ETHER Review 1

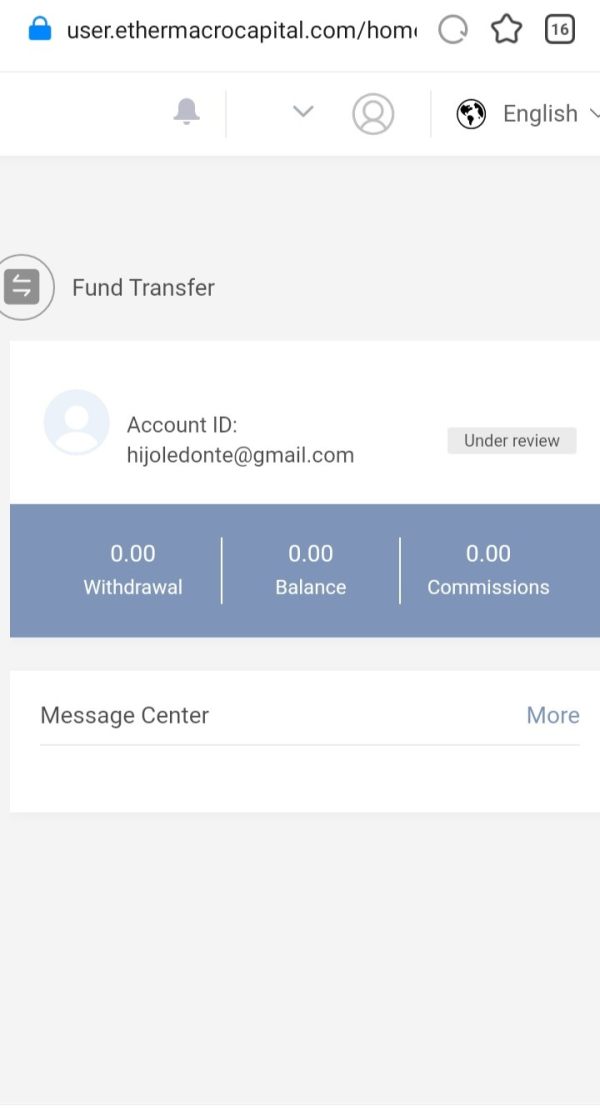

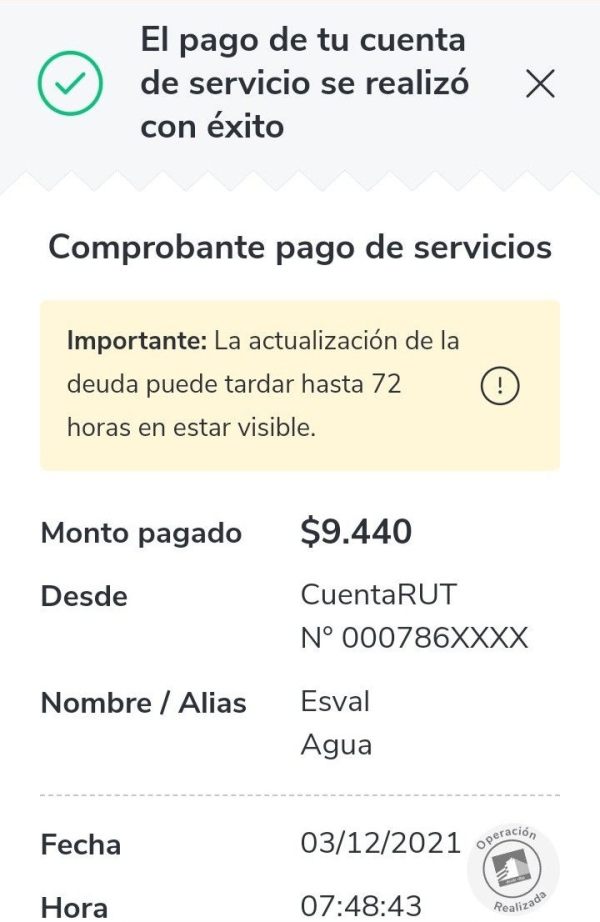

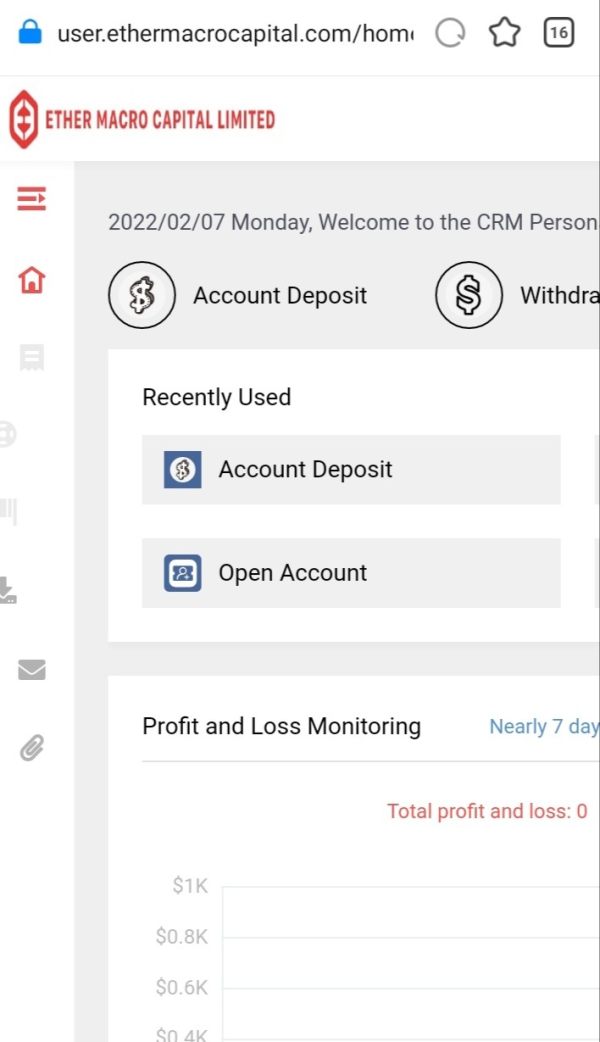

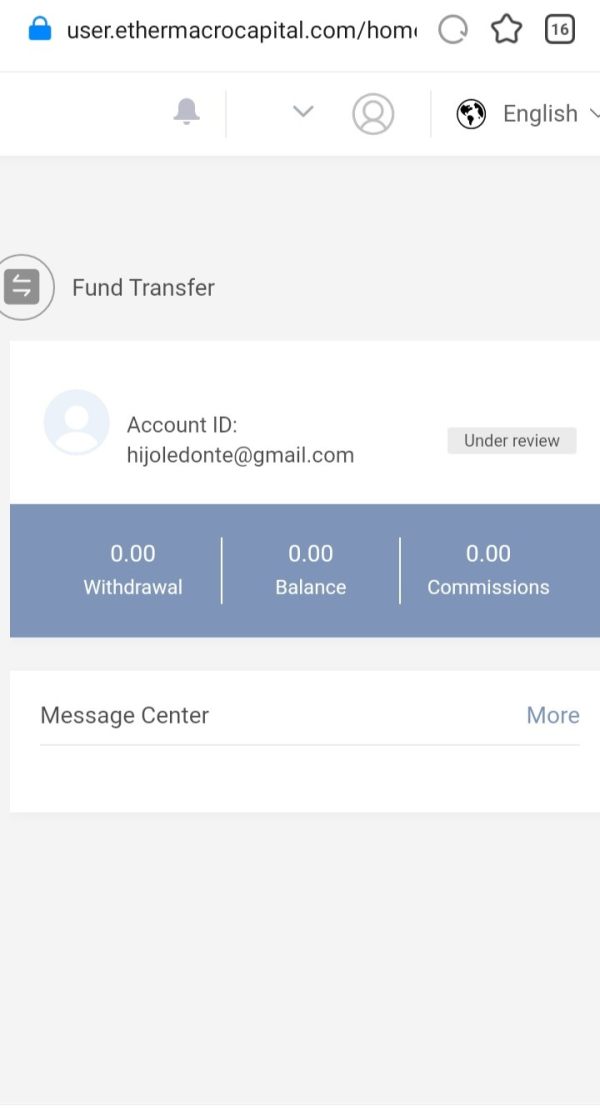

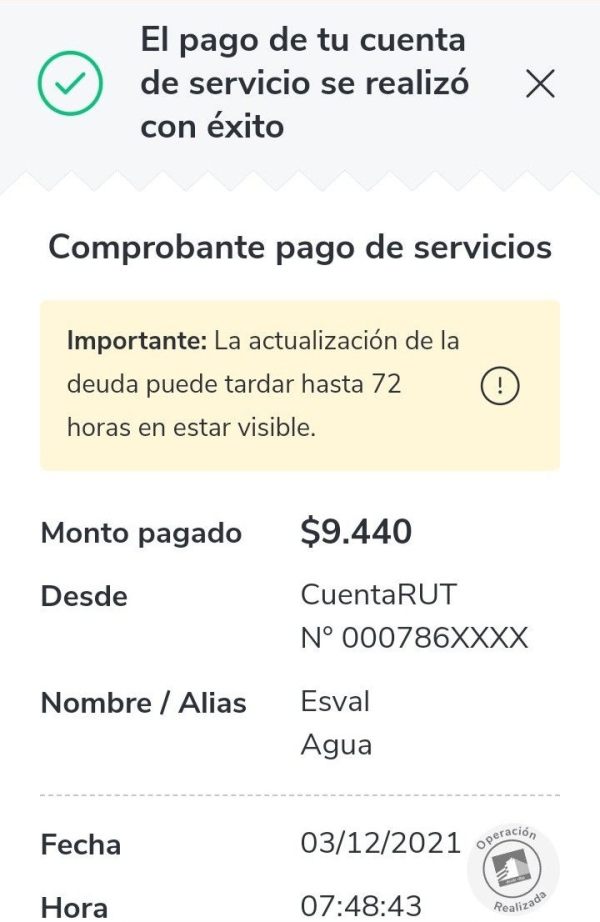

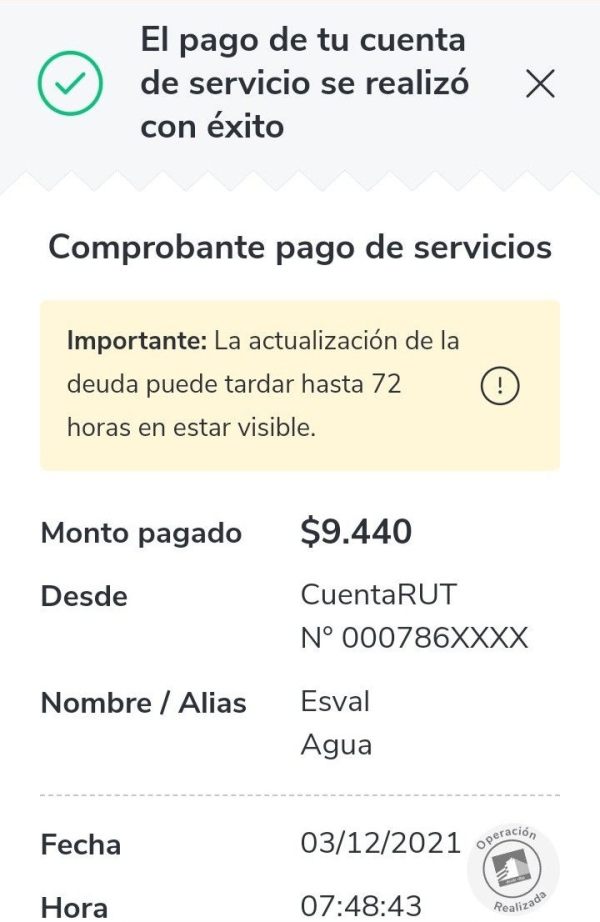

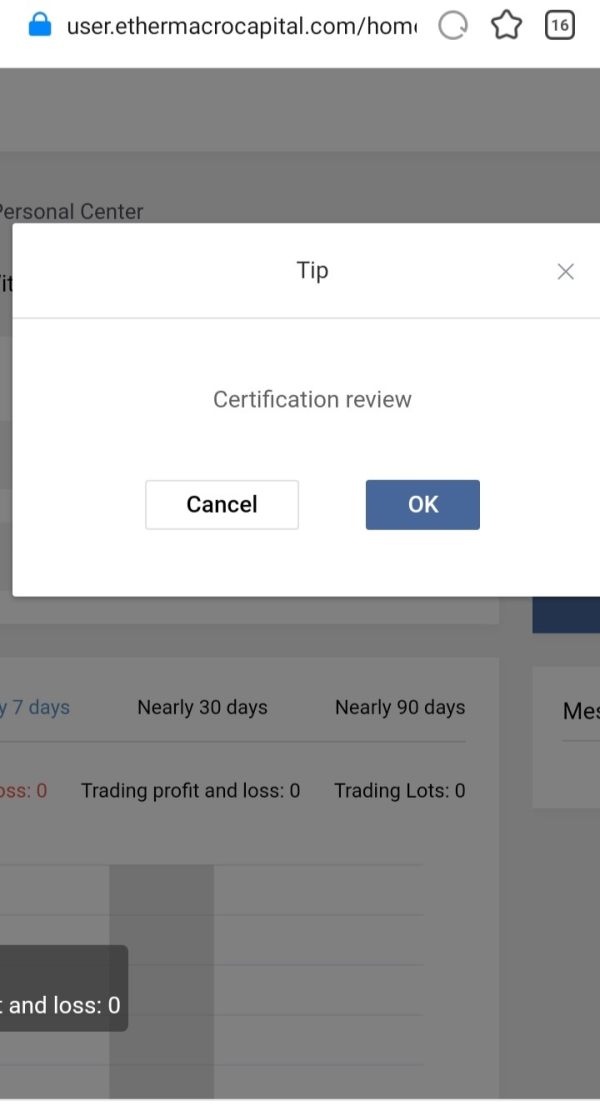

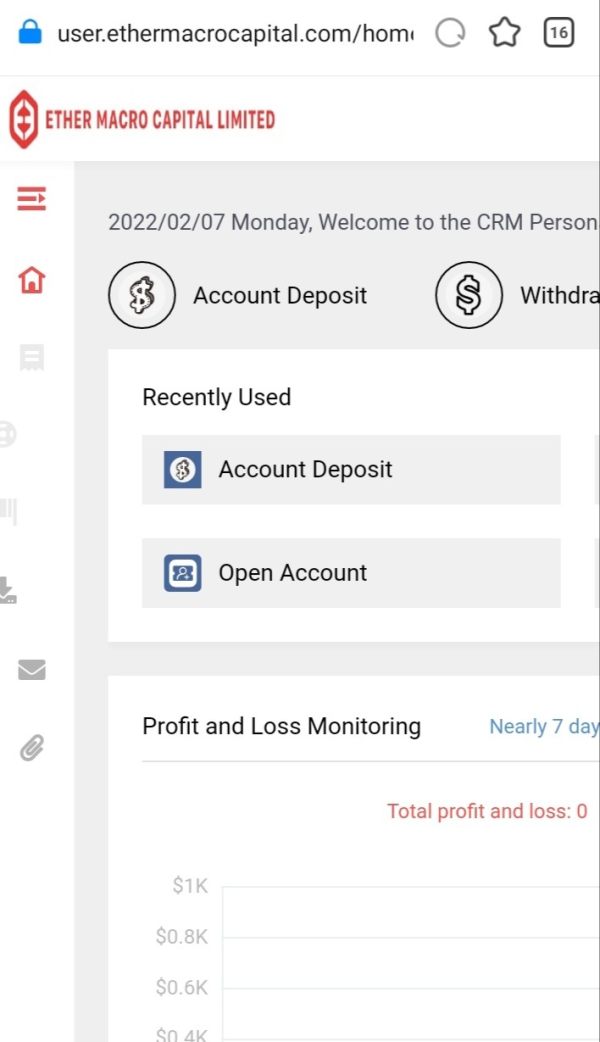

