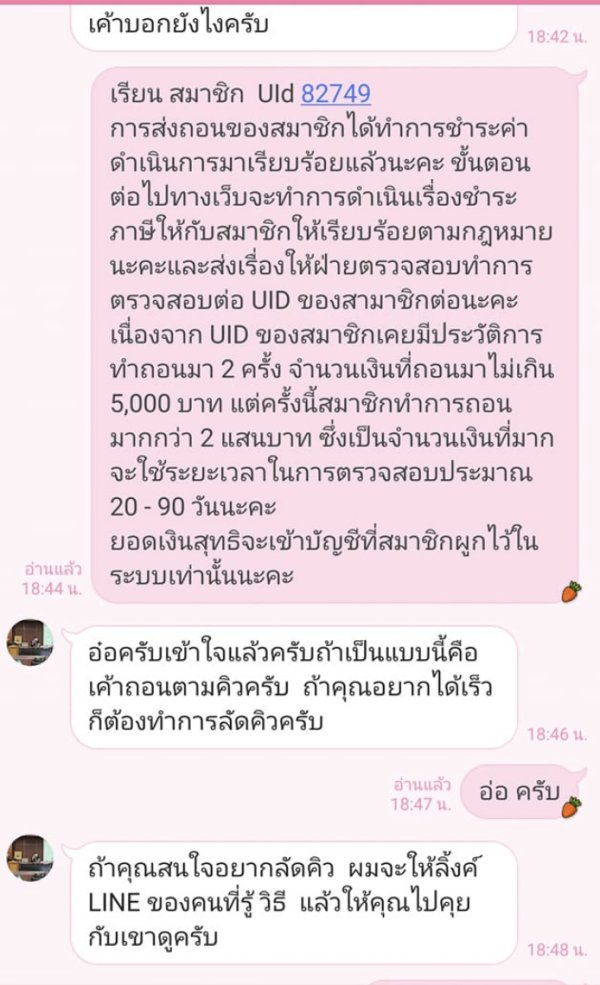

My friend said it was normal to pay taxes before withdrawing. But I waited for the withdrawal so long. What could I do?

PROFIT TRADE Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

My friend said it was normal to pay taxes before withdrawing. But I waited for the withdrawal so long. What could I do?

Profit Trade operates as an unregulated forex broker. It has gotten mixed attention in the trading community over the past year. Based on available user feedback, this Profit Trade review shows that users generally do not consider the platform a scam, but the broker lacks essential regulatory oversight that typically provides trader protection for investors worldwide. The platform primarily focuses on CFD trading across multiple asset classes. It attracts traders interested in diverse market exposure opportunities.

According to reviews from various platforms including Trustpilot and consumer review sites, Profit Trade has accumulated over 300 customer reviews with varying experiences reported by users. The broker offers trading opportunities in forex, CFDs, and other financial instruments. However, specific details about trading conditions remain limited in publicly available information sources. Users have reported mixed experiences with the platform. Some highlight the platform's accessibility while others express concerns about the absence of regulatory protection measures.

The platform appears to target traders seeking CFD trading opportunities. It particularly focuses on those willing to trade with unregulated entities in the current market environment. However, the lack of transparent regulatory information raises important considerations for potential users evaluating the platform's credibility and safety measures for their investments.

This Profit Trade review is based on publicly available information and user feedback collected from various review platforms and broker analysis sites worldwide. Due to Profit Trade's unregulated status, trading experiences may vary significantly across different regions and user demographics in the global market. The absence of specific regulatory oversight means that standard investor protections typically associated with regulated brokers may not apply to users.

