CDG Global 2025 Review: Everything You Need to Know

Executive Summary

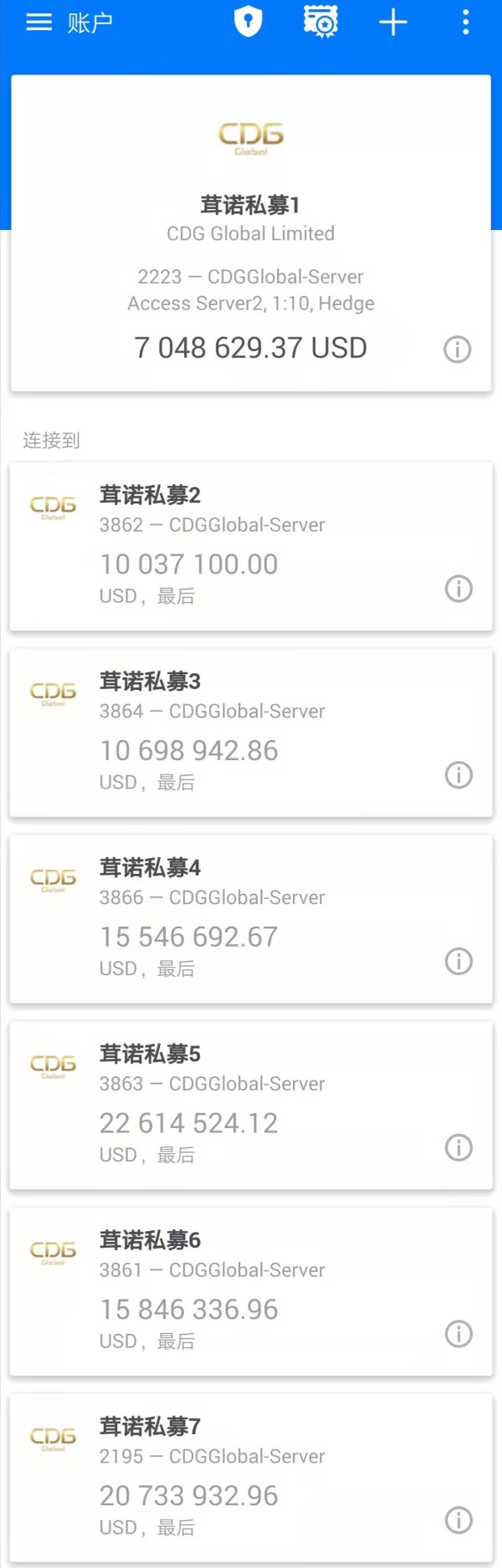

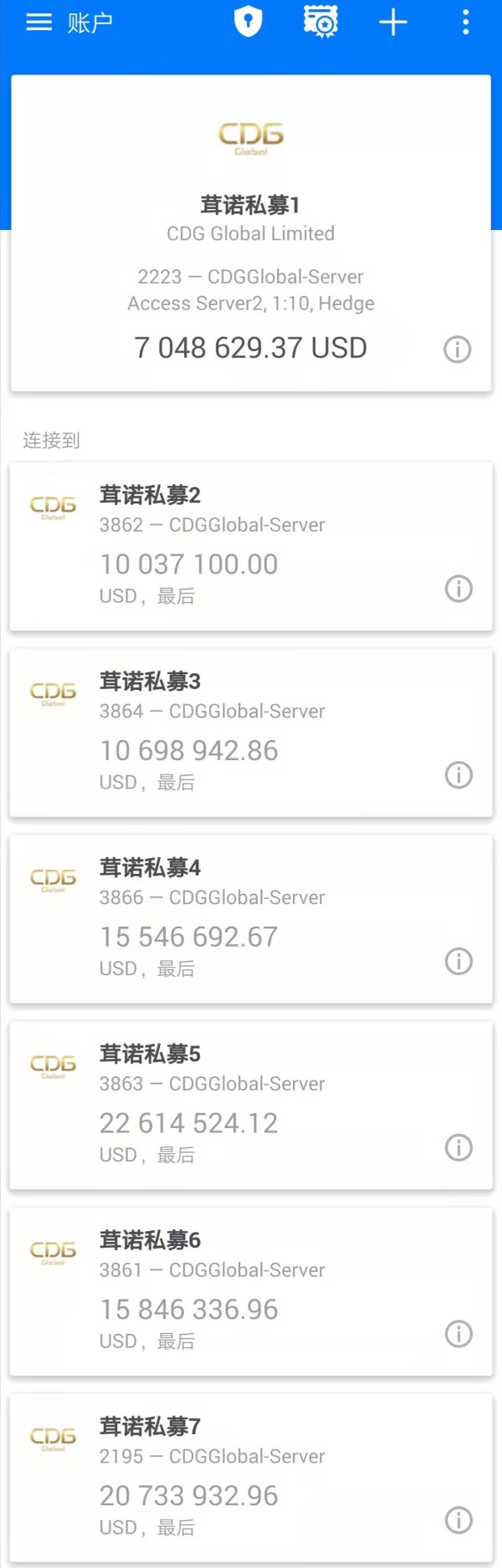

CDG Global presents itself as a fast-growing boutique forex broker. The company focuses on B2B and institutional market segments. This cdg global review reveals a mixed picture of a broker that shows potential but raises certain concerns among traders.

