Experia Markets 2025 Review: Everything You Need to Know

Executive Summary

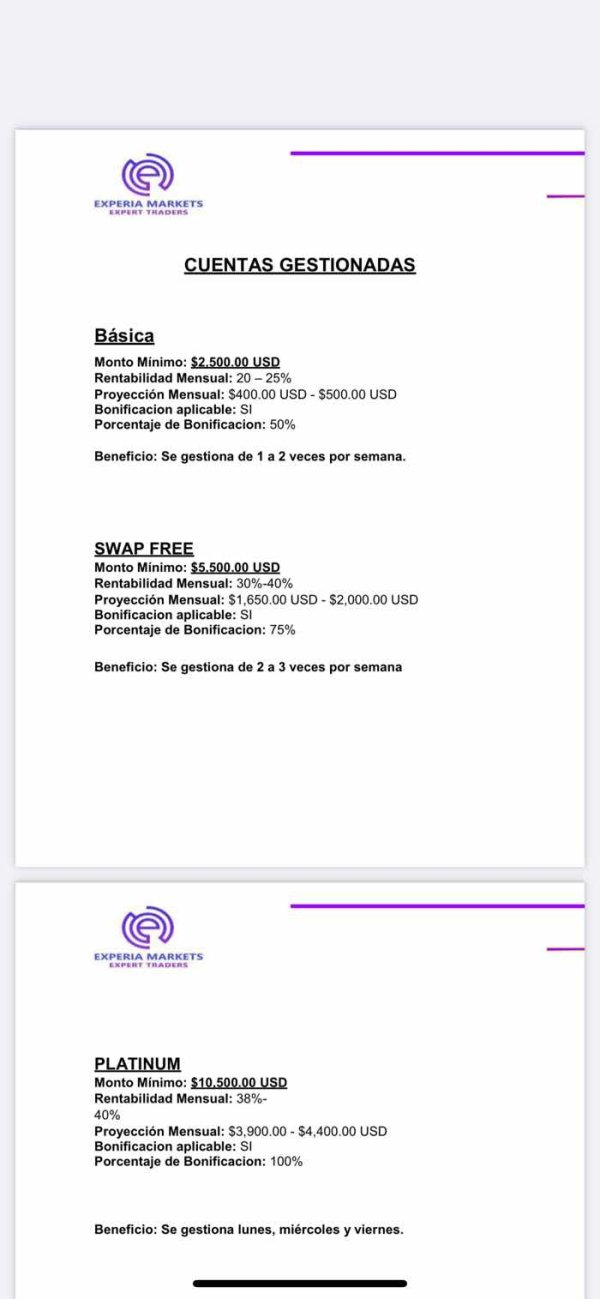

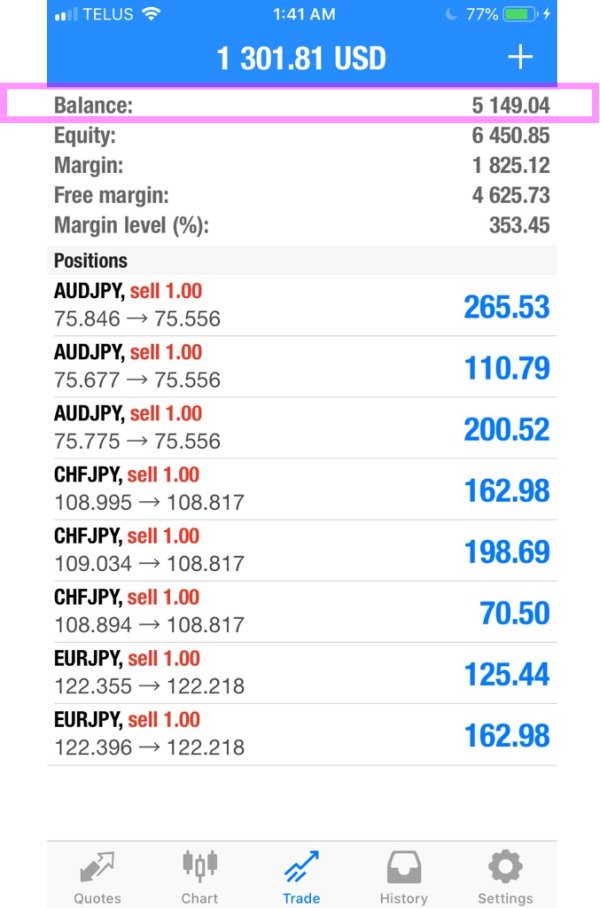

This experia markets review looks at an unregulated forex broker that offers flexible trading conditions for experienced traders willing to accept higher risk levels. The company provides competitive trading terms including spreads starting from 0.0 pips and leverage up to 1:500, making it attractive for traders seeking cost-effective execution. Experia Markets gives access to over 70 financial instruments across multiple asset classes, including currency pairs, precious metals, and CFD indices.

Trading happens through the widely-used MetaTrader 4 platform, which provides reliable functionality for most trading strategies. However, the minimum deposit requirement of $500 positions this broker primarily toward intermediate to advanced traders rather than beginners. While Experia Markets presents competitive trading conditions, potential clients should carefully consider the implications of trading with an unregulated entity.

The broker's headquarters in Saint Vincent and the Grenadines, combined with the absence of major regulatory oversight, requires traders to conduct thorough due diligence before committing funds. This setup may appeal to experienced traders who prioritize trading flexibility over regulatory protection.

Important Notice

Regional Entity Differences: As an unregulated forex broker, Experia Markets' regulatory status may vary significantly across different countries and jurisdictions. Traders must understand the legal implications and potential risks associated with trading through unregulated entities in their specific regions. Local financial regulations may restrict or prohibit engagement with such brokers.

Review Methodology: This evaluation is based on publicly available information and market analysis. The assessment does not include personal user experiences or individual testimonials, focusing instead on verifiable data and industry-standard evaluation criteria.

Rating Framework

Broker Overview

Experia Markets operates as an unregulated forex broker headquartered in Saint Vincent and the Grenadines. The company focuses on providing flexible trading conditions for experienced traders who understand the risks associated with unregulated financial services. Despite the absence of traditional regulatory oversight, the broker attempts to maintain competitive market positioning through attractive trading terms and comprehensive asset offerings.

The broker's business model centers on providing direct market access through the MetaTrader 4 platform, enabling traders to access over 70 different financial instruments. This includes an extensive range of currency pairs, precious metals, and CFD indices, catering to diverse trading strategies and portfolio requirements. The company's operational structure in Saint Vincent and the Grenadines allows for more flexible service provision, though this comes with inherent regulatory limitations that potential clients must carefully consider.

Regulatory Status: Available information does not specify particular regulatory authorities overseeing Experia Markets operations, consistent with its classification as an unregulated broker.

