BLGOTD Review 1

This is the best exchange I have used. Trading has been taking place at the exchange for three years already. I have gained very optimistic profits.

BLGOTD Forex Broker provides real users with 1 positive reviews, * neutral reviews and * exposure review!

Business

License

This is the best exchange I have used. Trading has been taking place at the exchange for three years already. I have gained very optimistic profits.

BLGOTD presents itself as a forex and CFD broker offering trading services across multiple asset classes. This blgotd review reveals significant concerns about the platform's legitimacy and operational standards, however. According to available information from WikiBit and other industry sources, BLGOTD operates with questionable regulatory status. The company has attracted negative attention from trading community watchdogs as well. The broker claims to provide standard and ECN account options with access to forex, cryptocurrencies, precious metals, energy, futures, and indices markets.

Our comprehensive analysis indicates that BLGOTD lacks proper regulatory oversight. The broker has been flagged by multiple review platforms as potentially problematic too. The broker's registration appears to be basic without substantial regulatory backing. This raises serious red flags for potential investors who want safety and security. User feedback consistently points to poor service quality, limited customer support channels, and concerns about fund security. Given these findings, BLGOTD appears unsuitable for most retail traders, particularly those seeking reliable, well-regulated trading environments with strong customer protection measures.

This review is based on publicly available information from industry databases, regulatory records, and user feedback platforms as of 2025. BLGOTD's registration status shows basic incorporation without comprehensive financial services regulation, which is concerning. Our evaluation methodology incorporates data from WikiBit, Scamadviser, and other industry monitoring platforms to provide an objective assessment of the broker's services and reliability.

Potential users should be aware that regulatory environments vary significantly across jurisdictions. What may be acceptable in one region could be prohibited in another region entirely. This analysis focuses on internationally recognized standards for broker evaluation and safety measures that protect retail investors.

| Evaluation Criteria | Score | Rating |

|---|---|---|

| Account Conditions | 4/10 | Below Average |

| Tools and Resources | 5/10 | Average |

| Customer Service | 2/10 | Poor |

| Trading Experience | 4/10 | Below Average |

| Trust and Safety | 1/10 | Very Poor |

| User Experience | 3/10 | Poor |

| Overall Rating | 3.2/10 | Poor |

BLGOTD emerged in the online trading space with registration dating to 2024. The company positions itself as a multi-asset broker serving international markets across the globe. According to WikiBit data, the company operates with basic registration status, which immediately raises concerns about its regulatory compliance and operational legitimacy. The broker claims to offer comprehensive trading services across major asset classes including foreign exchange, digital currencies, precious metals, energy commodities, futures contracts, and stock indices.

The company's business model appears to follow the standard Market Maker approach. It offers both commission-free standard accounts and low-spread ECN accounts to attract different types of traders with varying needs. However, the lack of detailed information about the company's founding team, physical offices, or substantial regulatory backing creates significant transparency issues that potential clients should carefully consider.

BLGOTD's operational structure suggests it targets international retail traders seeking diverse asset exposure. The absence of proper regulatory oversight from recognized financial authorities makes it unsuitable for traders prioritizing safety and regulatory protection, though. This blgotd review indicates that while the broker offers standard trading services, the fundamental trust and safety concerns outweigh any potential benefits from its service offerings.

Regulatory Status: BLGOTD operates with basic registration rather than comprehensive financial services regulation. WikiBit reports indicate the broker lacks oversight from major regulatory bodies such as FCA, ASIC, or CySEC, which significantly impacts its credibility and client protection measures in important ways.