The company is registered in Saint Vincent and the Grenadines and claims authorization from multiple regulatory bodies including ASIC and LFSA. It positions itself as an international investment service boutique. The broker specializes in forex, metals, and stocks trading.

It targets experienced traders and institutional investors rather than retail beginners. While CDG Global's team consists of seasoned forex industry professionals with extensive cross-regional experience, user feedback suggests moderate satisfaction levels.

The company's offshore nature and limited transparency in key operational areas contribute to cautious sentiment among potential clients. CDG Global's approach to the market emphasizes bringing "a new ERA to the Financial Industry." However, concrete evidence of revolutionary changes remains limited.

The broker's institutional focus may explain the lack of comprehensive retail-oriented features and educational resources that many individual traders expect from modern forex brokers.

Important Notice

CDG Global operates as an offshore broker. This inherently differs from brokers regulated in major financial jurisdictions. Potential clients should carefully evaluate the implications of dealing with an offshore entity, including differences in regulatory protection, dispute resolution mechanisms, and operational transparency.

The broker's regulatory status and operational model may vary significantly from brokers in other regions. This requires thorough due diligence from prospective users. This review is based on publicly available information and user feedback available at the time of writing.

Market conditions, regulatory requirements, and broker policies may change. Readers should verify current information directly with the broker before making any trading decisions.

Rating Overview

Broker Overview

CDG Global positions itself as a boutique investment service provider with international presence. However, specific founding details remain unclear from available information. The company emphasizes its team's extensive experience in the forex industry and claims to bring innovative approaches to financial services.

The broker's actual operational history and track record in the industry are not well-documented in public sources. The broker's business model centers on serving B2B clients and institutional investors. This may explain the limited retail-focused features and marketing materials.

CDG Global offers trading in forex, metals, and stocks. It utilizes market execution for order processing. The company accepts deposits in USD and EUR, with margin call levels set at 50% and stop-out levels at 20%.

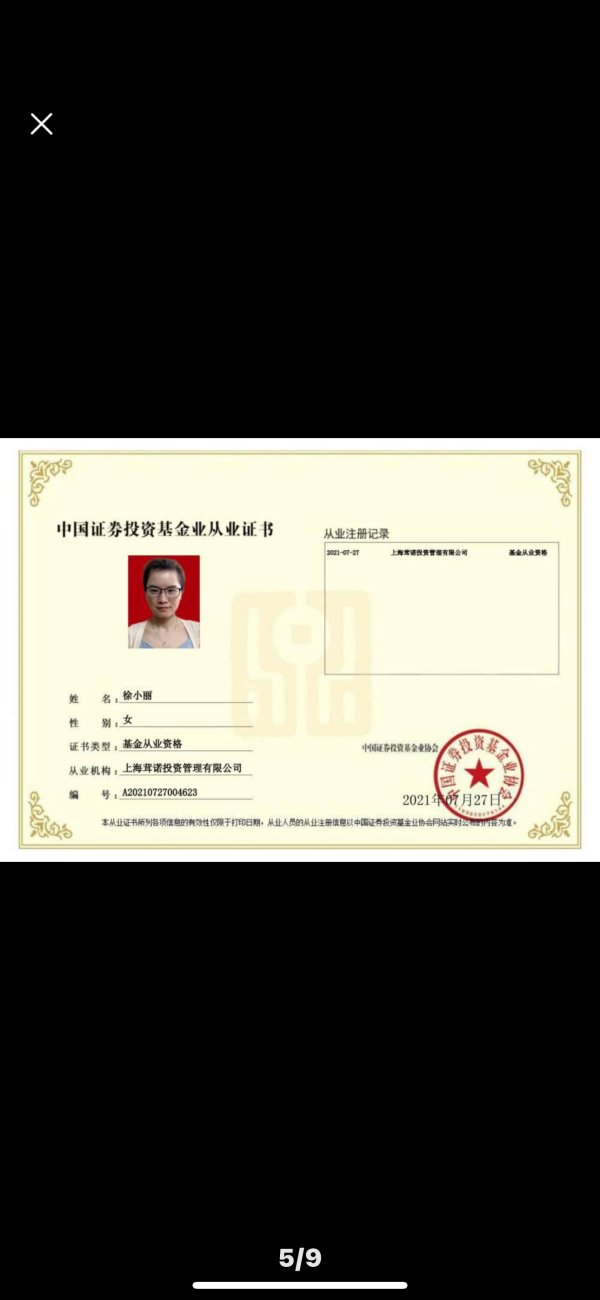

According to available information, CDG Global operates under regulatory oversight from ASIC and LFSA. However, the specific license numbers and regulatory details are not clearly published. This cdg global review finds that the broker's regulatory transparency could be improved to better serve client confidence and trust.

