Brook 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive brook review aims to provide traders with an objective analysis of Brook's services and offerings in 2025. Based on available information and market research, Brook appears to operate in multiple sectors including hospitality and event services, with limited transparency regarding its financial services operations. The available data primarily references Shadowbrook's event planning services and Brook Hotel operations, rather than traditional forex brokerage activities.

Key features identified include diverse service offerings spanning event coordination, security services, and hospitality management. However, critical information regarding trading conditions, regulatory compliance, and platform specifications remains largely undisclosed in publicly available sources. The user rating for Brook Hotel shows a moderate 4/5 score, suggesting reasonable customer satisfaction in the hospitality sector.

The primary user base appears to target event planning clients and hospitality service seekers rather than traditional forex traders. This brook review reveals significant information gaps that potential clients should carefully consider before engaging with the platform.

Important Notice

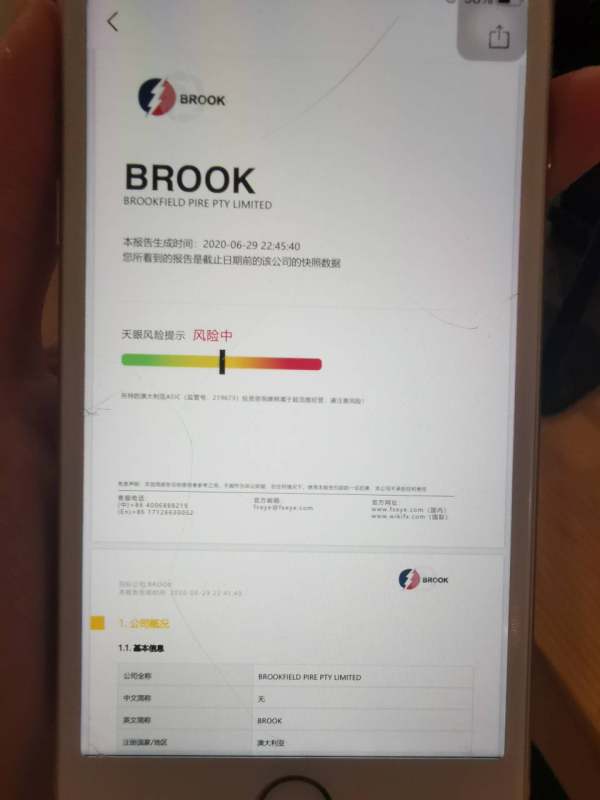

Based on comprehensive research, this brook review must note several critical limitations in available information. The analysis reveals substantial differences between various entities using the "Brook" name across different regions and service sectors. No specific regulatory information for forex trading services was identified in the source materials, which raises important considerations for potential trading clients.

This evaluation methodology relies on publicly available information, user feedback, and industry standard assessment criteria. Readers should conduct independent due diligence and verify current regulatory status before making any financial commitments.