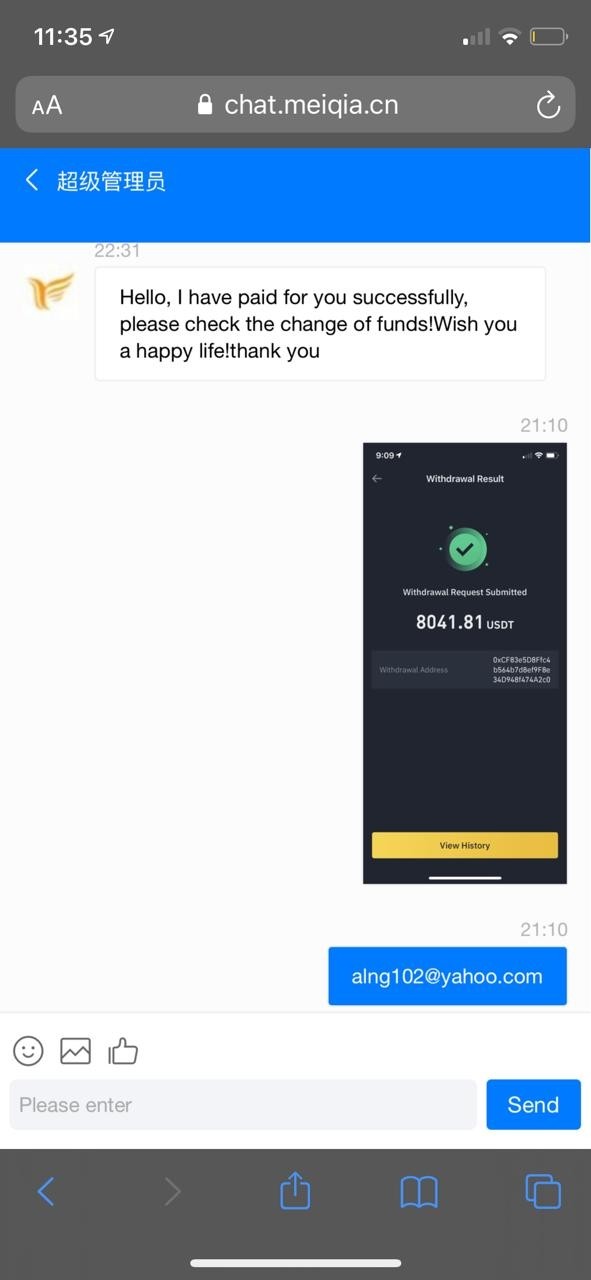

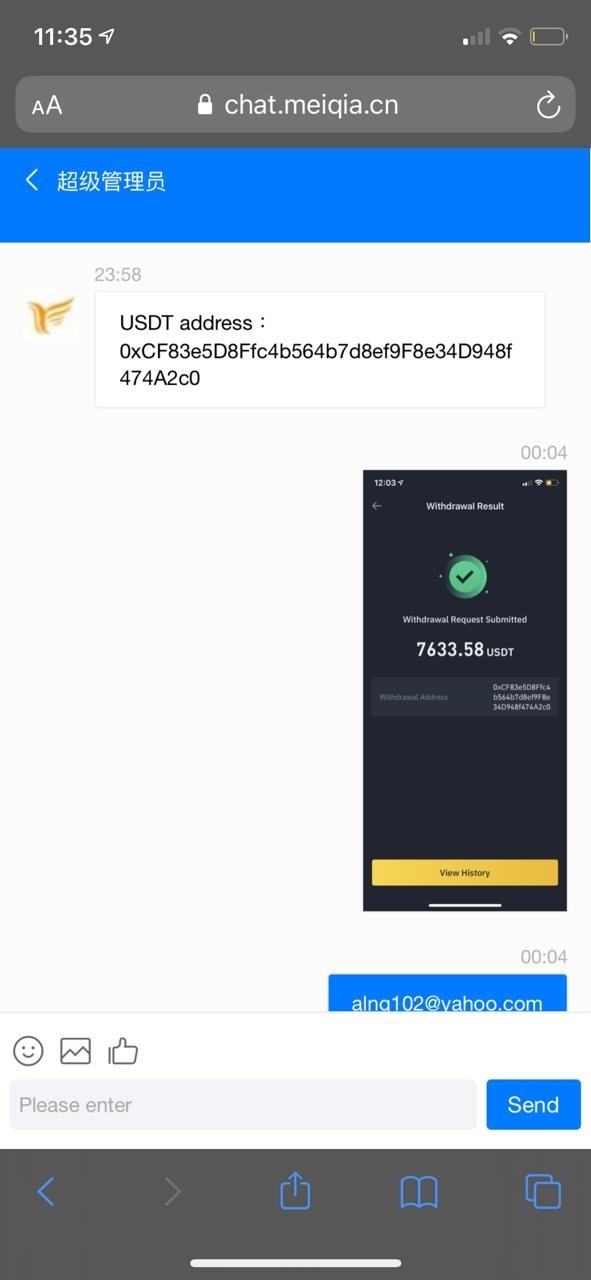

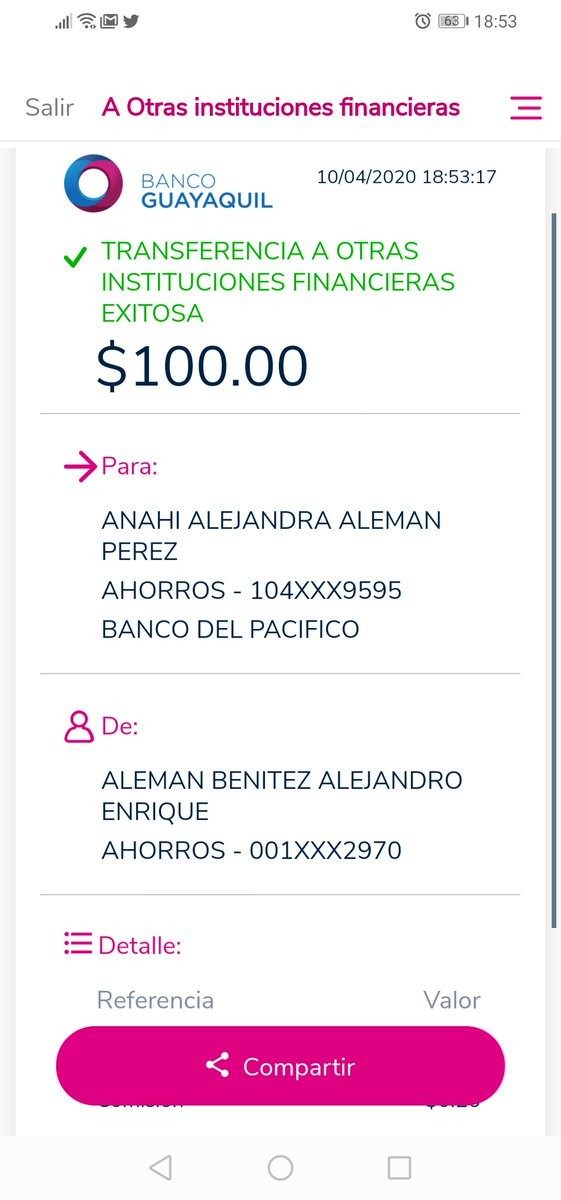

Deposit and Withdrawal Methods: Specific payment methods and processing procedures are not detailed in current available information.

Minimum Deposit Requirements: The broker requires a minimum initial deposit of $500, positioning it toward intermediate-level traders rather than beginners.

Bonus and Promotional Offers: Current promotional activities and bonus structures are not specified in available documentation.

Tradeable Assets: The platform provides access to over 70 financial instruments, including currency pairs, precious metals, and various CFD indices, offering diversification opportunities.

Cost Structure: Spreads begin from 0.0 pips, though specific commission structures and additional fees require further clarification through direct broker contact.

Leverage Ratios: Maximum leverage reaches 1:500, providing significant amplification potential for experienced traders understanding associated risks.

Platform Options: Trading is conducted exclusively through the MetaTrader 4 platform, offering standard industry functionality.

Geographic Restrictions: Specific regional limitations are not detailed in current available information.

Customer Support Languages: Available language support options are not specified in accessible documentation.

Detailed Rating Analysis

Account Conditions Analysis (7/10)