Regulatory Jurisdiction

CDG Global is registered in Saint Vincent and the Grenadines. It claims authorization from ASIC and LFSA. However, specific license numbers and detailed regulatory information are not readily available in public sources.

Deposit and Withdrawal Methods

Specific information about deposit and withdrawal methods is not detailed in available sources. The broker accepts USD and EUR as account currencies. However, the actual payment processors, minimum deposit requirements, and processing times are not clearly specified.

Minimum Deposit Requirements

Available information does not specify minimum deposit requirements for different account types. This lack of transparency in basic account opening requirements may concern potential clients seeking clear cost structures.

No specific information about bonuses, promotions, or incentive programs is available in the reviewed sources. The broker may not offer traditional retail-focused promotional campaigns. This is consistent with its institutional market focus.

Available Trading Instruments

CDG Global offers trading in three main asset categories: forex pairs, metals, and stocks. The exact number of instruments in each category and specific trading conditions for different asset classes are not detailed in available information.

Cost Structure

Detailed information about spreads, commissions, and other trading costs is not specified in available sources. The broker uses market execution, which typically involves variable spreads. However, specific cost examples are not provided.

Leverage Options

Leverage ratios offered by CDG Global are not specified in available information. This represents a significant information gap for potential traders evaluating the broker's competitiveness.

The specific trading platforms offered by CDG Global are not detailed in available sources. However, the broker likely provides standard industry platforms given its institutional focus.

Geographic Restrictions

Information about geographic restrictions or jurisdictional limitations is not available in reviewed sources.

Customer Support Languages

Available customer support languages are not specified in the reviewed information.

This cdg global review highlights significant information gaps that potential clients should address directly with the broker before proceeding with account opening.

Account Conditions Analysis

CDG Global's account conditions present a mixed picture with some reasonable features but significant information gaps. The broker sets margin call levels at 50% and stop-out levels at 20%. These are standard industry practices that provide reasonable risk management for traders.

These levels offer adequate protection against excessive losses while allowing for reasonable market fluctuations. However, the lack of detailed information about account types, minimum deposit requirements, and specific account features creates uncertainty for potential clients.

Most reputable brokers provide clear account tier structures with varying features and requirements. CDG Global's account offerings are not well-documented in available sources. The broker accepts USD and EUR as account currencies, providing some flexibility for international clients.

However, the absence of information about Islamic accounts, demo account availability, and special account features limits the broker's appeal to diverse trading communities. The account opening process complexity and required documentation are not specified. This makes it difficult for potential clients to prepare for the onboarding experience.

This cdg global review finds that the broker could significantly improve client confidence by providing more transparent account condition information.

CDG Global's trading tools and resources represent one of the broker's weaker areas based on available information. While the broker offers trading in forex, metals, and stocks, the specific tools provided for market analysis, research, and trading execution are not well-documented.

This lack of transparency suggests either limited tool offerings or poor communication of available resources. The absence of detailed information about market analysis resources, economic calendars, trading signals, or research reports indicates that CDG Global may not prioritize these features.

For a broker targeting institutional clients, this could be less problematic, as institutional traders often rely on their own research and analysis tools. Educational resources appear to be minimal or non-existent based on available information.

Most modern brokers provide comprehensive educational materials, webinars, and trading guides. However, CDG Global's educational offerings are not mentioned in reviewed sources. Automated trading support, including Expert Advisors and algorithmic trading capabilities, is not specifically addressed in available information.

This represents a significant gap for traders who rely on automated strategies. The broker's tool limitations may reflect its institutional focus, where clients typically have sophisticated internal resources and require primarily execution services rather than comprehensive retail trading tools.

Customer Service Analysis

Customer service appears to be a significant weakness for CDG Global based on available information and user feedback patterns. The specific customer service channels, response times, and service quality metrics are not well-documented.

This itself indicates potential service limitations. Available information does not specify the customer support channels offered, such as live chat, email, phone support, or help desk systems.

This lack of transparency about basic service access points creates uncertainty for potential clients who need to understand how they can reach support when needed. Response times and service quality standards are not published. This makes it impossible for potential clients to set appropriate expectations for support interactions.

Professional brokers typically provide clear service level agreements and response time commitments. The absence of information about multilingual support capabilities may limit the broker's appeal to international clients, despite its claimed international presence.