Rating Framework

Overall Rating: 3.7/10

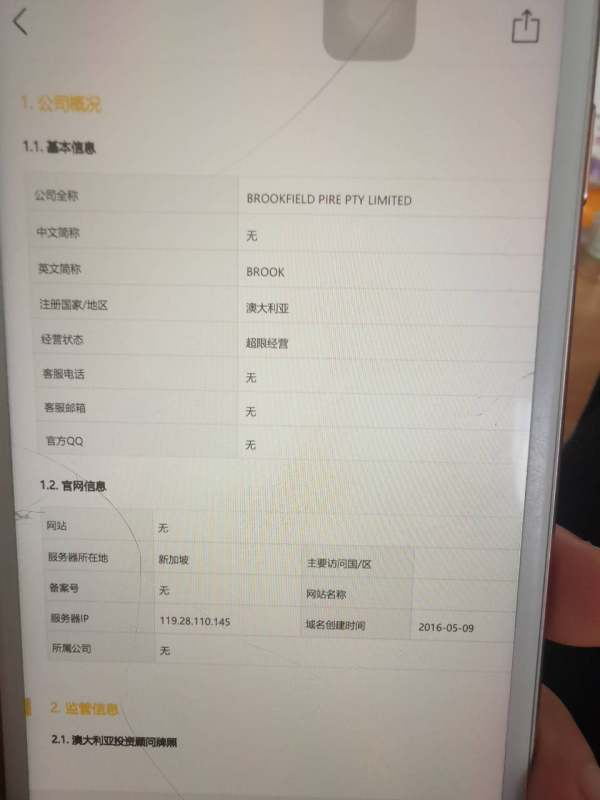

Broker Overview

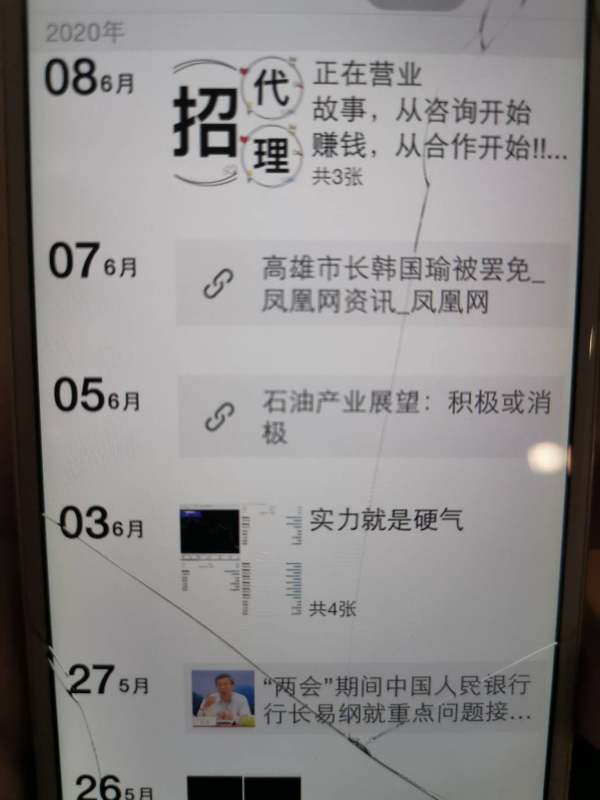

Brook's corporate structure and operational history present a complex picture across multiple business sectors. The available information indicates involvement in event planning services through Shadowbrook operations, which provides comprehensive event coordination including weddings, corporate events, fundraising activities, and social gatherings. Additionally, Brook Hotel operates in London's hospitality sector, suggesting diversified business interests beyond traditional financial services.

The company's service portfolio encompasses bartender services, day-of coordination, lighting services, security services, and various event management solutions. This broad operational scope includes meetings and conferences, birthday celebrations, ceremonies, corporate events, holiday parties, non-profit events, private parties, retreats, social events, team building activities, and wedding services. The business model appears focused on full-service event management with additional offerings in audio/visual services, event staffing, on-site management, and post-event cleaning.

Regarding financial services operations, specific information about trading platforms, asset classes, and brokerage services remains notably absent from available sources. The lack of detailed information about forex trading capabilities, regulatory compliance status, and traditional brokerage operations represents a significant concern for potential trading clients seeking this brook review for investment guidance.

Regulatory Regions: Available sources do not specify regulatory oversight for financial services operations. This absence of regulatory information represents a critical gap for potential trading clients.

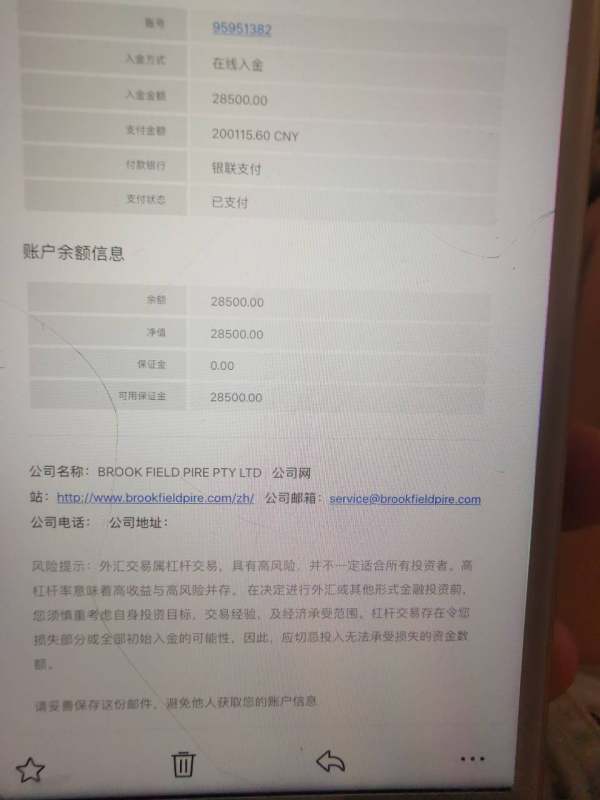

Deposit and Withdrawal Methods: Specific payment processing methods and financial transaction procedures are not detailed in available documentation.

