DEX Investing 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive dex investing review reveals concerning findings about DEX Investing LLC. The company presents significant red flags for potential traders and investors. Based on available information and user feedback, DEX Investing operates as an unregulated offshore entity registered in Saint Vincent and the Grenadines. It lacks oversight from major financial regulatory authorities. The company claims to provide investment and trading services across multiple asset classes including forex, commodities, stocks, and cryptocurrencies.

User reviews consistently warn against engaging with this platform. Many describe it as a potential scam operation. The lack of regulatory oversight, combined with overwhelmingly negative user feedback, positions DEX Investing as a high-risk proposition. It may only appeal to investors with exceptionally high risk tolerance. The absence of transparent information regarding trading conditions, fees, and operational procedures further compounds concerns about the platform's legitimacy and safety for client funds.

Important Disclaimer

Regional Entity Differences: DEX Investing LLC is registered in Saint Vincent and the Grenadines. This is an offshore jurisdiction that does not provide the same level of regulatory protection as major financial centers. The company lacks authorization from prominent regulatory bodies such as the FCA, ASIC, CySEC, or other tier-one regulators. This significantly impacts the safety and recourse options available to traders.

Review Methodology: This evaluation is based on publicly available information, user testimonials, and industry reports. Due to the company's limited transparency and unregulated status, certain operational details could not be independently verified through official channels.

Overall Rating Framework

Broker Overview

DEX Investing LLC presents itself as a financial services provider offering investment and trading opportunities across multiple asset classes. The company is registered in Saint Vincent and the Grenadines, a jurisdiction known for its lenient regulatory environment and minimal oversight requirements. This offshore registration immediately raises concerns about the level of protection available to clients and the company's commitment to industry best practices.

The business model centers around providing access to financial derivatives including foreign exchange, commodities, equities, and cryptocurrency markets. However, the lack of detailed information about the company's operational history, founding date, and management team creates significant transparency gaps. These gaps are typically filled by legitimate, regulated brokers.

According to available information, DEX Investing targets investors seeking exposure to diverse financial markets. However, the overwhelming consensus from user feedback suggests that the platform fails to deliver on its promises and may pose substantial risks to client funds. This dex investing review emphasizes the importance of thorough due diligence before considering any engagement with this entity.

The absence of proper regulatory oversight means that clients have limited recourse in case of disputes or issues with fund withdrawals. This factor alone makes DEX Investing unsuitable for most retail investors who require the protection and oversight provided by established regulatory frameworks.

Regulatory Status: DEX Investing operates without authorization from major financial regulatory authorities. The company's registration in Saint Vincent and the Grenadines provides minimal regulatory protection, as this jurisdiction does not maintain the same stringent oversight standards as tier-one financial centers.

Deposit and Withdrawal Methods: Specific information about funding options and withdrawal procedures is not detailed in available sources. This creates uncertainty about the practical aspects of account management and fund access.

Minimum Deposit Requirements: The platform's minimum deposit thresholds are not specified in available documentation. This makes it difficult for potential clients to assess entry requirements.

Promotional Offers: Information regarding bonus structures, promotional campaigns, or incentive programs is not available in the reviewed sources.

Tradeable Assets: The company claims to offer access to forex, commodities, stocks, and cryptocurrencies. However, the specific instruments, market depth, and execution quality for these asset classes remain unclear.

Cost Structure: Critical information about spreads, commissions, overnight fees, and other trading costs is notably absent from available sources. This lack of transparency regarding pricing is a significant concern for potential traders.

Leverage Ratios: Specific leverage offerings and margin requirements are not detailed in the available information. This prevents proper assessment of risk management parameters.

Platform Options: The trading platforms and technological infrastructure provided by DEX Investing are not specified in reviewed sources.

Geographic Restrictions: Information about service availability in different jurisdictions is not clearly outlined in available documentation.

Customer Support Languages: The range of languages supported by customer service teams is not specified in the reviewed materials.

This dex investing review highlights the concerning lack of transparency across multiple operational areas that legitimate brokers typically disclose prominently.

Account Conditions Analysis

The evaluation of DEX Investing's account conditions reveals significant information gaps that raise serious concerns about the platform's transparency and legitimacy. Unlike established brokers who provide detailed specifications about account types, trading conditions, and client onboarding procedures, DEX Investing fails to offer clear information about these fundamental aspects of their service.

