Peakmarket Review 1

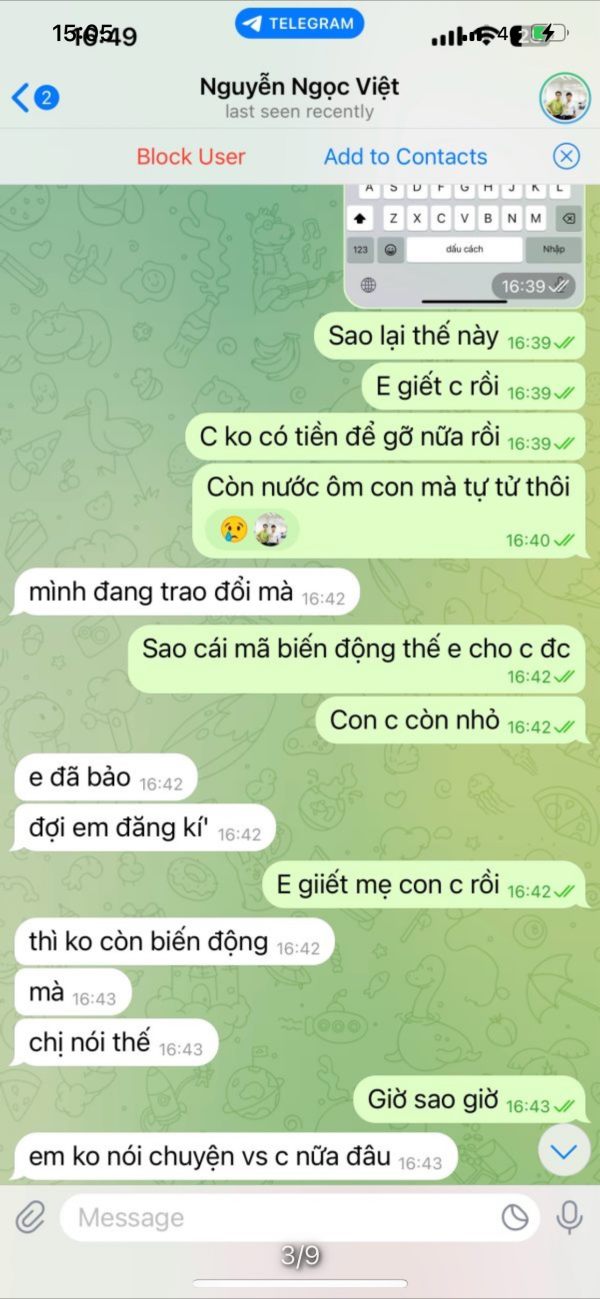

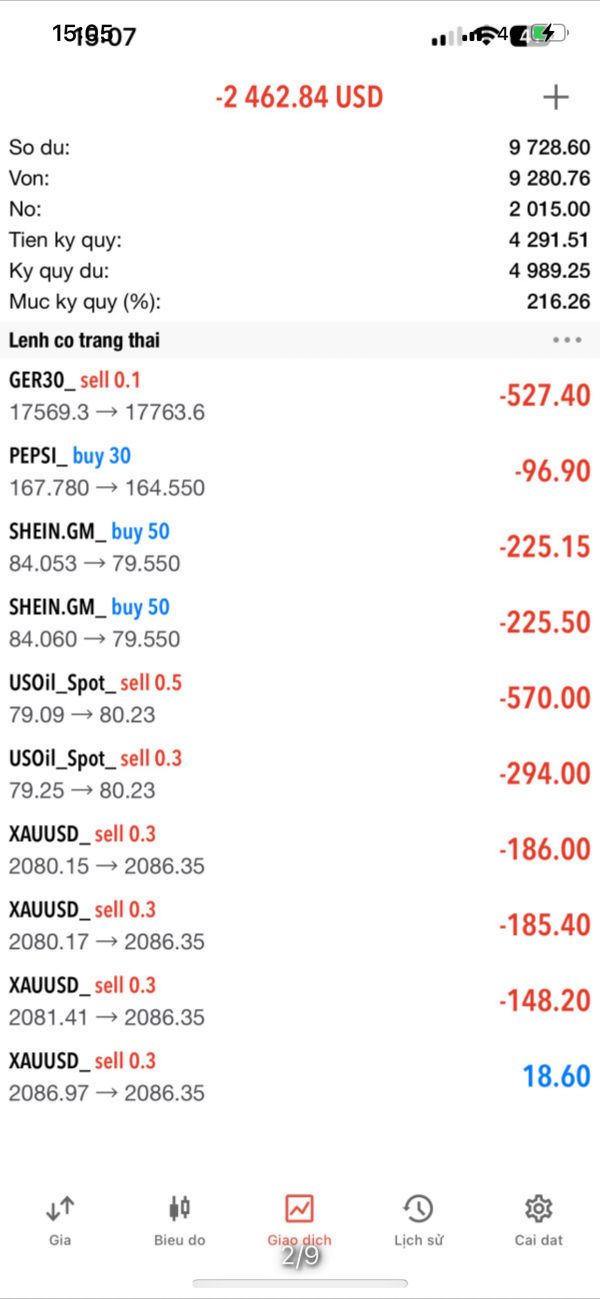

Scam exchange does not allow withdrawals, forces deposits, and burns accounts.

Peakmarket Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Business

License

Scam exchange does not allow withdrawals, forces deposits, and burns accounts.

This peakmarket review shows big concerns about Peak Markets as a forex broker. Peak Markets started in April 2017 and works as an unregulated trading platform that says it provides various financial services including forex, indices, commodities, cryptocurrencies, and stocks. Our analysis shows that Peak Markets lacks proper regulatory authorization to offer forex trading services. This raises serious questions about trader protection and fund security.

The broker's trust rating stays extremely low. Scam Detector gives it a score of only 3 out of 10, while BrokersView has called Peak Markets a fraudulent website. The broker claims to offer multiple trading instruments, but the lack of regulatory oversight and poor user feedback make this platform very risky for traders. This review targets traders who might consider Peak Markets but need to understand the big risks involved with unregulated brokers before making any financial commitments.

This evaluation uses publicly available information and user feedback analysis. Peak Markets appears to operate without proper regulatory authorization, and traders should use extreme caution when considering this broker. Our assessment method relies on verified sources, regulatory databases, and documented user experiences to provide an accurate picture of the broker's offerings and limitations.

The information presented reflects the current status as of 2025 and may change over time. Potential traders should do their own research and consider regulated alternatives for safer trading experiences.

| Evaluation Criteria | Score | Rating Justification |

|---|---|---|

| Account Conditions | 3/10 | No specific information available about spreads, commissions, minimum deposits, or leverage ratios |