Minimum Deposit Requirements: No minimum deposit thresholds or account funding requirements are specified in the source materials.

Bonuses and Promotions: Current promotional offerings and bonus structures are not outlined in publicly available information.

Tradeable Assets: The range of available trading instruments, currency pairs, commodities, indices, or other financial products remains unspecified.

Cost Structure: Critical pricing information including spreads, commissions, overnight fees, and other trading costs are not documented in available sources. This lack of transparency regarding fee structures presents significant concerns for cost-conscious traders.

Leverage Ratios: Maximum leverage offerings and margin requirements are not specified in the available documentation.

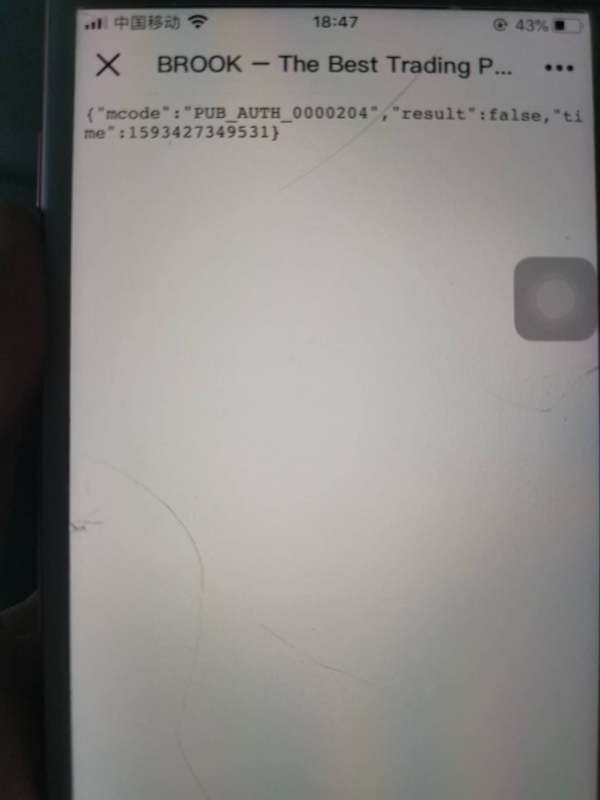

Platform Options: Trading platform specifications, software compatibility, and technical capabilities are not detailed in current sources.

Regional Restrictions: Geographic limitations and jurisdictional restrictions are not clearly outlined.

Customer Service Languages: Available language support options are not specified in the documentation.

This brook review must emphasize that the absence of these fundamental details significantly impacts the ability to provide comprehensive guidance to potential clients.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

The evaluation of Brook's account conditions reveals significant information gaps that impact this brook review assessment. Available sources do not provide specific details about account types, tier structures, or differentiated service levels that typically characterize professional brokerage operations. The absence of clear minimum deposit requirements makes it impossible to assess accessibility for different trader segments or evaluate the broker's target market positioning.

Account opening procedures and verification processes are not documented in available materials, raising questions about compliance with standard KYC (Know Your Customer) and AML (Anti-Money Laundering) protocols. The lack of information regarding specialized account features, such as Islamic accounts for Sharia-compliant trading, suggests limited accommodation for diverse client needs.

Without detailed specifications about account benefits, fee structures, or service differentiation across account tiers, potential clients cannot make informed decisions about which account type might suit their trading requirements. The absence of clear terms and conditions regarding account maintenance, inactivity fees, or closure procedures further compounds these concerns.

The assessment of trading tools and resources available through Brook reveals substantial deficiencies in publicly available information. No specific details about trading platforms, analytical tools, or technical analysis resources are documented in the source materials. This absence of information about fundamental trading infrastructure represents a significant concern for serious traders seeking comprehensive market analysis capabilities.