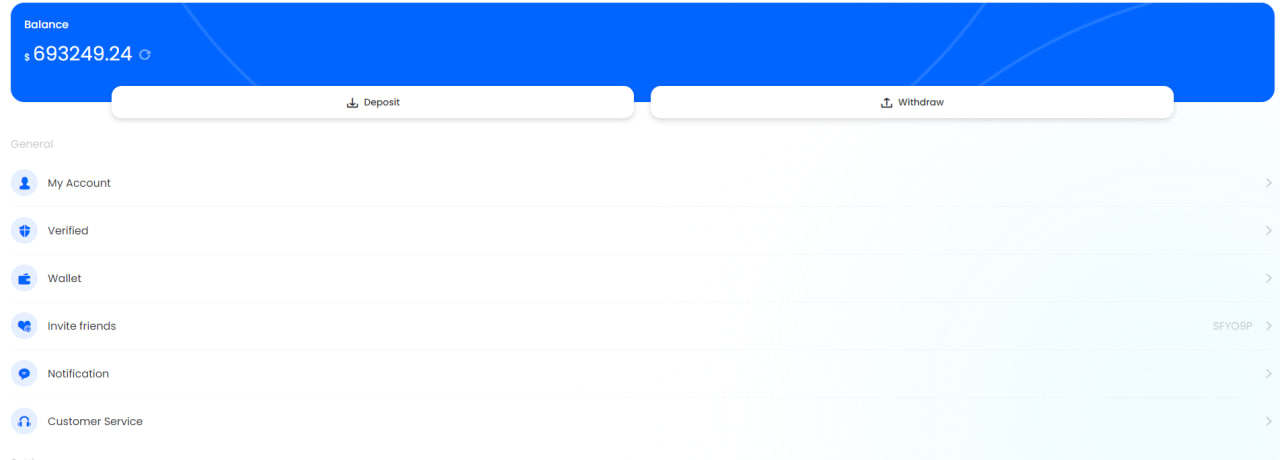

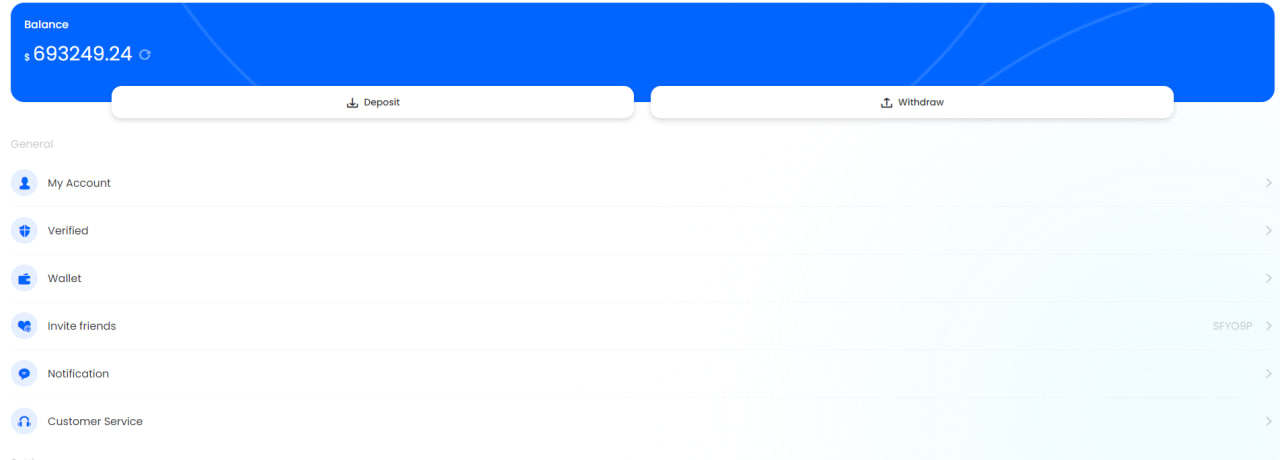

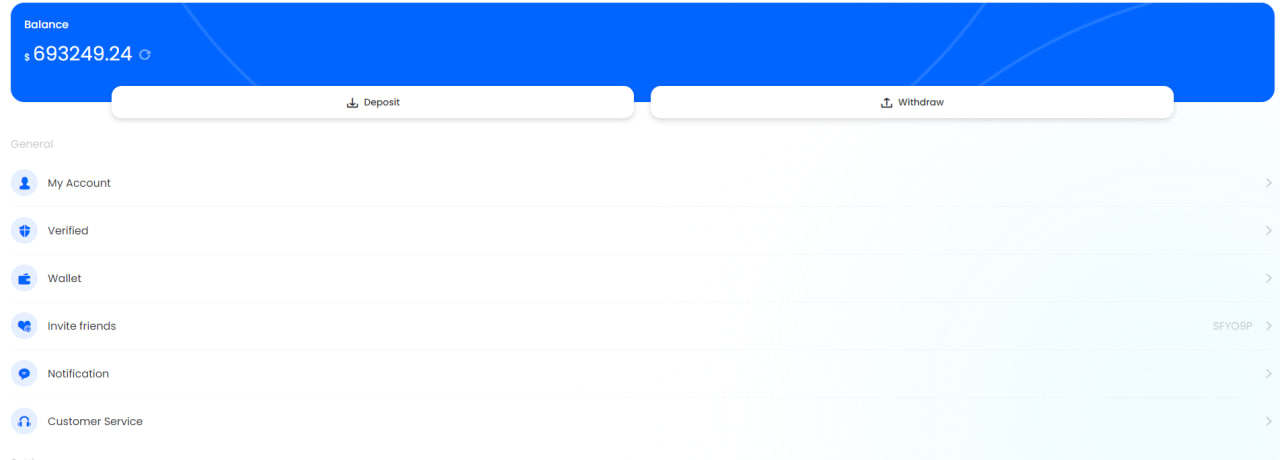

Deposit and Withdrawal Methods: Specific information about payment methods remains unclear in available documentation. The broker has not provided transparent details about supported payment processors, minimum withdrawal amounts, or processing timeframes, which adds to operational transparency concerns that potential clients should note.

Minimum Deposit Requirements: Exact minimum deposit amounts are not clearly specified in available sources. This suggests potential inconsistency in account opening requirements or lack of standardized procedures across different account types that the broker offers.

Promotional Offers: No substantial information about bonus programs or promotional campaigns appears in current documentation. This indicates either absence of such programs or poor marketing transparency on the broker's part.

