BTCC Global 2025 Review: Everything You Need to Know

Summary:

BTCC Global has garnered mixed reviews from users and experts alike, with significant concerns regarding its regulatory status and customer service. While it offers a variety of trading instruments and competitive leverage options, numerous complaints about withdrawal issues and poor user experiences raise red flags about its trustworthiness.

Note:

It is essential to be aware that BTCC Global operates under various entities across regions, which can complicate the regulatory landscape. This review aims to provide a balanced perspective based on available information to help potential users make informed decisions.

Ratings Overview

Note: These ratings are derived from a synthesis of user feedback and expert analysis.

How We Rated the Broker:

The ratings reflect an aggregation of user experiences, expert opinions, and factual data regarding BTCC Global's offerings and operational practices.

Broker Overview

Founded in 2018, BTCC Global is a cryptocurrency trading platform that provides access to various digital assets, including Bitcoin and Ethereum, alongside tokenized commodities and stocks. The platform claims regulatory compliance in the U.S. and Canada, although many sources highlight the lack of credible regulation and numerous complaints from users. The trading experience is facilitated through a web-based platform and mobile applications, allowing users to engage in both spot and futures trading.

Detailed Section

Regulatory and Geographical Presence

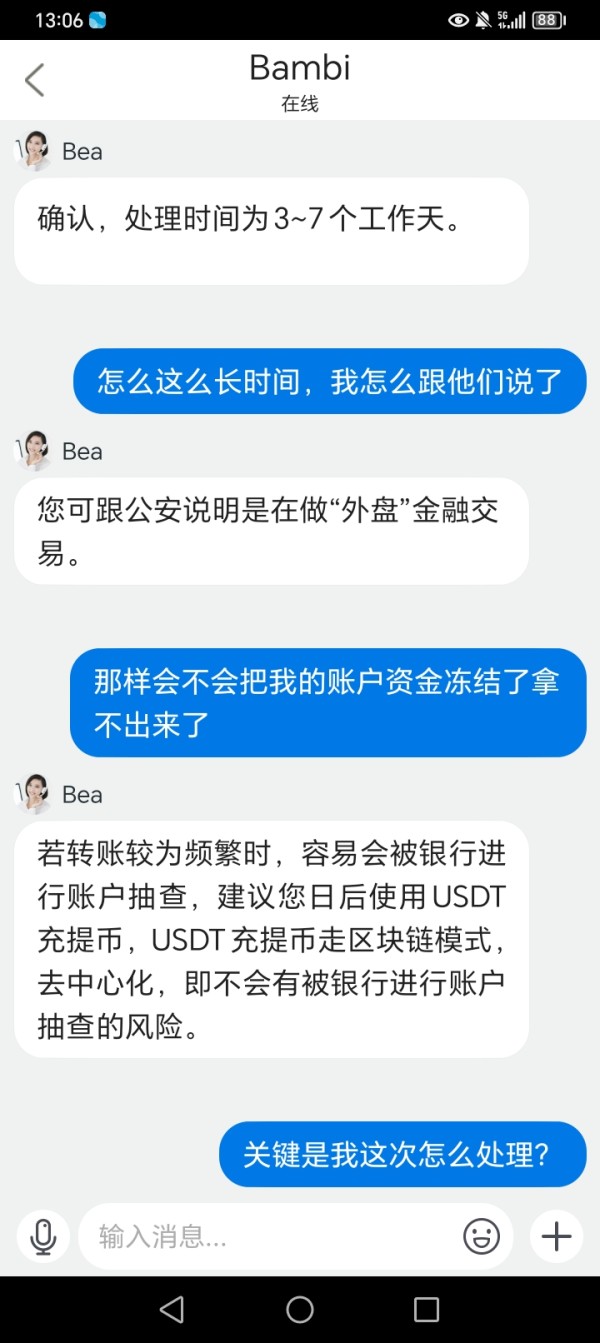

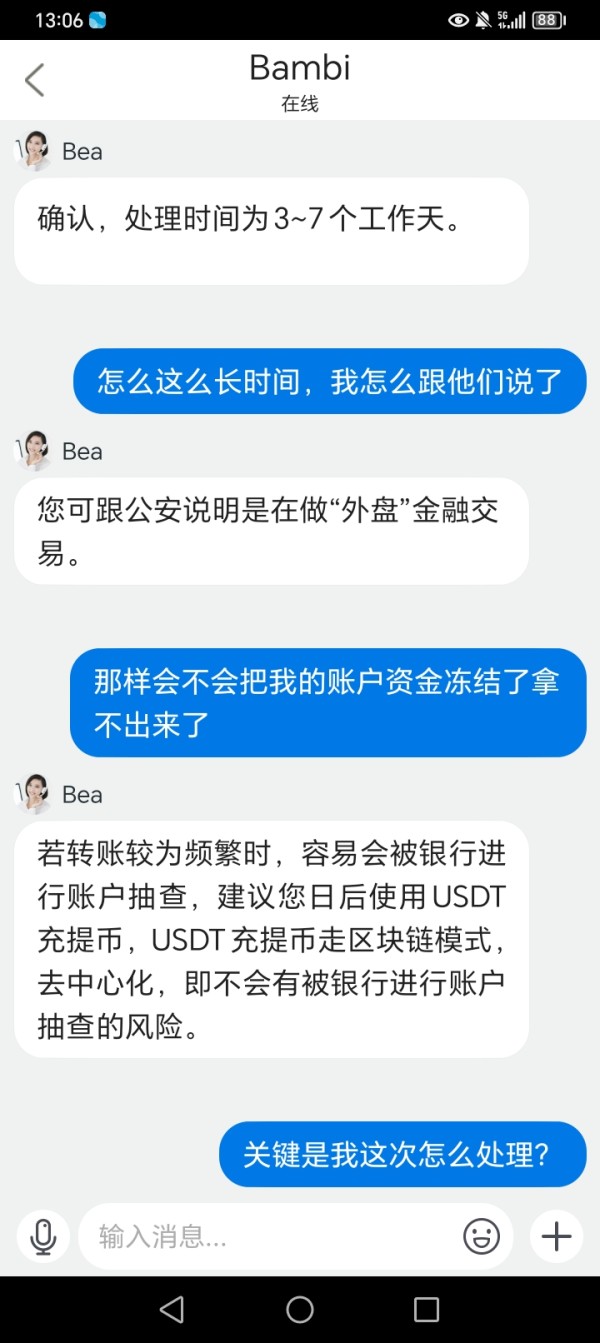

BTCC Global claims to operate under U.S. regulations, specifically the Financial Crimes Enforcement Network (FinCEN) and other regulatory bodies in Canada and Europe. However, multiple sources, including WikiFX, indicate that it lacks valid regulatory oversight, which raises significant concerns regarding its legitimacy and user protection (WikiFX). Users are advised to exercise caution when engaging with unregulated entities.