Educational resources, which are typically essential for trader development and platform adoption, are not mentioned in available documentation. The lack of information about research reports, market commentary, economic calendars, or educational webinars suggests limited support for trader education and development. Professional traders often rely on sophisticated charting tools, automated trading capabilities, and advanced order types, none of which are specifically addressed in the available materials.

The absence of details about mobile trading applications, desktop platform features, or web-based trading interfaces makes it impossible to assess the technological sophistication of Brook's offerings. Without information about third-party integrations, API access, or algorithmic trading support, advanced traders cannot evaluate the platform's suitability for their requirements.

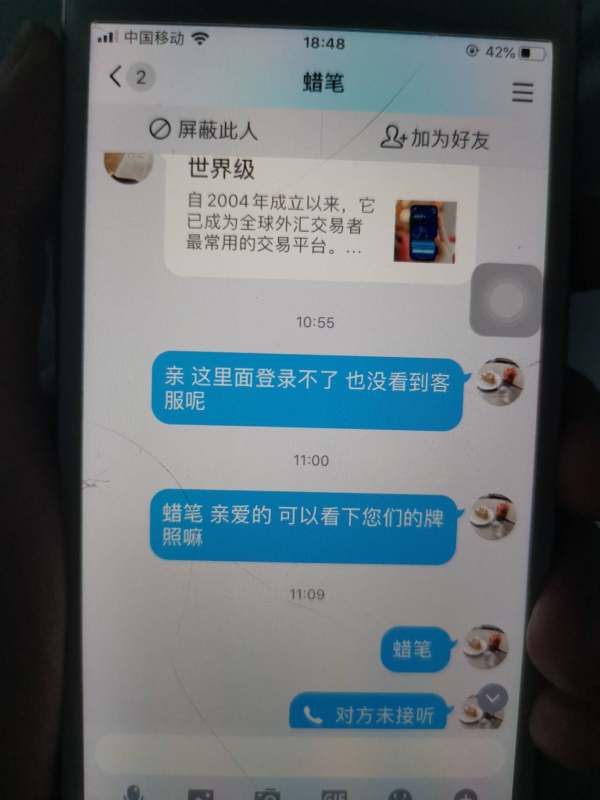

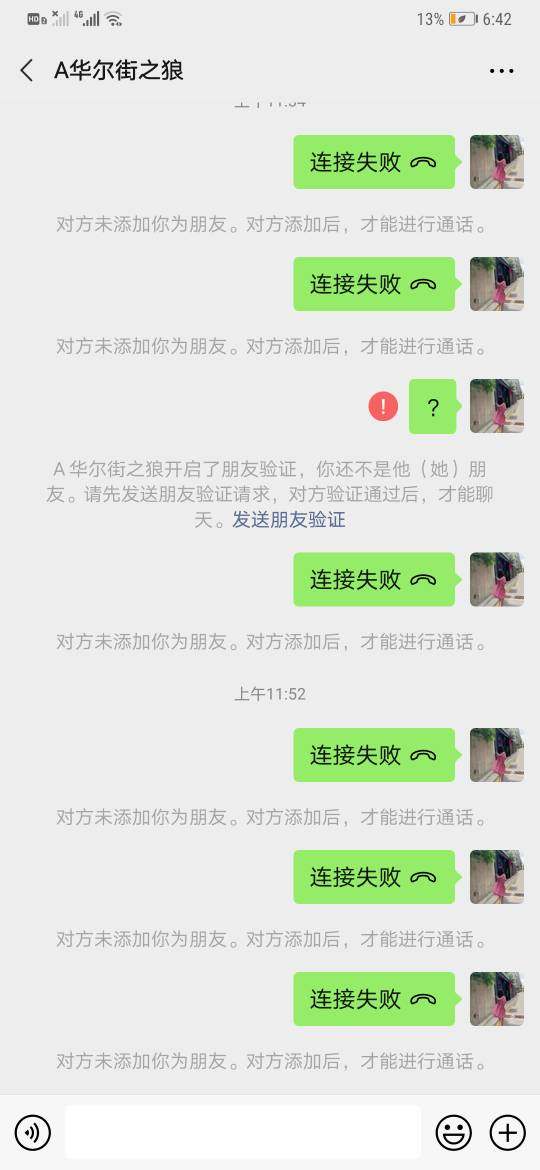

Customer Service and Support Analysis (Score: 5/10)

Customer service evaluation for Brook presents mixed signals based on available information. The Brook Hotel's 4/5 user rating suggests reasonable customer satisfaction in the hospitality sector, though this may not directly translate to financial services support quality. However, specific information about trading support channels, response times, and service availability remains undocumented.