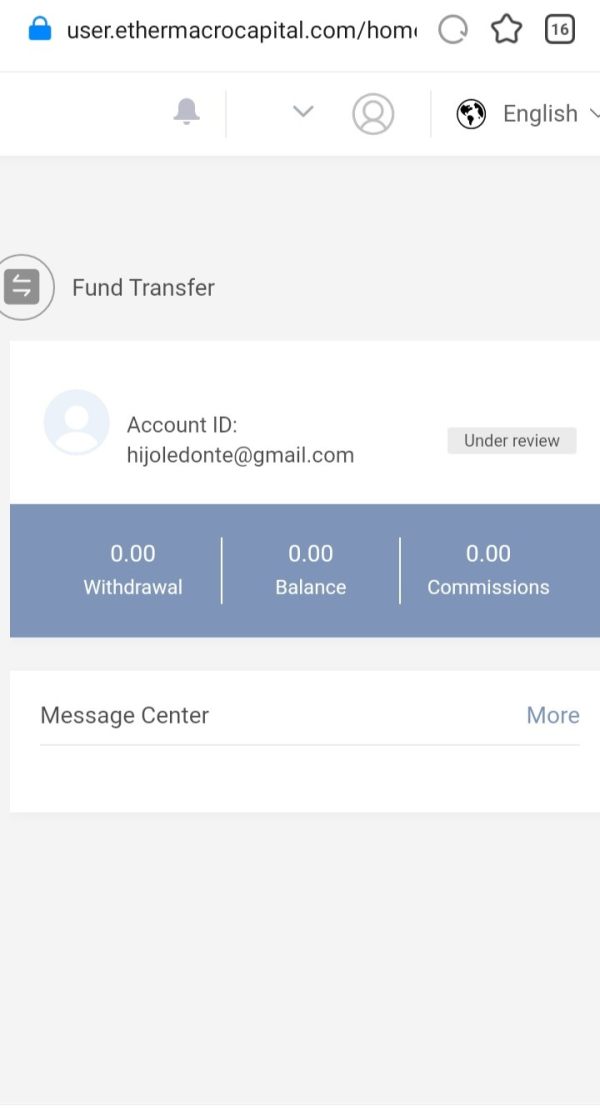

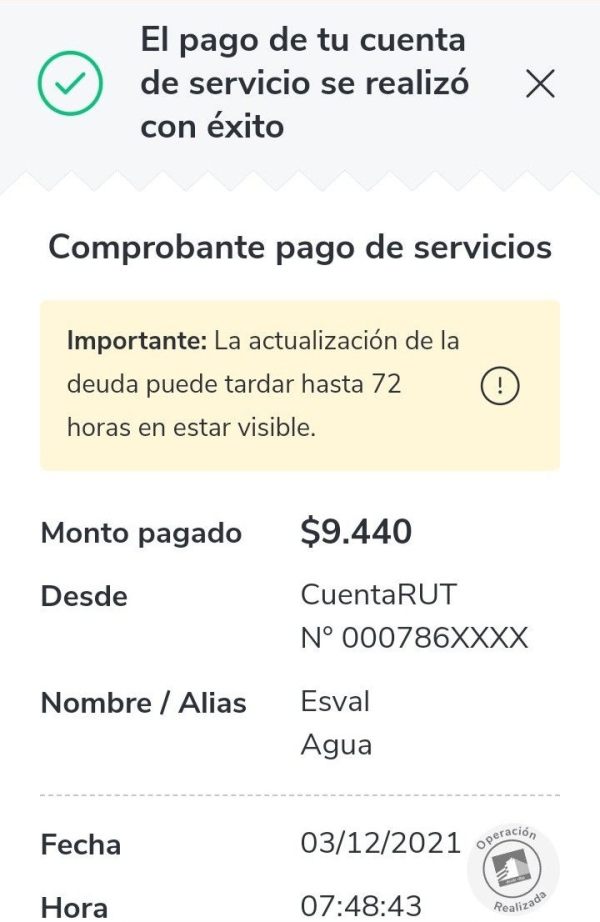

I withdrew more than $1,300 and it did not reach my bank. Besides, I do not see my investment of $9,440 on the board and they are being innocent to avoid paying me. Please help me to recover everything.

ETHER Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

I withdrew more than $1,300 and it did not reach my bank. Besides, I do not see my investment of $9,440 on the board and they are being innocent to avoid paying me. Please help me to recover everything.

This comprehensive ether review examines the current state of Ethereum trading opportunities in 2025. Based on available information from major financial platforms, Ethereum continues to serve as one of the most significant cryptocurrency assets for traders worldwide. The platform maintains its position as a bridge between traditional trading mechanisms and blockchain technology, specifically focusing on Ethereum's native currency, ETH.

Our analysis reveals that Ethereum trading platforms provide essential tools and functionalities for traders seeking exposure to ETH markets. However, the landscape remains complex with varying regulatory frameworks across different jurisdictions. The primary user base consists of cryptocurrency traders, institutional investors, and blockchain enthusiasts who understand the technical aspects of Ethereum's ecosystem.