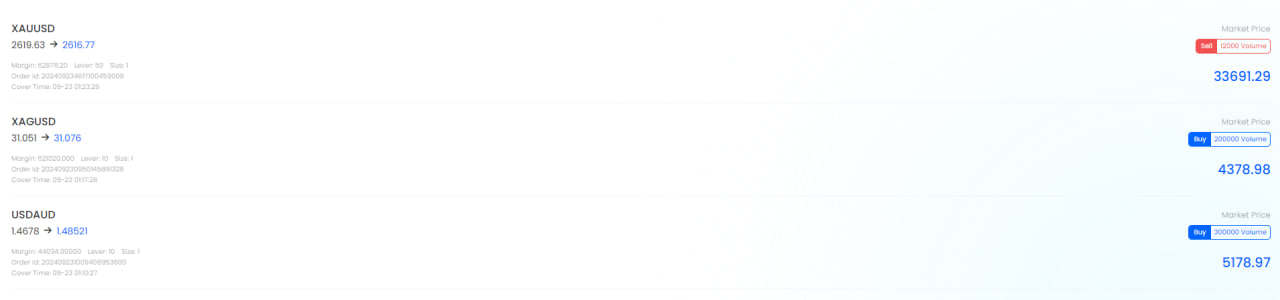

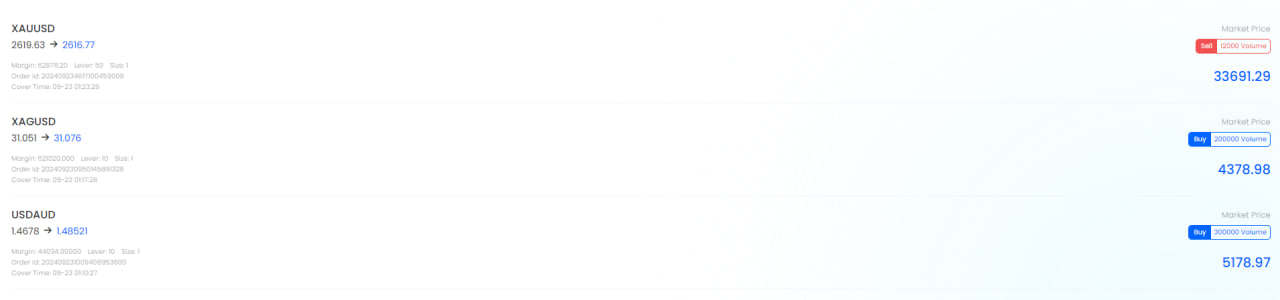

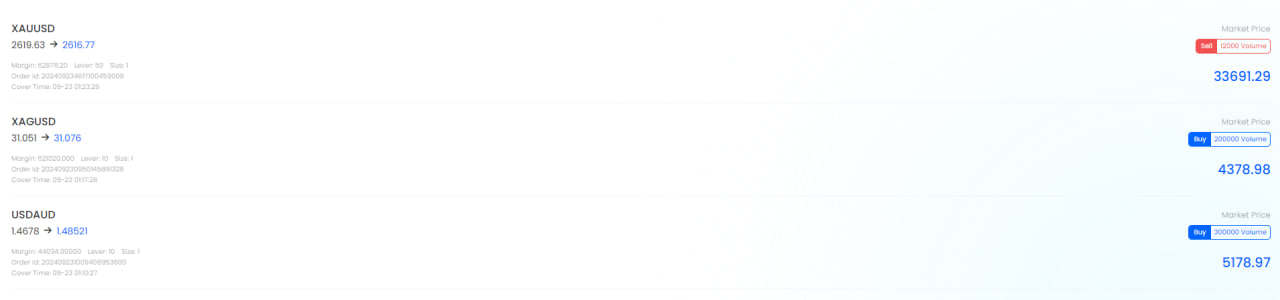

Trading Assets: BLGOTD offers access to forex pairs, cryptocurrency CFDs, precious metals including gold and silver, energy commodities like oil and gas, futures contracts, and major stock indices. This diverse asset selection represents one of the few positive aspects of the platform's offerings for traders.

Cost Structure: Standard accounts reportedly operate with zero commission and spreads starting from 1 pip. ECN accounts claim spreads as low as 0 pips, which sounds competitive on the surface. However, the lack of detailed fee schedules and potential hidden costs creates uncertainty about true trading expenses. This blgotd review found insufficient transparency regarding overnight financing rates, withdrawal fees, and inactivity charges that could affect traders.

Leverage Options: Specific leverage ratios are not clearly documented in available sources. This represents another transparency gap that potential traders should note before making any decisions.

Platform Selection: The trading platform technology and software providers are not specified in current documentation. This raises questions about the quality and reliability of the trading infrastructure that supports client activities.

Geographic Restrictions: Specific country restrictions and compliance requirements are not clearly outlined in available materials. This creates uncertainty for international traders about their eligibility.

Customer Support Languages: The range of supported languages for customer service remains unspecified in current documentation. This could create communication barriers for non-English speaking clients.

BLGOTD's account structure includes standard and ECN options. This superficially appears competitive with industry norms that most brokers follow. The standard account offers commission-free trading with spreads starting from 1 pip, while the ECN account promises tighter spreads beginning at 0 pips. However, this blgotd review reveals significant concerns about the transparency and reliability of these account conditions that traders should understand.

The absence of detailed information about minimum deposit requirements, account verification procedures, and specific trading conditions creates uncertainty for potential clients. User feedback suggests that the actual trading conditions may differ from advertised specifications, with reports of unexpected fees and poor execution quality that affect profitability. The lack of specialized account types such as Islamic accounts or professional trader classifications limits the broker's appeal to diverse trading communities.

Furthermore, the account opening process lacks transparency regarding required documentation, verification timeframes, and compliance procedures. Without proper regulatory oversight, clients have limited recourse if account conditions change unexpectedly or if disputes arise regarding trading terms and conditions that were previously agreed upon.

BLGOTD claims to provide trading services across multiple asset classes. This suggests some level of market access and trading infrastructure for clients. The broker's offering of both standard and ECN account types indicates awareness of different trader preferences and strategies. However, specific details about trading tools, analytical resources, and educational materials remain largely undocumented in available sources.

User feedback indicates disappointment with the quality and reliability of available trading tools. The absence of detailed information about charting capabilities, technical indicators, automated trading support, or market research resources suggests either limited offerings or poor communication about available features that could help traders. Professional traders typically require sophisticated analytical tools and market data, which appear to be inadequately addressed by BLGOTD's current service structure.

