Flying Hummingbird 2025 Review: Everything You Need to Know

Executive Summary

This flying hummingbird review shows a concerning forex broker situation. Based on information from 2021, Flying Hummingbird operated under the fhbinvest domain and was flagged as an unregulated broker with serious red flags. The platform claimed to offer MetaTrader 5 trading with leverage up to 1:200. It targeted forex and CFD traders who wanted high-leverage trading opportunities.

However, major concerns exist about the broker's regulatory status and legitimacy. The lack of proper oversight and regulatory compliance makes this broker wrong for most retail traders. This is especially true for those seeking secure and transparent trading environments. While the platform may offer access to various trading instruments including forex, precious metals, and commodities, the absence of regulatory protection creates big risks for potential clients.

This review aims to give traders essential information to make informed decisions. It highlights both the claimed features and the significant risks associated with this broker. Given the regulatory concerns, traders should use extreme caution and consider well-regulated alternatives for their trading activities.

Important Notice

This evaluation uses publicly available information and user feedback collected as of 2021. Due to limited regulatory information and the broker's questionable status, traders across different regions should be particularly aware of local legal implications and risk factors. The broker's operations may vary significantly across jurisdictions. Users must understand their local regulatory environment before engaging with any unregulated financial service provider.

Our assessment methodology relies on available public information, regulatory databases, and industry reports. However, given the limited transparency of this broker, significant information gaps exist that may affect the completeness of this review.

Rating Framework

Broker Overview

Flying Hummingbird emerged in the online forex trading space claiming to provide comprehensive trading services through the MetaTrader 5 platform. The broker positioned itself as a global trading solution. It offered access to various financial instruments including foreign exchange, precious metals, and commodity CFDs. According to available information, the platform operated under the fhbinvest domain and targeted retail traders seeking high-leverage trading opportunities.

The broker's business model centered around providing online forex and CFD trading services with maximum leverage reaching 1:200. However, significant concerns arose regarding the company's regulatory compliance and operational transparency. This led to its classification as an unregulated broker with potential risks for client funds and trading activities.

The platform claimed to offer access to popular trading assets including crude oil, spot gold, major and minor forex pairs, and spot silver. Despite these offerings, the lack of proper regulatory oversight and transparent business practices raised serious questions about the broker's legitimacy and client fund security. This makes this flying hummingbird review particularly important for potential traders.

Regulatory Status: No specific regulatory information was available in the source materials. This indicates a lack of proper oversight from recognized financial authorities.

Deposit and Withdrawal Methods: Specific information about funding methods was not detailed in available sources. This creates uncertainty about transaction processes.

Minimum Deposit Requirements: The exact minimum deposit amounts were not specified in the available information. This makes it difficult to assess accessibility for different trader segments.

Bonus and Promotions: No promotional offers or bonus structures were mentioned in the source materials.

Tradeable Assets: The platform offered access to crude oil, spot gold, foreign exchange pairs, and spot silver. This provides a basic range of popular trading instruments.

Cost Structure: Detailed information about spreads, commissions, and other trading costs was not available in the source materials. This creates transparency concerns.

Leverage Ratios: Maximum leverage was reported to reach 1:200. This is relatively high and carries significant risk.

Platform Options: MetaTrader 5 was the primary trading platform offered by the broker.

Regional Restrictions: Specific geographical limitations were not detailed in available sources.

Customer Support Languages: Language support information was not specified in the available materials.

This flying hummingbird review highlights the concerning lack of detailed operational information. This is typically a red flag in broker evaluation.

Account Conditions Analysis

The account conditions offered by Flying Hummingbird present significant concerns due to the lack of detailed information available about their structure and terms. Without specific details about account types, minimum deposit requirements, or account opening procedures, potential traders face uncertainty about what to expect when engaging with this broker.

The absence of clear information about account tiers, special features, or different account categories suggests either poor transparency or limited service offerings. Most legitimate brokers provide comprehensive details about their account structures. This includes benefits, requirements, and specific features for different trader segments.

Furthermore, the lack of information about Islamic accounts, professional trading accounts, or other specialized account types indicates a potentially limited service range. The unavailability of detailed terms and conditions regarding account management, maintenance fees, or inactivity charges creates additional uncertainty for potential clients.

