Is ADS safe?

Pros

Cons

Is ADS Safe or a Scam?

Introduction

In the dynamic and often volatile world of forex trading, choosing the right broker is crucial for both novice and experienced traders. ADS Securities, commonly referred to as ADSS, has established itself as a prominent player in the forex market, particularly in the Middle East and North Africa (MENA) region. Founded in 2011 and headquartered in Abu Dhabi, ADSS offers a wide range of trading instruments, including forex, CFDs, commodities, and cryptocurrencies. However, with the proliferation of online trading platforms, traders must exercise caution and conduct thorough evaluations of their chosen brokers to avoid potential scams.

This article aims to provide an objective and comprehensive analysis of whether ADS is safe or potentially a scam. Our investigation is structured around several key areas: regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, risk assessment, and overall conclusions. By utilizing a combination of qualitative assessments and quantitative data, we hope to equip traders with the necessary insights to make informed decisions.

Regulation and Legitimacy

The regulatory framework under which a broker operates is a critical factor in determining its legitimacy and safety. ADSS is regulated by several reputable authorities, including the Securities and Commodities Authority (SCA) in the UAE, the Financial Conduct Authority (FCA) in the UK, and the Securities and Futures Commission (SFC) in Hong Kong. These regulatory bodies enforce strict compliance standards that brokers must adhere to, providing a layer of protection for traders.

| Regulatory Authority | License Number | Jurisdiction | Verification Status |

|---|---|---|---|

| SCA | 1190047 | UAE | Verified |

| FCA | 577453 | UK | Verified |

| SFC | Axc847 | Hong Kong | Verified |

The presence of multiple regulatory licenses indicates a commitment to maintaining high operational standards. The SCA, for instance, requires brokers to maintain a minimum capital base, segregate client funds, and adhere to stringent reporting requirements. The FCA and SFC also impose similar regulations, which enhances the overall safety of trading with ADSS. Historically, ADSS has maintained compliance with these regulatory bodies, which further supports the assertion that ADS is safe for traders.

Company Background Investigation

ADSS was established in 2011 and has since grown to become one of the largest forex brokers in the UAE. The company operates under the umbrella of ADS Holding LLC, which has a strong foothold in the financial services sector. The management team at ADSS comprises seasoned professionals with extensive experience in finance and trading, which contributes to the broker's credibility.

The company's transparency is evident in its operations, as it provides detailed information about its services, fees, and trading conditions on its website. ADSS is also known for its commitment to customer service, offering various educational resources to help traders enhance their skills. This level of transparency and professionalism is essential in establishing trust, and it reinforces the notion that ADS is safe for potential clients.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is paramount. ADSS provides competitive spreads and a variety of account types, catering to different trading styles and preferences. The broker's fee structure primarily comprises spreads, with no commissions on trades, which is a common practice in the industry.

| Fee Type | ADS Securities | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.0 pips | 1.2 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | Varies |

ADSS offers a minimum deposit of $100, making it accessible for new traders. However, some users have reported higher spreads on certain account types, particularly for non-commission accounts. This could be a point of concern for traders seeking low-cost trading options. Despite this, the overall trading conditions at ADSS are competitive, and the absence of hidden fees suggests that ADS is safe for trading.

Client Fund Security

A broker's approach to client fund security is a significant factor in determining its reliability. ADSS employs robust security measures, including the segregation of client funds, which ensures that traders' money is kept separate from the broker's operational funds. This practice is essential for protecting clients in the event of financial difficulties faced by the broker.

Additionally, ADSS provides negative balance protection, which prevents clients from losing more than their initial investment. This is a critical feature for risk management in forex trading. Historically, there have been no significant incidents or controversies regarding fund security at ADSS, reinforcing the belief that ADS is safe for traders.

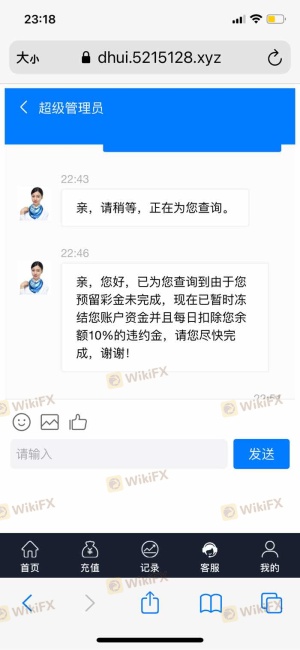

Customer Experience and Complaints

Customer feedback is a vital aspect of assessing a broker's reliability. ADSS has generally received positive reviews from clients, particularly regarding its customer support and trading platform performance. However, some common complaints include the lack of 24/7 support and occasional delays in withdrawal processing.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Moderate | Generally responsive |

| Lack of 24/7 Support | Low | Available during business hours |

Typical cases include users who experienced delays in withdrawals but reported that the company addressed their concerns promptly. Overall, while there are minor grievances, the majority of feedback suggests that ADS is safe and responsive to client needs.

Platform and Trade Execution

ADSS offers two primary trading platforms: MetaTrader 4 (MT4) and its proprietary platform, Orex. Both platforms are well-regarded for their performance and user experience. Users have reported minimal slippage and high execution quality, which is crucial for successful trading.

However, there have been isolated reports of order rejections, particularly during high-volatility periods. This could be a concern for scalpers and high-frequency traders. Nevertheless, the overall performance of the platforms indicates that ADS is safe for most trading activities.

Risk Assessment

Trading with any broker comes with inherent risks. The primary risks associated with ADSS include market risk, operational risk, and regulatory risk. However, the broker's strong regulatory framework and commitment to client security mitigate many of these concerns.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Market Risk | High | Exposure to market volatility and price fluctuations |

| Operational Risk | Medium | Potential for technical issues or platform outages |

| Regulatory Risk | Low | Strong regulatory oversight reduces this risk |

To mitigate these risks, traders should ensure they understand the market conditions and utilize risk management strategies, such as stop-loss orders and position sizing. Overall, the risk profile associated with ADS is safe compared to many other brokers.

Conclusion and Recommendations

In conclusion, the evidence gathered throughout this analysis suggests that ADS is safe and operates as a legitimate forex broker. The regulatory oversight, company transparency, competitive trading conditions, and strong client fund security measures all contribute to a favorable assessment of the broker.

While there are minor complaints and areas for improvement, the overall reputation and operational integrity of ADSS indicate that it is not a scam. For traders looking for a reliable broker in the MENA region, ADSS presents a solid option. However, traders should always conduct their own research and consider their individual trading needs before making a decision.

For those seeking alternatives, brokers such as XM, IG, and OANDA are also reputable options worth considering.

Is ADS a scam, or is it legit?

The latest exposure and evaluation content of ADS brokers.

ADS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ADS latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.