HXPM 2025 Review: Everything You Need to Know

Executive Summary

This hxpm review shows a complete analysis of a forex broker that has gotten mixed attention in the trading community. HXPM calls itself an online forex and CFD broker, offering high leverage up to 1:500 and supporting popular trading platforms including MT4 and their own HX-GTS2 platform. The broker says it provides services for forex and precious metals trading. It targets traders who want high leverage and multiple platform options.

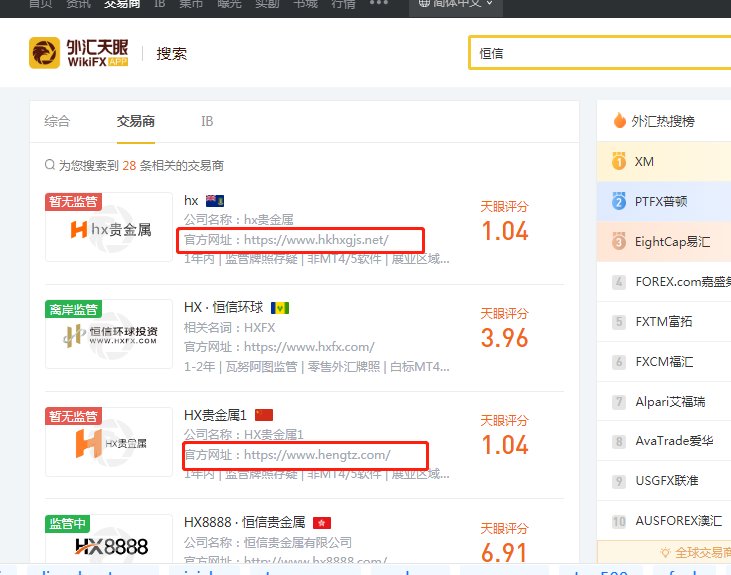

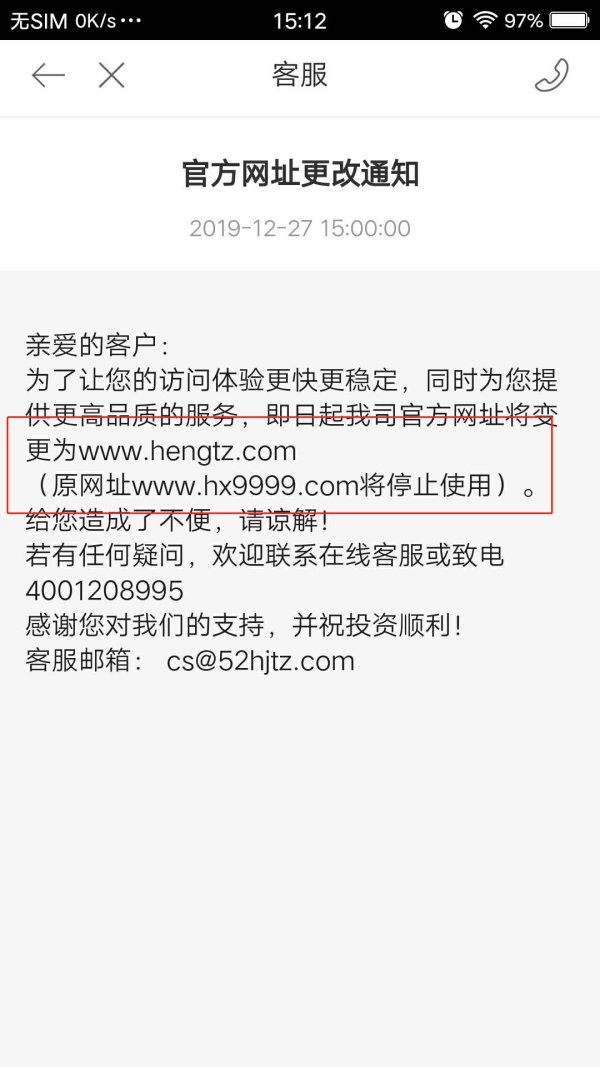

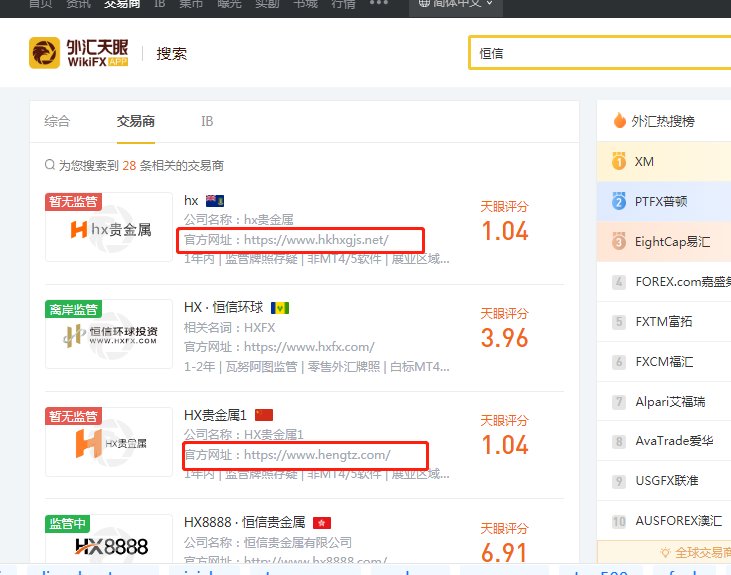

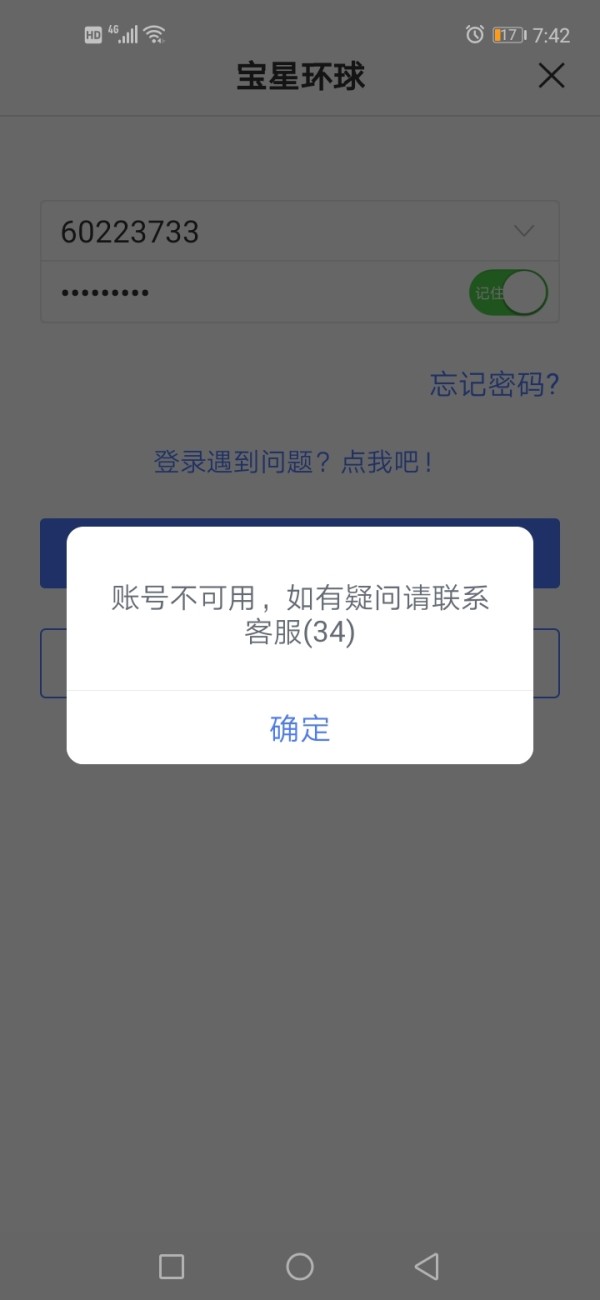

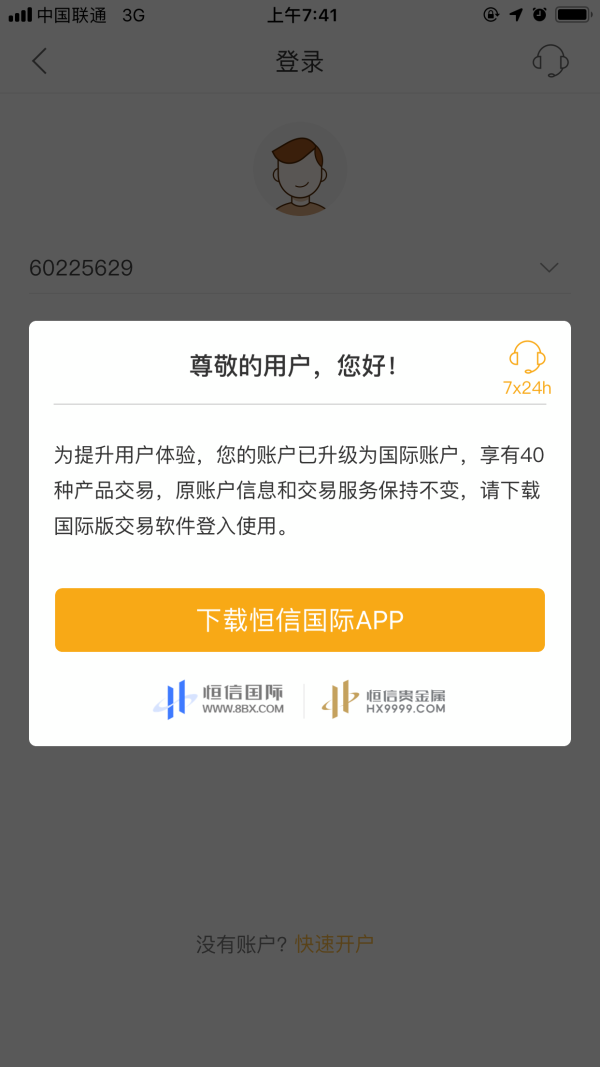

However, our review shows big concerns about HXPM's regulatory status and overall trustworthiness. According to available information, HXPM operates without clear regulatory oversight, which raises red flags about investor protection and fund safety. User feedback shows a mixed picture, with some positive and neutral reviews balanced against concerning exposure reports and high-risk signals. The broker's legitimacy has been questioned. Some sources suggest it may be a potential clone company, which significantly impacts its credibility in the competitive forex market.

For traders considering HXPM, this review provides essential insights into the platform's offerings, limitations, and potential risks to help make informed trading decisions.

Important Disclaimer