Given these information gaps and the broker's unregulated status, the account conditions receive a poor rating in this flying hummingbird review. Traders seeking transparent and well-structured account offerings would likely find better alternatives with properly regulated brokers that provide comprehensive account information and clear terms of service.

Flying Hummingbird's tools and resources offering appears limited based on available information. The broker provides access to MetaTrader 5, which is a recognized and capable trading platform used by many legitimate brokers worldwide. MT5 offers advanced charting capabilities, technical analysis tools, and automated trading support through Expert Advisors.

However, beyond the basic platform offering, there is no evidence of additional proprietary tools, market research resources, or educational materials. Most reputable brokers supplement their platform offerings with market analysis, economic calendars, trading signals, and educational content to support their clients' trading activities.

The absence of information about research departments, market commentary, or analytical resources suggests that traders would need to rely on external sources for market insights and trading education. This limitation particularly affects novice traders who typically benefit from comprehensive educational resources and market guidance.

Additionally, there is no indication of advanced trading tools, risk management resources, or portfolio analysis capabilities beyond what the standard MT5 platform provides. The lack of mobile trading app information or platform customization options further limits the overall tools and resources evaluation. This contributes to the below-average rating in this assessment.

Customer Service and Support Analysis

Customer service and support represent critical weaknesses in Flying Hummingbird's offering, with virtually no information available about their support infrastructure. The absence of clear contact channels, response time commitments, or service quality standards creates significant concerns for potential traders who may need assistance with their accounts or trading activities.

Legitimate brokers typically provide multiple communication channels including live chat, email support, phone assistance, and comprehensive FAQ sections. The lack of published customer service information suggests either inadequate support infrastructure or poor transparency about available services.

Without details about operating hours, multilingual support capabilities, or specialized assistance for different account types, traders cannot assess whether they would receive adequate support when needed. This is particularly concerning for international traders who may require support in different time zones or languages.

The absence of user feedback about customer service experiences, resolution procedures, or support quality further compounds these concerns. Most established brokers actively promote their customer service capabilities and maintain transparent communication about support availability. This makes the information void particularly notable in this evaluation.

Given these significant gaps in customer service transparency and the potential implications for trader support, this dimension receives one of the lowest ratings in our assessment. This highlights the risks associated with choosing an unregulated broker with unclear support structures.

Trading Experience Analysis

The trading experience evaluation for Flying Hummingbird faces substantial limitations due to the lack of detailed information about platform performance, execution quality, and user experience feedback. While the broker offers MetaTrader 5, which is generally considered a robust trading platform, the overall trading environment remains questionable due to regulatory concerns.

Platform stability and execution speed are critical factors that were not addressed in available information. Without data about server uptime, order execution times, or slippage statistics, traders cannot assess the technical reliability of the trading environment. These factors are particularly important for active traders and scalping strategies where execution quality directly impacts profitability.

The absence of information about order types, execution models, or liquidity providers creates uncertainty about the underlying trading infrastructure. Additionally, there are no details about trading restrictions, maximum position sizes, or hedging capabilities that could affect trading strategies.

Mobile trading experience, which is increasingly important for modern traders, lacks documentation regarding app availability, functionality, or performance. The integration between desktop and mobile platforms, real-time synchronization, and mobile-specific features remain unknown.

Without user testimonials, performance reviews, or independent testing data, it's impossible to verify the actual trading experience quality. This information gap, combined with the broker's unregulated status, suggests significant risks for traders seeking reliable execution and professional trading conditions.

