MT Review 2

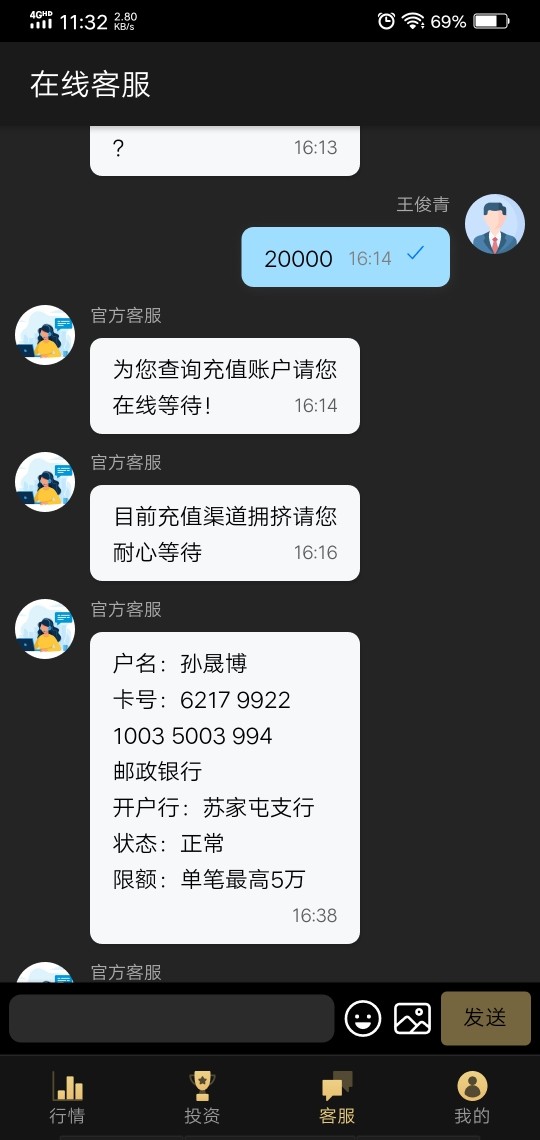

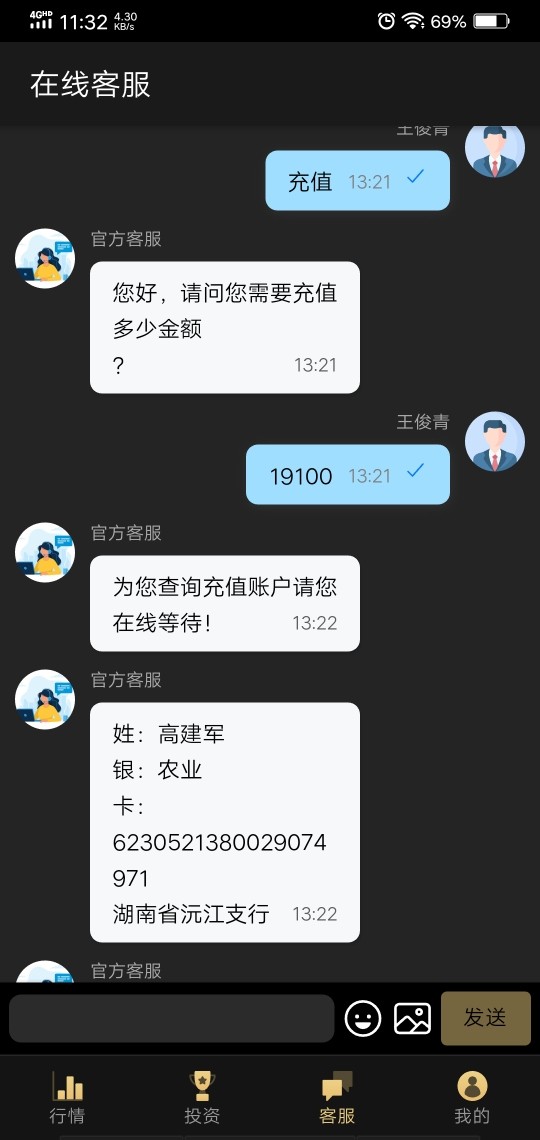

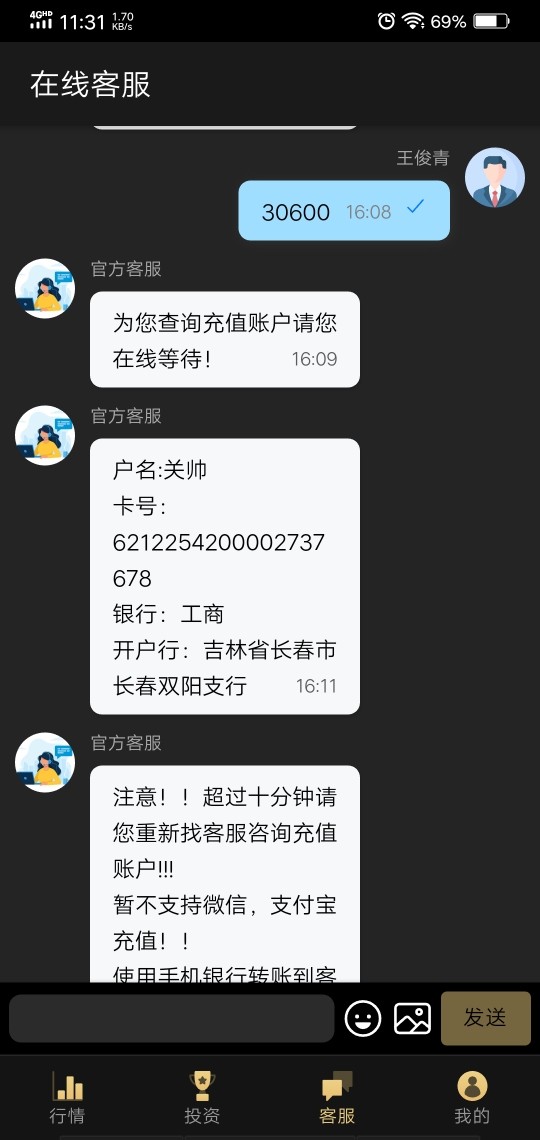

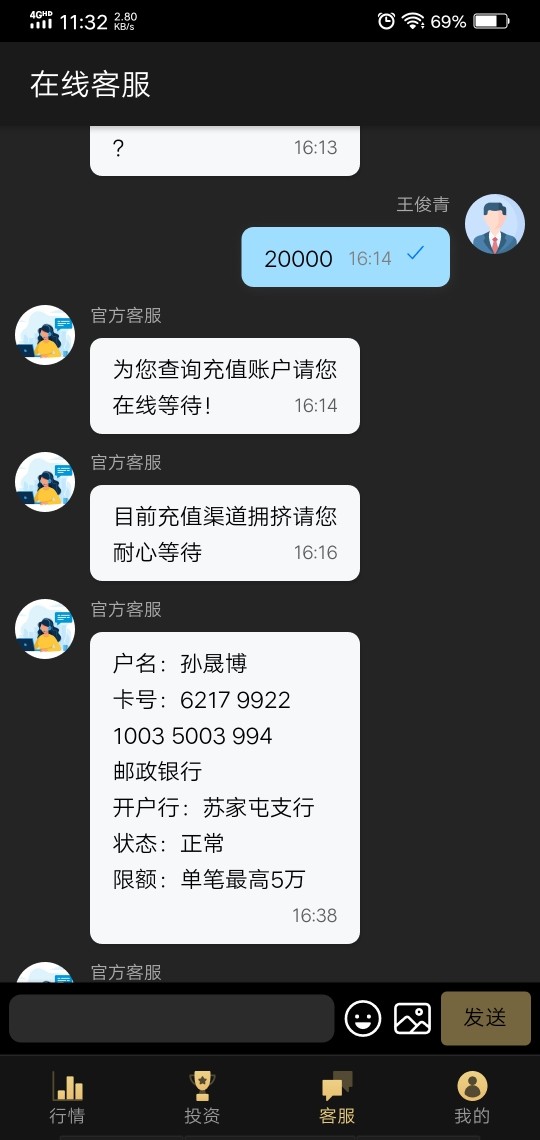

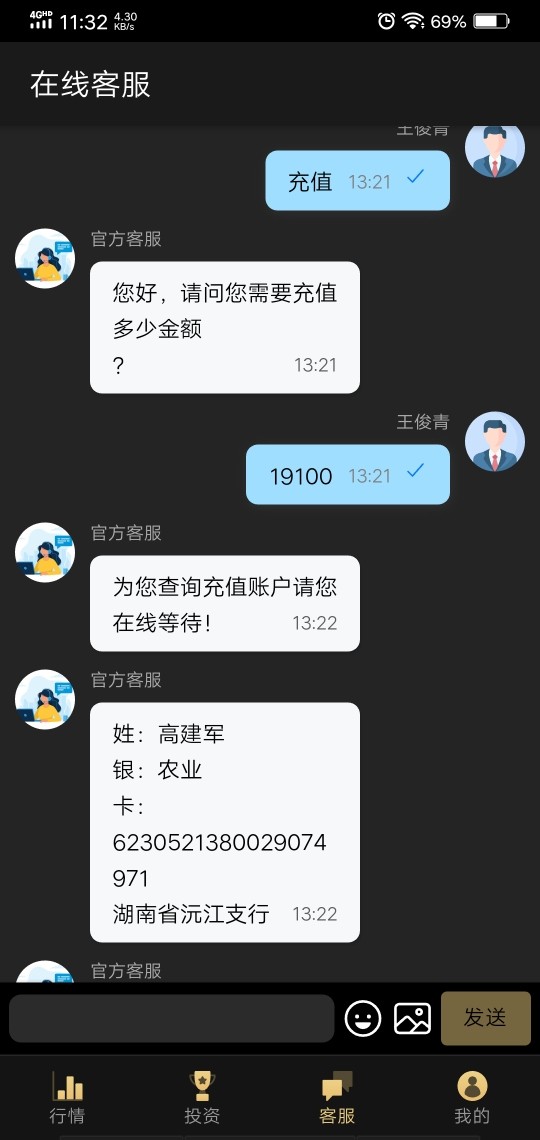

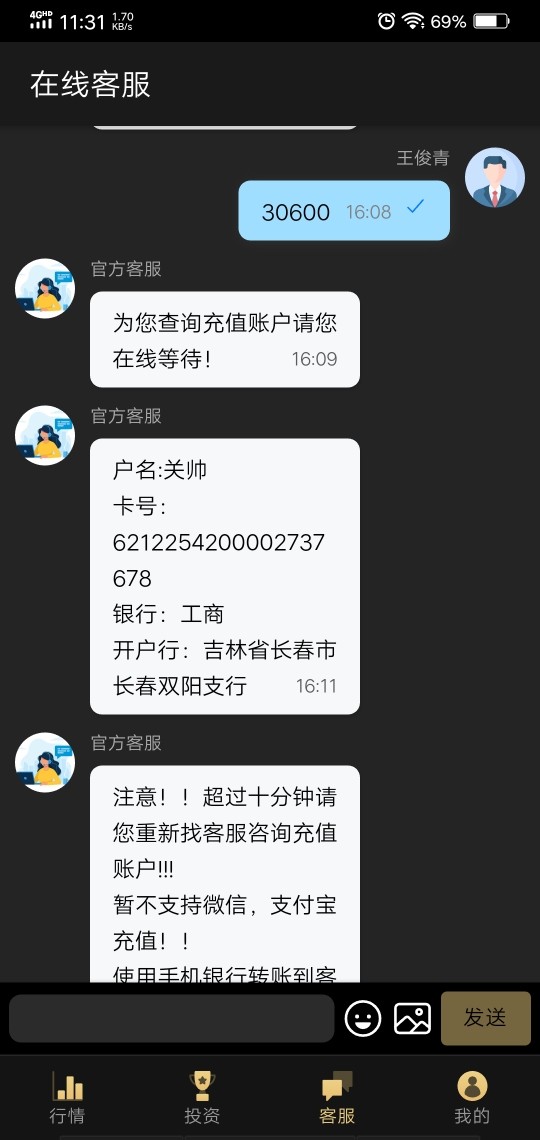

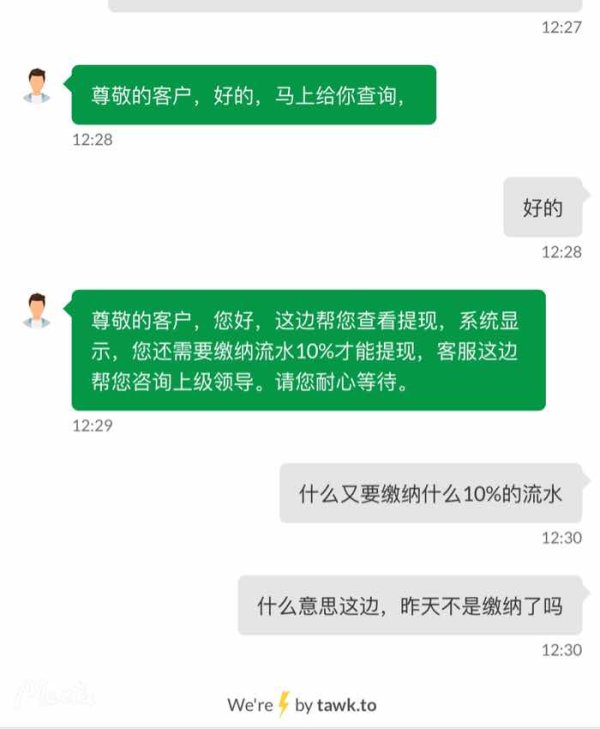

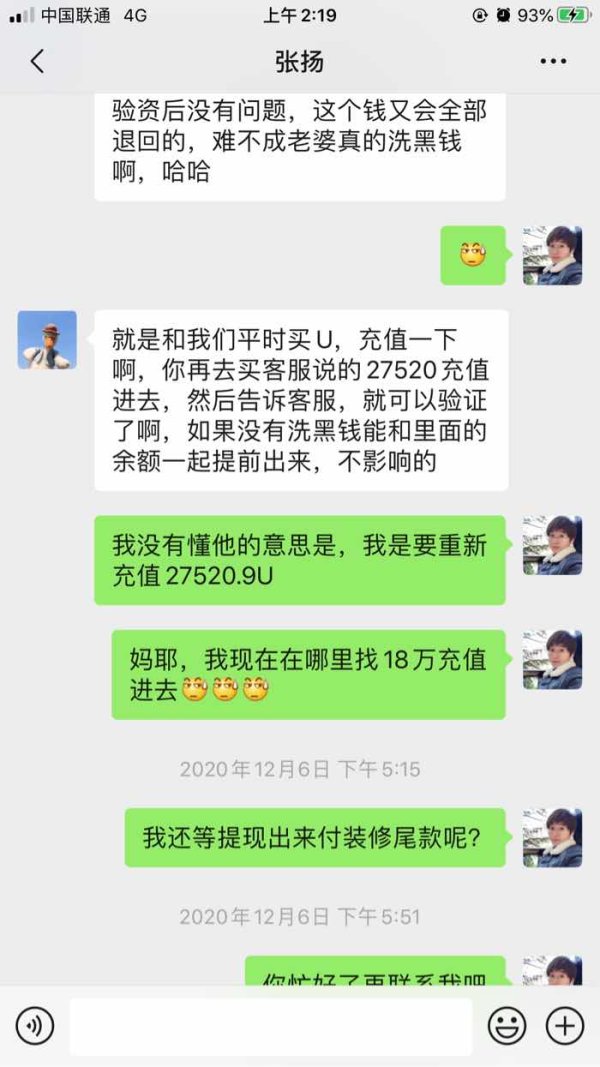