Cross-Regional Entity Differences: HXPM has not provided specific regulatory information across different jurisdictions, which may indicate potential compliance issues in various regions. Traders should be particularly cautious about the lack of regulatory transparency. They should verify the broker's legal status in their respective countries before engaging with the platform.

Review Methodology: This evaluation is based on available information summaries and public reports about HXPM. The analysis does not involve actual account usage experience or real-money trading verification. Readers should conduct their own due diligence and consider seeking professional financial advice before making trading decisions.

Rating Framework

Broker Overview

HXPM entered the forex market in 2019. The company established itself as an online forex and CFD broker with headquarters reportedly in Hong Kong. The company positions itself as a service provider for global clients, focusing on forex and precious metals contract trading. Despite its relatively recent establishment, HXPM has attempted to build a presence in the competitive online trading space by offering high leverage options and multiple trading platforms.

The broker's business model centers around providing access to forex and precious metals markets through both established and proprietary trading platforms. HXPM supports the widely popular MetaTrader 4 (MT4) platform alongside their own HX-GTS2 platform. This platform is available across web, PC, and mobile applications. This multi-platform approach aims to cater to different trader preferences and technical requirements.

However, a significant concern in this hxpm review is the lack of clear regulatory information. The broker has not provided specific details about regulatory oversight from recognized financial authorities. This raises questions about compliance standards and investor protection measures. This absence of regulatory transparency is particularly concerning in an industry where regulatory compliance is crucial for trader safety and fund security.

The broker's asset offerings focus primarily on forex currency pairs and precious metals contracts, specifically gold and silver. While this represents a more limited range compared to some competitors, it allows HXPM to concentrate on core forex trading services that appeal to traditional currency traders and precious metals investors.

Regulatory Status: HXPM's regulatory information remains unclear and unspecified in available sources. This lack of regulatory transparency poses significant concerns about the broker's compliance with international financial standards and investor protection protocols. The absence of clear regulatory oversight is a major red flag for potential clients.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods has not been detailed in available sources. This lack of transparency regarding funding options makes it difficult for potential clients to assess the convenience and security of financial transactions with the broker.

Minimum Deposit Requirements: The minimum deposit requirements for opening an account with HXPM are not specified in available information. This makes it challenging for traders to understand the financial commitment required to begin trading with this broker.

