Crystal Ball Markets 2025 Review: Everything You Need to Know

Executive Summary

Crystal Ball Markets has become a notable player in the online trading industry. The company offers comprehensive trading services across multiple asset classes. This crystal ball markets review reveals a broker that caters to global clients with competitive trading conditions and an extensive selection of financial instruments.

The platform distinguishes itself by providing access to over 160 trading tools. These tools span forex, commodities, indices, stocks, and cryptocurrencies. With leverage reaching up to 1:1,000, Crystal Ball Markets positions itself as an attractive option for traders seeking flexible trading conditions.

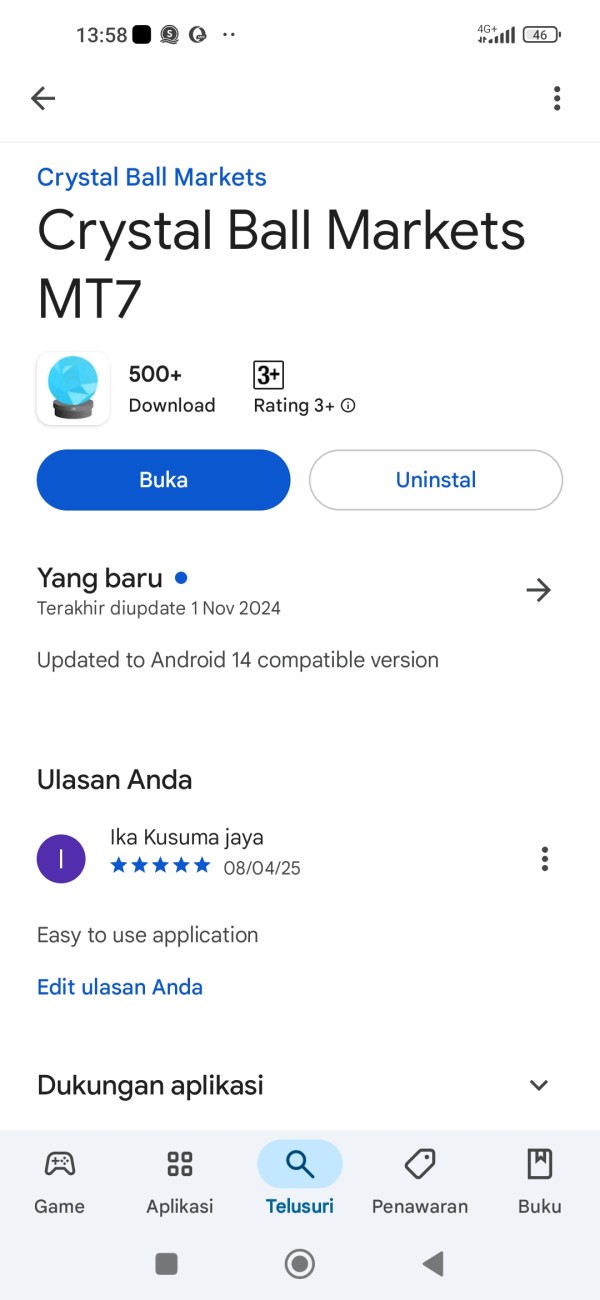

The broker operates through its proprietary Mobius Trader 7 platform. It also incorporates social trading capabilities to enhance user experience. User feedback indicates generally positive reception, with clients praising the platform's payment processing speed and professional service delivery.

The broker maintains regulatory compliance through FINTRAC in Canada while being registered in Saint Vincent and the Grenadines. Based on available user reviews, Crystal Ball Markets maintains an average rating of 4 stars from 8 reviews. This suggests satisfactory performance in meeting trader expectations.

The platform appears well-suited for diverse trading styles and experience levels. It offers both individual trading opportunities and social trading features for those seeking community-based investment approaches.

Important Notice

Crystal Ball Markets operates with multiple regulatory frameworks across different jurisdictions. The company is registered in Saint Vincent and the Grenadines while maintaining a Canadian registered entity subject to FINTRAC regulations.

This dual-jurisdiction structure means that services and regulatory protections may vary depending on client location and applicable regulatory framework. This review is compiled based on publicly available information and user feedback collected from various sources. Trading conditions, fees, and service offerings may be subject to change, and potential clients should verify current terms directly with the broker before making investment decisions.

The information presented reflects the broker's status as of the review date and should not be considered as investment advice or recommendation.

Rating Framework

Broker Overview

Crystal Ball Markets operates as an online trading platform and brokerage firm. The company provides comprehensive trading services across multiple financial markets. The company focuses on delivering accessible trading solutions for global clients, emphasizing technological innovation and user-friendly trading environments.