According to recent market data from Forbes Advisor India and other financial sources, Ethereum's price predictions for 2024-2030 show significant volatility expectations, making it crucial for traders to understand the platforms facilitating these trades. This ether review aims to provide clarity on the trading infrastructure supporting Ethereum transactions.

This evaluation is based on publicly available information and user feedback compiled from various financial platforms and cryptocurrency exchanges. Readers should note that regulatory frameworks for cryptocurrency trading vary significantly across different regions and jurisdictions. The information presented may not reflect the most current regulatory status in all markets.

Our assessment methodology combines technical analysis of platform capabilities, user experience reports, and regulatory compliance information where available. Due to the rapidly evolving nature of cryptocurrency regulations, traders should verify current compliance requirements in their specific jurisdiction before engaging with any Ethereum trading platform.

| Dimension | Score | Rating Basis |

|---|---|---|

| Account Conditions | N/A | Insufficient specific information available |

| Tools and Resources | 6/10 | Basic trading tools and blockchain integration |

| Customer Service | N/A | Limited customer support information available |

| Trading Experience | N/A | Varied across different platforms |

| Trust and Security | N/A | Regulatory information not comprehensively available |

| User Experience | N/A | Mixed user feedback across platforms |

Ethereum trading platforms have evolved significantly since the cryptocurrency's inception, serving as essential intermediaries between traders and the Ethereum blockchain network. These platforms facilitate access to ETH trading without requiring users to directly interact with complex blockchain protocols. The business model typically revolves around providing user-friendly interfaces for buying, selling, and trading Ethereum tokens.

According to information from IG International and other major trading platforms, Ethereum trading has become increasingly sophisticated, offering various trading instruments including CFDs and direct token purchases. The platforms generally operate through web-based interfaces and mobile applications, making Ethereum trading accessible to both retail and institutional traders.

The regulatory landscape for these platforms remains complex, with different jurisdictions implementing varying compliance requirements. This ether review indicates that while some platforms operate under established financial regulatory frameworks, others function in less regulated environments, creating a diverse ecosystem of trading options for Ethereum enthusiasts.

Regulatory Environment: The regulatory status of Ethereum trading platforms varies significantly across jurisdictions. While some operate under traditional financial services regulations, others function within cryptocurrency-specific regulatory frameworks that continue to evolve.

Deposit and Withdrawal Methods: Most platforms support multiple funding methods including bank transfers, credit cards, and other cryptocurrency deposits. Specific options depend on the platform and user location.

Minimum Deposit Requirements: Requirements vary widely across different platforms, with some offering no minimum deposits while others require substantial initial investments.

Promotional Offers: Limited information available regarding specific bonus structures or promotional campaigns across Ethereum trading platforms.

Available Assets: Primary focus on Ethereum trading, with many platforms also offering other major cryptocurrencies and traditional trading instruments.

Cost Structure: Fee structures typically include trading commissions, spread costs, and potential blockchain transaction fees, though specific rates vary significantly between platforms.

Leverage Options: Leverage availability depends on regulatory jurisdiction and platform type, with some offering significant leverage for cryptocurrency CFD trading.

Platform Selection: Primarily web-based and mobile applications designed for cryptocurrency trading.

Regional Restrictions: Vary by platform and local regulations.

Customer Service Languages: Generally include major international languages, though availability varies by platform.

The account opening process for Ethereum trading platforms typically involves standard KYC procedures, though specific requirements vary significantly across different service providers. Most platforms require identity verification, proof of residence, and compliance with local anti-money laundering regulations. However, comprehensive information about specific account types and their features remains limited in available sources.

Minimum deposit requirements show considerable variation across the ecosystem. Some platforms cater to retail traders with low or no minimum deposits, while others target institutional clients with higher entry requirements. The lack of standardized account condition information makes it challenging to provide definitive comparisons in this ether review.

Account funding options generally include traditional banking methods and cryptocurrency deposits, though the specific availability depends on regulatory compliance in each jurisdiction. Users should verify available funding methods based on their location and chosen platform.

Special account features such as demo accounts, educational resources, and advanced trading tools vary significantly between providers. The diversity in account offerings reflects the evolving nature of the cryptocurrency trading industry.