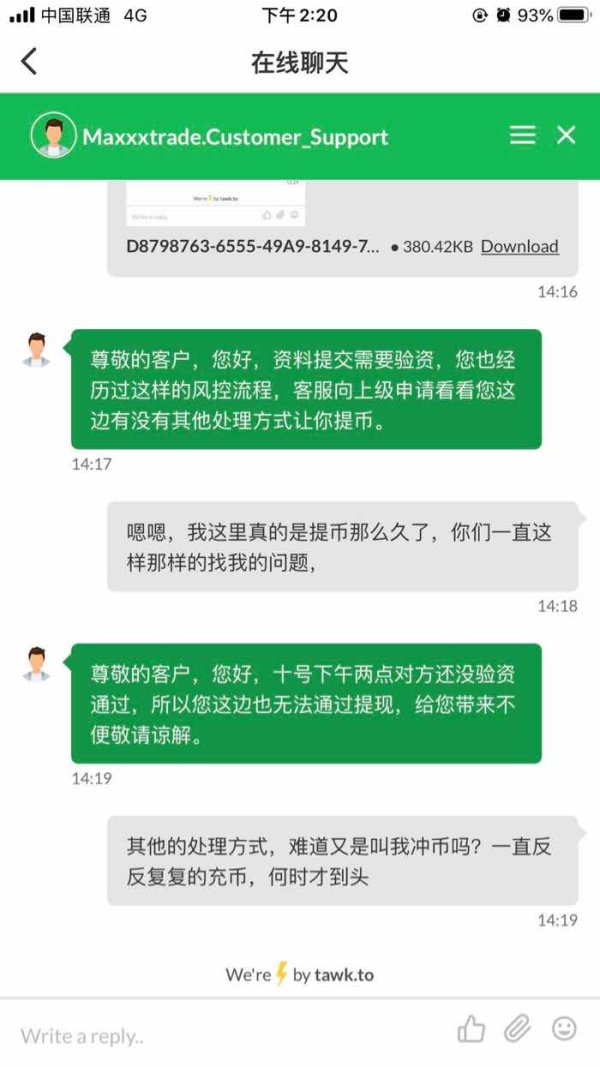

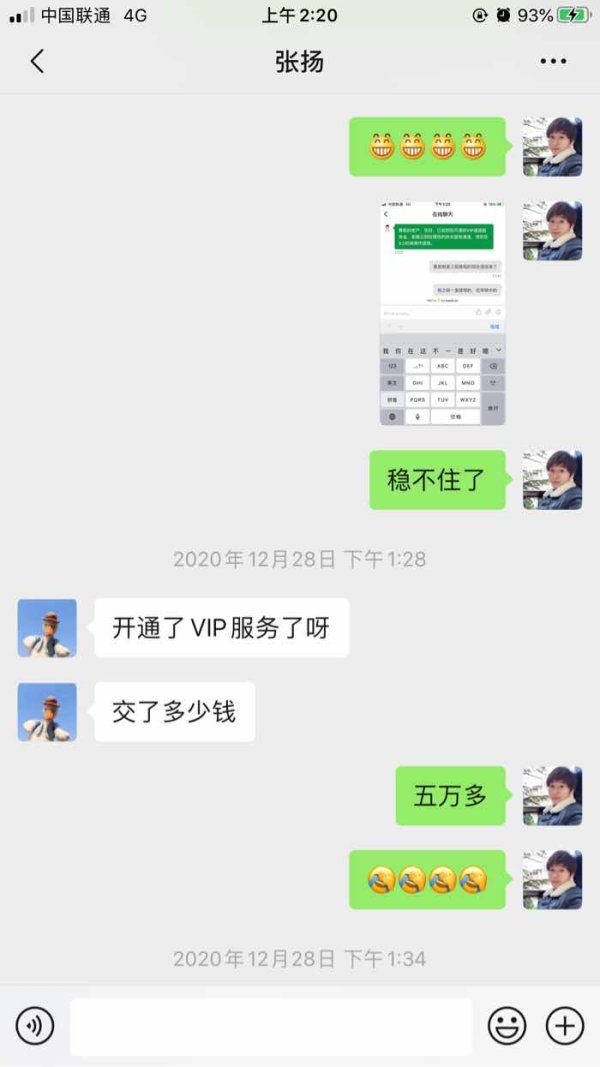

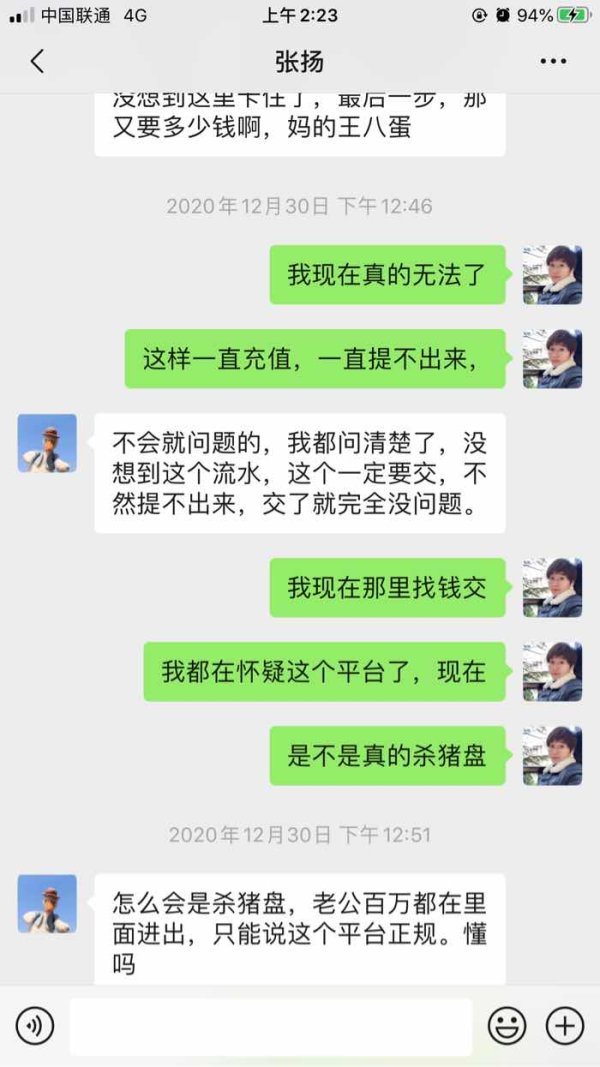

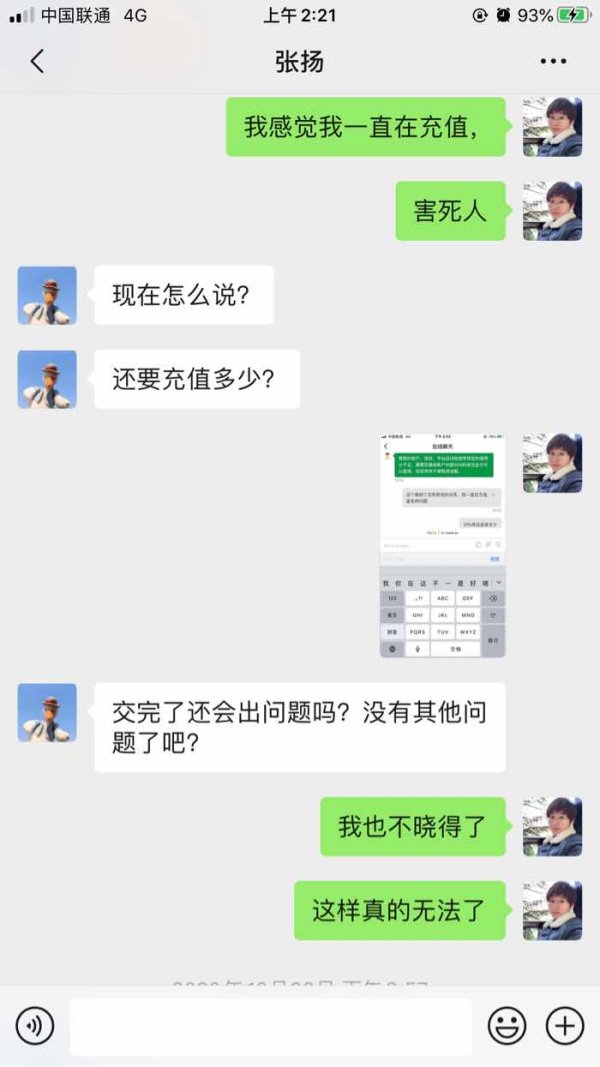

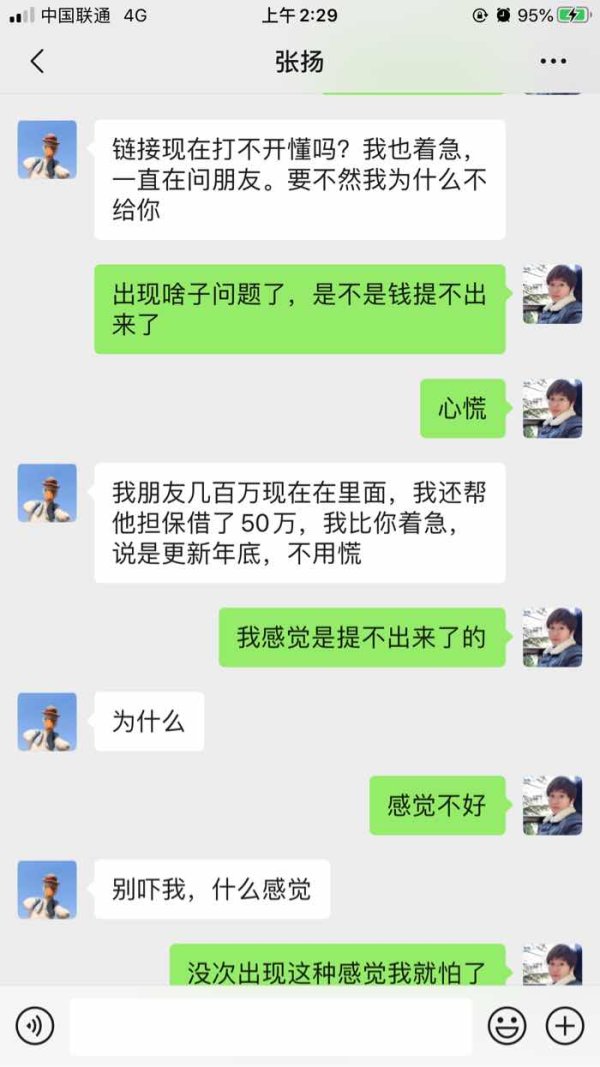

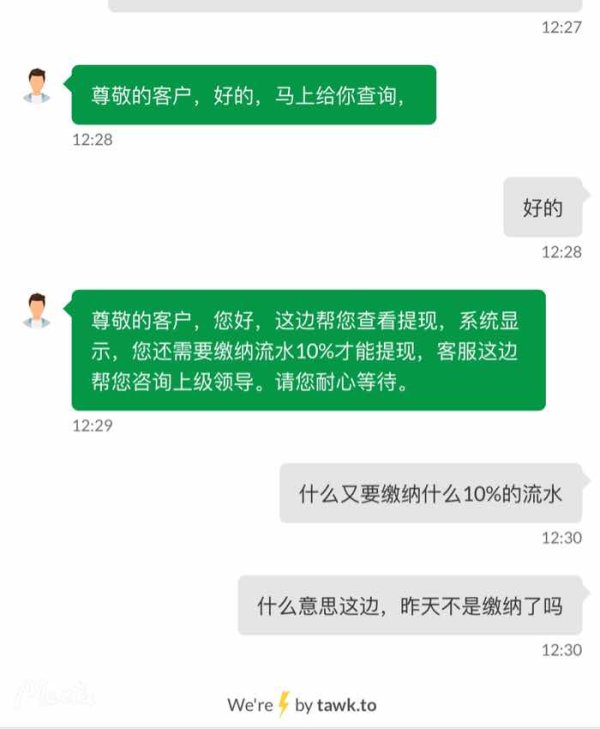

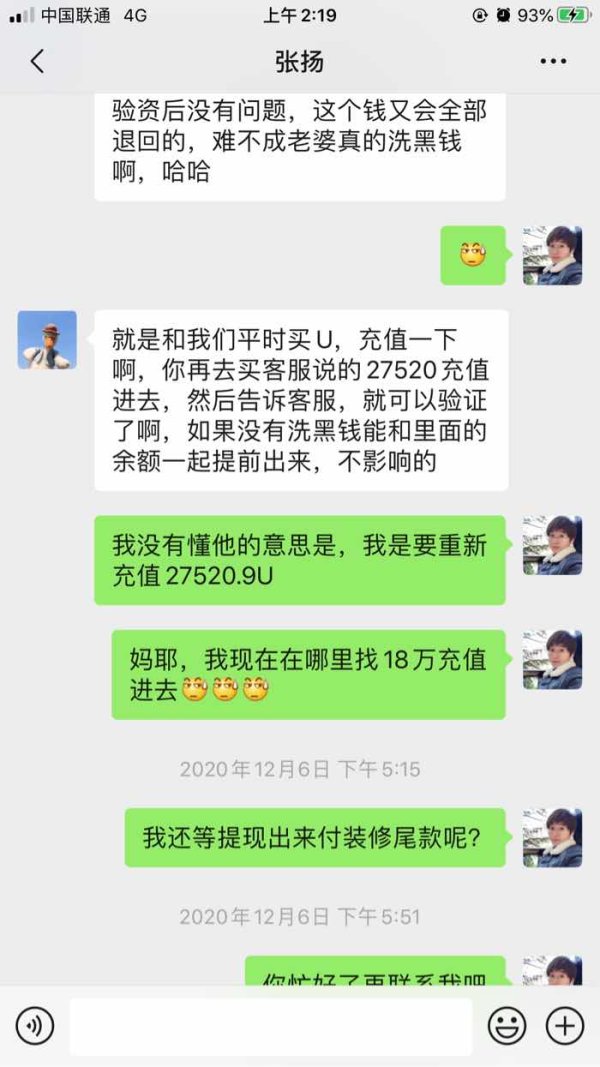

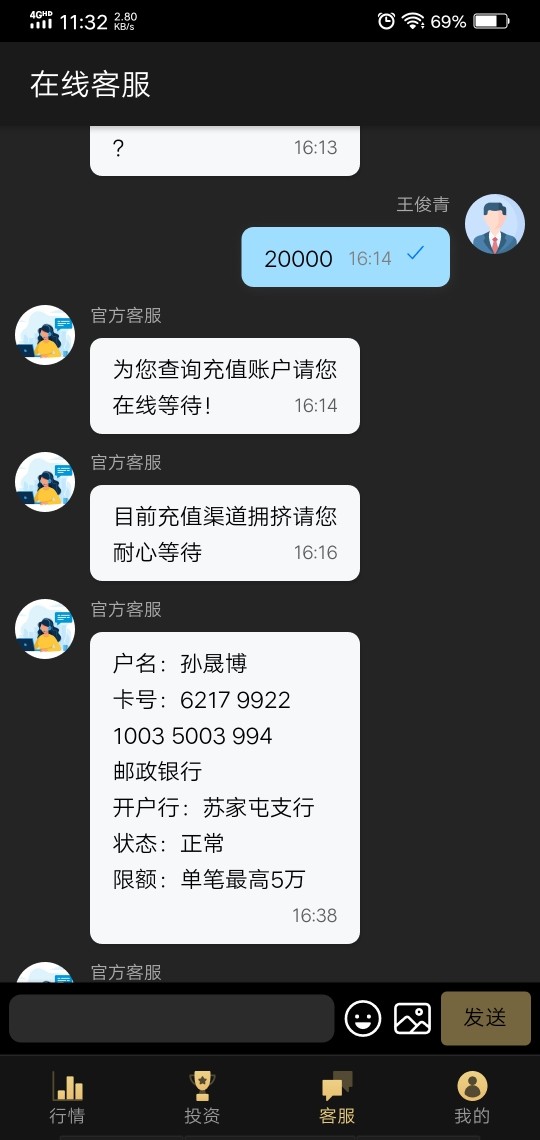