Bonuses and Promotions: Available sources do not mention any specific bonus offers or promotional activities provided by HXPM. This may indicate either a conservative approach to marketing or a lack of competitive promotional strategies compared to other brokers in the market.

Available Trading Assets: HXPM offers trading in forex currency pairs and precious metals, specifically gold and silver contracts. While this asset selection covers fundamental trading instruments, it appears more limited compared to brokers offering stocks, indices, cryptocurrencies, and other CFDs.

Cost Structure: Critical information about spreads, commissions, and other trading costs remains unspecified in available sources. This lack of cost transparency makes it extremely difficult for traders to assess the true cost of trading with HXPM and compare it with other brokers in the market.

Leverage Ratios: HXPM offers maximum leverage up to 1:500, which represents a relatively high leverage option that may attract traders seeking significant position sizing capabilities. However, such high leverage also increases trading risks substantially.

Platform Options: The broker supports MT4 and their proprietary HX-GTS2 platform across multiple device types including web browsers, PC applications, and mobile devices. This provides flexibility for different trading preferences and technical requirements.

This comprehensive hxpm review reveals significant information gaps that potential clients should carefully consider before engaging with this broker.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

The account conditions offered by HXPM present several concerning gaps in available information. Unlike established brokers that provide comprehensive details about their account structures, HXPM has not disclosed specific information about account types, their respective features, or the benefits associated with different account tiers. This lack of transparency makes it challenging for potential traders to understand what they can expect from their trading relationship with the broker.

The absence of minimum deposit requirements in publicly available information is particularly problematic. Traders cannot properly plan their initial investment or compare HXPM's accessibility with other brokers in the market. Most reputable brokers clearly outline their minimum deposit requirements across different account types, allowing traders to choose options that match their financial capacity and trading goals.

Furthermore, the account opening process and verification requirements remain unclear based on available sources. Professional brokers typically provide detailed information about documentation requirements, verification timelines, and account activation procedures. The lack of such information raises questions about HXPM's operational transparency and customer onboarding procedures.

Special account features such as Islamic accounts, professional trader accounts, or institutional account options are not mentioned in available sources. This suggests either a limited account structure or inadequate information disclosure. Both of these issues impact the overall assessment of account conditions.

The evaluation of account conditions in this hxpm review is significantly hampered by insufficient publicly available information, resulting in a below-average rating that reflects these transparency concerns.

HXPM demonstrates reasonable strength in its platform and tool offerings. The company supports both the industry-standard MetaTrader 4 platform and their proprietary HX-GTS2 trading system. The MT4 platform brings established functionality that experienced traders expect, including advanced charting capabilities, technical analysis tools, and automated trading support through Expert Advisors. This platform choice shows HXPM's recognition of trader preferences for proven trading technology.

The proprietary HX-GTS2 platform represents an attempt to provide unique trading solutions across web, PC, and mobile environments. Multi-platform accessibility is essential in today's trading environment, where traders need flexibility to monitor and execute trades across different devices and locations. The availability of mobile trading options particularly addresses the growing demand for on-the-go trading capabilities.

However, significant information gaps exist regarding research and analysis resources. Established brokers typically provide market analysis, economic calendars, trading signals, and educational materials to support trader decision-making. The absence of detailed information about such resources in available sources suggests either limited offerings or inadequate communication about available tools.

Educational resources, which are increasingly important for broker differentiation and trader development, are not specifically mentioned in available information. Quality educational content, webinars, tutorials, and market insights are standard offerings from reputable brokers. Their absence or lack of visibility impacts the overall assessment of tools and resources.

The automation trading support capabilities, while likely available through MT4, are not specifically detailed in terms of HXPM's approach to algorithmic trading, copy trading, or other automated strategies that modern traders often seek.

Customer Service and Support Analysis (5/10)