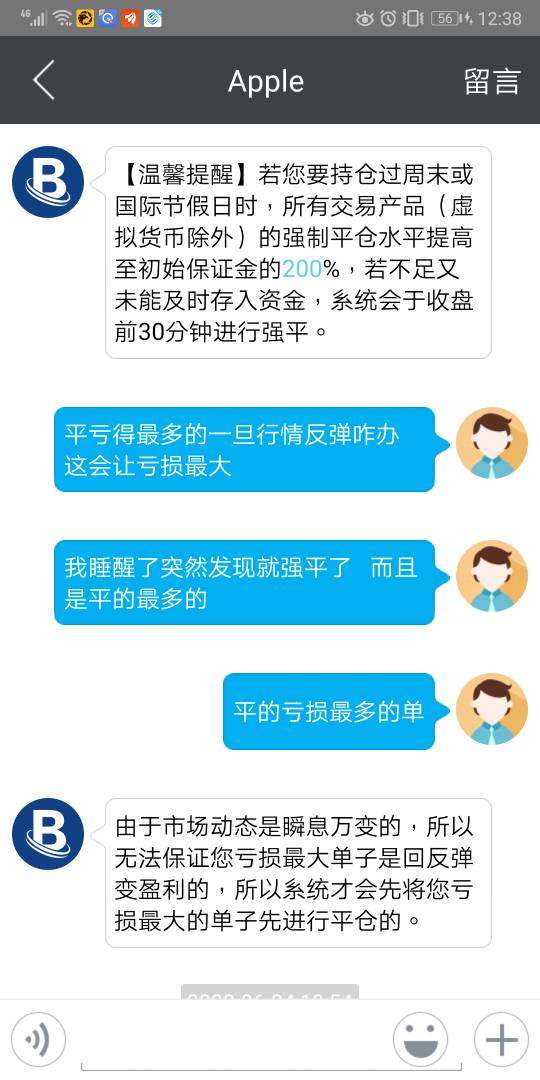

Deposit/Withdrawal Currencies

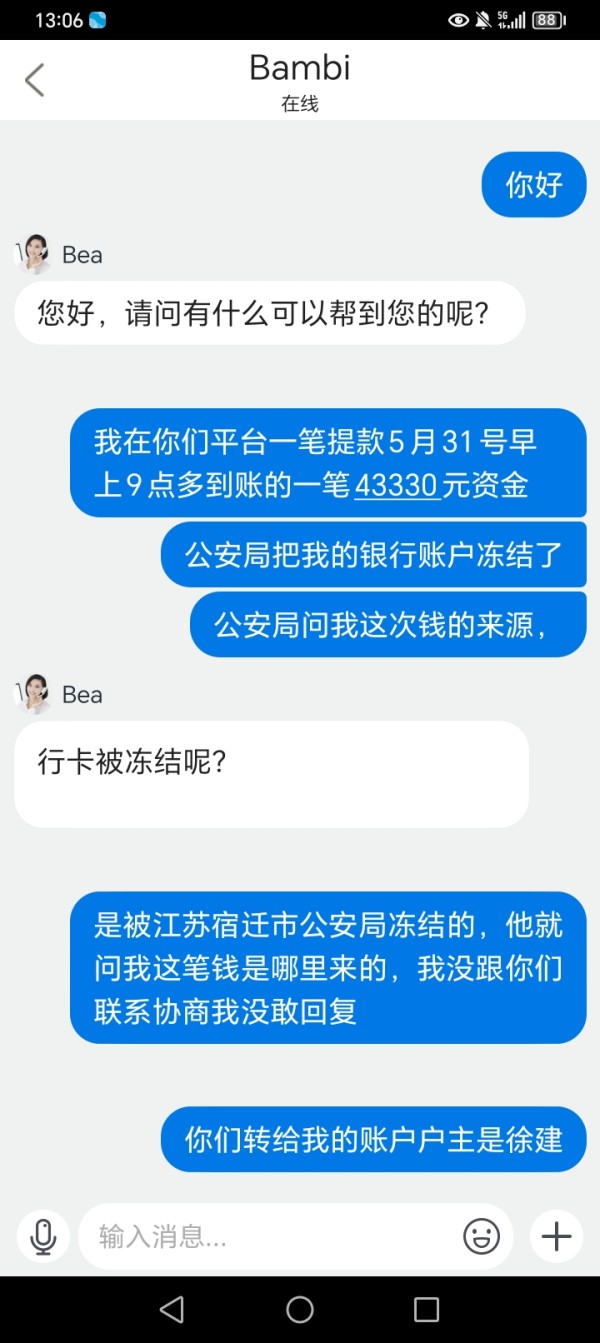

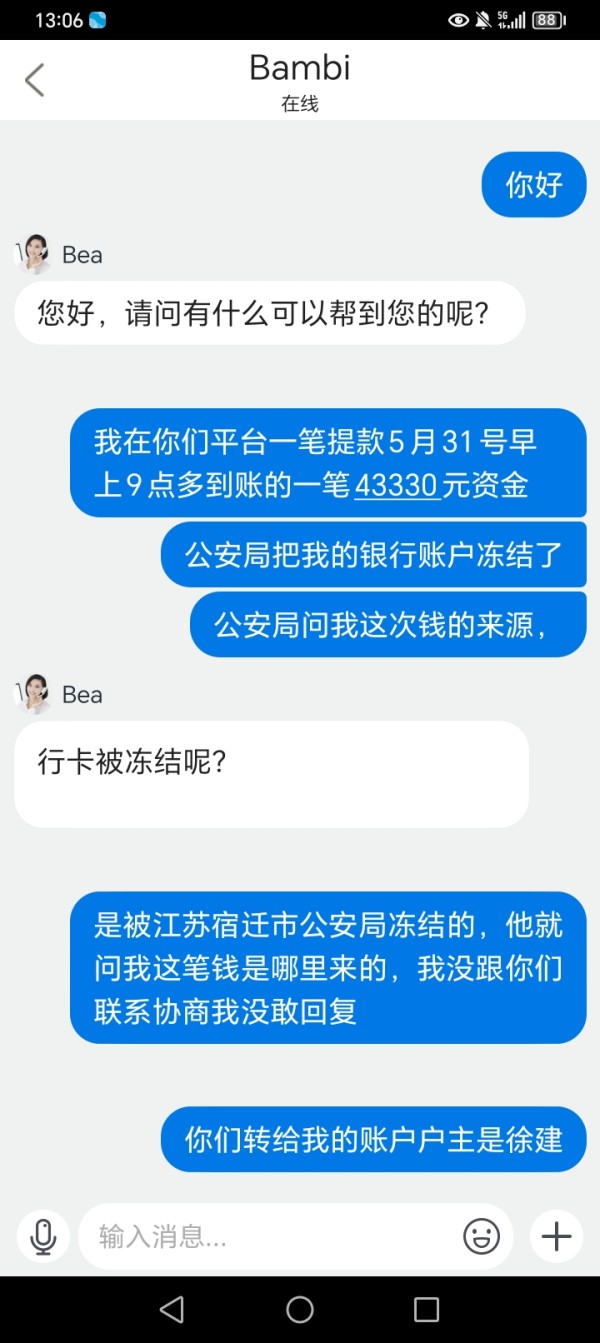

Users can deposit and withdraw funds using major credit cards and ACH transfers. The minimum deposit requirement is set at 200 USDT, which may deter some potential users. However, there are reports of difficulties in withdrawing funds, with some users claiming their accounts were frozen after withdrawal requests, leading to frustrations and allegations of fraudulent practices (WikiFX).

There is little information available regarding ongoing promotions or bonuses at BTCC Global. Many users have expressed dissatisfaction with the lack of incentives for new or existing traders, which could limit the platform's appeal compared to competitors offering attractive promotional packages.