Ethereum trading platforms generally provide essential trading tools including real-time price charts, order management systems, and basic technical analysis indicators. According to available information, most platforms focus on delivering fundamental trading functionality rather than comprehensive analytical resources.

Research and analysis resources vary considerably across different platforms. Some providers offer market analysis and cryptocurrency news feeds, while others maintain minimal educational content. The quality and depth of research materials often correlate with the platform's target market and regulatory status.

Educational resources for Ethereum trading remain inconsistent across the industry. While some platforms provide comprehensive guides about blockchain technology and trading strategies, others offer limited educational support. This gap in educational resources represents a significant consideration for novice traders.

Automated trading support and API access are available on select platforms, primarily targeting more sophisticated traders and institutional clients. However, the availability and quality of these advanced features vary significantly between service providers.

Customer service information for Ethereum trading platforms remains limited in available sources. The support infrastructure varies significantly across different providers, with some offering comprehensive multi-channel support while others maintain minimal customer service capabilities.

Response times and service quality appear to differ substantially between platforms, likely reflecting their operational scale and regulatory requirements. Platforms operating under strict financial regulations typically maintain higher customer service standards compared to less regulated alternatives.

Multi-language support availability depends on the platform's target markets and operational scope. International platforms generally offer support in major languages, while regional providers may focus on local language support.

Customer service hours and availability show considerable variation across the ecosystem. Some platforms provide 24/7 support reflecting the global nature of cryptocurrency markets, while others maintain traditional business hours.

The trading experience on Ethereum platforms varies significantly depending on the specific service provider and regulatory environment. Platform stability and execution speed depend on the underlying technology infrastructure and regulatory compliance requirements.

Order execution quality differs across platforms, with some offering direct blockchain interaction while others provide CFD-based Ethereum exposure. This ether review indicates that execution methods significantly impact the overall trading experience.

Platform functionality completeness ranges from basic buy/sell interfaces to sophisticated trading environments with advanced order types and risk management tools. The feature set generally correlates with the platform's target market and regulatory status.

Mobile trading experience has become increasingly important for Ethereum traders. Most modern platforms offer mobile applications, though the quality and functionality vary considerably between providers.

Security measures for Ethereum trading platforms typically include standard cybersecurity protocols, though specific implementations vary significantly. The security infrastructure often reflects the platform's regulatory status and operational scale.

Regulatory compliance information remains limited for many Ethereum trading platforms. While some operate under established financial regulatory frameworks, others function in less regulated environments, creating varying levels of oversight and protection.

Company transparency varies considerably across the ecosystem. Established platforms typically provide comprehensive corporate information, while newer or less regulated providers may offer limited transparency about their operations and ownership structure.

Industry reputation and track record differ significantly between platforms. Long-established providers generally maintain better reputational standing compared to newer entrants, though this doesn't necessarily correlate with service quality.

Overall user satisfaction with Ethereum trading platforms appears mixed based on available information. The diverse regulatory environment and varying service quality create inconsistent user experiences across different providers.

Interface design and usability show considerable variation between platforms. Some providers focus on user-friendly interfaces for retail traders, while others prioritize functionality for sophisticated users.

Registration and verification processes typically follow standard KYC requirements, though implementation and efficiency vary between platforms. The verification timeline can range from minutes to several days depending on the provider and regulatory requirements.

Fund management experiences differ significantly across platforms, particularly regarding deposit and withdrawal processing times and available methods. These operational aspects significantly impact overall user satisfaction.

This comprehensive ether review reveals a diverse and evolving ecosystem of Ethereum trading platforms with varying capabilities, regulatory status, and user experiences. While Ethereum trading has become increasingly accessible, the lack of standardized information and regulatory frameworks creates challenges for traders seeking reliable platform comparisons.

The platforms generally serve cryptocurrency traders seeking exposure to Ethereum markets, though the quality of service and regulatory protection varies significantly. Potential users should carefully research specific platforms and verify regulatory compliance in their jurisdiction before engaging in Ethereum trading activities.

The main advantages include growing accessibility to Ethereum markets and improving platform functionality. However, significant disadvantages include inconsistent regulatory oversight, limited transparency, and varying service quality across different providers.

FX Broker Capital Trading Markets Review