| Tools and Resources | 5/10 | Claims to offer multiple trading services but lacks detailed tool specifications |

| Customer Service and Support | 2/10 | Poor user reviews and extremely low trust ratings indicate inadequate support |

| Trading Experience | 4/10 | Limited user feedback available regarding platform stability and execution quality |

| Trust and Security | 2/10 | Unregulated status and Scam Detector trust score of only 3 points |

| User Experience | 3/10 | Multiple negative reviews and poor overall user satisfaction ratings |

Peak Markets entered the forex trading market on April 9, 2017. It positions itself as a trading platform offering access to various financial instruments. The company claims to be based in Saint Lucia and markets itself as providing complete trading services across multiple asset classes. However, our investigation reveals that Peak Markets operates without proper regulatory authorization, which immediately raises red flags about the broker's legitimacy and trader protection measures.

The broker's business model centers around offering forex trading alongside other financial products. The absence of regulatory oversight means traders have no recourse through official channels if disputes arise. This peakmarket review emphasizes that while the broker claims to provide access to forex, indices, commodities, cryptocurrencies, and stocks, the lack of proper licensing undermines any potential benefits these offerings might provide.

Peak Markets has struggled to establish credibility within the forex community. Multiple warning signs have emerged from various review platforms and regulatory watchdogs. The broker's operational transparency remains questionable, and potential clients should be aware that trading with unregulated entities carries significant risks to their invested capital.

Regulatory Status: Peak Markets operates as an unregulated broker without authorization from recognized financial regulatory bodies. The company's claimed location in Saint Lucia does not provide the regulatory framework typically expected by serious forex traders.