Our evaluation methodology incorporates user testimonials, available platform information, and industry standard assessment criteria used by professionals. However, readers should note that limited official documentation makes comprehensive analysis challenging for reviewers. This review aims to present available information objectively. It highlights areas where data remains insufficient for complete assessment of the platform's services.

| Criteria | Score | Justification |

|---|---|---|

| Account Conditions | N/A | Specific account terms not detailed in available sources |

| Tools and Resources | N/A | Trading tools information not comprehensively available |

| Customer Service | N/A | Limited feedback on support quality in reviewed sources |

| Trading Experience | N/A | Insufficient platform performance data available |

| Trust and Safety | 4/10 | Unregulated status significantly impacts trust rating |

| User Experience | N/A | Mixed user feedback without sufficient detail for scoring |

Profit Trade presents itself as a trading platform focusing on CFD and forex trading opportunities for investors. The broker's establishment date and detailed company background information are not clearly specified in available documentation. This reflects the overall transparency challenges associated with unregulated trading platforms in today's market. The platform appears to operate primarily through online channels. It offers access to various financial markets without traditional regulatory oversight from major authorities.

The broker's business model centers around providing CFD trading services across multiple asset classes for different types of traders. According to available information, Profit Trade offers trading opportunities in forex markets, CFDs on various underlying assets, and potentially other financial instruments available today. However, the specific range of available instruments, trading conditions, and platform features require further investigation. This is due to limited official documentation provided by the company.

The absence of clear regulatory information represents a significant aspect of this Profit Trade review that potential users should consider. Unlike regulated brokers that must comply with specific jurisdictional requirements and maintain transparent operations, Profit Trade operates without apparent oversight from major financial regulators worldwide. This status affects various aspects of the trading experience. It impacts everything from fund security to dispute resolution mechanisms available to users.

Regulatory Status: Available information does not indicate specific regulatory oversight from recognized financial authorities such as FCA, CySEC, or other major regulators worldwide.

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and associated fees is not detailed in available sources.

Minimum Deposit Requirements: The minimum deposit threshold for opening trading accounts is not specified in reviewed materials.

Promotional Offers: Details about welcome bonuses, trading promotions, or loyalty programs are not clearly outlined in available documentation from the company.

Available Assets: The platform appears to offer forex trading and CFD opportunities across various markets.

Cost Structure: Specific information about spreads, commissions, overnight fees, and other trading costs is not comprehensively available in reviewed sources.

Leverage Options: Maximum leverage ratios and margin requirements are not detailed in available information from official sources.

Trading Platforms: The specific trading platform technology, mobile applications, and software features require direct investigation as this Profit Trade review found limited technical specifications available.

Geographic Restrictions: Information about restricted countries or regional limitations is not clearly specified in available documentation.

Customer Support Languages: Available support languages and communication channels are not detailed in reviewed sources from the platform.

The evaluation of Profit Trade's account conditions faces significant limitations due to insufficient publicly available information from official sources. Standard account features such as account types, minimum deposit requirements, and specific terms of service are not clearly documented in accessible sources available to reviewers. This lack of transparency makes it challenging for potential traders to make informed decisions about account opening and management processes.

Without detailed information about account tiers, special features, or Islamic account options, traders cannot adequately compare Profit Trade's offerings against industry standards. The absence of clear account condition documentation may indicate either limited transparency practices or the need for direct broker communication to access this information from company representatives. Account opening processes, verification requirements, and ongoing account management procedures remain unclear based on available sources reviewed.

This Profit Trade review highlights the importance of obtaining comprehensive account information directly from the broker before making trading decisions. This is particularly important given the unregulated nature of the platform and its operations.

Assessment of Profit Trade's trading tools and educational resources proves challenging due to limited available information about platform capabilities and features. Standard trading tools such as technical analysis indicators, charting packages, and automated trading support are not detailed in accessible documentation provided by the company. This makes comprehensive evaluation difficult for potential users seeking detailed platform information.

Educational resources, market analysis, and research materials that typically support trader development are not clearly outlined in available sources from the platform. The absence of detailed information about trading tools may reflect either limited offerings or insufficient public documentation of available features for users. Economic calendars, market news feeds, and analytical resources that enhance trading decision-making are not specifically mentioned in reviewed materials available.