While specific establishment details are not extensively documented in available materials, the broker has positioned itself as a modern trading platform catering to contemporary market demands. The company's business model centers on providing multi-asset trading capabilities through its proprietary technology platform. Crystal Ball Markets distinguishes itself by offering social trading features alongside traditional trading services, enabling clients to engage with community-driven investment strategies.

The broker's approach combines individual trading autonomy with collaborative trading opportunities. This appeals to both independent traders and those seeking social trading experiences. The platform operates under a regulatory framework that includes FINTRAC oversight in Canada, while maintaining its primary registration in Saint Vincent and the Grenadines.

This crystal ball markets review finds that the broker offers trading access across major asset classes including foreign exchange, commodities, stock indices, individual stocks, and cryptocurrencies. The Mobius Trader 7 platform serves as the primary trading interface, providing clients with comprehensive market access and trading functionality.

Regulatory Jurisdictions: Crystal Ball Markets maintains registration in Saint Vincent and the Grenadines while operating a Canadian entity under FINTRAC regulations. This dual-jurisdiction approach provides regulatory framework coverage for different client segments.

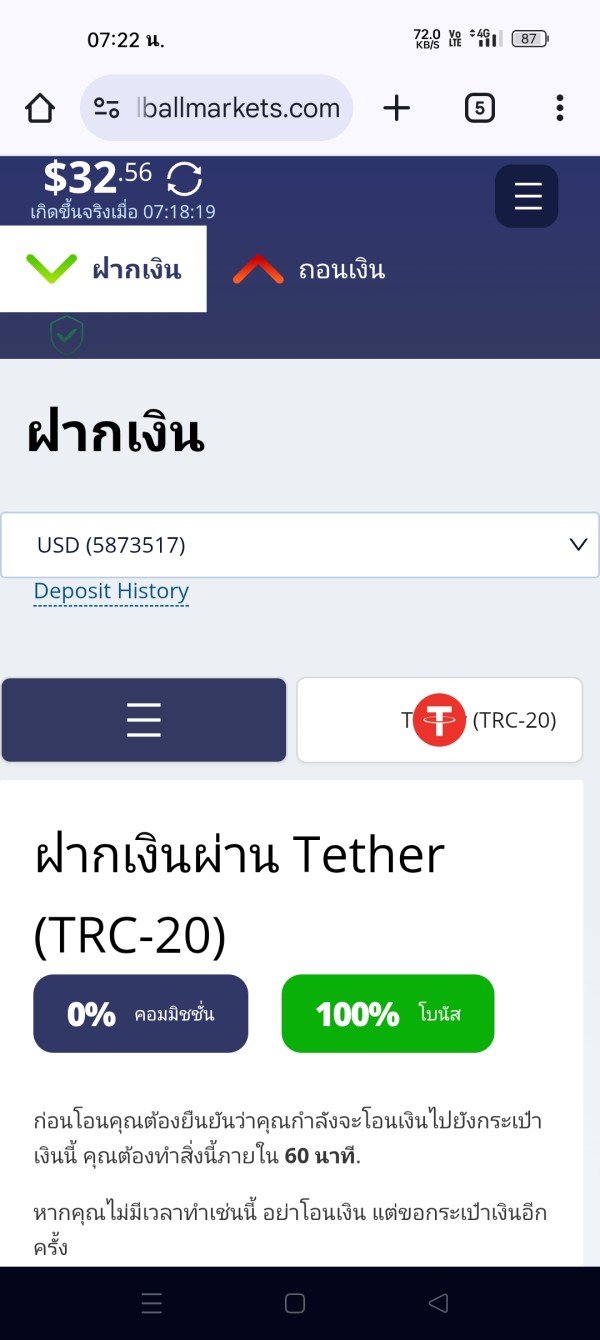

Deposit and Withdrawal Methods: Specific deposit and withdrawal options are not detailed in available materials. This requires direct verification with the broker for current payment processing methods and associated timeframes.

Minimum Deposit Requirements: Minimum deposit information is not specified in available documentation. This suggests potential flexibility in account opening requirements or the need for direct inquiry with the broker.

Bonus and Promotional Offers: Current promotional offerings and bonus structures are not detailed in available materials. This indicates either absence of such programs or the need for direct verification with the broker.

Tradeable Assets: The platform provides access to over 160 trading instruments across multiple asset classes including currencies, commodities, indices, stocks, and cryptocurrencies. This extensive selection supports diverse trading strategies and portfolio diversification approaches.

Cost Structure: Specific information regarding spreads, commissions, and other trading costs is not detailed in available materials. Traders should verify current pricing structures directly with the broker before account opening.