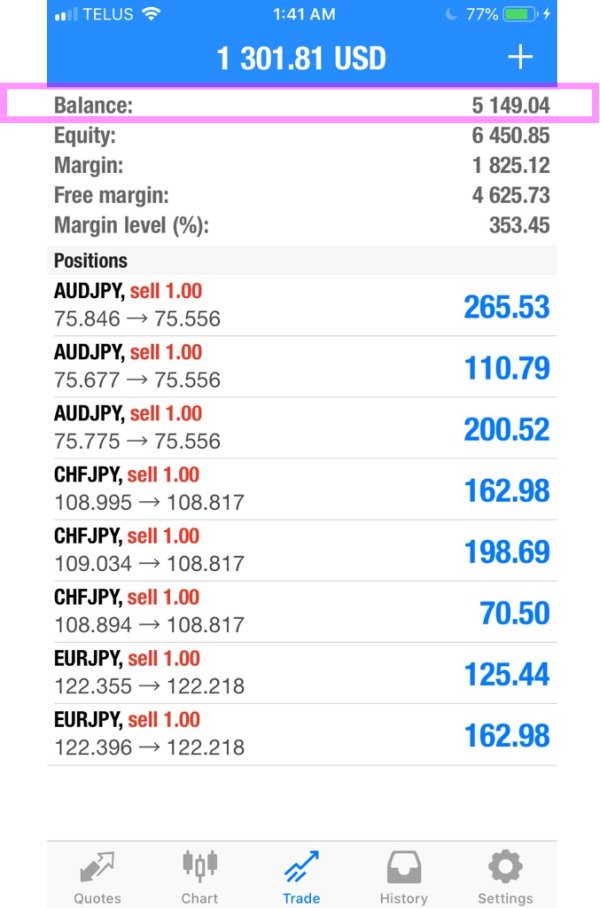

The experia markets review reveals competitive account conditions designed for experienced traders. The $500 minimum deposit requirement positions this broker in the intermediate market segment, filtering out casual traders while remaining accessible to serious market participants. This threshold demonstrates the broker's focus on attracting committed traders who can utilize the advanced features effectively.

The maximum leverage of 1:500 provides substantial amplification opportunities, though it requires sophisticated risk management skills. This high leverage ratio appeals to experienced traders seeking maximum capital efficiency, but newcomers should approach such levels with extreme caution. The spreads starting from 0.0 pips represent competitive pricing in the current market environment, potentially reducing trading costs for active traders.

However, the lack of detailed information about different account types limits our understanding of the full service spectrum. Most established brokers offer tiered account structures with varying benefits, but specific details about Experia Markets' account hierarchy are not readily available. This information gap makes it difficult for potential clients to assess which account type might best suit their trading requirements.

Experia Markets provides access to over 70 financial instruments, creating opportunities for portfolio diversification across multiple asset classes. This selection includes major and minor currency pairs, precious metals, and CFD indices, covering the primary instruments most forex traders require. The variety allows for different trading strategies, from currency speculation to commodity hedging and index trading.

The exclusive use of MetaTrader 4 ensures access to a robust trading platform with extensive technical analysis capabilities. MT4's proven reliability and comprehensive charting tools provide the foundation for professional trading activities. The platform's automated trading support through Expert Advisors enables sophisticated trading strategies for those with programming knowledge or access to third-party solutions.

However, available information does not detail specific research and analysis resources provided by the broker. Many competitive brokers offer daily market analysis, economic calendars, and educational materials to support trader decision-making. The absence of clear information about such resources represents a potential limitation for traders who rely on broker-provided market intelligence and educational support.

Customer Service and Support Analysis (5/10)