Critical support infrastructure details such as live chat availability, phone support hours, email response protocols, and multilingual support capabilities are not specified in available sources. The absence of information about dedicated account managers, technical support specialists, or trading desk assistance raises questions about the level of personalized service available to clients.

Without documented information about complaint resolution procedures, escalation processes, or customer satisfaction metrics specific to trading services, it becomes difficult to assess the reliability and effectiveness of customer support operations. The lack of transparency regarding support team qualifications and expertise in financial markets represents another area of concern for potential clients.

Trading Experience Analysis (Score: 4/10)

The evaluation of trading experience through Brook encounters significant limitations due to insufficient technical information in available sources. Platform stability, execution speed, and order processing capabilities are not documented, making it impossible to assess the quality of the trading environment. These technical specifications are crucial for traders who require reliable and fast execution, particularly in volatile market conditions.

Order execution quality, including information about slippage rates, requote frequency, and execution transparency, is not addressed in available materials. The absence of details about available order types, such as market orders, limit orders, stop-loss orders, and trailing stops, suggests potential limitations in trading flexibility and risk management capabilities.

Mobile trading capabilities, which are increasingly important for modern traders, are not specifically addressed in the documentation. The lack of information about platform compatibility across different devices, operating systems, and browsers raises questions about accessibility and user convenience. Without details about real-time data feeds, price accuracy, and market depth information, traders cannot assess the quality of market information provided through the platform.

This brook review must note that the absence of specific trading environment details significantly impacts the ability to recommend the platform for serious trading activities.