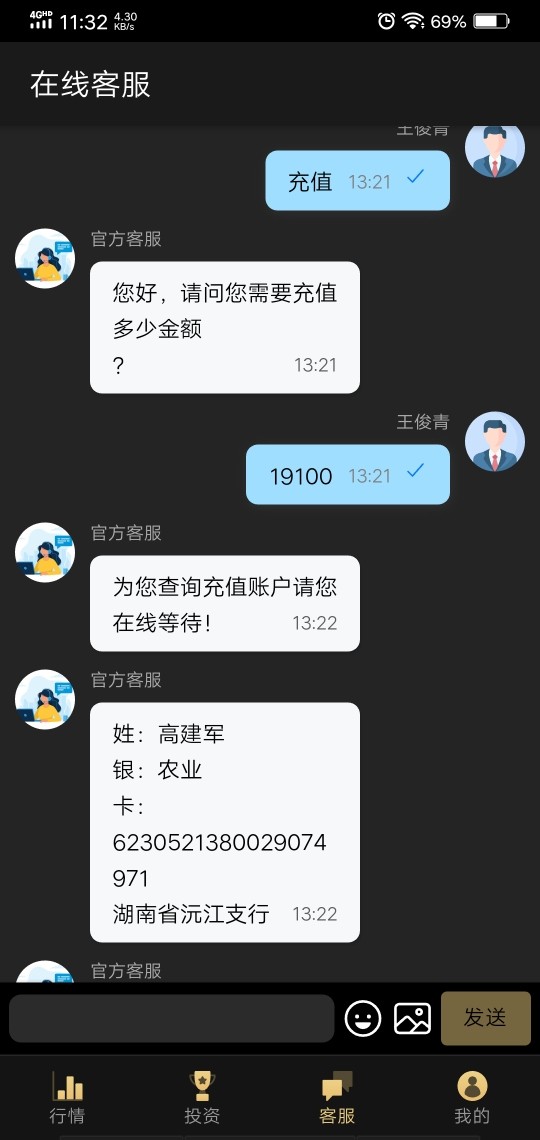

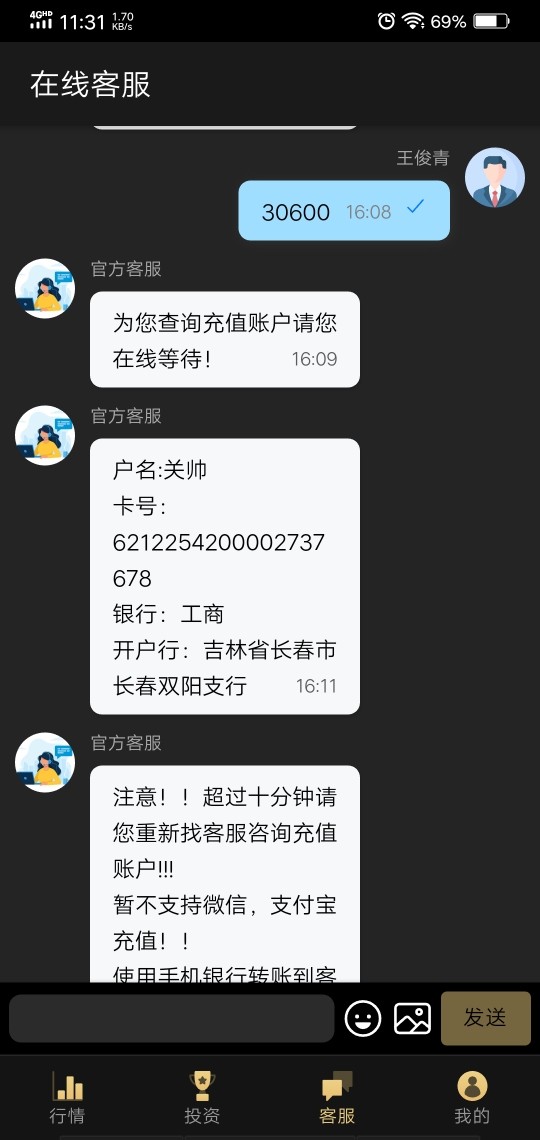

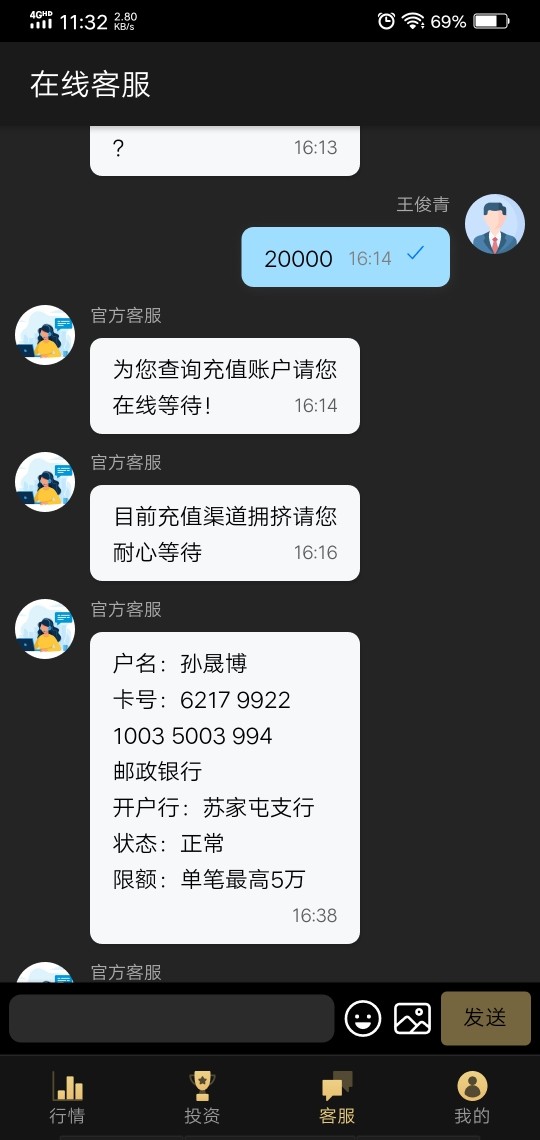

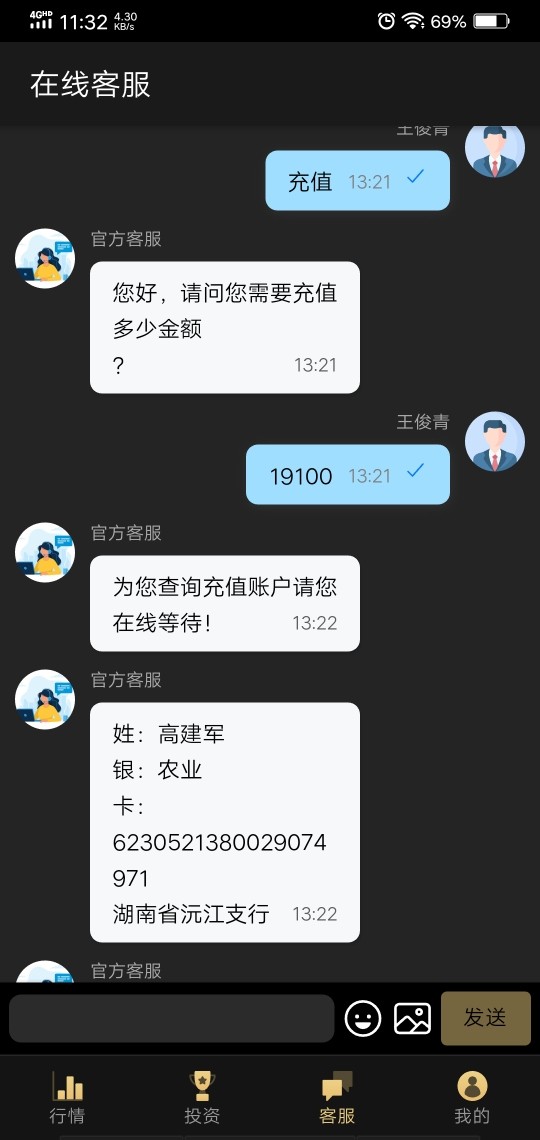

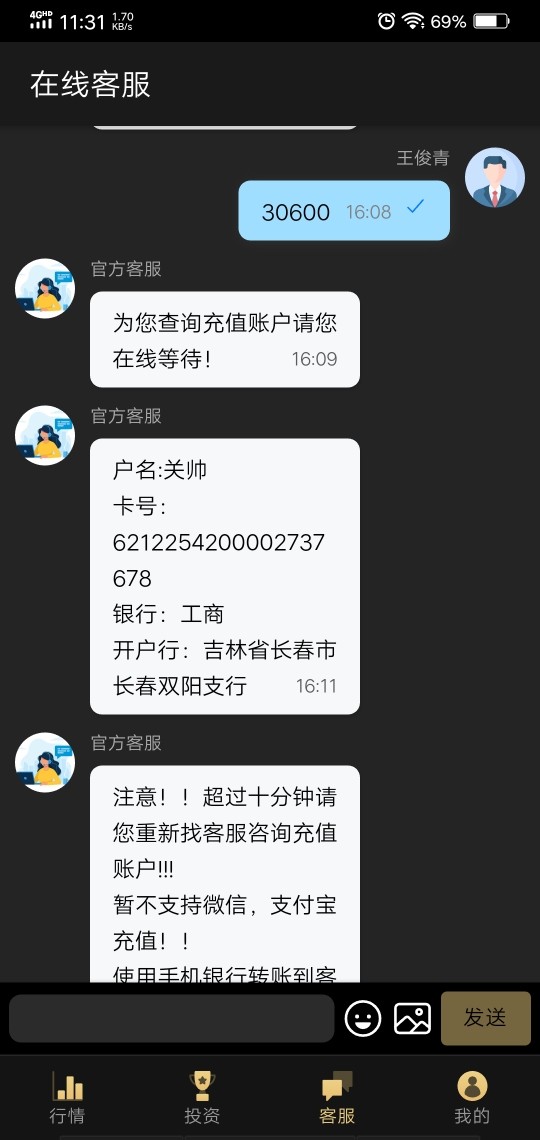

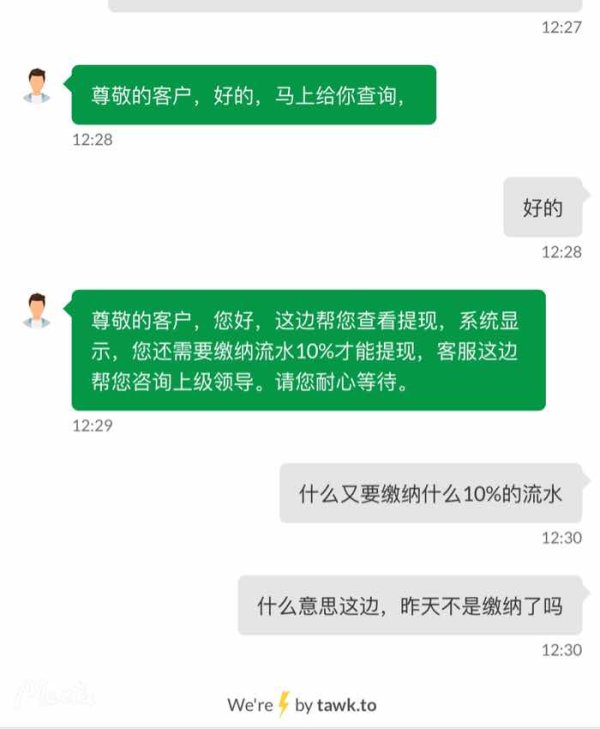

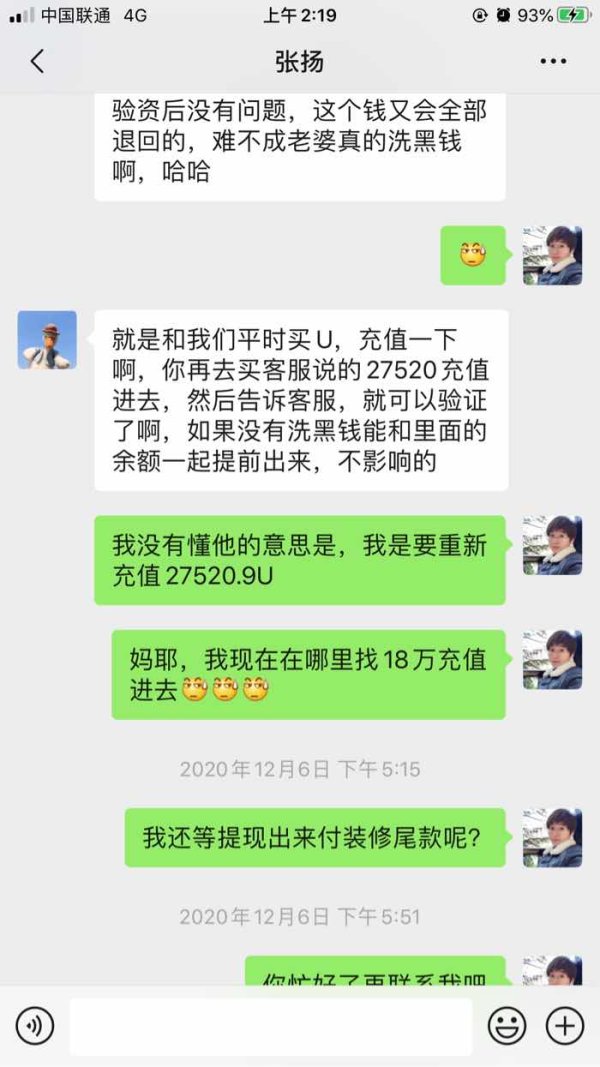

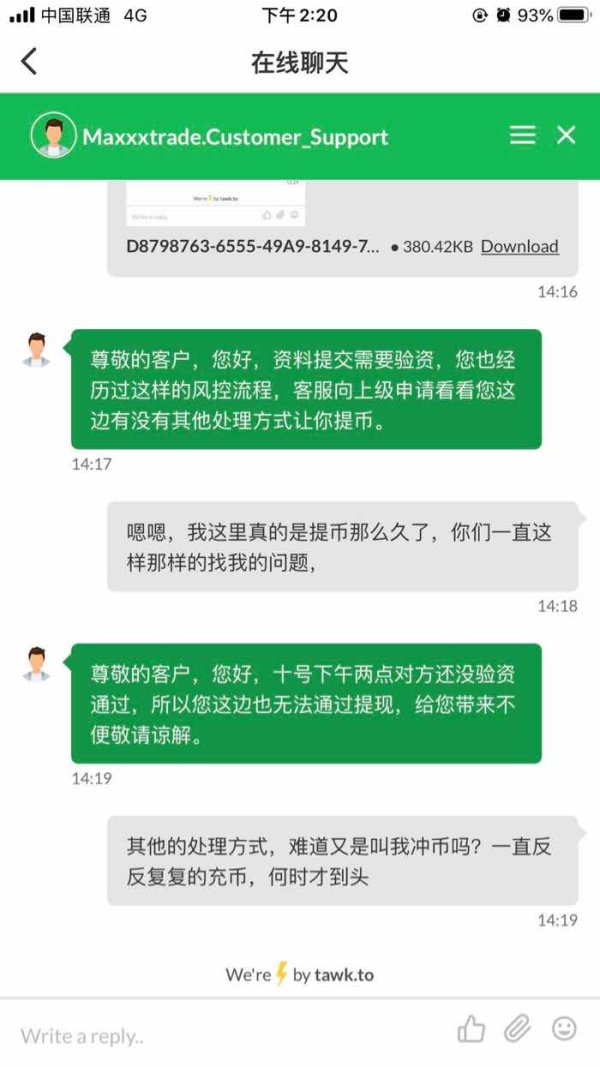

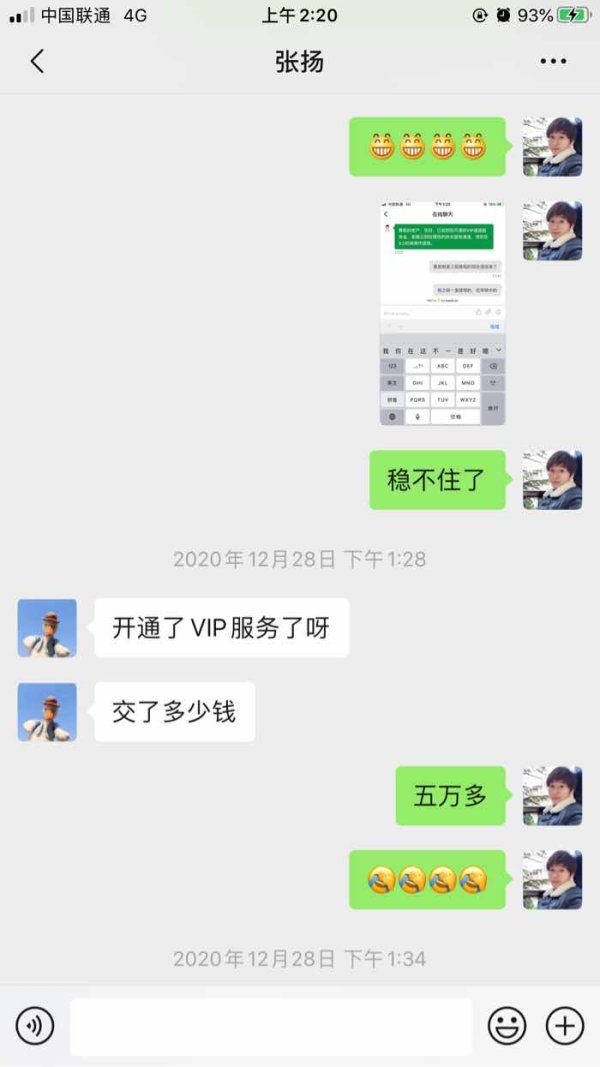