Leverage Options: Crystal Ball Markets offers leverage up to 1:1,000. This provides significant capital amplification opportunities for qualified traders while requiring appropriate risk management considerations.

Trading Platform Options: The broker operates primarily through its Mobius Trader 7 platform. This serves as the main trading interface for client activities and market access.

Geographic Restrictions: The platform primarily serves global clients. However, specific regional restrictions may apply based on local regulatory requirements.

Customer Support Languages: Available customer support languages are not specified in current materials and would require direct verification with the broker.

This crystal ball markets review notes that several operational details require direct verification with the broker for the most current and comprehensive information.

Detailed Rating Analysis

Account Conditions Analysis (Score: 7/10)

Crystal Ball Markets provides competitive account conditions that cater to diverse trading preferences. However, specific details about account tiers and requirements are not extensively documented in available materials. The absence of clearly stated minimum deposit requirements suggests either flexible entry conditions or the need for direct inquiry with the broker to understand specific account opening criteria.

The platform's leverage offering of up to 1:1,000 represents a significant advantage for traders seeking capital amplification opportunities. This high leverage ratio places Crystal Ball Markets among brokers offering competitive margin trading conditions, though it requires careful risk management consideration from users. The availability of over 160 trading instruments provides substantial diversity for portfolio construction and trading strategy implementation.

User feedback indicates generally satisfactory account management experiences. However, specific testimonials regarding account opening processes, verification requirements, or account maintenance are limited in available materials. The broker's dual regulatory structure through Saint Vincent and the Grenadines registration and Canadian FINTRAC compliance suggests structured account oversight, though specific client protection measures are not detailed.

The inclusion of social trading capabilities within account offerings adds value for clients interested in community-based trading approaches. However, the lack of detailed information about Islamic accounts, account types differentiation, or special features limits comprehensive evaluation of account condition competitiveness.

This crystal ball markets review finds that while basic account conditions appear competitive, the limited transparency regarding specific terms and conditions affects the overall assessment of this criterion.

Crystal Ball Markets demonstrates strong performance in tools and resources provision. This is primarily through its extensive selection of over 160 trading instruments across multiple asset classes. This comprehensive instrument coverage supports diverse trading strategies and enables clients to access major global markets through a single platform interface.

The integration of social trading tools represents a notable enhancement to the platform's resource offering. Social trading capabilities allow users to observe, learn from, and potentially replicate strategies of other traders, adding educational and performance enhancement value to the overall trading environment. This feature particularly benefits newer traders seeking to learn from experienced market participants.

The Mobius Trader 7 platform serves as the primary technological resource. However, specific details about its analytical capabilities, charting tools, or advanced features are not extensively documented in available materials. The platform's functionality and user interface quality would require hands-on evaluation to fully assess its competitive position against industry-standard platforms.

While the broker offers substantial instrument diversity, information about additional resources such as market research, economic calendars, educational materials, or analytical tools is not detailed in current materials. The absence of information about automated trading support, API access, or third-party tool integration limits comprehensive evaluation of the platform's technological capabilities.

User feedback suggests positive reception of available tools, with clients noting professional service delivery. However, specific commentary on tool quality, reliability, or feature satisfaction is limited in available reviews.

Customer Service and Support Analysis (Score: 6/10)

Customer service evaluation for Crystal Ball Markets is constrained by limited detailed information about support infrastructure, response times, and service quality metrics in available materials. User feedback provides some positive indicators, with clients describing the company as professional and efficient in payment processing, suggesting competent operational support.

The absence of specific information about customer support channels, availability hours, or language support options limits comprehensive assessment of service accessibility. Modern traders typically expect multiple contact methods including live chat, email, and phone support, though Crystal Ball Markets' specific offerings in these areas are not documented in available materials.

Response time performance and issue resolution effectiveness are critical factors for customer service evaluation. However, specific metrics or user testimonials regarding support responsiveness are not extensively available. The limited sample of user reviews makes it difficult to assess consistency of service quality or identify common support strengths or weaknesses.

The broker's dual regulatory framework suggests structured operational oversight, which typically correlates with organized customer support procedures. However, without specific information about complaint handling processes, escalation procedures, or customer protection measures, comprehensive service quality assessment remains limited.

Geographic coverage and multilingual support capabilities are important considerations for global brokers. However, Crystal Ball Markets' specific capabilities in these areas are not detailed in current materials. This gap in available information affects the ability to evaluate service accessibility for international clients.

Trading Experience Analysis (Score: 8/10)

Crystal Ball Markets delivers a strong trading experience based on available user feedback and platform capabilities. Client testimonials describe the broker as a "fast paying professional company," indicating efficient transaction processing and reliable operational performance. This positive feedback suggests effective order execution and prompt handling of client requests.