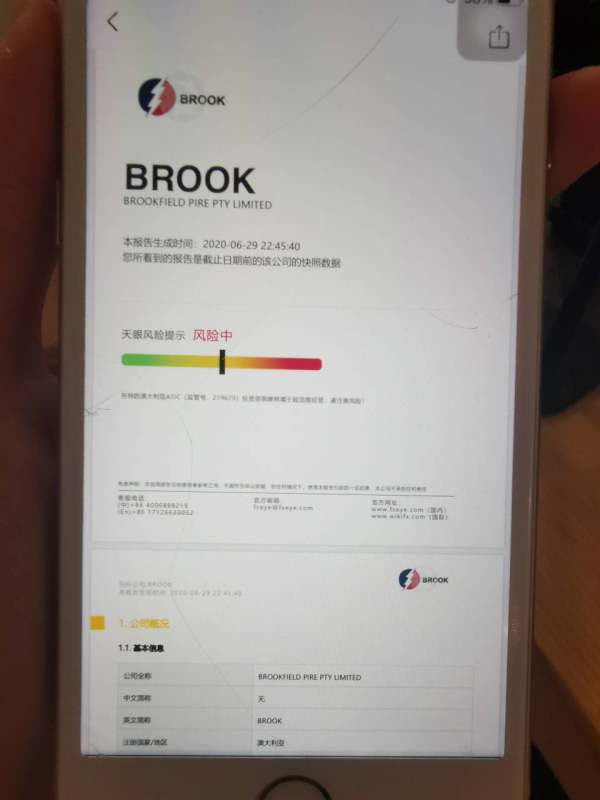

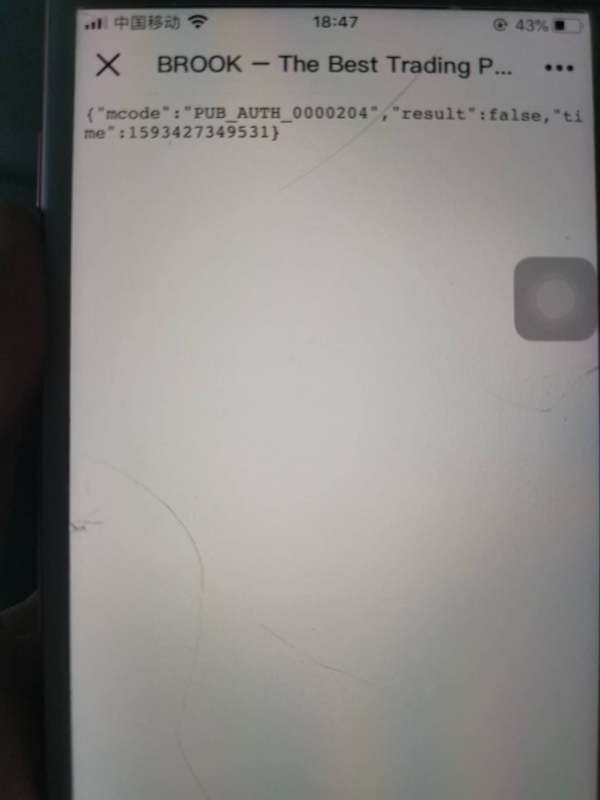

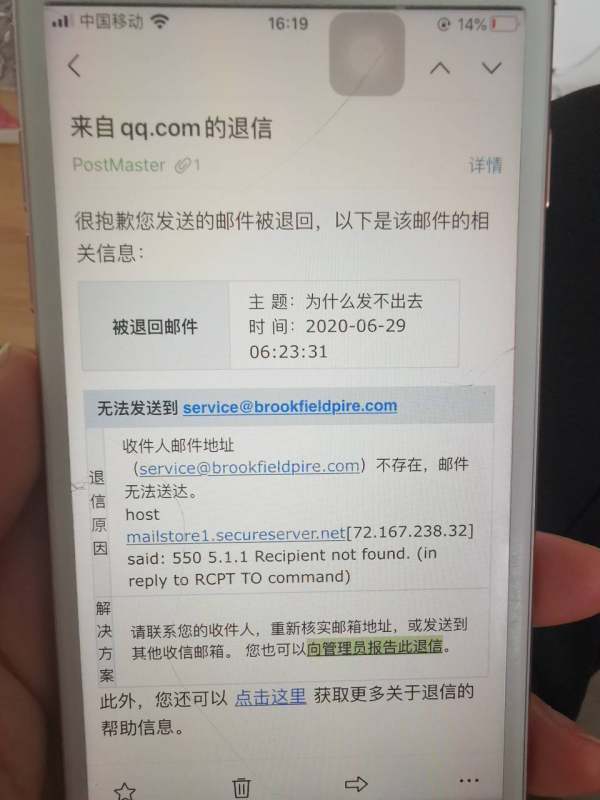

Trust and Reliability Analysis (Score: 2/10)