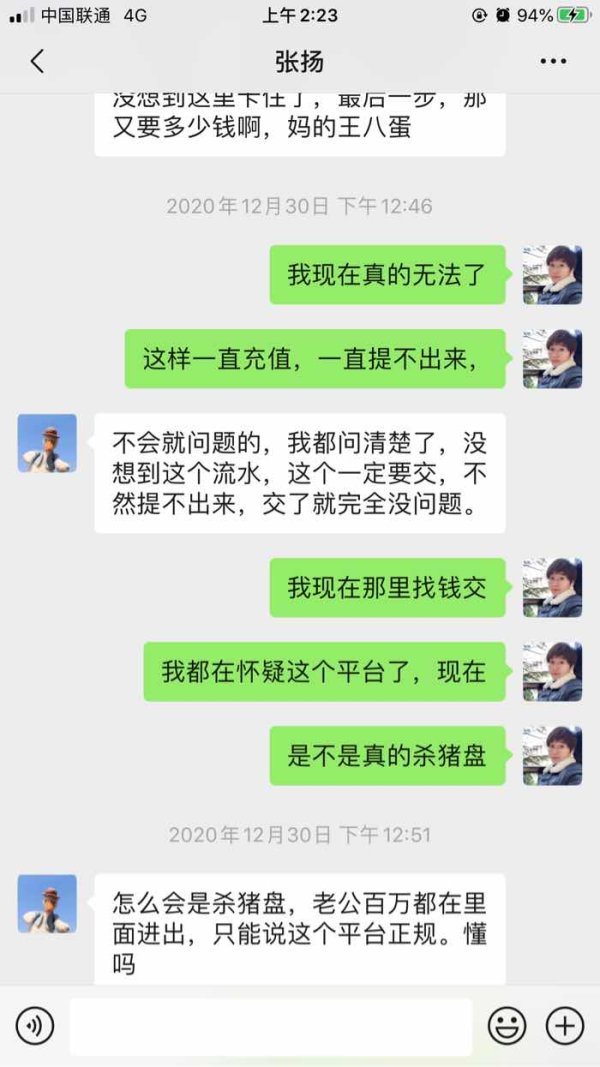

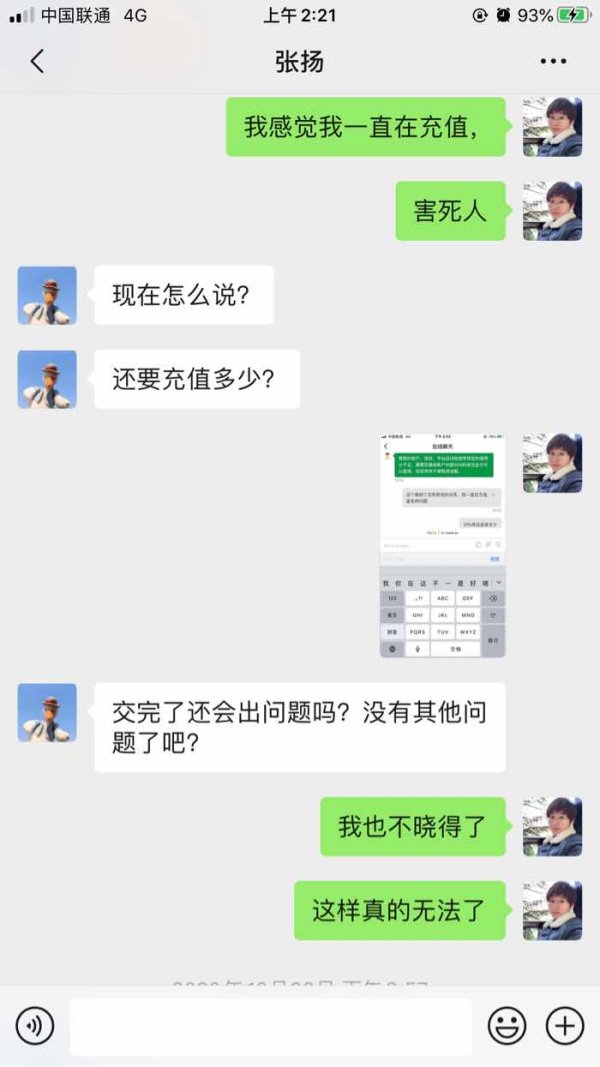

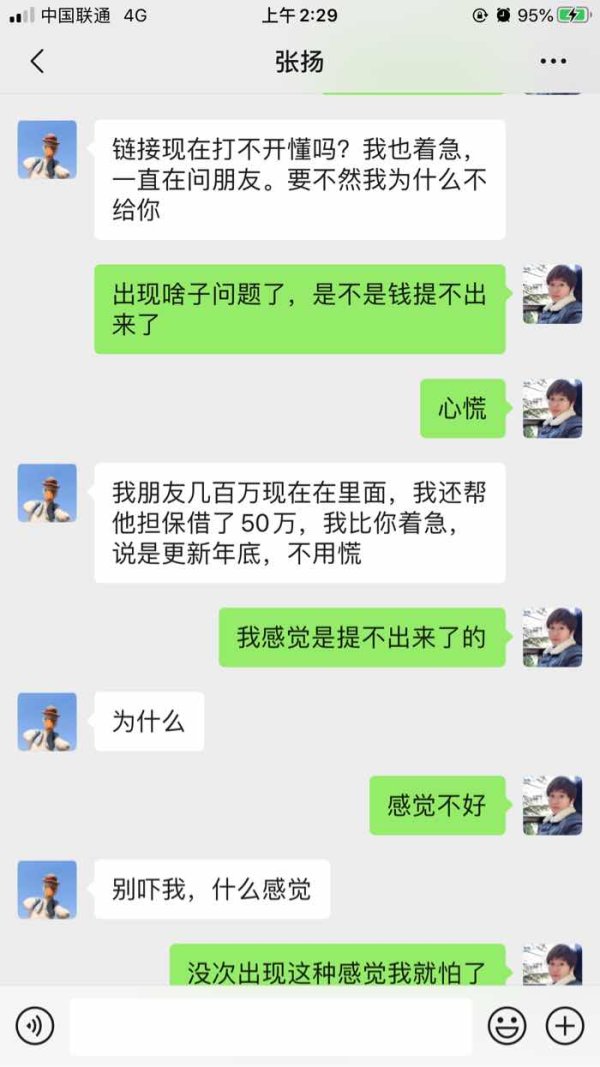

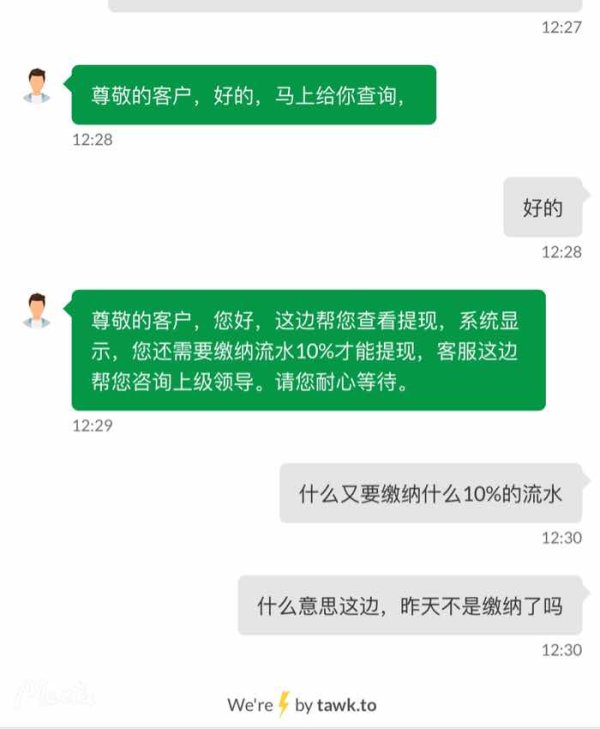

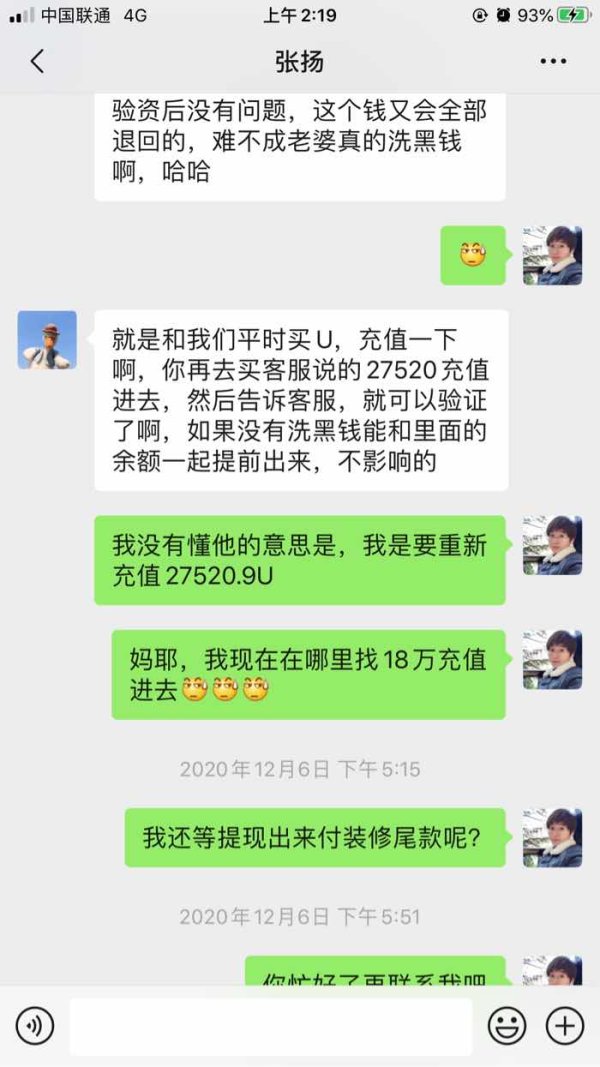

Cheat me of 69,000 yuan. Now I can't withdraw. Lose all

Hope u can help me recover part of my money. Hateful fraud, pay my money back.

MT Forex Broker provides real users with * positive reviews, * neutral reviews and 2 exposure review!

Business

License

Cheat me of 69,000 yuan. Now I can't withdraw. Lose all

Hope u can help me recover part of my money. Hateful fraud, pay my money back.

This comprehensive mt review examines MT as a trading platform and service provider in 2025. MT offers the widely-recognized MetaTrader 4 trading platform, which has become an industry standard for forex trading, but our overall evaluation remains neutral due to limited information about regulatory oversight and comprehensive trading conditions.

The platform's main strength is its use of the MT4 infrastructure. This gives traders access to familiar charting tools, technical indicators, and automated trading capabilities that have made this platform popular among retail investors worldwide. MT also shows competitive pricing strategies in certain product segments, though specific details about trading costs and fee structures need further clarification.