The absence of information regarding account varieties, minimum deposit requirements, and specific trading conditions makes it impossible for potential clients to make informed decisions about platform suitability. Legitimate brokers typically offer multiple account tiers designed to accommodate different trader profiles, from beginners to institutional clients, each with clearly defined features and requirements.

User feedback consistently warns against the platform. Many describe experiences that suggest potential fraudulent activities. The lack of transparent account opening procedures, combined with unclear verification requirements, creates an environment where client protection appears to be minimal.

The absence of information about specialized account features, such as Islamic accounts for Muslim traders or institutional-grade services for large-volume clients, further demonstrates the platform's limited commitment to serving diverse client needs. This dex investing review emphasizes that the lack of clear account conditions represents a fundamental failure in meeting industry standards for broker transparency.

DEX Investing's offering of trading tools and educational resources appears limited based on available information. While the company claims to provide access to multiple asset classes including forex, commodities, stocks, and cryptocurrencies, the specific tools, analytical resources, and educational materials available to traders remain largely undisclosed.

Professional trading platforms typically offer comprehensive charting packages, technical analysis tools, economic calendars, market research, and educational resources to support trader development. The absence of detailed information about such offerings suggests either a limited service provision or a lack of transparency that is concerning for potential users.

User feedback consistently recommends avoiding the platform. This indicates that whatever tools and resources may be available fail to meet trader expectations or industry standards. The lack of information about automated trading support, API access, or third-party integration capabilities further limits the platform's appeal to serious traders.

Educational resources are crucial for trader development, particularly for newcomers to financial markets. The absence of clear information about webinars, tutorials, market analysis, or educational content suggests that DEX Investing may not prioritize client education and development. This is typically a hallmark of reputable brokers.

Customer Service and Support Analysis

Customer service quality represents one of the most critical aspects of any financial services provider. Yet DEX Investing's support infrastructure remains largely opaque based on available information. The lack of clear information about customer service channels, availability hours, response times, and service quality creates significant concerns about the level of support clients can expect.

User reviews consistently advise against engaging with the platform. This suggests that any customer service interactions that do occur may be unsatisfactory or problematic. Legitimate brokers typically provide multiple contact channels including live chat, email, phone support, and comprehensive FAQ sections to address client needs promptly and effectively.

The absence of information about multilingual support capabilities is particularly concerning given the global nature of financial markets and the diverse client base that most brokers serve. Professional brokers typically offer support in multiple languages to accommodate international clients effectively.

Response time commitments and service level agreements are standard features of professional customer support operations, yet no such information is available for DEX Investing. The lack of documented customer service standards suggests either minimal support infrastructure or a deliberate lack of transparency about service capabilities.

Trading Experience Analysis

The trading experience offered by DEX Investing remains largely undefined due to insufficient information about platform capabilities, execution quality, and operational reliability. Professional trading environments require stable platforms, fast execution speeds, comprehensive order types, and reliable market data feeds to support effective trading activities.

User feedback overwhelmingly advises against using the platform. This suggests that the actual trading experience fails to meet even basic expectations for functionality and reliability. The absence of information about platform stability, execution speeds, slippage rates, and order fill quality makes it impossible to assess the technical capabilities of the trading environment.

Mobile trading capabilities have become essential for modern traders who require access to markets and account management tools while away from desktop computers. The lack of information about mobile platform availability and functionality represents another significant gap in service transparency.

Risk management tools, including stop-loss orders, take-profit levels, and position sizing calculators, are fundamental features of professional trading platforms. The absence of detailed information about such capabilities raises questions about the platform's suitability for serious trading activities. This dex investing review emphasizes that the lack of clear trading experience information represents a major deterrent for potential users.

Trust and Safety Analysis

Trust and safety considerations represent the most critical concerns regarding DEX Investing. Multiple red flags indicate significant risks for potential clients. The company's unregulated status, combined with registration in an offshore jurisdiction with minimal oversight, creates an environment where client protection is severely limited.

The absence of authorization from major regulatory bodies such as the Financial Conduct Authority, Australian Securities and Investments Commission, or Cyprus Securities and Exchange Commission means that clients have limited recourse in case of disputes or issues with fund withdrawals. This regulatory gap represents a fundamental safety concern that cannot be overlooked.