Trust and Safety Analysis

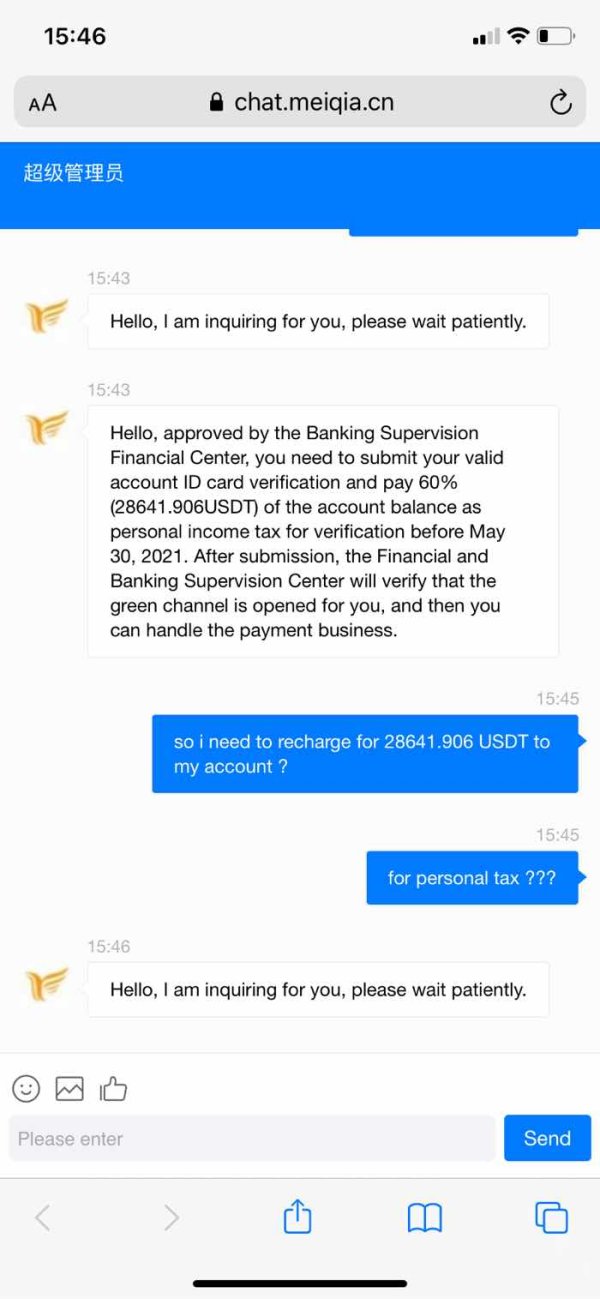

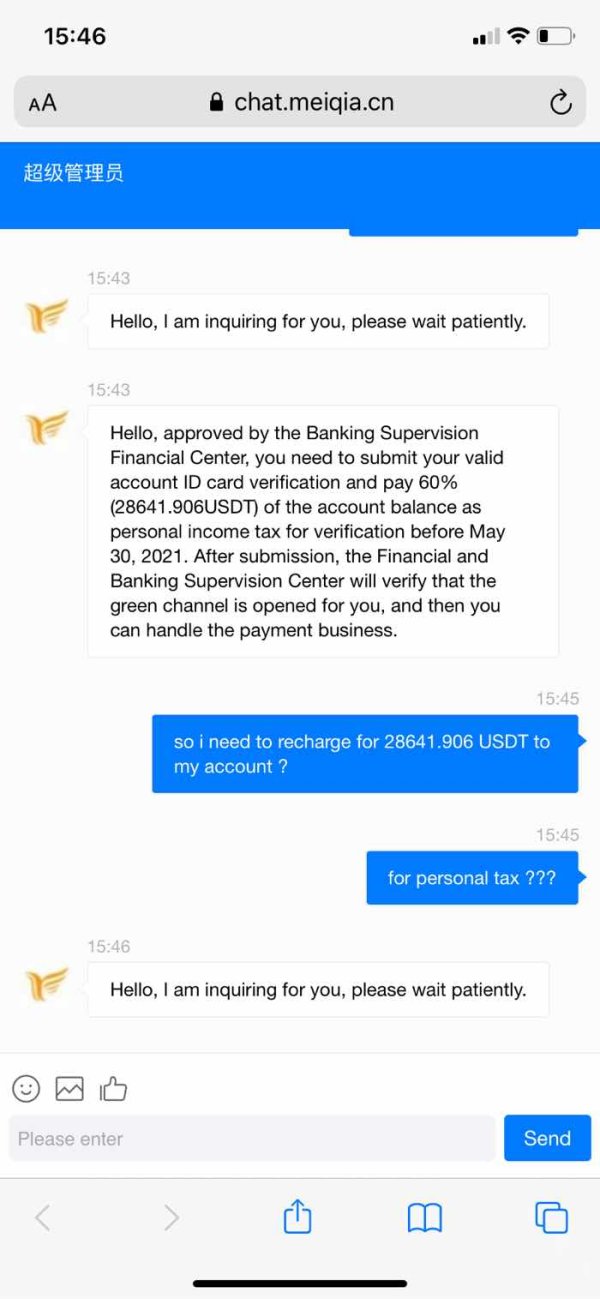

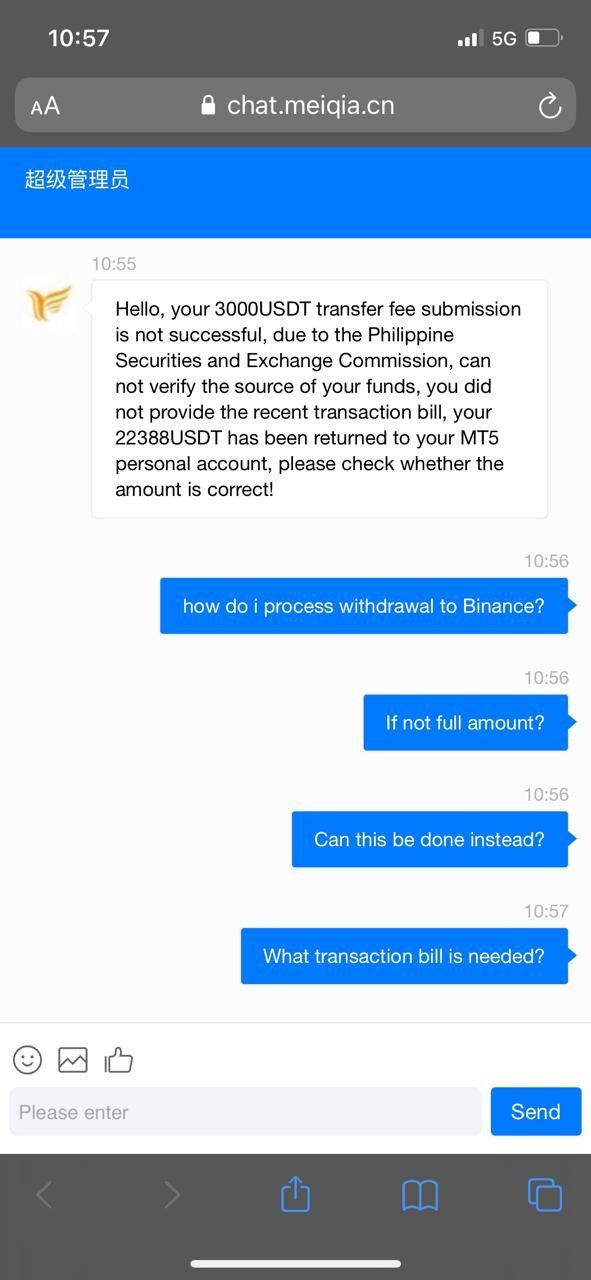

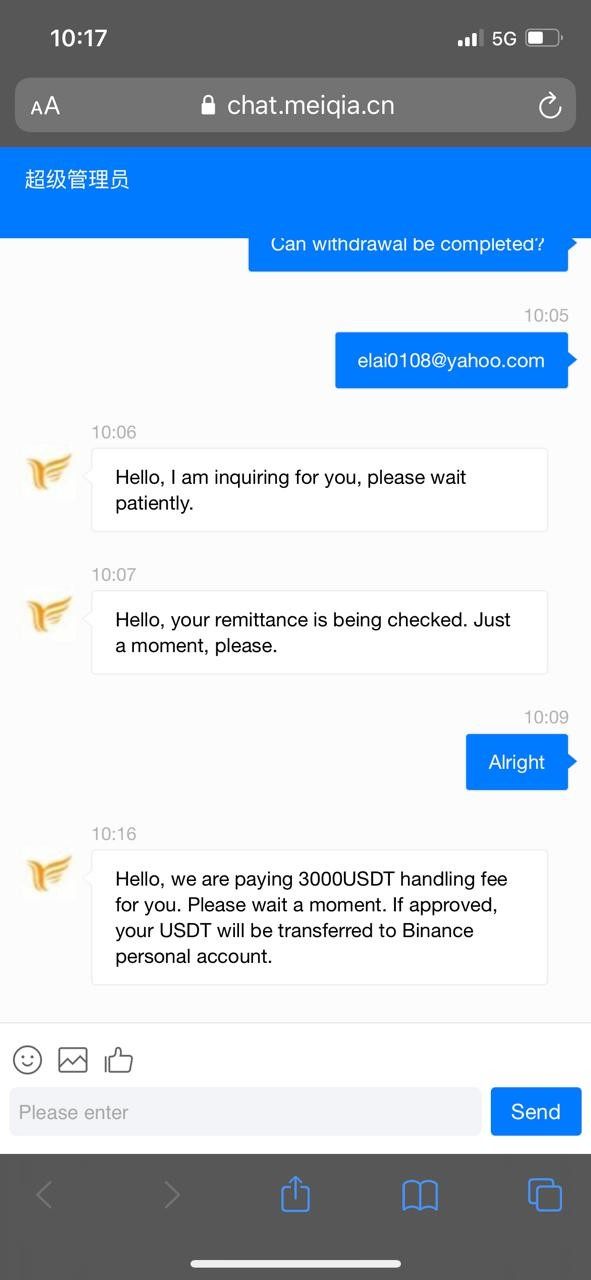

Trust and safety represent the most critical concerns in this flying hummingbird review, with the broker failing to meet basic regulatory and transparency standards expected from legitimate financial service providers. The classification as an unregulated broker immediately raises red flags about client fund protection and operational oversight.

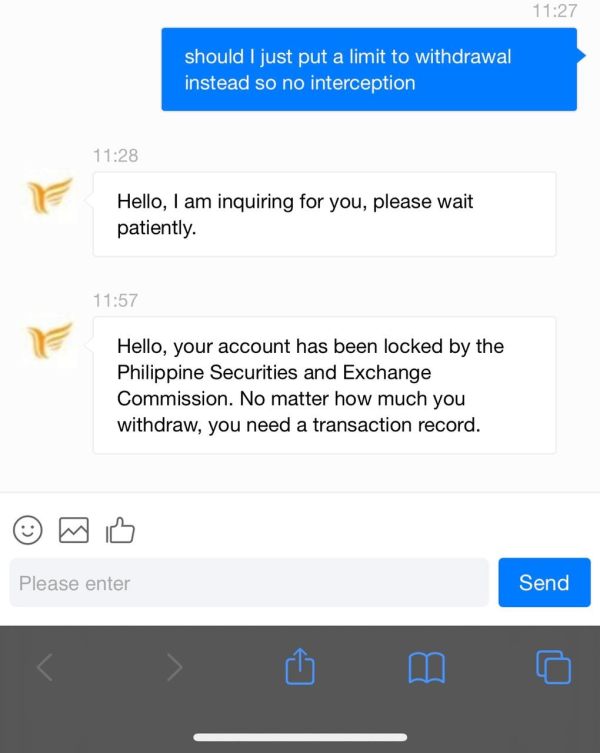

The absence of regulatory authorization from recognized financial authorities means that traders have no regulatory recourse in case of disputes, fund recovery issues, or operational problems. Legitimate brokers typically hold licenses from established regulators such as FCA, ASIC, CySEC, or other recognized authorities that provide investor protection schemes and oversight mechanisms.

Without information about client fund segregation, deposit insurance, or third-party fund custody arrangements, traders face significant risks regarding the safety of their deposits. Regulated brokers are typically required to maintain client funds in segregated accounts and provide detailed information about fund protection measures.

The lack of transparency about company ownership, management team, financial statements, or operational history further undermines trust. Established brokers usually provide comprehensive information about their corporate structure, regulatory compliance, and business operations to build client confidence.

Additionally, the absence of negative incident reporting, regulatory actions, or dispute resolution procedures makes it impossible to assess the broker's track record in handling client issues. The combination of unregulated status and limited transparency creates an unacceptable risk level for most traders. This results in the lowest possible rating for trust and safety.

User Experience Analysis

User experience evaluation for Flying Hummingbird is severely hampered by the lack of available user feedback, interface documentation, and process descriptions. Without access to user reviews, satisfaction surveys, or experience testimonials, it's impossible to assess how clients actually interact with the broker's services and platforms.

The registration and account verification processes remain undocumented, creating uncertainty about onboarding procedures, required documentation, and timeline expectations. Legitimate brokers typically provide clear guidance about account opening requirements, verification procedures, and expected processing times to set appropriate client expectations.

