Regarding the legitimacy of MT forex brokers, it provides ASIC and WikiBit, (also has a graphic survey regarding security).

Is MT safe?

Business

License

Is MT markets regulated?

The regulatory license is the strongest proof.

ASIC Inst Forex Execution (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Inst Forex Execution (STP)

Licensed Entity:

MORTGAGE HOUSE CAPITAL PTY LTD

Effective Date: Change Record

2007-08-20Email Address of Licensed Institution:

afcacase@mortgagehouse.com.auSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

L 34 101 MILLER ST NORTH SYDNEY NSW 2060Phone Number of Licensed Institution:

0281161016Licensed Institution Certified Documents:

Is MT Safe A Scam?

Introduction

In the dynamic world of forex trading, MT Safe has emerged as a notable player, attracting both novice and experienced traders alike. Known for its user-friendly platform and diverse trading options, MT Safe positions itself as a viable option for those looking to engage in forex trading. However, as the forex market is rife with scams and unregulated entities, it is crucial for traders to conduct thorough due diligence before selecting a broker. This article aims to provide an objective assessment of MT Safe, analyzing its regulatory status, company background, trading conditions, customer experiences, and overall safety to determine whether it is a scam or a legitimate trading platform.

To ensure a comprehensive evaluation, this investigation employs a multi-faceted approach, combining qualitative assessments with quantitative data. Information was gathered from reputable financial websites, regulatory bodies, and user reviews to form a well-rounded understanding of MT Safe's credibility.

Regulation and Legitimacy

The regulatory environment surrounding a broker is one of the most critical factors in assessing its legitimacy. A regulated broker is typically held to strict standards that protect investor funds and ensure fair trading practices. In the case of MT Safe, the broker's regulatory status is a significant point of concern.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

As illustrated in the table above, MT Safe lacks regulation from any recognized financial authority. This absence of regulatory oversight raises serious questions about the broker's operational integrity and the safety of client funds. Without a regulatory framework, traders are left vulnerable to potential fraud and unfair trading practices. Furthermore, the lack of a verified license indicates that MT Safe may not adhere to industry standards, making it a risky choice for traders seeking a secure trading environment.

The importance of regulation cannot be overstated; it serves as a safety net for traders in the event of disputes or financial discrepancies. Regulators enforce rules regarding client fund segregation, transparent pricing, and the provision of accurate information. Without such oversight, MT Safe's operations could be deemed questionable, leading to potential scams or unethical conduct.

Company Background Investigation

Understanding the company behind a trading platform is essential in evaluating its credibility. MT Safe's history, ownership structure, and transparency levels play a vital role in determining whether it is a trustworthy broker. Unfortunately, information regarding MT Safe's origins and corporate governance is sparse.

The lack of a clear company history raises red flags, as reputable brokers typically provide detailed information about their establishment, ownership, and mission. Additionally, the absence of a publicly available management team profile further complicates the assessment of MT Safe's reliability. A strong management team with relevant industry experience is often indicative of a broker's commitment to ethical practices and customer service.

Moreover, transparency is a key factor in assessing a broker's legitimacy. Traders should have access to comprehensive information about the company's operations, including its financial health, compliance history, and any past legal issues. The lack of such disclosures from MT Safe suggests a worrying level of opacity, which can be a common trait among scam brokers.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's experience and profitability. MT Safe's overall fee structure and trading costs warrant close examination to determine whether they align with industry standards.

| Fee Type | MT Safe | Industry Average |

|---|---|---|

| Spread on Major Pairs | TBD | 1.0 pips |

| Commission Model | TBD | $5 per lot |

| Overnight Interest Range | TBD | 0.5% - 2% |

As shown in the table, MT Safe's specific fees are currently undetermined, making it difficult to compare them directly with industry averages. However, it is essential to note that traders should be wary of any unusual or hidden fees that could erode their profits. Common complaints among traders often include unexpected charges, high spreads, and unfavorable commission structures.

A transparent fee structure is crucial for traders to make informed decisions. If MT Safe employs complex or opaque pricing policies, it could indicate an attempt to exploit traders, further solidifying concerns about its legitimacy.