Tradable Asset Classes

BTCC Global provides a diverse range of trading instruments, including cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH), tokenized commodities (like gold and silver), and stocks (such as Tesla and Amazon). This variety allows users to explore multiple investment avenues, although the platform reportedly lacks depth in certain asset classes, which may affect liquidity (WikiFX).

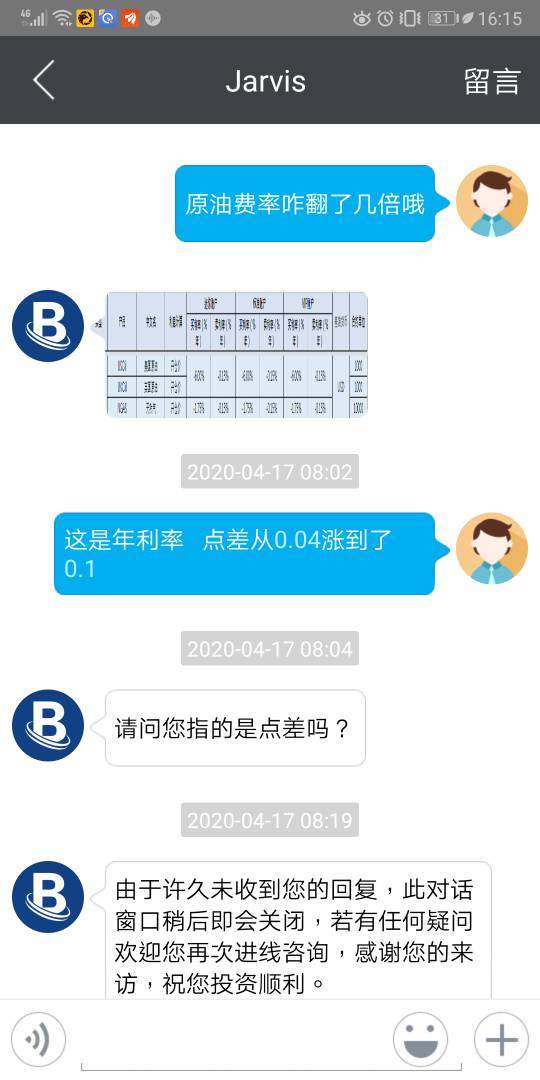

Costs (Spreads, Fees, Commissions)

The platform features competitive trading fees, with spreads starting from 0.09 pips. However, users have reported high slippage and unexpected fees that can significantly impact profitability. The absence of clear fee structures between maker and taker orders has also been a point of contention (WikiFX).