Customer service availability hours are also not specified. This could be problematic for clients in different time zones. User feedback suggests concerns about customer service quality and responsiveness, though specific examples and resolution cases are not detailed in available sources.

This pattern indicates that customer service may be an area requiring significant improvement for CDG Global.

Trading Experience Analysis

CDG Global's trading experience shows some positive aspects, particularly in execution methodology, though many details remain unclear. The broker uses market execution, which typically provides better price transparency and faster order processing compared to dealing desk models.

This execution type generally benefits active traders and those requiring quick order fills. The margin call and stop-out levels provide reasonable risk management parameters that allow for adequate trading flexibility while protecting against excessive losses.

These levels are competitive with industry standards and suggest appropriate risk management policies. However, critical trading experience factors remain unspecified in available information. Platform stability, execution speed, and slippage characteristics are not documented, making it difficult to assess the actual trading environment quality.

For active traders, these factors are crucial for successful trading outcomes. The absence of information about trading platform features, charting tools, and technical analysis capabilities creates uncertainty about the sophistication of the trading environment.

Modern traders expect comprehensive charting packages, multiple timeframes, and extensive technical indicator libraries. Mobile trading capabilities are not mentioned in available sources. This could be a significant limitation for traders who require on-the-go access to their accounts.

This cdg global review finds that while the basic execution framework appears sound, the lack of detailed platform information limits the ability to fully assess the trading experience quality.

Trust and Safety Analysis

Trust and safety considerations present mixed signals for CDG Global, with some positive regulatory claims but concerning transparency gaps. The broker claims authorization from ASIC and LFSA, which are recognized regulatory bodies.

However, specific license numbers and verification details are not readily available for public confirmation. The company's registration in Saint Vincent and the Grenadines, while legal, places it in an offshore jurisdiction with less stringent regulatory oversight compared to major financial centers.

This offshore status contributes to user concerns about trustworthiness and regulatory protection levels. Client fund protection measures, such as segregated accounts, deposit insurance, or compensation schemes, are not detailed in available information.

These protections are crucial for client confidence and are typically prominently featured by reputable brokers. Corporate transparency appears limited, with minimal information available about company financials, management team details, or operational history.

This lack of transparency contrasts with more established brokers who provide comprehensive corporate information. The broker has not received notable industry awards or recognition that would enhance its credibility profile.

Additionally, the handling of any past regulatory issues or client complaints is not documented in available sources. User feedback suggests moderate trust levels, with some clients expressing concerns about the broker's offshore nature and limited transparency.

This pattern indicates that trust-building remains a significant challenge for CDG Global.

User Experience Analysis

User experience with CDG Global appears to be moderate based on available feedback and operational characteristics. The overall user satisfaction level reflects in a TrustScore of 3.69, indicating room for improvement in client satisfaction metrics.

The broker's institutional focus may explain some limitations in retail user experience features. Institutional clients typically have different requirements and expectations compared to individual traders. However, this focus should not excuse basic user experience shortcomings.

Interface design and usability information is not available in reviewed sources. This makes it difficult to assess the quality of user interaction with the broker's systems. Modern traders expect intuitive, responsive interfaces that facilitate efficient trading operations.

The account registration and verification process complexity is not documented. However, user feedback suggests potential concerns about onboarding efficiency. Streamlined registration processes are increasingly important for user satisfaction in the competitive forex market.

Fund operation experiences, including deposit and withdrawal convenience and speed, are not well-documented in available sources. These operations are critical touchpoints for user satisfaction and trust building.

Common user complaints appear to center around concerns about the broker's offshore status and limited transparency rather than specific operational issues. This pattern suggests that addressing transparency and communication could significantly improve user experience.

The broker's target audience of experienced traders and institutional investors may have different user experience expectations. This potentially explains some of the moderate satisfaction levels observed in general user feedback.

Conclusion

CDG Global presents a complex picture as a forex broker with both potential strengths and notable concerns. The broker's institutional focus and claimed regulatory authorizations provide some positive foundation.

However, significant transparency gaps and moderate user satisfaction levels suggest caution is warranted. The broker appears most suitable for experienced traders and institutional investors who can conduct thorough due diligence and may not require extensive retail-focused features.

Individual traders seeking comprehensive educational resources, detailed cost transparency, and robust customer support may find better options elsewhere. Key advantages include market execution methodology, reasonable risk management parameters, and claimed regulatory oversight from recognized authorities.

However, disadvantages include limited transparency in operational details, concerns about offshore status, and apparent weaknesses in customer service and user experience areas. Potential clients should address the significant information gaps identified in this cdg global review directly with the broker before making any commitment.

The lack of detailed information about costs, platforms, and services makes it essential to obtain comprehensive disclosures before proceeding with account opening.