ILimits Invest 2025 Review: Everything You Need to Know

Executive Summary

ILimits Invest operates as an offshore broker. It has gained attention in the forex trading community, though not for good reasons. This ilimits invest review shows concerning facts about a broker that is registered in New Zealand but lacks proper oversight. Traders usually expect better regulation from good financial companies. The company clearly states on its website that its registration "does not mean that iLimits Invest is subject to active regulation or oversight by a New Zealand regulator."

The broker's offshore status creates big risks for clients. It does not have meaningful regulatory supervision. According to multiple industry sources, ILimits Invest has been flagged for safety concerns. Some platforms question whether it operates as a real brokerage or poses scam risks to traders. The limited information about trading conditions and fees makes these concerns worse. This broker targets traders who accept higher risks for offshore trading advantages. However, such benefits remain unclear given the lack of clear information about the company's services.

Important Disclaimers

ILimits Invest maintains registration in New Zealand through the Financial Service Providers Register. This registration should not be confused with active regulatory oversight. The company clearly states that its New Zealand registration does not subject it to supervision by New Zealand financial regulators. This difference is important for traders to understand. Registration and regulation represent very different levels of consumer protection and operational standards.

This review is based on publicly available information and user feedback from various industry platforms. However, the limited transparency around ILimits Invest's operations means that some aspects of their service may not be fully documented. Independent sources cannot verify all information.

Rating Framework

Broker Overview

ILimits Invest operates under iLimits Invest Limited Liability Company. It maintains incorporation in New Zealand and registration under the Financial Service Providers Register. Despite this formal registration, the company's operational transparency remains limited. Minimal publicly available information exists about its founding date, management team, or corporate history. The broker positions itself within the offshore trading space. However, its specific value proposition and target market strategy are not clearly stated through available public communications.

The company's business model appears focused on forex trading services. Complete details about asset offerings, trading platforms, and service features are notably absent from readily accessible sources. This lack of transparency extends to basic operational aspects that traders typically evaluate when selecting a broker. These include fee structures, minimum deposit requirements, and available trading tools. According to industry analysis platforms, ILimits Invest's web traffic data shows minimal engagement metrics. Average visit durations are virtually zero, suggesting limited user interaction with the company's online presence.

The broker's offshore status places it outside the regulatory frameworks that govern most established forex brokers. This potentially appeals to traders seeking alternatives to traditional regulated environments. However, this positioning also eliminates many of the consumer protections and operational standards that regulated brokers must maintain. It creates a risk-reward dynamic that heavily favors risk over security for potential clients.

Regulatory Status: ILimits Invest maintains registration in New Zealand but explicitly states it is not subject to active regulatory oversight. This positions it as an unregulated offshore entity.

Deposit and Withdrawal Methods: Specific information about accepted payment methods, processing times, and associated fees is not detailed in available public sources.

Minimum Deposit Requirements: The company has not publicly disclosed minimum deposit amounts or account funding requirements through accessible channels.

Promotional Offers: No information about bonuses, promotional campaigns, or special offers appears in available documentation about the broker's services.

Tradeable Assets: The broker appears to focus primarily on forex trading. However, the complete range of available currency pairs and other potential instruments remains unspecified.

Cost Structure: Critical pricing information including spreads, commissions, overnight fees, and other trading costs is not transparently disclosed in public materials.

Leverage Ratios: Maximum leverage offerings and leverage policies for different account types or client categories are not specified in available sources.