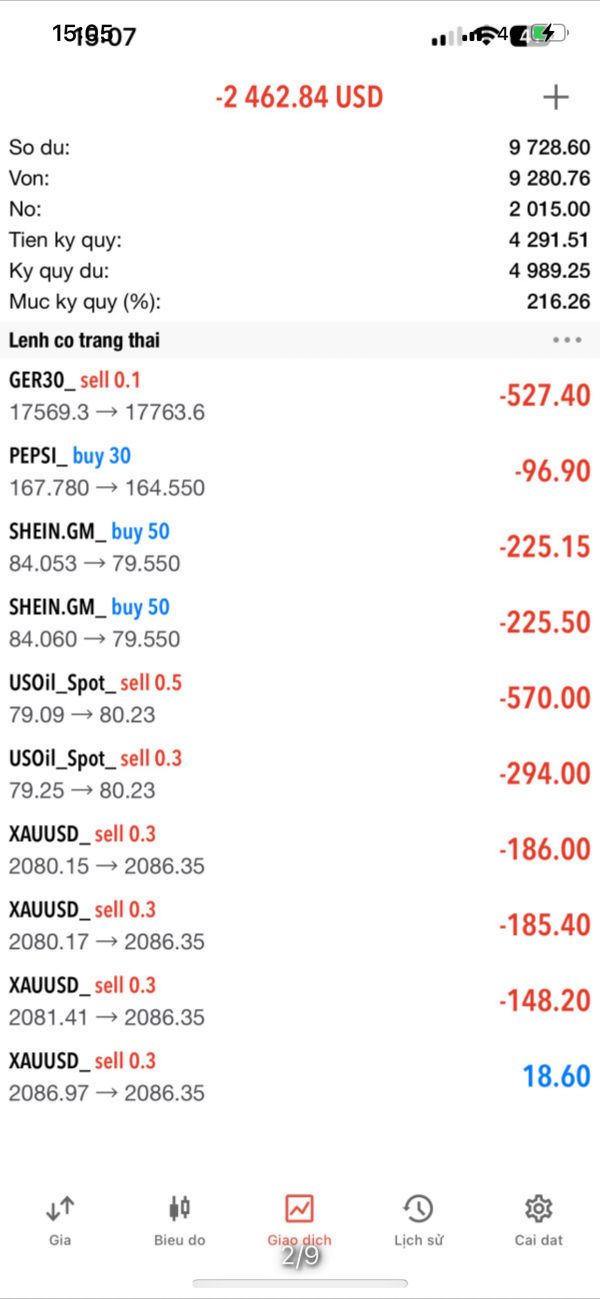

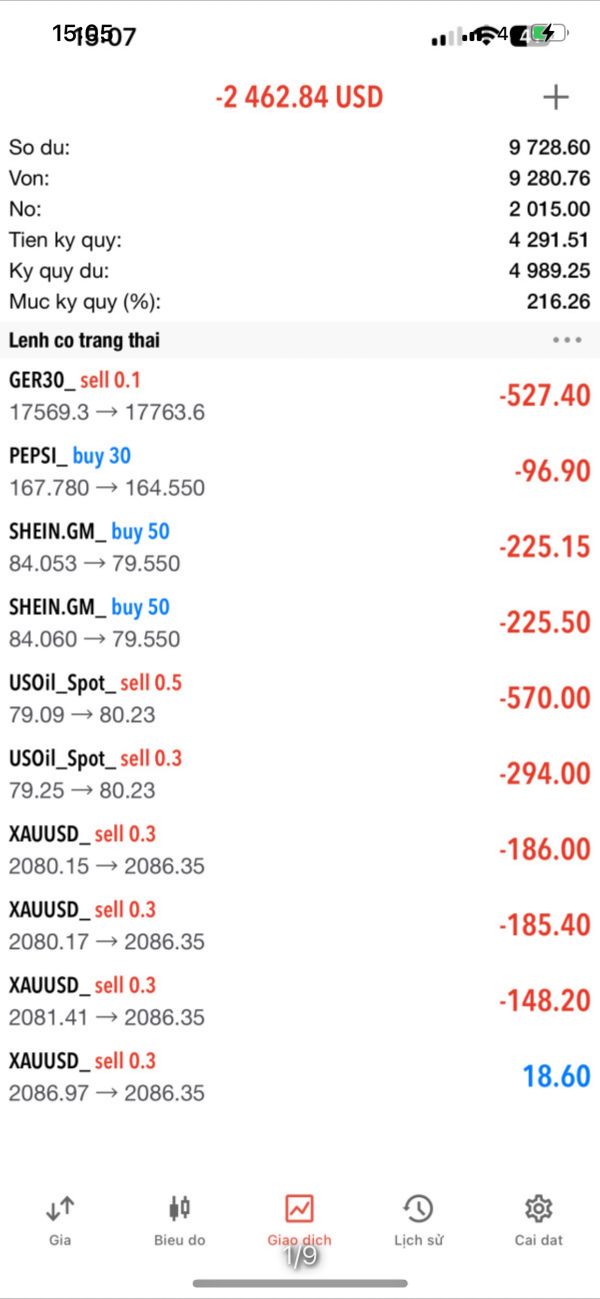

Deposit and Withdrawal Methods: Specific information about funding options is not detailed in available sources. This itself represents a concerning lack of transparency for potential clients.

Minimum Deposit Requirements: The broker has not disclosed minimum deposit amounts in accessible documentation. This makes it difficult for traders to plan their initial investment approach.

Bonus and Promotions: No information about promotional offers or bonus structures is available in current sources. This suggests either no such programs exist or poor marketing transparency.

Tradeable Assets: Peak Markets claims to offer trading in forex pairs, stock indices, commodities, cryptocurrencies, and individual stocks. The actual availability and conditions for these instruments remain unclear.

Cost Structure: Critical information about spreads, commissions, overnight fees, and other trading costs is notably absent from available materials. This prevents traders from accurately assessing the true cost of trading with this broker.

Leverage Ratios: Specific leverage information is not provided in accessible sources. This is unusual for legitimate forex brokers who typically highlight their leverage offerings prominently.

Platform Options: The trading platform types and features offered by Peak Markets are not clearly specified in available documentation.

This peakmarket review highlights the concerning lack of detailed information about essential trading conditions. Legitimate brokers typically provide this information transparently to potential clients.

The account conditions offered by Peak Markets remain largely mysterious due to insufficient public information. Unlike established brokers who provide clear details about account types, minimum deposits, and trading specifications, Peak Markets fails to deliver transparency in these fundamental areas. Available sources do not specify whether the broker offers different account tiers, what the minimum deposit requirements might be, or what specific benefits each account type provides.

