Is leobor safe?

Pros

Cons

Is Leobor Safe or Scam?

Introduction

Leobor is an online trading platform that positions itself within the forex market, claiming to offer a variety of trading instruments and competitive conditions. However, the rise of online trading has led to a proliferation of brokers, making it essential for traders to conduct thorough evaluations before committing their funds. Evaluating the safety and legitimacy of a forex broker like Leobor involves examining regulatory compliance, company background, trading conditions, and customer experiences. This article employs a comprehensive investigative approach, utilizing various sources and reviews to assess whether Leobor is a trustworthy broker or a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is a crucial factor in determining its legitimacy. A regulated broker is required to adhere to strict guidelines that protect clients, including maintaining segregated accounts and ensuring transparency in operations. Unfortunately, Leobor operates without any recognized regulatory oversight. This lack of regulation raises significant concerns regarding the safety of traders' funds and the broker's operational integrity.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation is a red flag, as unregulated brokers can easily manipulate trading conditions, impose unfair fees, or even disappear with clients' funds. Historical compliance records are non-existent for Leobor, which further complicates any claims of legitimacy. Traders are advised to be cautious and consider the risks associated with trading through an unregulated platform.

Company Background Investigation

Leobors history and ownership structure are vital in assessing its credibility. The company claims to have a global presence, but details about its inception, development, and management team are scarce. This lack of transparency often indicates that the broker may not be operating in good faith. Furthermore, the absence of verifiable information about the management team raises questions about their qualifications and experience in the financial sector.

In terms of corporate transparency, Leobor falls short. The lack of clear information about its operational practices and management can be alarming for potential investors. Without knowing who is behind the broker and their track record, traders are left vulnerable to potential scams. The absence of a physical address or verifiable contact information only compounds these concerns.

Trading Conditions Analysis

When evaluating Leobor, its essential to consider the trading conditions it offers. Competitive trading conditions can significantly impact a trader's profitability. However, Leobor's fee structure appears to be less favorable compared to industry standards.

| Fee Type | Leobor | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 pips |

| Commission Model | N/A | $5 per lot |

| Overnight Interest Range | N/A | 2-3% |

The spreads offered by Leobor are higher than average, which could erode potential profits for traders. Additionally, the lack of a clear commission structure can lead to unexpected costs, making it difficult for traders to assess their actual trading expenses. This opacity in fees is concerning, as it may indicate hidden charges that could further disadvantage traders.

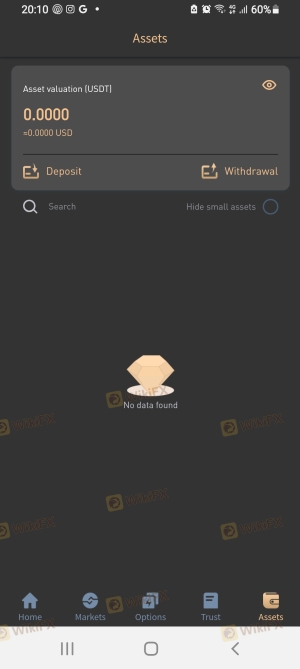

Client Fund Safety

The safety of client funds is paramount when choosing a forex broker. Leobor's lack of regulatory oversight means that it is not required to maintain segregated accounts or provide investor protection. This raises significant concerns about the security of funds deposited with the broker.

Leobor does not appear to offer any robust safety measures, such as negative balance protection or insurance for client funds. Moreover, there have been no documented incidents of fund security breaches, but the absence of guarantees means that clients could potentially lose their entire investment. Traders must consider these risks seriously before deciding to invest with Leobor.

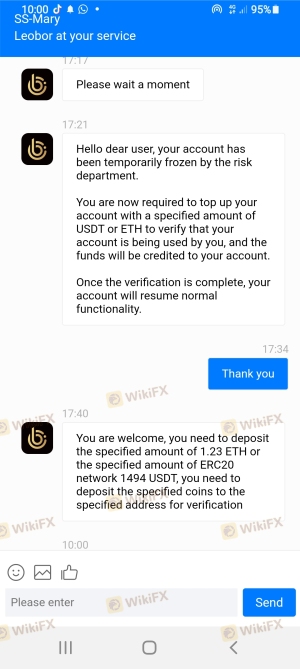

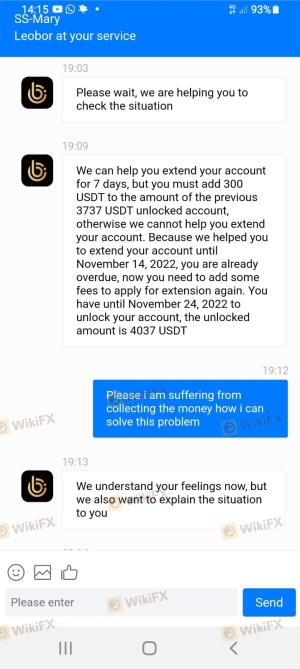

Customer Experience and Complaints

Analyzing customer feedback is crucial in evaluating the overall performance and reliability of a broker. Reviews and testimonials about Leobor reveal a pattern of negative experiences, particularly concerning withdrawal processes and customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Quality | Medium | Inadequate |

Common complaints include difficulties in withdrawing funds, where clients report delays and excuses from the broker. Furthermore, the quality of customer support has been criticized, with many users describing it as unresponsive or dismissive. These issues highlight significant concerns regarding Leobor's operational integrity, leading to questions about its overall reliability.

Platform and Trade Execution

The trading platform used by Leobor is another critical aspect to assess. A reliable platform should offer stability, user-friendly interfaces, and efficient trade execution. However, there have been mixed reviews regarding Leobor's platform performance.

Users have reported instances of slippage and delays in order execution, which can significantly affect trading outcomes. Additionally, there are concerns regarding the potential for platform manipulation, which could further jeopardize traders' investments. Such issues are particularly concerning for traders who rely on timely execution for their strategies.

Risk Assessment

When considering whether Leobor is safe or a scam, it is important to evaluate the overall risk associated with using this broker. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated, no oversight |

| Financial Risk | High | Lack of fund protection |

| Operational Risk | Medium | Complaints about execution and support |

| Transparency Risk | High | Limited information about the company |

To mitigate these risks, it is advisable for potential traders to conduct thorough research and consider alternative brokers that are regulated and have a proven track record.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that Leobor poses significant risks to traders. The lack of regulation, transparency, and poor customer feedback collectively indicate that Leobor is not a safe trading environment. Potential investors should exercise extreme caution and consider alternative options that offer regulatory oversight and better client protection.

For traders seeking reliable alternatives, consider brokers that are regulated by reputable authorities such as the FCA or ASIC. These brokers typically provide a safer trading environment with better support and transparency. Ultimately, the safety of your funds should be the top priority when selecting a forex broker.

In summary, is Leobor safe? The overwhelming evidence suggests it is not. Traders are encouraged to remain vigilant and prioritize their financial security by choosing regulated and reputable brokers.

Is leobor a scam, or is it legit?

The latest exposure and evaluation content of leobor brokers.

leobor Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

leobor latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.