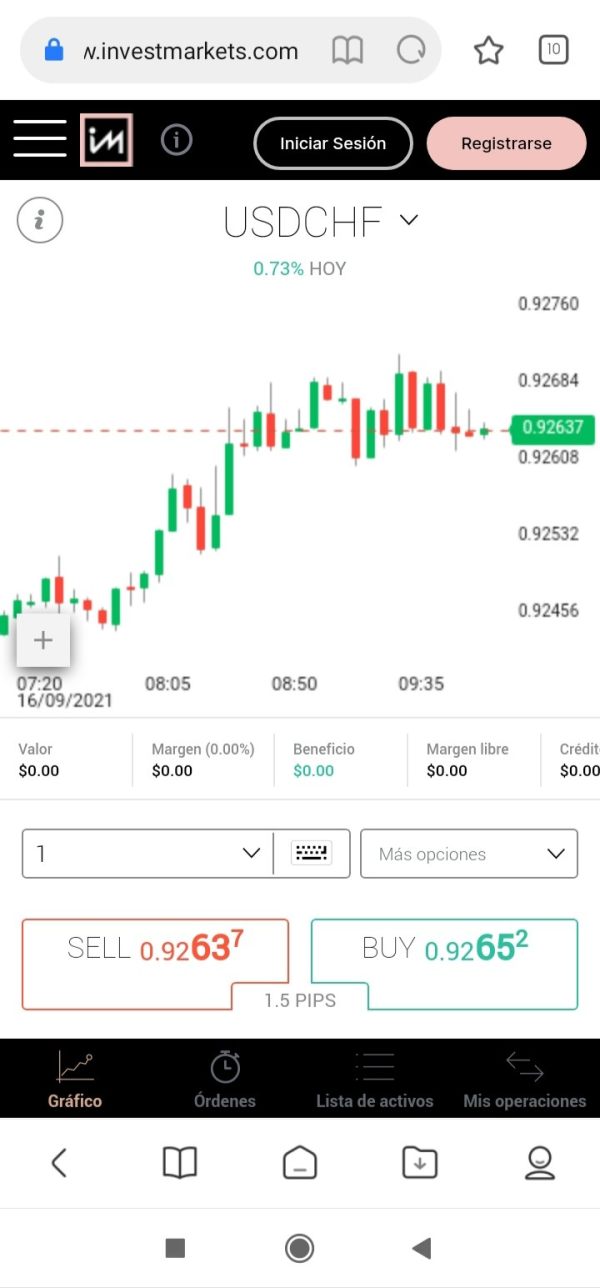

Platform Options: Details about trading platforms, whether proprietary or third-party solutions like MetaTrader, are not clearly documented in accessible information.

Geographic Restrictions: The broker has not published clear information about which jurisdictions it serves or excludes from its client base.

Customer Support Languages: While English support is indicated, the full range of supported languages for customer service remains unclear.

This comprehensive ilimits invest review reveals significant gaps in publicly available information about essential trading conditions. Informed traders typically require this information before making broker selection decisions.

Account Conditions Analysis

The evaluation of ILimits Invest's account conditions reveals substantial information gaps. These gaps significantly impact the assessment process. Unlike established brokers that transparently publish account specifications, trading conditions, and fee structures, ILimits Invest provides minimal detail about its account offerings through publicly accessible channels. This lack of transparency immediately raises concerns about the broker's commitment to client transparency and industry best practices.

Available sources do not specify the types of accounts offered. They do not indicate whether the broker provides different tiers of service or what features distinguish various account categories. The absence of clear minimum deposit requirements makes it impossible for potential clients to understand the financial commitment required to begin trading. Similarly, the lack of published information about account opening procedures, verification requirements, and approval timelines creates uncertainty about the client onboarding experience.

Industry standards typically include detailed disclosures about account features. These include Islamic account availability, demo account access, and special account types for different trader categories. ILimits Invest's failure to provide such information through standard channels suggests either limited account options or concerning transparency practices. This ilimits invest review finds that the broker's approach to account condition disclosure falls well below industry norms. It contributes to the poor rating in this category and raises questions about the overall professionalism of their operations.

The assessment of trading tools and resources available through ILimits Invest reveals perhaps the most concerning aspect of the broker's service offering. Established forex brokers typically provide comprehensive information about their trading platforms, analytical tools, research resources, and educational materials as key differentiators in a competitive market. However, ILimits Invest's public presence contains virtually no information about the tools and resources available to traders.

No details are available regarding the trading platform infrastructure. The broker does not indicate whether it offers popular platforms like MetaTrader 4 or 5, or if they have developed proprietary trading software. The absence of information about charting capabilities, technical analysis tools, or automated trading support suggests either a very basic service offering or poor communication of available features. Educational resources, market analysis, and research materials that modern traders expect are not evident in the broker's public documentation.

The lack of information about mobile trading capabilities, API access for algorithmic trading, or integration with third-party tools further diminishes the broker's appeal to serious traders. Economic calendar access, news feeds, and market commentary services that enhance trading decisions are not mentioned in available sources. This comprehensive absence of tool and resource information contributes to the very poor rating in this category. It suggests that ILimits Invest may not be equipped to serve traders who require professional-grade trading infrastructure and support materials.

Customer Service and Support Analysis

Customer service quality represents a critical factor in broker evaluation. This is particularly true for offshore entities where regulatory protections may be limited. Unfortunately, the assessment of ILimits Invest's customer support capabilities is hampered by the same transparency issues that affect other aspects of the broker's operations. Available sources provide minimal information about support channels, availability, response times, or service quality standards.

The broker indicates English language support. However, details about additional language options, support hours, or geographic coverage remain unclear. Standard support channels such as phone, email, live chat availability, and response time commitments are not clearly documented in accessible materials. This lack of transparency about customer service capabilities raises concerns about the level of support traders can expect when issues arise.