Leverage

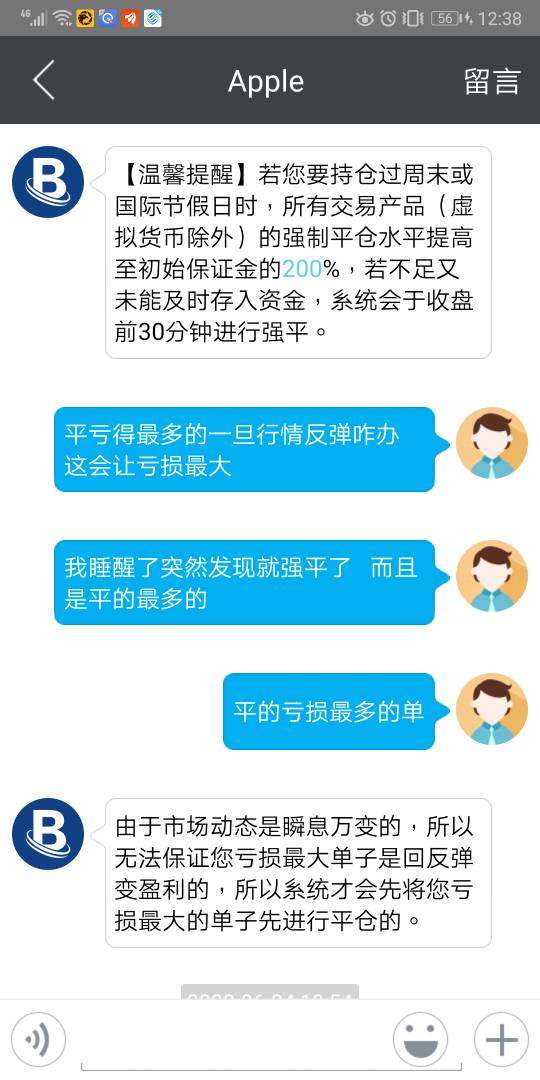

BTCC Global offers leverage options up to 150x, which can be appealing for experienced traders looking to maximize their positions. However, the high leverage also introduces substantial risk, particularly for novice traders who may not fully understand the implications of leveraged trading.

The trading experience is accessible through a user-friendly web platform and mobile applications available for iOS and Android. However, users have reported issues with logging in and accessing market data, which can hinder the trading experience (WikiFX).

Restricted Regions

While BTCC Global is available to users in various countries, it faces restrictions in regions such as mainland China, North Korea, and several others due to regulatory issues. This limitation may affect potential users looking to access the platform from these regions.

Available Customer Service Languages

Customer support is available in Chinese and English, with various channels for users to seek assistance. However, customers have reported long wait times and unresponsive service, leading to frustrations and negative experiences (WikiFX).

Ratings Breakdown

Account Conditions

Rating: 4/10

While BTCC Global offers a demo account and various account types, the minimum deposit requirement and the lack of clear fee structures have been points of concern for users.

Rating: 5/10

The platform provides some educational resources, but many users feel that more comprehensive tools and market analysis features are needed to enhance their trading experience.

Customer Service and Support

Rating: 3/10

Numerous complaints highlight the poor customer service experience, with users reporting long response times and unresolved issues.

Trading Experience

Rating: 6/10

Users generally find the trading platform easy to navigate, but issues with market data and login problems detract from the overall experience.

Trustworthiness

Rating: 2/10

The lack of credible regulatory oversight and numerous user complaints raise significant concerns about BTCC Global's trustworthiness and reliability.

User Experience

Rating: 4/10

While the platform is user-friendly, the reported issues with withdrawals and customer support severely impact the overall user experience.

Conclusion

In summary, BTCC Global presents a mixed bag of offerings, with significant advantages in terms of asset variety and competitive leverage options. However, the platform's numerous user complaints regarding withdrawals, lack of regulation, and poor customer service raise serious concerns. Potential users are advised to weigh these factors carefully before engaging with BTCC Global, as the risks may outweigh the benefits.