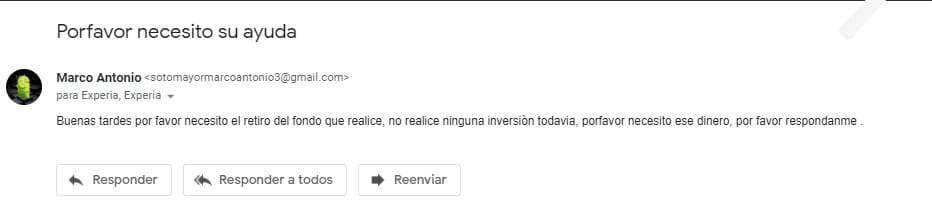

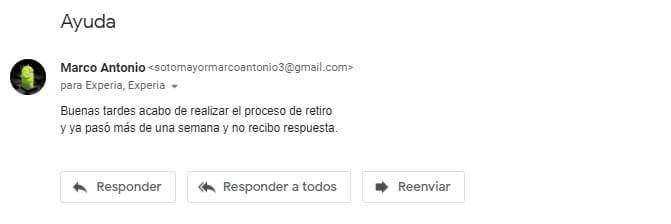

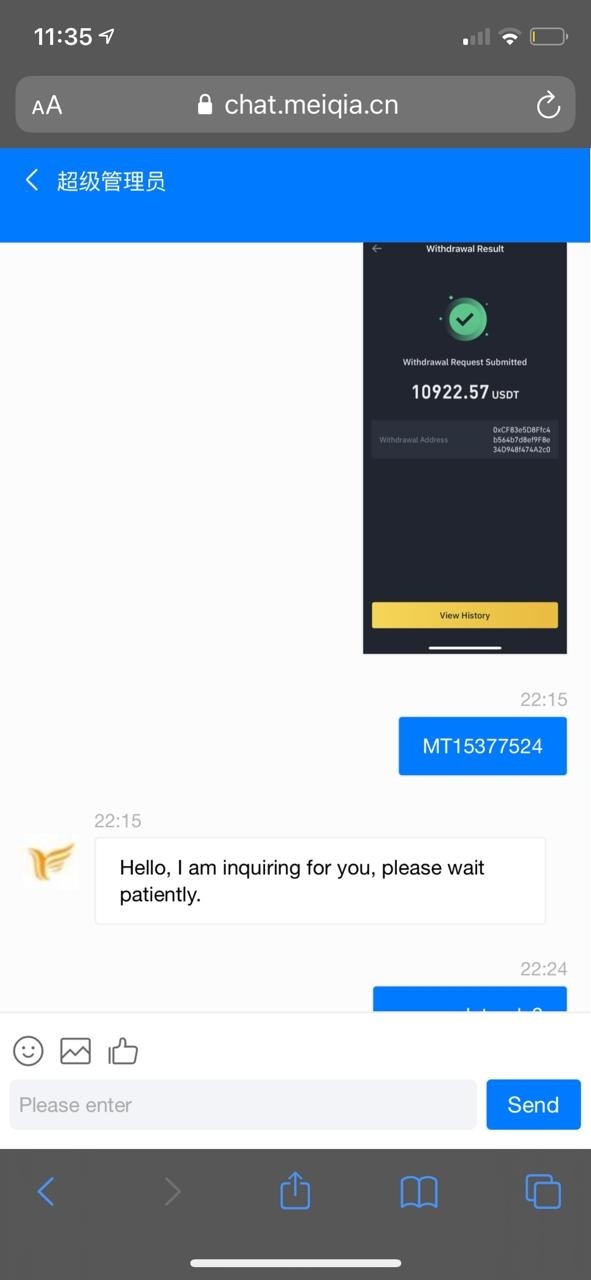

The evaluation of Experia Markets' customer service capabilities is limited by the lack of detailed information about support channels, availability, and service quality. Professional forex brokers typically offer multiple contact methods including live chat, email, and telephone support with extended hours to accommodate global trading schedules.

Without specific information about response times, service hours, or multilingual support capabilities, potential clients cannot adequately assess whether the broker's customer service will meet their requirements. This information gap is particularly concerning for traders who may require immediate assistance during volatile market conditions or technical difficulties.

The absence of documented user feedback about customer service experiences further complicates this evaluation. User testimonials and reviews typically provide valuable insights into real-world service quality, response effectiveness, and problem resolution capabilities. The lack of such feedback makes it difficult to provide a comprehensive assessment of the customer service dimension.

Trading Experience Analysis (7/10)

The MetaTrader 4 platform provides a solid foundation for trading experience, offering industry-standard functionality that most forex traders find familiar and reliable. MT4's stability and execution speed have been proven across numerous brokers and market conditions, providing confidence in the technical infrastructure supporting trading activities.

The spread structure starting from 0.0 pips suggests competitive pricing that can enhance trading experience through reduced transaction costs. For active traders, tight spreads significantly impact overall profitability, making this aspect particularly attractive for scalping and high-frequency trading strategies.

However, this experia markets review notes the absence of specific information about order execution quality, slippage rates, and platform performance during high-volatility periods. These factors critically impact real trading experience but cannot be adequately assessed without user feedback or performance data. Additionally, mobile trading capabilities and platform customization options are not detailed in available information.

Trust Factor Analysis (4/10)

