Is Experia Markets safe?

Business

License

Is Experia Markets Safe or Scam?

Introduction

Experia Markets is a forex and CFD broker that has emerged in the competitive landscape of online trading. Based in Saint Vincent and the Grenadines, it claims to provide a range of trading services, including access to various currency pairs and commodities. However, the lack of regulatory oversight raises significant concerns for potential investors. Evaluating the safety of a forex broker is crucial for traders, as it directly impacts the security of their funds and the integrity of their trading experience. This article aims to provide a comprehensive analysis of Experia Markets, focusing on its regulatory status, company background, trading conditions, customer safety, user experiences, platform performance, and associated risks. The investigation is based on a review of online resources, user feedback, and regulatory information to ascertain whether Experia Markets is safe for trading.

Regulation and Legitimacy

The regulatory framework under which a broker operates is one of the most critical factors influencing its legitimacy and safety. In the case of Experia Markets, the broker does not appear to be regulated by any recognized financial authority. This absence of regulation is a significant red flag for potential investors.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Saint Vincent and the Grenadines | Unregulated |

The lack of a regulatory license means that Experia Markets is not subject to the stringent requirements imposed by regulatory bodies that ensure fair trading practices, transparency, and the protection of client funds. This raises questions about the broker's operational integrity and its commitment to safeguarding investors' interests. Furthermore, reports indicate that Experia Markets has been linked to other disreputable brokers, further complicating its credibility. In summary, the absence of regulation is a significant concern, suggesting that Experia Markets is not safe for traders who prioritize security and reliability.

Company Background Investigation

Experia Markets is owned by Experia Markets Ltd., which operates out of Saint Vincent and the Grenadines. The companys choice of location is notable, as this jurisdiction is often associated with less stringent regulatory oversight, making it a popular choice for brokers seeking to avoid rigorous compliance standards. The management team behind Experia Markets has not been extensively documented, leading to a lack of transparency regarding their qualifications and experience in the financial industry.

The company's historical performance is also opaque, with limited information available about its operational history and any previous affiliations with other trading entities. This lack of transparency raises concerns about the broker's accountability and the potential risks associated with trading through an entity that does not openly disclose its management structure. As such, the overall opacity surrounding Experia Markets further supports the notion that Experia Markets is not a safe option for traders who value clarity and trustworthiness in their trading relationships.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly influence the overall trading experience. Experia Markets claims to offer competitive spreads and various account types, but the specifics of these conditions warrant closer scrutiny. The broker provides three main account types: Standard, Free Exchange, and Platinum, each with different deposit requirements and fee structures.

| Fee Type | Experia Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 - 0.8 pips | 1.0 - 2.0 pips |

| Commission Model | $3.5 per $100,000 traded | $7 per $100,000 traded |

| Overnight Interest Range | Varies | Varies |

While the spreads may appear attractive, the significant minimum deposit requirements (starting at $500 for a Standard account) may deter many retail traders. Additionally, the commission structure, while lower than some competitors, raises questions about the overall cost-effectiveness of trading with Experia Markets. The lack of transparency regarding other potential fees and charges could lead to unexpected costs for traders, further complicating the assessment of whether Experia Markets is safe for trading.

Client Funds Safety

The safety of client funds is paramount in the forex trading environment. Experia Markets does not provide clear information about its policies regarding fund segregation, investor protection, or negative balance protection. Without robust measures in place, clients' funds may be at risk, especially in the event of the broker facing financial difficulties.

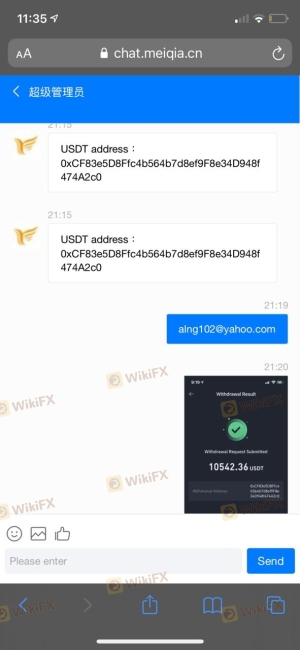

Reports of difficulties with fund withdrawals have emerged, indicating that clients may encounter challenges when attempting to access their money. Such issues are concerning, as they suggest a potential lack of operational integrity and transparency. The absence of investor protection schemes typically offered by regulated brokers further exacerbates these concerns, leading to the conclusion that Experia Markets is not a safe broker for those prioritizing the security of their investments.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reliability and service quality. Reviews of Experia Markets reveal a pattern of complaints, primarily focusing on withdrawal issues and inadequate customer support. Many users report being unable to withdraw their funds, with some alleging that their accounts were blocked without clear justification.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Inconsistent |

These complaints highlight a troubling trend that suggests a lack of responsiveness and accountability on the part of Experia Markets. While some users have reported satisfactory trading experiences, the prevalence of negative feedback raises serious concerns about the broker's operational practices. As such, traders should approach Experia Markets with caution, as the evidence suggests that Experia Markets is not a safe choice for those seeking a reliable trading partner.

Platform and Trade Execution

The trading platform offered by Experia Markets is based on the widely-used MetaTrader 4 (MT4) system, which is known for its user-friendly interface and robust features. However, user reviews indicate that the platform may experience stability issues, leading to delayed order execution and potential slippage.

The quality of trade execution is critical for traders, as any delays can significantly impact profitability. Reports of high slippage and rejected orders have emerged, suggesting that the broker may not provide the level of execution quality expected in the industry. Such issues can undermine the overall trading experience and raise further doubts about whether Experia Markets is safe for traders who rely on timely execution.

Risk Assessment

Using Experia Markets involves several inherent risks that traders should be aware of. The absence of regulatory oversight, coupled with a lack of transparency regarding fund safety and operational practices, creates a high-risk environment for potential investors.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | No regulation present |

| Fund Safety | High | Lack of protection measures |

| Customer Support | Medium | Inconsistent responses to complaints |

To mitigate these risks, traders are advised to thoroughly research any broker before investing and to consider regulated alternatives that offer greater transparency and security. Additionally, using risk management strategies, such as limiting exposure and diversifying investments, can help protect against potential losses.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that Experia Markets is not a safe broker for traders. The lack of regulatory oversight, coupled with numerous complaints regarding fund withdrawals and customer support, raises significant concerns about the broker's integrity and reliability. Potential investors should exercise extreme caution and consider alternative, well-regulated brokers that offer the necessary protections and transparency.

For traders seeking reliable options, consider brokers with established reputations and regulatory frameworks, such as those regulated by the FCA, ASIC, or CySEC, which provide a safer trading environment and ensure that clients' funds are adequately protected. Ultimately, ensuring the safety of your investments should be the top priority when selecting a forex broker.

Is Experia Markets a scam, or is it legit?

The latest exposure and evaluation content of Experia Markets brokers.

Experia Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Experia Markets latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.