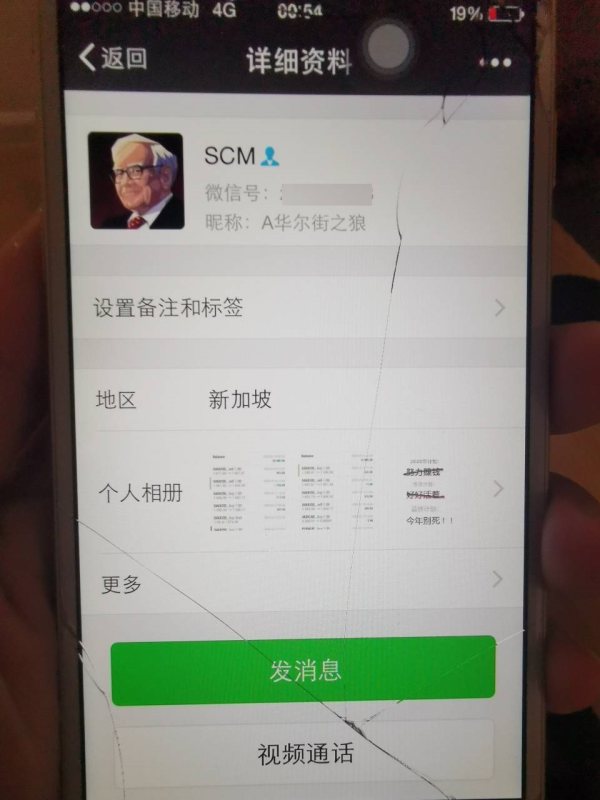

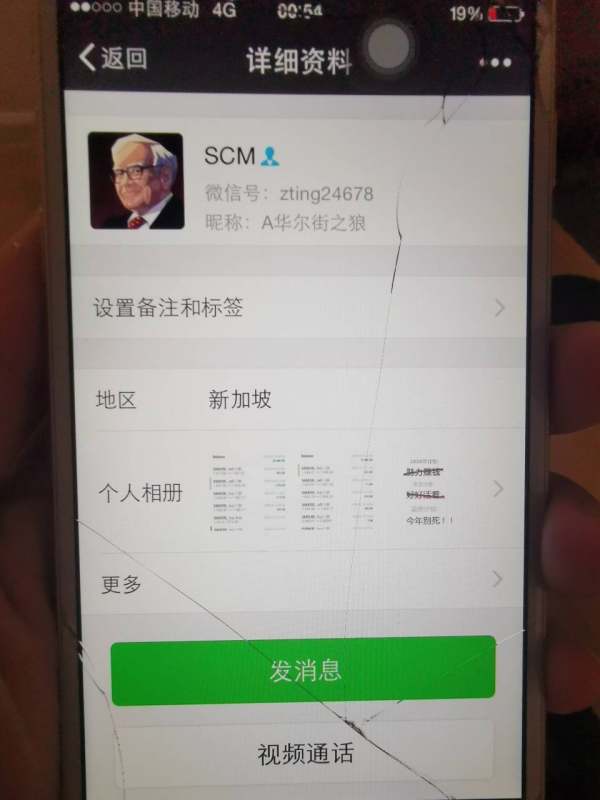

The trust and reliability assessment for Brook reveals concerning gaps in regulatory transparency and compliance information. No specific regulatory licenses, supervisory authorities, or compliance frameworks are documented in available sources. This absence of regulatory oversight information represents a critical concern for potential clients seeking secure and compliant trading environments.

Fund security measures, including client fund segregation, deposit protection schemes, and insurance coverage, are not detailed in available documentation. Professional brokers typically provide clear information about how client funds are protected and which regulatory frameworks govern their operations. The lack of such transparency raises significant questions about financial security and regulatory compliance.

Corporate transparency regarding company ownership, financial statements, operational history, and business licensing is notably absent from available sources. The inability to verify corporate registration details, management team credentials, or business track record in financial services creates substantial uncertainty about the organization's legitimacy and operational stability.

Industry reputation and third-party verification through regulatory databases, professional associations, or independent rating agencies are not documented. The absence of verifiable regulatory registration numbers or compliance certifications makes independent verification of the broker's legitimacy extremely difficult.

User Experience Analysis (Score: 4/10)

User experience evaluation for Brook faces significant limitations due to the scarcity of specific user feedback regarding trading services. While Brook Hotel shows a 4/5 rating in the hospitality sector, this does not necessarily reflect the quality of financial services user experience. The absence of detailed user reviews specifically addressing trading platform usability, account management interfaces, and overall service satisfaction creates substantial gaps in this assessment.

Interface design quality, navigation intuitiveness, and platform responsiveness are not addressed in available user feedback or technical documentation. Modern traders expect sophisticated yet user-friendly interfaces that facilitate efficient market analysis and trade execution. Without specific information about platform design and usability features, potential clients cannot assess whether the trading environment meets contemporary standards.

Registration and account verification processes are not detailed in available sources, making it impossible to evaluate the efficiency and user-friendliness of the onboarding experience. Streamlined account opening procedures and clear verification requirements are important factors in overall user satisfaction. The absence of information about funding procedures, withdrawal processes, and account management tools further limits the ability to assess user experience quality.

Conclusion

This comprehensive brook review reveals significant challenges in evaluating Brook as a forex trading platform due to substantial information gaps across critical assessment areas. The available evidence primarily relates to event planning and hospitality services rather than traditional brokerage operations, raising fundamental questions about the nature and scope of Brook's financial services offerings.

The absence of regulatory information, trading specifications, and transparent operational details makes it impossible to recommend Brook for serious forex trading activities. Potential clients seeking reliable brokerage services should prioritize platforms with clear regulatory oversight, transparent fee structures, and comprehensive trading infrastructure. The lack of verifiable information about platform capabilities, customer protection measures, and industry compliance represents substantial risks that outweigh any potential benefits suggested by limited positive feedback in non-trading sectors.