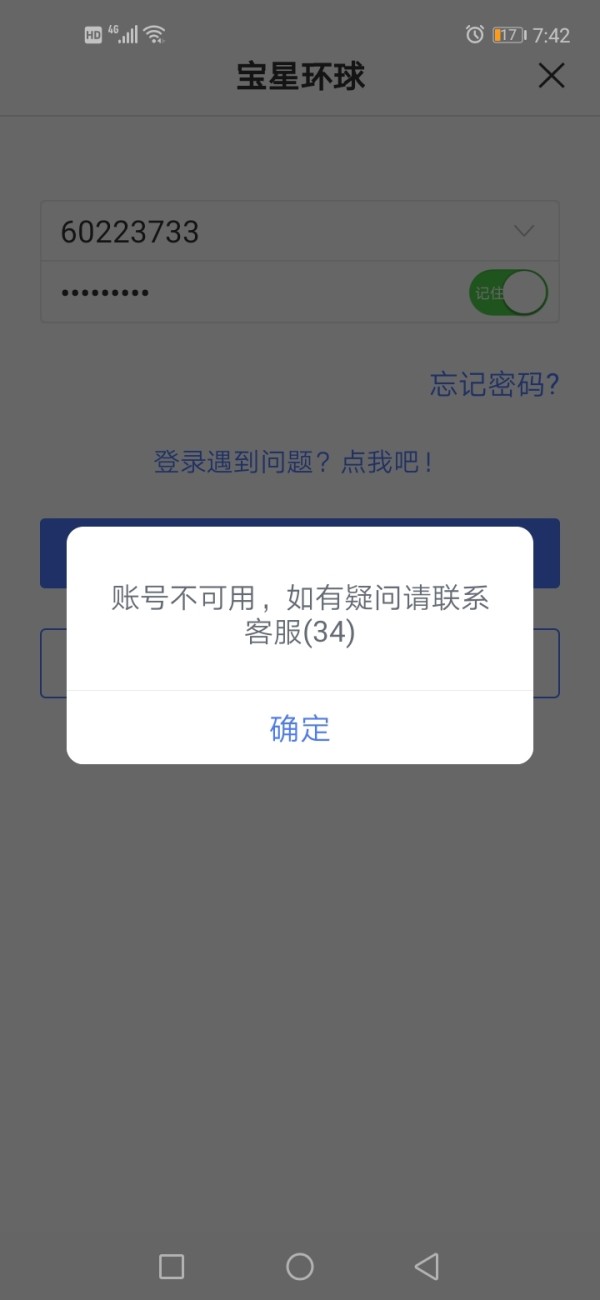

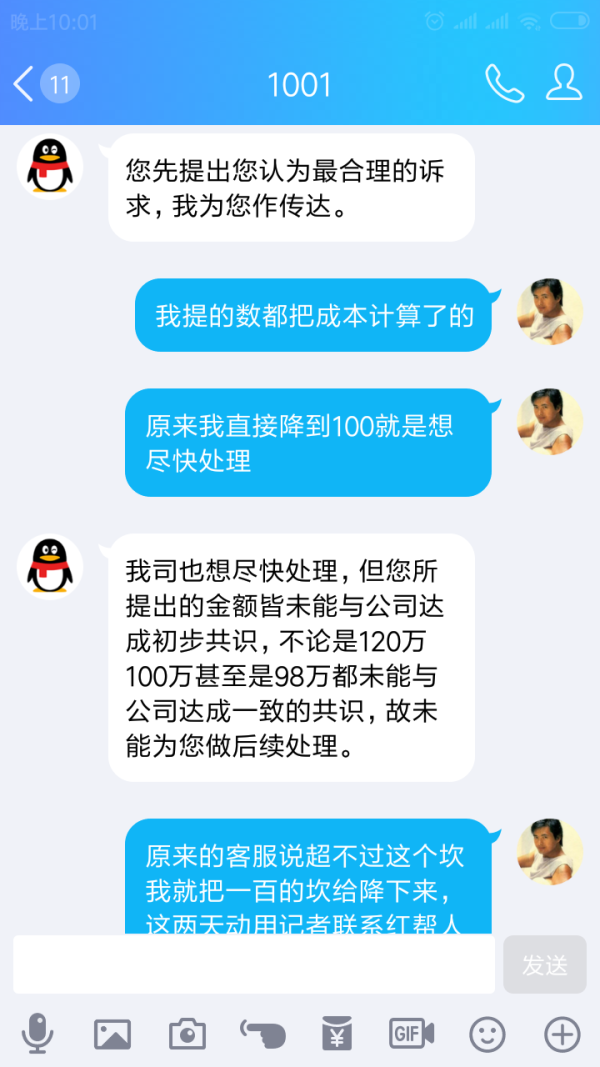

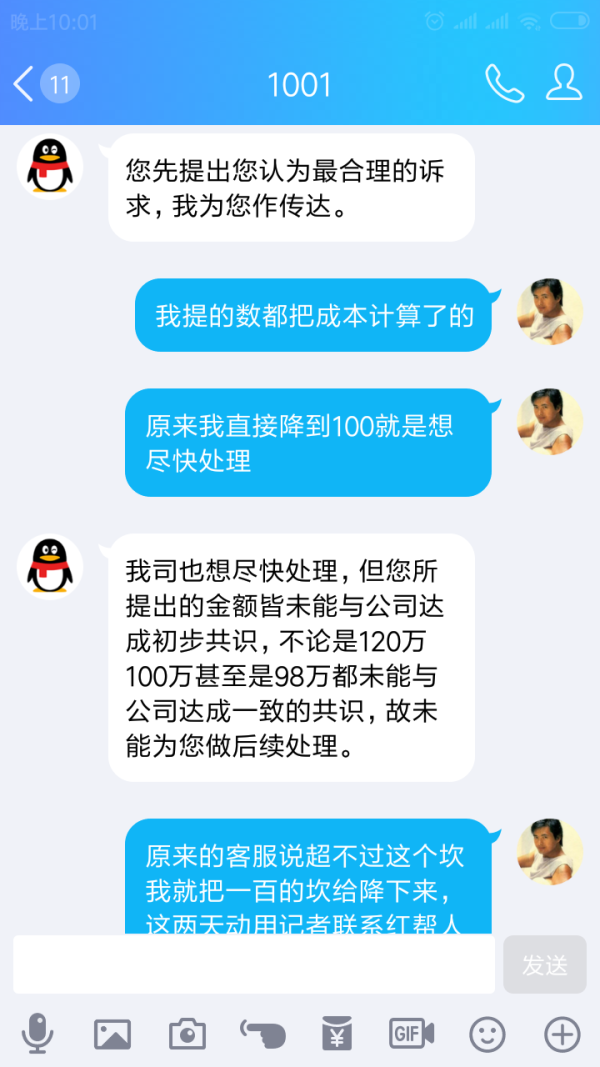

Customer service represents a critical area of concern for HXPM based on available information and user feedback patterns. The mixed nature of user reviews, combined with reports of high-risk signals, suggests inconsistent service quality that fails to meet professional standards expected in the forex industry. Reliable customer support is fundamental to trader confidence and operational success, making these concerns particularly significant.

Available sources do not provide specific information about customer service channels. This is problematic for traders who need to understand how they can reach support when issues arise. Professional brokers typically offer multiple contact methods including phone support, live chat, email assistance, and comprehensive FAQ sections. The absence of clear information about support channels raises questions about accessibility and responsiveness.

Response times, which are crucial for traders dealing with time-sensitive trading issues, are not specified in available information. In forex trading, where markets operate 24/5 and trading opportunities can be fleeting, prompt customer support response is essential. The lack of service level commitments or response time guarantees represents a significant service gap.

Multi-language support capabilities, important for a broker claiming to serve global clients, are not detailed in available sources. International brokers typically provide support in multiple languages to effectively serve diverse client bases. The absence of such information suggests potential limitations in global service capabilities.

Customer service hours and timezone coverage, critical for supporting international clients across different time zones, remain unspecified. The forex market's global nature requires support services that can address client needs across different trading sessions and geographical regions.