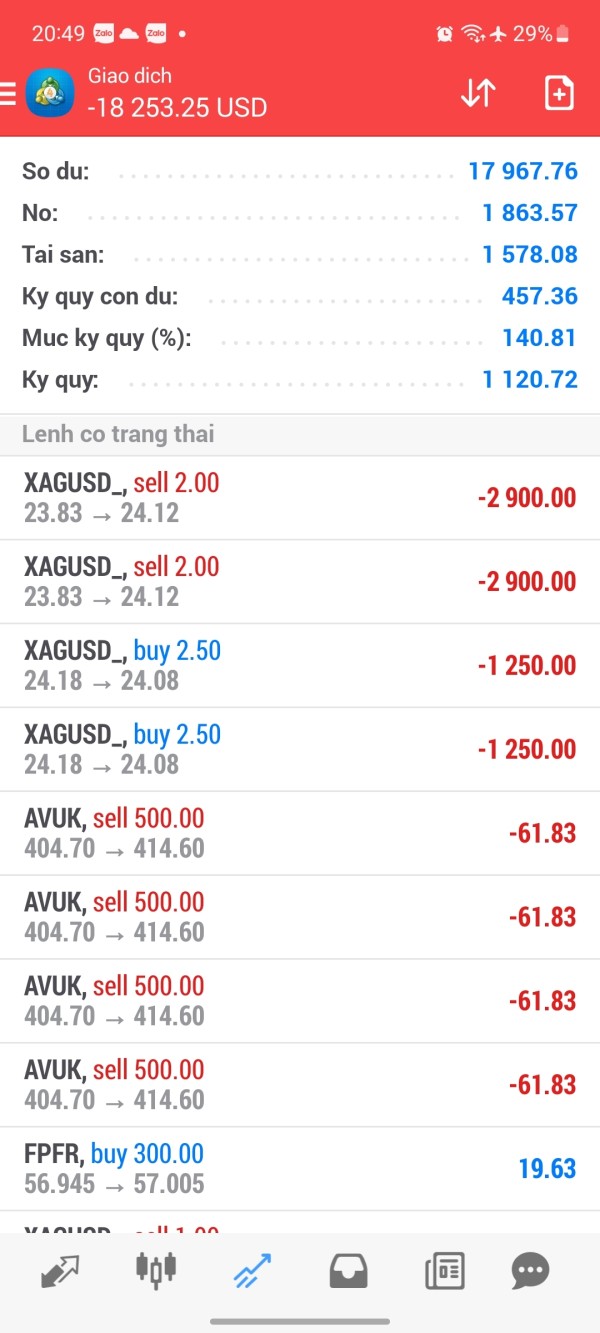

User feedback consistently characterizes the platform as a potential scam operation. Users warn about fund safety and withdrawal difficulties. Such widespread negative sentiment from actual users represents perhaps the most significant red flag regarding the platform's trustworthiness and operational integrity.

The lack of information about client fund segregation, deposit protection schemes, and financial safeguards further compounds safety concerns. Legitimate brokers typically maintain client funds in segregated accounts with tier-one banks and participate in compensation schemes that provide additional protection for client deposits.

Transparency regarding company ownership, management team, and financial backing is notably absent. This makes it impossible to assess the stability and credibility of the organization behind the platform. This lack of corporate transparency is inconsistent with industry best practices and regulatory expectations.