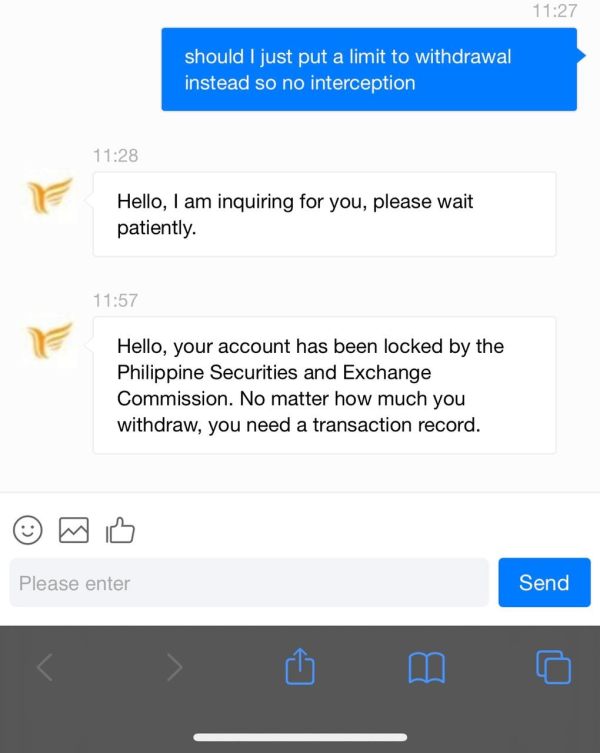

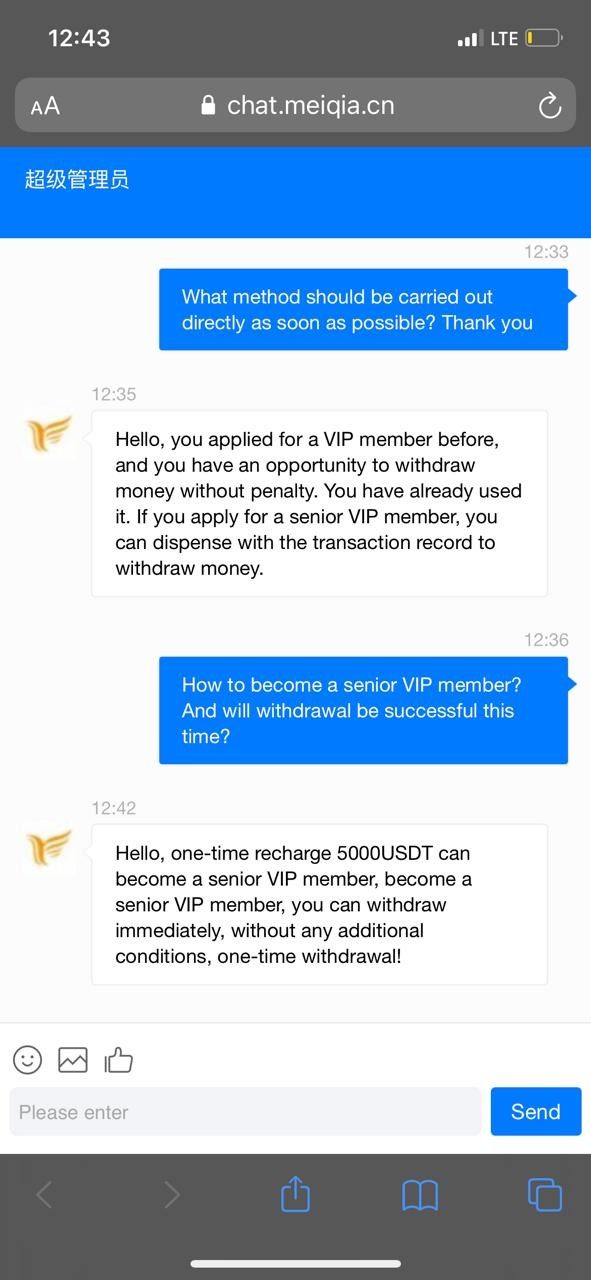

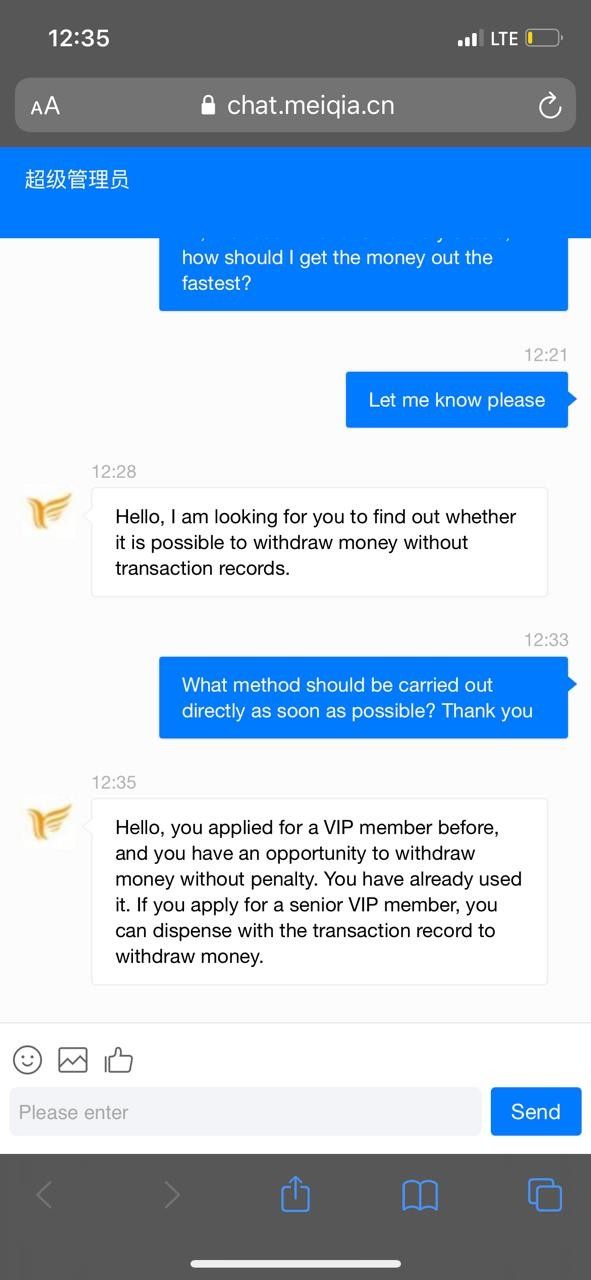

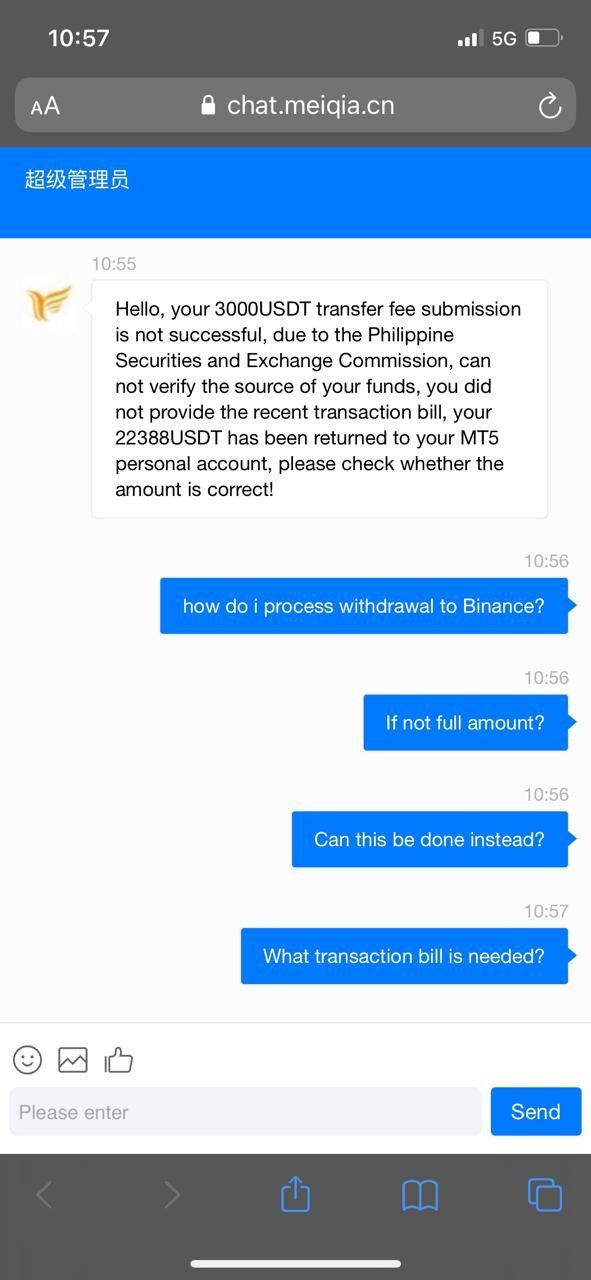

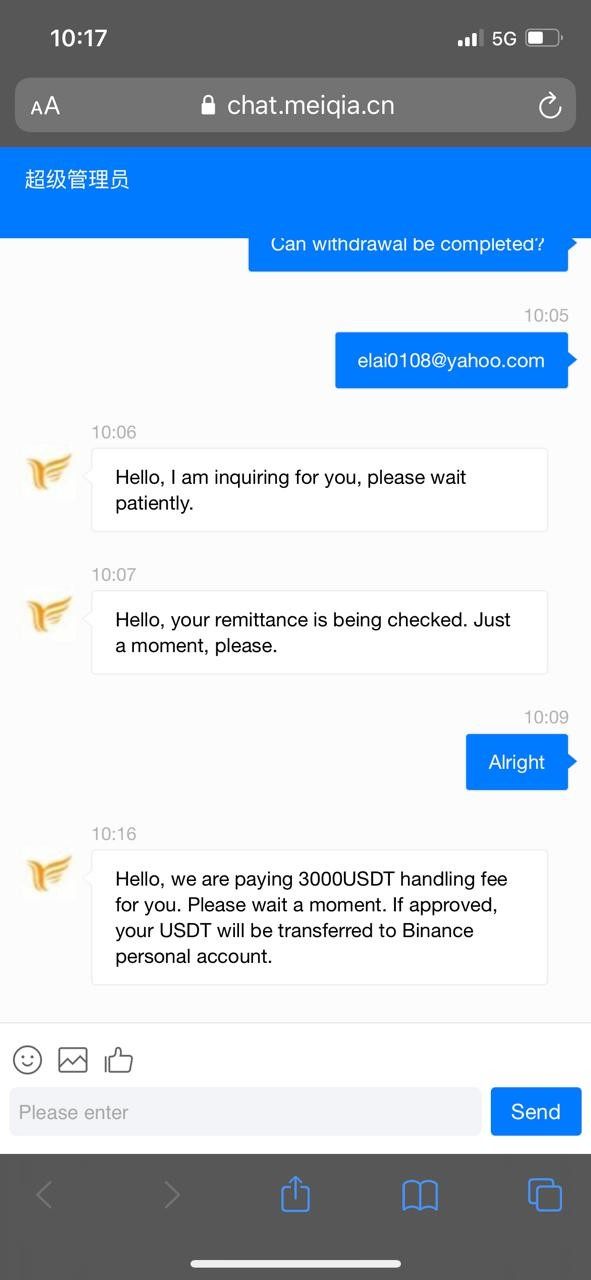

Funding and withdrawal experiences, which are often significant pain points for traders, lack any documentation or user feedback in available sources. The absence of information about processing times, fees, minimum amounts, or supported payment methods creates substantial uncertainty about the practical aspects of account management.

Interface design and platform usability beyond the standard MT5 offering remain unknown. While MT5 provides a standardized experience, broker-specific customizations, additional tools, or interface modifications could significantly impact user experience but are not documented in available materials.

The target user base appears to be traders interested in forex and CFD trading with high leverage tolerance, but the lack of user segmentation, personalization features, or tailored experiences suggests a generic approach that may not meet diverse trader needs effectively.

Conclusion

This comprehensive flying hummingbird review reveals significant concerns that make this broker unsuitable for most retail traders. The combination of unregulated status, limited transparency, and substantial information gaps creates an unacceptable risk profile that outweighs any potential benefits from the MetaTrader 5 platform or available trading instruments.

While the broker may appeal to traders seeking high leverage and access to popular trading assets, the lack of regulatory protection and operational transparency poses serious risks to client funds and trading success. The absence of detailed information about account conditions, customer support, and trading costs further compounds these concerns.

For traders prioritizing safety and reliability, numerous well-regulated alternatives offer similar or superior services with proper oversight and client protection. The risks associated with unregulated brokers typically far exceed any potential advantages. This makes regulated alternatives the prudent choice for serious trading activities.