Professional forex brokers typically provide detailed information about their support infrastructure. This includes dedicated account manager availability, technical support capabilities, and escalation procedures for complex issues. The absence of such information from ILimits Invest's public materials suggests either limited support infrastructure or poor communication practices. Given the broker's offshore status and lack of regulatory oversight, robust customer support becomes even more critical for client confidence. This makes the information gap particularly concerning for potential traders evaluating the broker's services.

Trading Experience Analysis

The evaluation of trading experience with ILimits Invest faces significant challenges. This is due to limited available information about platform functionality, execution quality, and overall trading environment. Professional traders typically evaluate brokers based on platform stability, order execution speed, slippage rates, and overall technological infrastructure. However, the absence of detailed information about ILimits Invest's trading technology makes such assessment difficult.

No specific data is available regarding platform uptime, server locations, execution speeds, or the quality of price feeds provided to traders. The lack of information about order types supported, whether the broker offers market or dealing desk execution, and how they handle order routing raises questions about the sophistication of their trading infrastructure. Mobile trading capabilities, which are essential for modern forex trading, are not documented in available sources.

User feedback about actual trading experiences appears limited. Newer user ratings have greater impact on overall assessments according to industry platforms. The minimal web traffic data and virtually zero average visit duration suggest limited user engagement with the broker's services. Without concrete information about spreads during different market conditions, execution quality during high volatility periods, or platform performance metrics, this ilimits invest review can only highlight the concerning lack of transparency. This characterizes the broker's approach to communicating their trading environment capabilities.

Trust and Safety Analysis

The trust and safety evaluation of ILimits Invest reveals the most significant concerns identified in this comprehensive review. The broker's regulatory status represents the primary issue. The company explicitly acknowledges that its New Zealand registration does not subject it to active regulatory oversight. This admission eliminates many of the consumer protections that traders rely on when working with regulated brokers. These protections include segregated client funds, compensation schemes, and regulatory complaint procedures.

Industry analysis platforms have flagged ILimits Invest for potential safety concerns. Some sources question whether the broker operates legitimately or poses scam risks to traders. The combination of offshore status, minimal regulatory oversight, and limited operational transparency creates a risk profile that significantly exceeds what most traders should accept. The absence of information about client fund protection measures, segregated account policies, or deposit compensation schemes further compounds these concerns.

The broker's minimal web presence and limited user engagement data suggest either a very new operation or one with limited legitimate trading activity. Professional forex brokers typically maintain robust online presences, active user communities, and transparent communication about their safety measures. ILimits Invest's failure to meet these basic industry standards, combined with explicit warnings from industry sources about potential risks, results in the very poor trust and safety rating assigned in this evaluation.

User Experience Analysis

The user experience evaluation for ILimits Invest is significantly impacted by the limited feedback available from actual users. The minimal digital footprint the broker maintains across industry platforms also affects this evaluation. Available data suggests extremely low user engagement, with web traffic analysis showing virtually zero average visit duration and minimal overall traffic to broker-associated websites. This pattern typically indicates either a very new operation or one that fails to retain user interest.

The absence of detailed user reviews, testimonials, or feedback about the registration process, platform usability, and overall service experience makes it difficult to assess the practical aspects of working with this broker. Industry platforms note that newer user ratings have greater impact on overall assessments. However, the scarcity of such ratings for ILimits Invest suggests limited active user base or engagement.

Standard user experience factors such as website design quality, account opening process efficiency, platform learning curve, and overall service accessibility cannot be properly evaluated due to information limitations. The broker's target audience appears to be traders willing to accept higher risks for potential offshore advantages. However, the specific benefits offered remain unclear. The poor user experience rating reflects both the limited available feedback and the concerning lack of transparency that characterizes the broker's overall approach to client communication and service delivery.

Conclusion

This comprehensive ilimits invest review reveals a broker that presents significant risks and limitations. These make it unsuitable for most forex traders. The combination of offshore status, lack of regulatory oversight, minimal transparency about trading conditions, and industry warnings about potential safety concerns creates a risk profile that heavily favors caution over engagement.

ILimits Invest may appeal only to a very specific subset of traders who prioritize offshore access over safety and transparency. However, even for risk-tolerant traders, the lack of clear information about services, costs, and trading conditions makes informed decision-making nearly impossible. The broker's explicit admission that it operates without regulatory oversight, combined with poor ratings across all evaluation categories, suggests that traders would be better served by exploring regulated alternatives. These alternatives provide greater transparency, consumer protection, and operational clarity.

For the vast majority of forex traders seeking reliable, transparent, and professionally operated brokerage services, ILimits Invest does not meet the basic standards expected in today's competitive forex market.