User Experience Analysis

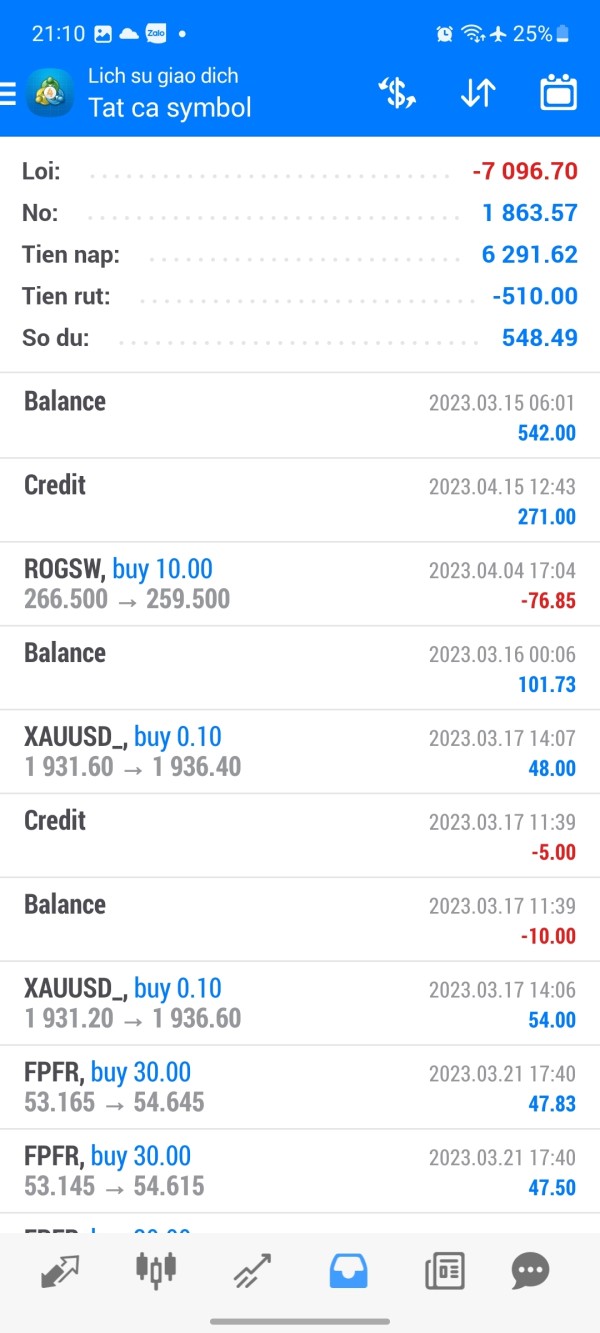

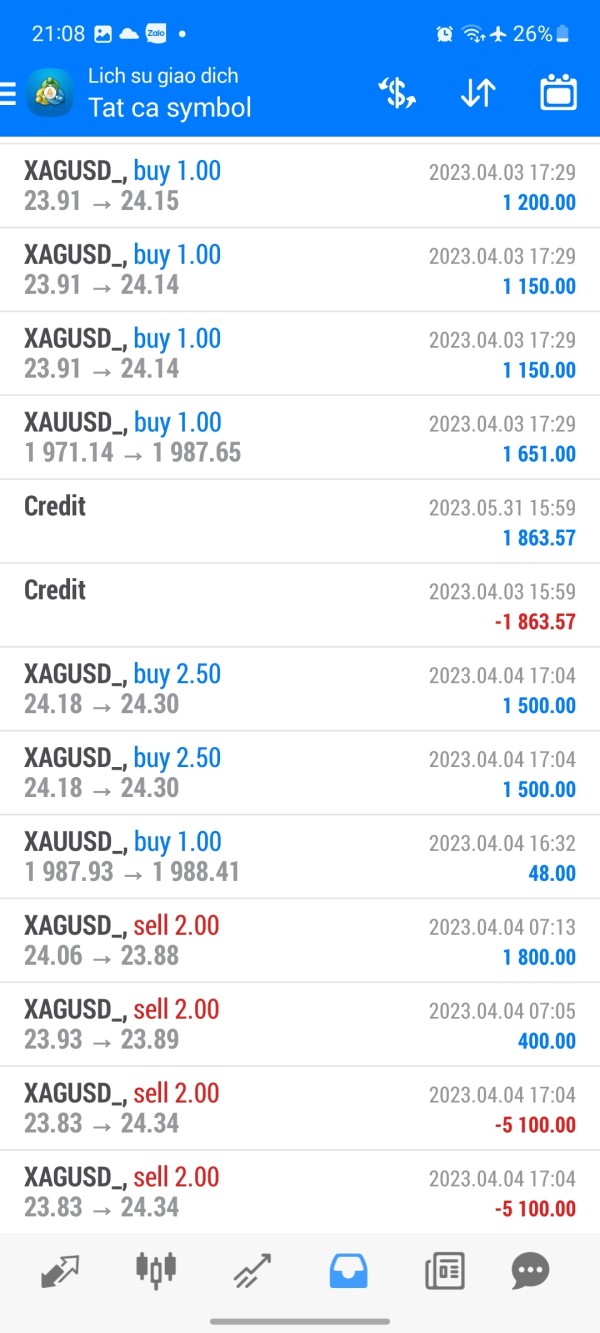

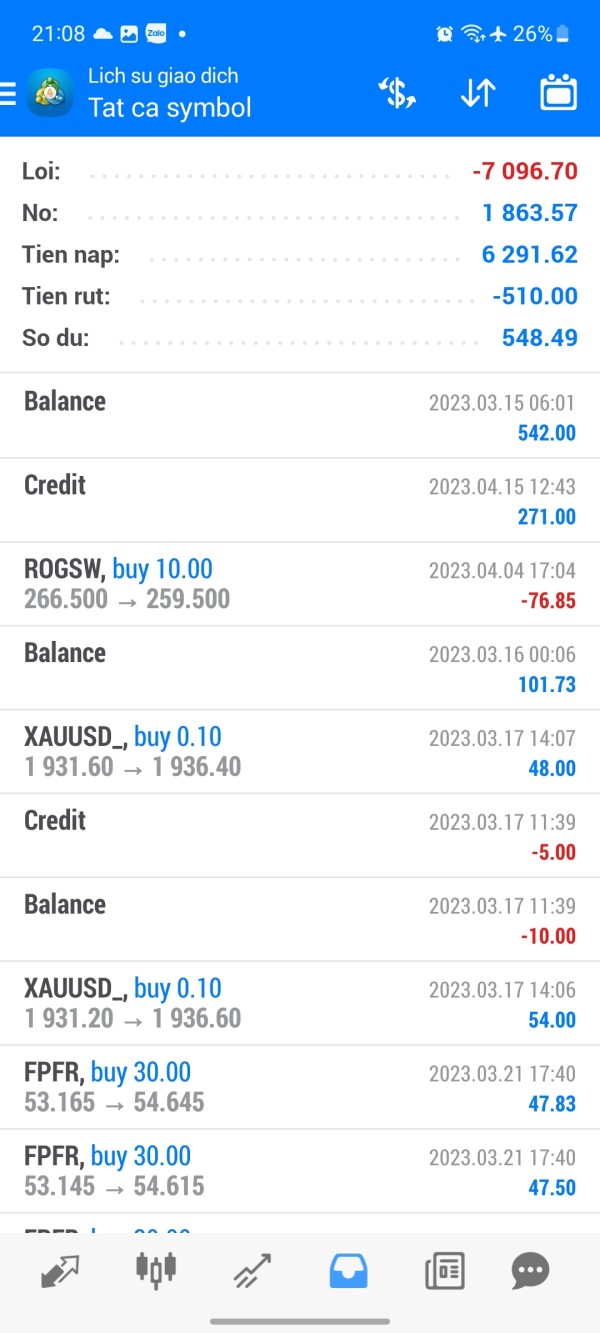

User experience analysis reveals consistently negative feedback regarding DEX Investing. User reviews universally recommend against engagement with the platform. This widespread negative sentiment represents a significant warning sign that potential clients should carefully consider before making any commitments.

The target demographic appears to be investors with high risk tolerance, though even risk-seeking investors should be cautious given the overwhelming negative feedback from existing users. The lack of positive user testimonials or success stories further reinforces concerns about the platform's legitimacy and service quality.

Interface design and platform usability information is not available in reviewed sources. This makes it difficult to assess the practical aspects of using the platform for trading activities. Professional brokers typically invest heavily in user interface development to ensure intuitive navigation and efficient trade execution.

Account registration and verification processes remain unclear. This creates uncertainty about onboarding procedures and documentation requirements. The lack of transparent information about these fundamental processes is inconsistent with industry standards and regulatory expectations.

Common user complaints appear to center around concerns about the platform's legitimacy and fund safety. Many users characterize their experiences as potentially fraudulent. The absence of positive feedback or successful user experiences represents a significant concern for potential clients considering the platform.

Conclusion

This comprehensive dex investing review reveals significant concerns about DEX Investing LLC that make it unsuitable for most traders and investors. The company's unregulated status, combined with consistently negative user feedback and lack of operational transparency, creates a risk profile that exceeds acceptable levels for prudent investment decisions.

The platform may only appeal to investors with exceptionally high risk tolerance who are willing to accept the possibility of total loss. However, even risk-seeking investors should carefully consider whether the potential risks justify any possible benefits, particularly given the availability of regulated alternatives in the market.

Key advantages: Limited to the claimed availability of multiple asset classes for trading and investment.

Major disadvantages: Unregulated status, widespread negative user feedback, lack of transparency regarding trading conditions and operational procedures, potential fund safety risks, and absence of regulatory protection for client deposits.

Potential users are strongly advised to conduct thorough due diligence and consider regulated alternatives that provide appropriate client protections and transparent operational standards.