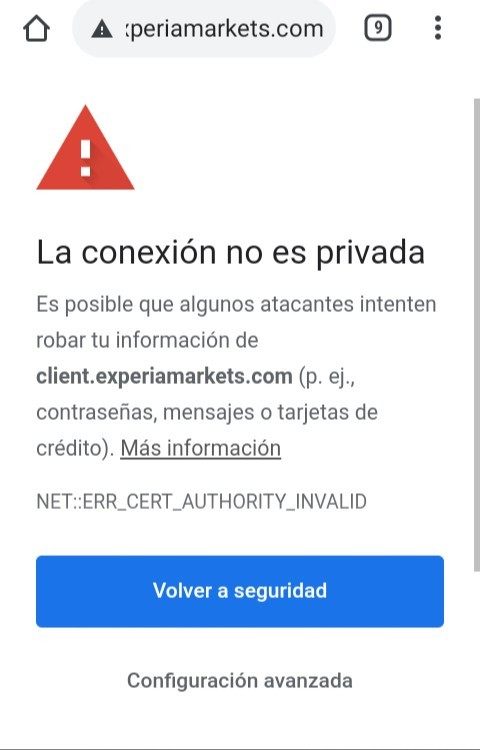

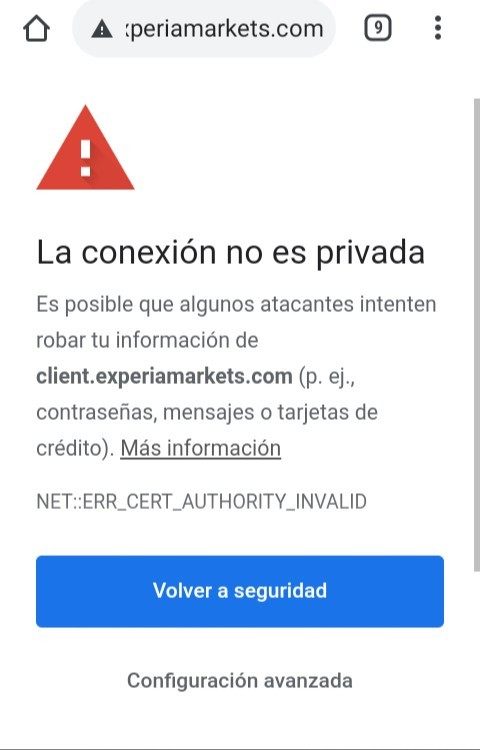

The trust factor evaluation reveals significant concerns primarily related to regulatory oversight. As an unregulated broker, Experia Markets operates without the protection and accountability mechanisms that regulated entities must maintain. This absence of regulatory supervision creates inherent risks for client fund safety and dispute resolution.

The lack of information about fund safety measures, segregated accounts, or compensation schemes further impacts trustworthiness. Regulated brokers typically maintain client funds in segregated accounts and participate in compensation schemes that protect client deposits up to specified amounts. Without such protections, traders bear additional risk beyond normal market exposure.

Company transparency also appears limited based on available information. Established brokers usually provide detailed information about company history, management team, financial statements, and regulatory compliance. The absence of such transparency makes it difficult for potential clients to conduct proper due diligence before committing funds to trading activities.

User Experience Analysis (5/10)

The overall user experience assessment is constrained by limited feedback and documentation about client interactions with Experia Markets. The MetaTrader 4 platform provides a familiar interface for experienced traders, with intuitive navigation and comprehensive functionality that generally supports positive user experience.

However, crucial aspects of user experience including account opening procedures, verification processes, and fund management workflows are not detailed in available information. These operational elements significantly impact daily trading experience and client satisfaction levels.

The absence of user testimonials, satisfaction surveys, or independent reviews makes it impossible to assess real-world user experience comprehensively. Most established brokers accumulate substantial user feedback that provides insights into service quality, platform reliability, and overall client satisfaction. This information gap represents a significant limitation in evaluating the complete user experience offering.

Conclusion

This experia markets review concludes that the broker presents a mixed proposition suitable primarily for experienced traders who understand and accept the risks associated with unregulated financial services. The competitive trading conditions, including low spreads and high leverage, offer attractive terms for active traders seeking cost-effective execution.

However, the absence of regulatory oversight and limited transparency create significant considerations that potential clients must carefully evaluate. The broker appears most suitable for intermediate to advanced traders who prioritize trading flexibility over regulatory protection and possess sufficient experience to conduct independent due diligence.

The main advantages include competitive spreads starting from 0.0 pips, substantial leverage up to 1:500, and access to over 70 financial instruments through the reliable MT4 platform. The primary disadvantages center on regulatory absence, limited customer service information, and insufficient transparency about operational procedures and safety measures.