Customer Funds Security

The security of customer funds is paramount when evaluating any trading platform. MT Safe's measures for safeguarding client deposits must be scrutinized to assess the overall safety of the trading environment.

MT Safe's approach to fund security has not been explicitly detailed, which raises concerns. Traders should expect to see clear policies regarding fund segregation, investor protection mechanisms, and negative balance protection. Without these safeguards, traders risk losing their entire investment in the event of financial mismanagement or a broker's insolvency.

Historically, many unregulated brokers have faced allegations of misappropriating client funds, leading to significant losses for traders. The absence of a robust framework for fund security at MT Safe could expose clients to similar risks, making it essential for potential users to consider alternative, more secure options.

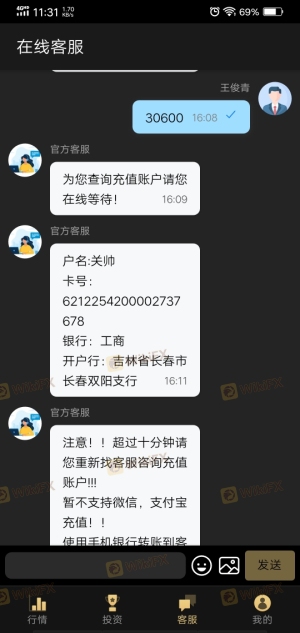

Customer Experience and Complaints

Analyzing customer feedback and experiences is crucial in understanding the overall reliability of a broker. For MT Safe, user reviews are varied, with some praising its platform while others express dissatisfaction.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Average |

| Platform Stability | High | Poor |

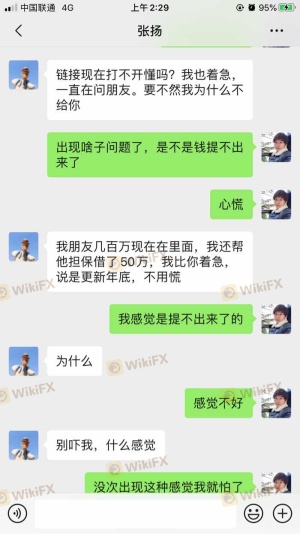

Common complaints about MT Safe include difficulties in withdrawing funds and slow customer support responses. Such issues can significantly impact a trader's experience and raise concerns about the broker's operational integrity.

For instance, one user reported being unable to access their funds for weeks, leading to frustration and distrust. Another trader noted that customer support was often unresponsive, leaving them feeling unsupported during critical trading moments. These complaints highlight potential systemic issues within MT Safe's operations, which could be indicative of a broader pattern of negligence or mismanagement.

Platform and Trade Execution

The performance and reliability of the trading platform are essential factors for any trader. MT Safe's platform must be evaluated for stability, speed, and overall user experience.

Traders have reported mixed experiences with MT Safe's platform, with some praising its user-friendly interface while others have encountered issues with order execution and slippage. High-quality order execution is critical for traders, particularly in the fast-paced forex market. If MT Safe's platform exhibits signs of manipulation or frequent rejections of trades, it could raise further red flags regarding its legitimacy.

Risk Assessment

Engaging with any broker carries inherent risks, and MT Safe is no exception. A comprehensive risk assessment is vital for traders considering this platform.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status |

| Fund Security Risk | High | Lack of clear safeguards |

| Customer Support Risk | Medium | Poor responsiveness |

Given the high-risk levels associated with MT Safe, traders should approach this broker with caution. It is advisable to employ risk mitigation strategies, such as starting with a small investment and closely monitoring trading activities.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that MT Safe may not be a reliable option for forex trading. Its lack of regulation, opaque company background, questionable trading conditions, and negative customer experiences indicate potential scams or unethical practices.

Traders are advised to exercise caution and consider alternative, well-regulated brokers that offer transparent trading conditions, robust customer support, and a proven track record of reliability. Some recommended alternatives include brokers regulated by top-tier authorities such as FCA or ASIC, which provide greater assurance of fund safety and ethical trading practices.

Ultimately, conducting thorough research and remaining vigilant is essential for traders seeking to navigate the forex market safely.

Is MT a scam, or is it legit?

The latest exposure and evaluation content of MT brokers.

MT Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MT latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.