Trading Experience Analysis (6/10)

The trading experience offered by HXPM presents a mixed picture with both positive aspects and significant information gaps. The availability of multiple trading platforms, including the widely respected MT4 and the proprietary HX-GTS2 system, provides traders with options to choose technology that best suits their trading style and preferences. Platform diversity can enhance the trading experience by allowing users to leverage different strengths and functionalities.

However, critical aspects of trading experience remain unclear due to insufficient information about platform stability and execution speed. These factors are fundamental to successful trading, particularly for strategies that depend on precise timing and reliable order execution. Without specific performance data or user testimonials about platform reliability, it's difficult to assess the actual trading experience quality.

Order execution quality, including factors such as slippage, requotes, and fill rates, are not detailed in available sources. Professional traders require transparency about execution statistics to evaluate whether a broker can support their trading strategies effectively. The absence of such information represents a significant gap in assessing HXPM's trading environment quality.

Platform functionality completeness, particularly regarding the comparison between HX-GTS2 and MT4 capabilities, lacks detailed explanation. Traders need to understand what features and tools are available on each platform to make informed decisions about which system best serves their trading needs.

Mobile trading experience, while mentioned as available, lacks specific details about functionality, user interface quality, and feature parity with desktop versions. Mobile trading has become increasingly important. The quality of mobile platforms significantly impacts overall trading experience.