The account opening process details are similarly absent from accessible documentation. This raises questions about the broker's operational legitimacy. Professional forex brokers typically provide complete information about account features, including Islamic accounts for religious compliance, demo accounts for practice, and VIP accounts for high-volume traders. The absence of such information in this peakmarket review reflects poorly on the broker's professionalism and commitment to client service.

Without clear account condition specifications, potential traders cannot make informed decisions about whether Peak Markets meets their trading requirements. The lack of transparency regarding account features, combined with the broker's unregulated status, creates an environment where traders cannot adequately assess the risks and benefits of opening an account with this platform.

Peak Markets claims to provide access to multiple asset classes including forex, indices, commodities, cryptocurrencies, and stocks. This suggests some breadth in trading opportunities. However, the specific tools and resources available to traders remain poorly documented. Professional trading platforms typically offer complete charting tools, technical analysis indicators, economic calendars, and market research resources, but Peak Markets has not clearly outlined what analytical tools they provide.

Educational resources appear to be absent or inadequately promoted by Peak Markets. These resources are crucial for trader development. Established brokers usually offer webinars, tutorials, market analysis, and educational materials to help traders improve their skills. The lack of visible educational support suggests that Peak Markets may not prioritize client development and success.

Research and analysis capabilities are essential for informed trading decisions. Available information does not detail what market research or analytical resources Peak Markets provides. Without proper tools and educational support, traders may find themselves disadvantaged in the competitive forex market, regardless of the asset variety the broker claims to offer.