Traders considering Profit Trade would need to investigate these features directly through platform demonstration or contact with the broker's support team. This direct investigation becomes necessary for making informed decisions about the platform's capabilities.

Customer service evaluation for Profit Trade remains limited due to insufficient detailed feedback in available sources from users and review platforms. While the platform has accumulated user reviews across various platforms, specific information about support channel availability, response times, and service quality requires more comprehensive analysis from multiple sources. The availability of multiple communication channels such as live chat, email support, phone assistance, and their respective operating hours is not clearly documented in official materials.

Language support options and regional customer service availability also lack detailed specification in reviewed materials from the company. User feedback regarding problem resolution, account assistance, and technical support effectiveness is not comprehensively available in the sources reviewed for this analysis of the platform. The quality of customer service often significantly impacts overall trading experience for users.

This information gap makes it particularly relevant for potential users considering the platform for their trading needs.

Platform performance, execution quality, and overall trading experience assessment faces limitations due to insufficient technical performance data in available sources. Critical factors such as order execution speed, platform stability, and slippage rates are not detailed in accessible documentation from official sources. Mobile trading capabilities, platform compatibility, and user interface design elements that contribute to trading experience are not comprehensively covered in reviewed materials available.

The absence of detailed platform specifications makes it difficult to evaluate Profit Trade's technological offerings against industry standards used by competitors. Trading environment features such as one-click trading, advanced order types, and risk management tools require direct platform investigation from potential users. This Profit Trade review emphasizes the importance of thorough platform testing before committing to live trading.

This testing becomes particularly important given the limited available technical specifications from official documentation.

Trust and safety evaluation reveals significant concerns due to Profit Trade's unregulated status in the current financial market environment. The absence of oversight from recognized financial regulators such as FCA, CySEC, ASIC, or other major authorities eliminates standard investor protections typically available with regulated brokers worldwide. Fund security measures, segregated account practices, and compensation schemes that protect trader deposits are not clearly documented in available materials from the company.

Without regulatory oversight, traders cannot rely on standard industry protections such as investor compensation funds or mandatory segregated client money requirements. The platform's transparency regarding company ownership, financial reporting, and operational practices appears limited based on available information from public sources. This lack of regulatory accountability represents a fundamental risk factor for users.

Potential traders must carefully consider this factor when evaluating Profit Trade as a trading partner for their investment activities.

Overall user satisfaction assessment proves challenging due to mixed and limited feedback available in reviewed sources from various platforms. While some users report positive experiences, the absence of comprehensive user experience data makes it difficult to establish clear satisfaction patterns or identify common user concerns effectively. Interface design, navigation ease, and platform accessibility for traders with varying experience levels are not detailed in available documentation from official sources.

User onboarding processes, account verification procedures, and initial trading setup experiences lack sufficient documentation for thorough evaluation by potential users. Common user complaints, frequently reported issues, and overall platform reliability from a user perspective require more comprehensive feedback analysis from multiple sources. The limited availability of detailed user experience information highlights the importance of conducting thorough due diligence before engaging with the platform.

This due diligence becomes essential for making informed decisions about using the platform for trading activities.

This Profit Trade review reveals a trading platform operating without regulatory oversight, which significantly impacts its overall assessment for potential users. While user feedback suggests the platform is not considered a scam by its users, the absence of regulatory protection creates inherent risks that traders must carefully consider before investing. Profit Trade may appeal to traders specifically interested in CFD trading opportunities who are comfortable operating with unregulated brokers in today's market.

However, the lack of comprehensive information about trading conditions, costs, and platform features makes thorough evaluation challenging for potential users. Potential users should conduct extensive due diligence, including direct platform testing and communication with customer support, before making trading decisions about their investments. The primary advantage appears to be access to multiple trading assets for diverse portfolio building.

The main disadvantage is the absence of regulatory oversight and limited transparency about operational details that affect user safety. Traders prioritizing regulatory protection and comprehensive platform documentation may find better alternatives among regulated brokers in their jurisdiction.

FX Broker Capital Trading Markets Review