The Mobius Trader 7 platform serves as the primary trading interface, providing access to over 160 instruments across multiple asset classes. While specific technical performance metrics are not detailed in available materials, the platform's ability to support diverse trading activities across forex, commodities, indices, stocks, and cryptocurrencies suggests robust functionality and market connectivity.

Leverage availability up to 1:1,000 enhances trading flexibility for clients seeking amplified market exposure. However, this also requires careful risk management consideration. The high leverage ratio indicates competitive trading conditions that can support various trading strategies and capital efficiency approaches.

Social trading integration adds value to the overall trading experience by enabling community interaction and strategy sharing. This feature particularly benefits traders interested in learning from others or diversifying their approach through social trading strategies.

However, specific information about execution speeds, slippage rates, platform stability during high volatility periods, or mobile trading capabilities is not extensively documented. These technical performance factors are crucial for comprehensive trading experience evaluation but require direct platform testing or additional user feedback for complete assessment.

The crystal ball markets review indicates that while available evidence suggests positive trading experience, more detailed technical performance data would strengthen the evaluation.

Trust and Reliability Analysis (Score: 6/10)

Crystal Ball Markets' trust and reliability assessment is based on its regulatory framework and available operational information. The broker maintains registration in Saint Vincent and the Grenadines while operating a Canadian entity subject to FINTRAC regulations. This dual-jurisdiction structure provides regulatory oversight, though the level of client protection may vary between jurisdictions.

FINTRAC compliance in Canada indicates adherence to anti-money laundering and financial transaction reporting requirements. This suggests structured operational oversight. However, Saint Vincent and the Grenadines regulation typically provides less comprehensive investor protection compared to major financial centers, which affects overall trust assessment.

The limited availability of detailed information about company background, financial reporting, segregated client fund arrangements, or insurance coverage constrains comprehensive reliability evaluation. Modern brokers typically provide transparent information about client fund protection measures, company financial status, and operational safeguards.

User feedback indicates generally positive experiences with payment processing and professional service delivery. This suggests reliable operational performance. However, the limited sample size of available reviews and absence of detailed testimonials about fund security or dispute resolution limits comprehensive trust assessment.

The absence of information about negative incidents, regulatory actions, or client complaints makes it difficult to evaluate the broker's track record. This includes handling operational challenges or maintaining consistent service quality over time.

User Experience Analysis (Score: 7/10)

User experience evaluation for Crystal Ball Markets shows generally positive indicators based on available feedback and platform features. Client reviews indicate satisfaction with service quality, with users describing positive experiences with payment processing and professional service delivery. The average 4-star rating from available reviews suggests satisfactory overall user satisfaction.

The platform's design and usability through the Mobius Trader 7 interface are not extensively detailed in available materials. This limits assessment of navigation ease, interface intuitiveness, or user workflow efficiency. Modern trading platforms require sophisticated yet user-friendly interfaces to support effective trading activities.

Account registration and verification processes are not specifically described in available materials. This makes it difficult to evaluate onboarding efficiency or documentation requirements. Streamlined account opening procedures are important factors in overall user experience assessment.

The integration of social trading features adds value for users interested in community-based trading approaches. This potentially enhances engagement and learning opportunities. This feature can improve user experience by providing additional interaction and strategy development options.

However, the absence of detailed information about mobile trading capabilities, platform customization options, or user interface features limits comprehensive user experience evaluation. Additionally, specific user feedback about common pain points, feature requests, or satisfaction with platform performance is not extensively available.

The limited documentation of negative feedback or areas for improvement makes it challenging to identify potential user experience weaknesses. It also affects assessment of how well the platform addresses diverse user needs and preferences.

Conclusion

Crystal Ball Markets presents a competent trading platform with several notable strengths, including extensive instrument selection, competitive leverage options, and positive user feedback regarding service delivery. This crystal ball markets review finds that the broker offers solid fundamentals for traders seeking diverse market access and flexible trading conditions.

The platform's strength lies in its comprehensive asset coverage with over 160 trading instruments and social trading capabilities that appeal to both individual and community-oriented traders. The high leverage availability and professional service approach contribute to its attractiveness for global clients seeking competitive trading conditions.

However, limited transparency regarding specific operational details, fee structures, and comprehensive service offerings affects the overall evaluation. Potential clients should conduct direct verification of current terms, conditions, and service capabilities before making trading decisions.

Crystal Ball Markets appears best suited for traders who value instrument diversity, appreciate social trading features, and seek platforms with competitive leverage options. The broker may particularly appeal to international clients comfortable with offshore regulatory frameworks while maintaining Canadian regulatory compliance elements.