The lack of educational resources, webinars, or market analysis content further limits the platform's value proposition. This is particularly problematic for newer traders who benefit from educational support and market guidance to improve their skills.

BLGOTD's customer support infrastructure appears severely limited. Only online chat services are mentioned in available documentation that we could find. The absence of telephone support, email ticketing systems, or comprehensive help desk services creates significant barriers for clients seeking assistance with trading issues, account problems, or technical difficulties.

User feedback consistently highlights poor response times, limited problem-solving capabilities, and inadequate communication from support staff. The lack of 24/7 support coverage is particularly problematic for forex trading, which operates across global time zones and requires continuous technical assistance availability for traders. The absence of multilingual support information suggests potential communication barriers for international clients, while the lack of detailed FAQ sections, user guides, or self-service resources forces clients to rely on limited direct support channels for even basic inquiries.

User reports indicate significant concerns about BLGOTD's trading platform stability and execution quality. Traders have reported issues with platform connectivity, slow order processing, and frequent technical glitches that interfere with trading activities in frustrating ways. The absence of detailed platform specifications makes it difficult to assess the underlying technology and infrastructure supporting trading operations.

Execution quality appears problematic, with user feedback mentioning slippage issues, requotes during volatile market conditions, and delays in order processing. These technical problems significantly impact trading performance and create additional costs for active traders who require reliable, fast execution for their strategies to work properly. The lack of mobile trading platform information and limited details about platform features suggest that BLGOTD may not offer the comprehensive trading environment that modern retail traders expect from their brokers.

This blgotd review finds that the trading experience falls well below industry standards for reliability and functionality.

BLGOTD's trust and safety profile presents the most serious concerns identified in this evaluation. The broker operates without substantial regulatory oversight from recognized financial authorities, which eliminates most standard client protection measures that regulated brokers must maintain by law. WikiBit and other industry monitoring platforms have flagged BLGOTD as potentially problematic, with some sources suggesting possible fraudulent operations.

The absence of regulatory supervision means no independent oversight of client fund segregation, no compensation schemes for client losses due to broker failure, and no standardized complaint resolution procedures. These fundamental safety gaps create unacceptable risks for retail traders who depend on regulatory protection for their invested capital and financial security. Industry databases indicate negative community feedback and warnings about BLGOTD's operations, suggesting that experienced traders and industry professionals view the broker as unreliable and potentially dangerous for client funds.

The lack of transparent company information, verified business addresses, and legitimate regulatory status creates a risk profile unsuitable for any serious trading activity.

Overall user satisfaction with BLGOTD appears consistently negative across available feedback platforms. Traders report frustration with limited customer service, poor platform reliability, and concerns about fund security that significantly impact their trading experience in negative ways. The absence of comprehensive onboarding procedures and account verification transparency creates additional friction for new users.

Interface design and platform usability information remains limited in available documentation. This suggests either poor user experience design or inadequate communication about platform features that could help traders. The registration and account verification process lacks clear guidelines and timeframes, creating uncertainty for potential clients about account activation procedures that should be straightforward. User complaints focus primarily on customer service responsiveness, trading platform stability, and concerns about withdrawal processing that affect their ability to access their funds.

The pattern of negative feedback across multiple review platforms indicates systemic issues with service delivery rather than isolated incidents.

This comprehensive blgotd review reveals that BLGOTD fails to meet basic standards for safe, reliable forex and CFD trading services. While the broker offers a diverse range of trading assets and claims competitive account conditions, the fundamental lack of proper regulatory oversight and consistently negative user feedback create unacceptable risks for retail traders who value their capital. The broker's poor performance across all evaluation criteria, particularly the critical trust and safety dimension, makes it unsuitable for traders of any experience level.

The absence of proper customer protection measures, combined with technical reliability issues and inadequate customer support, creates an environment where traders risk both their capital and their trading success. Potential traders should prioritize properly regulated brokers with established track records, comprehensive customer protection measures, and positive user feedback when selecting trading platforms for their investment activities and financial goals.

FX Broker Capital Trading Markets Review