This hxpm review finds that while platform options exist, the lack of detailed performance and functionality information limits the ability to fully assess the trading experience quality.

Trust and Safety Analysis (3/10)

Trust and safety represent the most concerning aspects of HXPM's profile. Multiple red flags significantly impact the broker's credibility and reliability assessment. The most serious concern is the absence of clear regulatory information, which is fundamental to trader protection and industry compliance. Reputable forex brokers operate under strict regulatory oversight from recognized financial authorities, providing transparency about their regulatory status and compliance measures.

The suspicion that HXPM may be a potential clone company represents a severe trust issue that cannot be overlooked. Clone companies typically attempt to mimic legitimate brokers to deceive traders, often resulting in financial losses and fraudulent activities. Such allegations, even if unconfirmed, create substantial doubt about the broker's legitimacy and operational integrity.

Fund safety measures, which should be clearly communicated by any legitimate broker, are not specified in available information. Professional brokers typically provide detailed information about client fund segregation, deposit insurance, negative balance protection, and other safety mechanisms. The absence of such information raises serious questions about client asset protection.

Company transparency, including details about corporate structure, management team, financial statements, and operational history, appears limited based on available sources. Transparency is crucial for building trust in the financial services industry. The lack of comprehensive corporate information impacts credibility assessment.

Industry reputation concerns are evident from various sources questioning HXPM's legitimacy and operational standards. While some users provide positive feedback, the presence of high-risk signals and exposure reports suggests significant operational or ethical issues that affect the broker's standing in the trading community.

The combination of regulatory uncertainty, clone company suspicions, and limited transparency creates a high-risk profile that substantially impacts the trust and safety assessment in this evaluation.

User Experience Analysis (6/10)

User experience with HXPM presents a complex picture characterized by mixed feedback and limited comprehensive data. Available sources indicate the presence of both positive and neutral user reviews, suggesting that some traders have had satisfactory experiences with the platform. However, the lack of detailed user satisfaction metrics and specific feedback categories makes it challenging to assess the overall quality of user experience comprehensively.

Interface design and usability feedback for both the MT4 and HX-GTS2 platforms are not specifically detailed in available sources. User interface quality significantly impacts trading efficiency and user satisfaction, particularly for traders who spend considerable time analyzing markets and executing trades. The absence of specific usability feedback represents a gap in understanding the practical user experience.

Registration and account verification processes, which form the first impression for new users, lack detailed description in available information. Smooth onboarding experiences are crucial for user satisfaction. Complex or lengthy verification processes can negatively impact initial user perceptions and engagement.

Fund operation experiences, including deposit and withdrawal convenience, processing times, and associated costs, are not detailed in available sources. These operational aspects significantly impact user satisfaction, as traders need reliable and efficient access to their funds for effective trading operations.

Common user complaints mentioned in available sources include high-risk signals and exposure reports, suggesting that some users have experienced significant issues with the broker. While specific details of these complaints are not provided, their existence indicates potential problems that could affect user experience quality.

The user demographic appears to focus on traders seeking high leverage options and multiple platform choices. This suggests that HXPM may appeal to specific trader segments despite broader concerns about the broker's operations and transparency.

Conclusion

This comprehensive hxpm review reveals a broker with mixed characteristics that present both opportunities and significant risks for potential traders. HXPM offers attractive features such as high leverage up to 1:500 and multiple platform options including MT4 and HX-GTS2. These features may appeal to traders seeking flexible trading environments and substantial position sizing capabilities.

However, the evaluation uncovers serious concerns that substantially outweigh the potential benefits. The lack of regulatory transparency, suspicions about the company's legitimacy, and limited operational information create a high-risk profile that is difficult to recommend for most traders. The absence of clear regulatory oversight is particularly concerning in an industry where investor protection depends heavily on regulatory compliance and oversight.

HXPM may be suitable for highly experienced traders who understand the risks associated with unregulated brokers and have the expertise to navigate potential challenges. However, the majority of traders, particularly those new to forex trading or those prioritizing safety and regulatory protection, should exercise extreme caution and consider alternative brokers with clearer regulatory status and more transparent operations.

The main advantages include high leverage options and platform diversity, while significant disadvantages encompass regulatory uncertainty, legitimacy concerns, and limited transparency across multiple operational aspects. Potential clients should conduct thorough due diligence and consider these factors carefully before making any trading decisions with HXPM.