Customer service quality appears to be a significant weakness for Peak Markets based on available user feedback and trust ratings. The extremely low trust score from Scam Detector and the classification as a fraudulent website by BrokersView suggest that users have experienced substantial problems with customer support and overall service delivery.

Professional forex brokers typically offer multiple customer service channels including live chat, telephone support, email assistance, and complete FAQ sections. However, information about Peak Markets' customer service availability, response times, and support quality is notably lacking in accessible sources. This absence of clear customer service information is particularly concerning for a financial services provider where client support is crucial.

The poor reputation indicators suggest that when traders do encounter problems, Peak Markets may not provide adequate resolution services. Without proper customer support infrastructure and given the broker's unregulated status, traders may find themselves with limited recourse when issues arise, whether related to technical problems, account access, or withdrawal difficulties.

The trading experience with Peak Markets remains largely undocumented in terms of platform stability, execution speeds, and order processing quality. Professional trading platforms typically provide detailed information about their trading infrastructure, execution models, and performance statistics. The absence of such technical specifications makes it difficult to assess whether Peak Markets can deliver a competitive trading environment.

Platform functionality and user interface quality are crucial factors in trading success. Available sources do not provide insights into the actual trading experience with Peak Markets. Legitimate brokers often showcase their platform features, mobile trading capabilities, and advanced order types to attract traders. The lack of detailed platform information suggests either poor platform development or inadequate marketing transparency.

User feedback specifically related to trading experience appears limited. This could indicate either a small user base or reluctance among users to share their experiences publicly. Without complete user testimonials about trading conditions, platform reliability, and execution quality, potential clients cannot make informed decisions about the practical aspects of trading with Peak Markets.

Trust and security represent Peak Markets' most significant weaknesses. The broker operates without regulatory authorization from recognized financial authorities. Regulatory oversight provides essential protections including segregated client funds, compensation schemes, and dispute resolution mechanisms. Peak Markets' unregulated status means traders lack these fundamental protections.

The Scam Detector trust rating of only 3 points and BrokersView's classification of Peak Markets as a fraudulent website provide strong warning signals about the broker's reliability. These independent assessments suggest that multiple red flags have been identified regarding the broker's operations and business practices.

Fund security measures are not clearly documented by Peak Markets. These measures are typically highlighted by legitimate brokers. Professional brokers usually provide information about client fund segregation, insurance coverage, and security protocols. The absence of such transparency, combined with the unregulated status, creates substantial risks for traders considering depositing funds with this broker.

Overall user satisfaction with Peak Markets appears to be poor based on available feedback and trust ratings. The negative assessments from review platforms suggest that users who have interacted with the broker have encountered significant problems that have led to unfavorable evaluations.

The user interface and platform usability remain undocumented in accessible sources. This makes it impossible to assess whether Peak Markets provides a modern, intuitive trading environment. Professional brokers typically invest heavily in user experience design to ensure their platforms are accessible to both novice and experienced traders.

Registration and verification processes are not clearly outlined by Peak Markets. These processes significantly impact initial user experience. Legitimate brokers usually provide transparent information about account opening requirements, verification timeframes, and onboarding procedures. The lack of such information suggests either poor process documentation or potential complications in the account opening experience that the broker prefers not to highlight publicly.

This complete peakmarket review reveals substantial concerns about Peak Markets as a forex trading option. The broker's unregulated status, extremely low trust ratings, and lack of transparency regarding essential trading conditions create significant risks for potential traders. Peak Markets claims to offer access to multiple asset classes, but the absence of regulatory protection and poor user feedback substantially outweigh any potential benefits.

Peak Markets may only be suitable for traders who fully understand and accept the risks associated with unregulated brokers. Such traders would likely find better alternatives among properly regulated competitors. The broker's main disadvantages include lack of regulatory oversight, poor trust ratings, limited transparency about trading conditions, and inadequate customer service reputation. The primary advantage appears to be the claimed variety of trading instruments, though this benefit is severely undermined by the security and trust concerns.

Traders seeking reliable forex trading services should strongly consider regulated alternatives. These alternatives provide proper client protections, transparent trading conditions, and established track records of customer satisfaction.

FX Broker Capital Trading Markets Review