The target audience for MT appears to be retail forex traders, especially those seeking reliable trading platform access and established trading tools. However, potential users should exercise caution and conduct thorough research, as critical information about regulatory compliance, customer protection measures, and detailed trading conditions remains unclear in available documentation.

This mt review is based on currently available information and may not cover all aspects of the user experience. Due to the absence of specific regulatory information in available sources, traders are strongly advised to independently verify the regulatory status and compliance measures before engaging with the platform.

Cross-regional regulatory differences may apply. Users should confirm the specific regulatory framework governing their jurisdiction. The evaluation methodology in this review relies on publicly available information, which may not reflect the complete operational picture or recent developments in the company's service offerings.

| Dimension | Score | Rating Basis |

|---|---|---|

| Account Conditions | 5/10 | Limited information available regarding specific account types and requirements |

| Tools and Resources | 7/10 | Provides MT4 platform, a widely-used and established trading tool |

| Customer Service | 5/10 | Customer service quality information not detailed in available sources |

| Trading Experience | 6/10 | MT4 platform stability generally recognized, but lacks specific user feedback |

| Trust Factor | 4/10 | Absence of clear regulatory information reduces overall trust assessment |

| User Experience | 5/10 | Specific user feedback and experience details not available in current sources |

MT operates as a trading service provider offering access to financial markets through the MetaTrader 4 platform. While specific details about the company's establishment date, founding background, and corporate structure are not detailed in available sources, the organization positions itself within the competitive forex and CFD trading landscape.

The company's business model centers around providing market access through proven trading technology. This approach specifically leverages the MT4 platform's established infrastructure. Traders can access familiar trading tools, automated trading capabilities, and comprehensive charting functionalities that have become industry standards.

Available sources do not provide specific information about primary regulatory authorities or compliance frameworks governing MT's operations. This represents a significant information gap that potential users should address through direct inquiry with the company. The absence of clear regulatory information in this mt review highlights the importance of independent verification before committing funds to any trading platform.

The platform appears to serve forex and CFD markets. However, detailed information about specific asset classes, trading instruments, and market coverage requires further clarification from official company sources.

Regulatory Jurisdictions: Available sources do not specify particular regulatory authorities overseeing MT's operations. Potential users must independently verify compliance status.

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and associated fees is not detailed in current documentation.

Minimum Deposit Requirements: Exact minimum deposit amounts for various account types are not specified in available sources.

Bonus and Promotions: Current promotional offerings, welcome bonuses, or ongoing incentive programs are not detailed in accessible information.

Tradeable Assets: The platform appears to focus on forex and CFD markets. However, specific currency pairs, commodities, indices, and other instruments require confirmation from official sources.

Cost Structure: Detailed information about spreads, commission structures, overnight financing charges, and other trading costs is not comprehensively covered in available documentation. This represents a critical information gap for potential users in this mt review.

Leverage Ratios: Specific leverage offerings for different asset classes and account types are not detailed in current sources.

Platform Options: MT provides access to the MetaTrader 4 platform. This offers standard charting tools, technical indicators, and automated trading capabilities.

Regional Restrictions: Information about geographical limitations or restricted jurisdictions is not specified in available sources.

Customer Support Languages: Supported languages for customer service communications are not detailed in current documentation.

The account conditions evaluation for MT reflects the limited information available about specific account types, features, and requirements. Available sources do not detail the variety of account options, minimum deposit requirements, or special account features that might cater to different trader categories.

Potential users face uncertainty about the onboarding process without specific information about account opening procedures, verification requirements, or documentation needed. The absence of details about specialized accounts, such as Islamic accounts for Sharia-compliant trading, further limits the assessment of MT's accommodation for diverse trader needs.

The scoring reflects this information gap. A comprehensive evaluation requires understanding of deposit requirements, account maintenance fees, inactivity charges, and other conditions that directly impact the trader experience. This mt review emphasizes the need for direct communication with MT to clarify these essential account details.

Professional traders seeking multiple account types or specific features may find the lack of detailed information concerning. This becomes particularly relevant when comparing options across different brokers in the competitive forex market.

MT's strength lies in providing access to the MetaTrader 4 platform. This represents a significant advantage in terms of trading tools and resources. The MT4 platform offers comprehensive charting capabilities, extensive technical indicator libraries, and support for automated trading through Expert Advisors.

The platform includes standard features such as multiple timeframe analysis, customizable chart layouts, and one-click trading functionality that experienced forex traders expect. Additionally, MT4's market acceptance means traders can access a vast ecosystem of third-party indicators, trading robots, and analysis tools developed by the global trading community.

However, the evaluation is limited by the absence of information about additional research resources, market analysis, economic calendars, or educational materials that MT might provide beyond the standard MT4 offering. Many competitive brokers supplement platform access with proprietary research, daily market commentary, and educational content.

The scoring acknowledges MT4's proven capabilities. It also recognizes that modern traders often expect comprehensive research and educational support alongside their trading platform access.

Customer service evaluation proves challenging due to the absence of specific information about MT's support infrastructure, response times, and service quality measures. Available sources do not detail the communication channels available to clients, such as phone support, live chat, email ticketing systems, or callback services.

The lack of information about customer service hours, multilingual support capabilities, and regional support teams represents a significant gap in assessing MT's commitment to client service. Modern forex traders expect responsive, knowledgeable support, particularly during market hours when trading issues require immediate attention.

This evaluation relies on the general expectation that established brokers should provide adequate customer support infrastructure without specific user feedback about support experiences, resolution times, or service quality. The neutral scoring reflects this information uncertainty rather than any specific service deficiencies.

Potential users should prioritize testing customer service responsiveness and quality before committing significant funds. Reliable support becomes crucial during account issues or technical difficulties.

The trading experience assessment benefits from MT4's established reputation for platform stability and functionality. MetaTrader 4 has demonstrated consistent performance across global markets, offering reliable order execution, minimal downtime, and comprehensive trading tools that support various trading strategies.

The platform's technical capabilities include support for pending orders, stop-loss and take-profit orders, trailing stops, and partial position closures that provide traders with essential risk management tools. Additionally, MT4's charting engine supports multiple timeframes, trend line drawing, and pattern recognition that facilitate technical analysis.

However, this mt review cannot assess specific aspects of MT's trading environment, such as execution speeds, slippage rates, requote frequency, or spread competitiveness, due to limited available data. These factors significantly impact the actual trading experience beyond platform functionality.

The evaluation also lacks information about mobile trading capabilities, platform customization options, or any proprietary enhancements MT might have implemented to improve the standard MT4 experience.

The trust factor evaluation reflects significant concerns due to the absence of clear regulatory information in available sources. Regulatory oversight represents a fundamental aspect of broker trustworthiness, as it provides client protection, dispute resolution mechanisms, and operational standards compliance.

Potential users face uncertainty about their fund security and legal protections without specific details about regulatory licenses, client fund segregation practices, deposit protection schemes, or compliance audits. Established regulatory frameworks typically require brokers to maintain client funds in segregated accounts, provide negative balance protection, and participate in compensation schemes.

The lack of information about MT's corporate transparency, financial reporting, or regulatory compliance history further impacts the trust assessment. Professional traders typically prioritize regulatory status when selecting brokers, as it provides recourse in case of disputes or operational issues.

This scoring emphasizes the critical importance of regulatory verification before engaging with any forex broker. This applies regardless of platform quality or other service aspects.

User experience evaluation remains limited due to the absence of specific user feedback, interface design details, and operational process information in available sources. The assessment cannot address crucial aspects such as account opening efficiency, verification procedures, or fund transfer experiences that significantly impact overall user satisfaction.

The evaluation cannot assess any customizations, improvements, or additional features MT might have implemented to enhance the user experience while MT4's interface is familiar to many traders. Modern traders often expect streamlined onboarding, intuitive account management interfaces, and efficient fund management processes.

The lack of information about common user complaints, satisfaction ratings, or testimonials prevents a comprehensive understanding of the typical client experience. Additionally, details about platform accessibility, mobile app quality, or user interface improvements remain unclear.

This evaluation relies on general expectations rather than actual user experience data without specific feedback about registration processes, document verification efficiency, or withdrawal processing times.

This comprehensive mt review reveals a mixed picture of the trading service provider. MT offers access to the proven MetaTrader 4 platform, which provides solid trading functionality and tools, but significant information gaps about regulatory oversight and detailed trading conditions result in a neutral overall assessment.

The platform appears most suitable for experienced forex traders who prioritize MT4 platform access and are comfortable conducting thorough research about regulatory status and trading conditions. The primary advantage lies in leveraging MT4's established infrastructure, while the main concern centers on the lack of transparent regulatory information.

Potential users should prioritize direct communication with MT to clarify regulatory status, trading conditions, and customer protection measures before making any financial commitments. The absence of comprehensive information in this review underscores the importance of independent verification in the broker selection process.

FX Broker Capital Trading Markets Review